The market extended rally and climbed another milestone with the Nifty50 and the BSE Sensex closing above 17,000 and 57,000 levels for the first time on August 31. Amid further buying by FIIs post dovish Federal Reserve's stance, all sectoral indices participated in the run with Financial Services, IT, Metal and Healthcare being the prominent gainers, rising over 1 percent each.

The BSE Sensex rallied 662.63 points or 1.16 percent to 57,552.39, while the Nifty50 jumped 201.20 points or 1.19 percent to 17,132.20 and formed a bullish candle on the daily charts.

"A long bull candle was formed on the daily chart, which is back to back for the second consecutive sessions. Technically, this pattern indicates a sharp upside breakout in the market after a small range movement. Normally, such violent upmoves in the short term more often result in a minor consolidation or breather patterns, before showing further upside momentum," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels the short term trend of Nifty is sharply up and still there is no indication of any tiredness at the higher levels. "Having moved up by around 450 points in the last two sessions, there is a higher possibility of consolidation or minor profit booking from the highs in the short term. Hence, one may expect 17,200-17,300 to be a crucial overhead resistance band for this week. Immediate support is placed at 17,010 levels," he said.

Though the Nifty moved up sharply, the overall market breadth was not conducive, as the broad market indices like Nifty Midcap 100 and Smallcap 100 indices have managed to close higher by 0.62 percent and 0.68 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,980.83, followed by 16,829.47. If the index moves up, the key resistance levels to watch out for are 17,218.53 and 17,304.87.

Nifty Bank

The Nifty Bank rose 76.90 points to close at 36,424.60, underperforming frontline indices on August 31. The important pivot level, which will act as crucial support for the index, is placed at 36,242.93, followed by 36,061.27. On the upside, key resistance levels are placed at 36,579.54 and 36,734.47 levels.

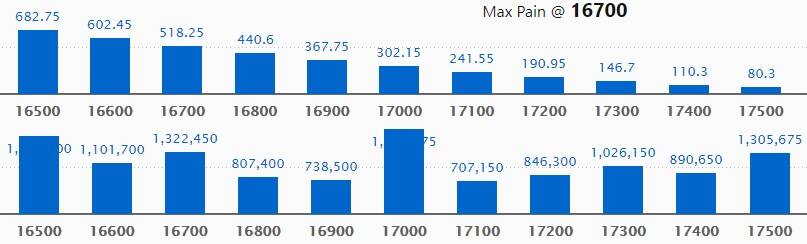

Call option data

Maximum Call open interest of 18.14 lakh contracts was seen at 17000 strike. This is followed by 16,500 strike, which holds 16.56 lakh contracts, and 16,700 strike, which has accumulated 13.22 lakh contracts.

Call writing was seen at 17,600 strike, which added 2.05 lakh contracts, followed by 17,100 strike, which added 1.55 lakh contracts and 17,500 strike which added 1.47 lakh contracts.

Call unwinding was seen at 16,600 strike, which shed 1.89 lakh contracts, followed by 16,500 strike, which shed 1.4 lakh contracts, and 16,700 strike which shed 1.22 lakh contracts.

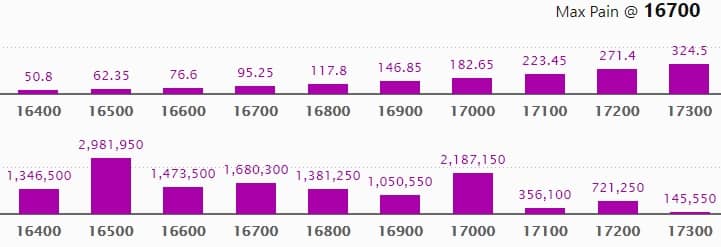

Put option data

Maximum Put open interest of 29.81 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the September series.

This is followed by 17,000 strike, which holds 21.87 lakh contracts, and 16,700 strike, which has accumulated 16.8 lakh contracts.

