The market lost significant early hour gains to finally settle with moderate gains on June 22, supported by technology, HDFC, L&T and Maruti Suzuki. However, banks, select FMCG, and Reliance Industries were under pressure.

The BSE Sensex gained 14.25 points at 52,588.71, while the Nifty50 rose 26.30 points to 15,772.80 and formed bearish candle which resembles Shooting Star kind of pattern on the daily charts.

"Nifty opened on a strong note and registered a day high at 15,895 levels. However, the profit booking at higher levels dragged the index lower to close on a flat note. The daily price action has formed a bearish candle carrying either side shadows representing volatility at higher levels," Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities told Moneycontrol.

He said the next higher levels to be watched are around 15,800 levels. Any sustainable move above 15,800 levels may cause momentum towards 15,900-15,950 levels, according to him.

On the downside, any violation of an intraday support zone of 15,750 levels may cause profit booking towards 15,700-15,650 levels, he said.

The Nifty Midcap 100 index gained one-tenth of a percent, and Nifty Smallcap 100 index rose half a percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,718, followed by 15,663.2. If the index moves up, the key resistance levels to watch out for are 15,861.7 and 15,950.6.

Nifty Bank

The Nifty Bank dropped 126.30 points to close at 34,745 on June 22. The important pivot level, which will act as crucial support for the index, is placed at 34,512.3, followed by 34,279.6. On the upside, key resistance levels are placed at 35,129.8 and 35,514.6 levels.

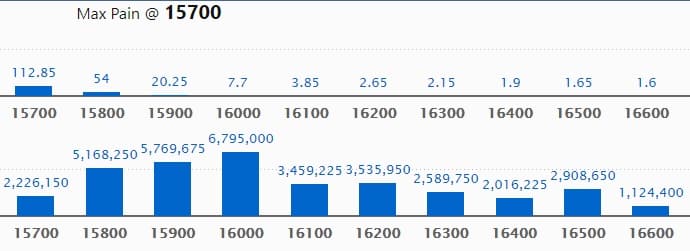

Call option data

Maximum Call open interest of 67.95 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the June series.

This is followed by 15900 strike, which holds 57.69 lakh contracts, and 15800 strike, which has accumulated 51.68 lakh contracts.

Call writing was seen at 15900 strike, which added 20.46 lakh contracts, followed by 16000 strike which added 12.39 lakh contracts, and 16100 strike which added 10.54 lakh contracts.

Call unwinding was seen at 15700 strike, which shed 13.56 lakh contracts, followed by 15600 strike which shed 8.71 lakh contracts, and 15500 strike which shed 4.45 lakh contracts.

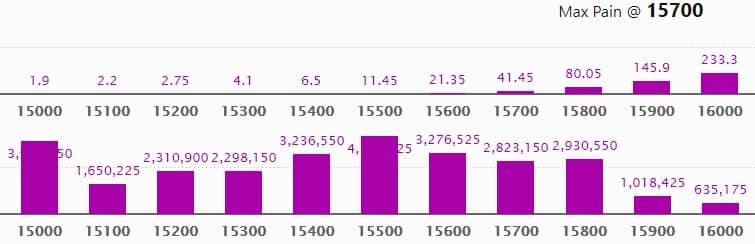

Put option data

Maximum Put open interest of 41.54 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the June series.

This is followed by 15000 strike, which holds 39.08 lakh contracts, and 15600 strike, which has accumulated 32.76 lakh contracts.

Put writing was seen at 15800 strike, which added 13.51 lakh contracts, followed by 15900 strike which added 6.54 lakh contracts, and 16000 strike which added 1.52 lakh contracts.

Put unwinding was seen at 15600 strike which shed 9.94 lakh contracts, followed by 15000 strike which shed 9.65 lakh contracts and 15500 strike which shed 6.21 lakh contracts.