Put writing was seen at 17,000 strike, which added 8.75 lakh contracts, followed by 16,500 strike which added 5.12 lakh contracts, and 16,400 strike which added 3.91 lakh contracts.

There was hardly any Put unwinding seen on Tuesday.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

74 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

16 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

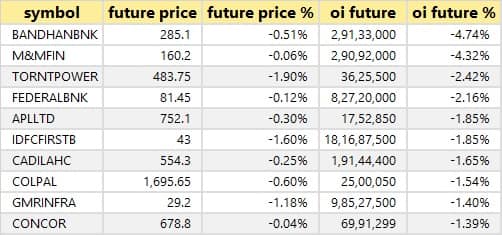

31 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

53 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

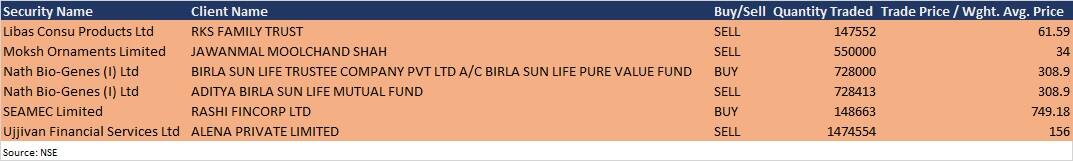

Bulk deals

(For more bulk deals, click here)

Analysts/Investors Meeting

Jubilant Pharmova: The company's officials will meet investors and analysts in an e-conference on September 1.

HSIL: The company's officials will meet Locus Investment Group on September 1.

Associated Alcohols & Breweries: The company's officials will meet Ventura Securities on September 1.

Antony Waste Handling Cell: The company's officials will meet analysts and investors on September 1.

Poonawalla Fincorp: The company's officials will meet Wellington Management Singapore PTE on September 1.

UTI AMC: The company's officials will meet institutional investors in ‘Ashwamedh - Elara India Dialogue 2021’ on September 1.

Dollar Industries: The company's officials will meet institutional investors in Elara India Dialogue 2021 on September 2.

Allcargo Logistics: The company's officials will meet Ventura Securities on September 3.

TCS: The company's officials will meet investors in Motilal Oswal 17th Annual Global Investor Conference, 2021 on September 6 and 14, Citi India @ GEMs Conference on September 8, 28th Annual CITIC CLSA Flagship Investors' Forum 2021 on September 13, and JP Morgan India Investor Summit on September 20.

IIFL Wealth Management: The company's officials will meet investors in Elara India Dialogue 2021 on September 8, and Motilal Oswal 17th Annual Global Investor Conference (AGIC), 2021 on September 13.

Stocks in News

Likhitha Infrastructure: The company has received an order worth Rs 145.86 crore from Indradhanush Gas Grid (IGGL) for laying and construction of steel gas pipeline and terminals along with associated facilities for section 5 & 9 of North-East Gas Grid (NEGG) Project.

Mastek: The company partnered with fulfillmenttools to deliver modern omnichannel fulfillment solutions to customers worldwide.

Shoppers Stop: The company exited non-core business by selling its subsidiary, Crossword Bookstores, at a gross business valuation of Rs 41.62 crore and will focus on expanding core business and strategic growth pillars - First Citizen, Private Labels, Beauty and Omnlchannel business.

JB Chemicals and Pharmaceuticals: Vijay Bhatt has resigned from the services of the company and shall cease to be the Chief Financial Officer of the company.

Wipro: The company and HERE Technologies partnered to provide location-based services and analytics for customers globally.

Stocks to be added in F&O: Abbott India, Crompton Greaves Consumer Electricals, Dalmia Bharat, Delta Corp, The India Cements, JK Cement, Oberoi Realty, and Persistent Systems will be available for trading from October 1.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 3,881.16 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 1,872.40 crore in the Indian equity market on August 31, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Canara Bank - is under the F&O ban for September 1. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!