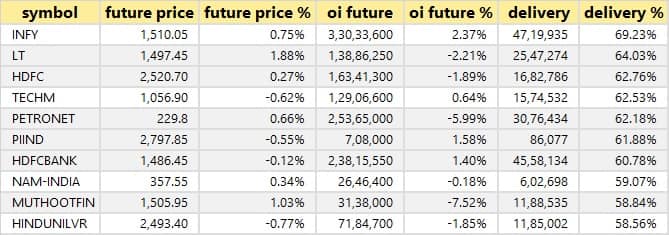

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

32 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

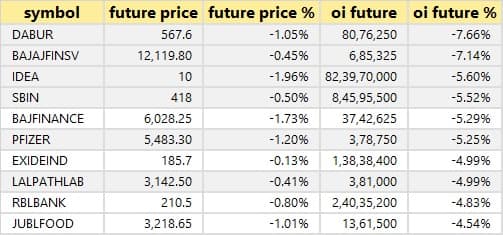

43 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

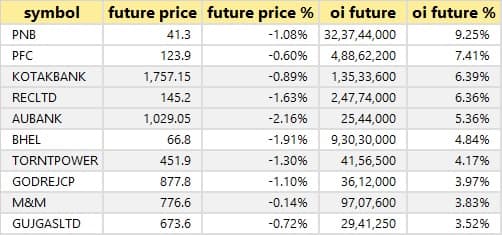

36 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

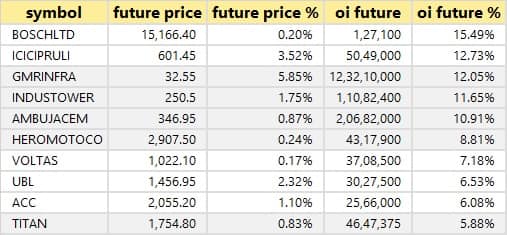

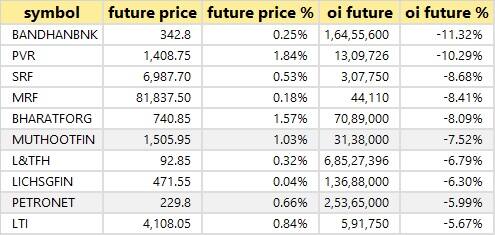

47 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

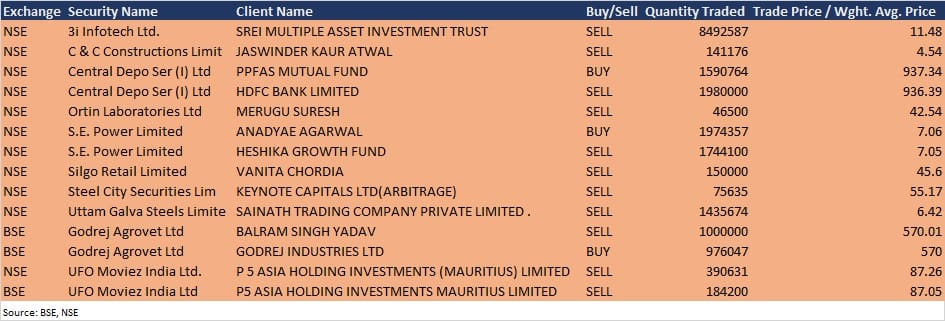

Bulk deals

CDSL: PPFAS Mutual Fund acquired 15,90,764 equity shares in CDSL at Rs 937.34 per share, whereas HDFC Bank sold 19.80 lakh equity shares in the company at Rs 936.39 per share, the NSE bulk deals data showed.

UFO Moviez India: P5 Asia Holding Investments (Mauritius) sold 3,90,631 equity shares in UFO at Rs 87.26 per share on the NSE and 1,84,200 shares at Rs 87.05 per share on the BSE, the bulk deals data showed.

Godrej Agrovet: Investor Balram Singh Yadav sold 10 lakh equity shares in the company at Rs 570.01 per share, whereas promoter Godrej Industries acquired 9,76,047 equity shares in the company at Rs 570 per share, the BSE bulk deals data showed.

(For more bulk deals, click here)

Results on June 23, and Analysts/Investors Meeting

Results on June 23: Apollo Hospitals Enterprise, Asian Hotels (East), Allcargo Logistics, Andrew Yule & Company, Deepak Spinners, Empire Industries, HCC, MBL Infrastructures, Mcleod Russel India, Mercator, Munjal Showa, Precision Wires India, Schneider Electric Infrastructure, Sharon Bio-Medicine, Speciality Restaurants, Technofab Engineering, and V2 Retail will release quarterly earnings on June 23.

Dixon Technologies (India): The company's officials will meet BOB Capital on June 23.

Welspun India: The company's officials will meet analysts/investors in Motilal Oswal Ideation Conference on June 23 and June 25.

Tata Consumer Products: The company's officials will meet Kotak Mahindra Asset Management Company on June 23, and UBS Securities India on June 25.

Greenlam Industries: The company's officials will meet analysts/investors on June 23.

Bharat Forge: The company's officials will meet Amansa capital on June 23, ICICI Prudential Life on June 24, and Hermes Fund Managers on June 25.

V2 Retail: The company's officials will meet analysts/investors on June 24.

Kirloskar Brothers: The company's officials will meet Motilal Oswal Securities on June 25.

Gland Pharma: The company's officials will meet Somerset Capital on June 23, and Capital World on June 30.

Infibeam Avenues: The company's officials will meet Electrum Capital on June 23.

Gokaldas Exports: The company's officials will meet AUM Advisors, Ashmore India, Oysterrock Capital, Family Office Group, DSP Investment Managers, Banyan Capital, and KSA Securities on June 23.

Stocks in News

Krebs Biochemicals & Industries: A group or section of employees from Krebs workers and Staff Union at Nellore unit are remaining themselves absent from duties during various shifts in an unauthorized and unjustified manner. The company may face loss of production and hindrance in the operations due to the said strike of the workers.

Bharat Electronics: The company reported higher consolidated profit at Rs 1,368.15 crore in Q4FY21 against Rs 1,046.97 crore in Q4FY20, revenue jumped to Rs 6,917.47 crore from Rs 5,816.77 crore YoY.

Hero MotoCorp: The company will make an upward revision in the ex-showroom prices of its motorcycles and scooters, with effect from July 1, 2021, to partially offset the impact of continuous increase in commodity prices. The price hike across the range of motorcycles and scooters will be up to Rs 3,000.

GE Power India: The company reported higher consolidated profit at Rs 16 crore in Q4FY21 against Rs 14.87 crore in Q4FY20, revenue jumped to Rs 930.5 crore from Rs 732.68 crore YoY.

GSS Infotech: Promoter Raghunadha Rao Marepally acquired 1.02 lakh equity shares via open market transaction on June 16, increasing shareholding to 18.55% from 17.95% earlier.

Sobha: The company reported lower consolidated profit at Rs 17.9 crore in Q4FY21 against Rs 50.7 crore in Q4FY20, revenue fell to Rs 553.4 crore from Rs 910.1 crore YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,027.94 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 302.45 crore in the Indian equity market on June 22, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Vodafone Idea, and Sun TV Network - are under the F&O ban for June 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!