The market snapped a seven-day winning streak to end moderately lower on June 1, dented by a bit of profit booking and selling pressure in banks, metals, select auto and FMCG stocks. It gained 4.5 percent in previous seven consecutive sessions.

The BSE Sensex closed 2.56 points lower at 51,934.88, while the Nifty50 fell 7.90 points to 15,574.90 and formed a bearish candle which resembles Spinning Top kind of pattern on the daily charts.

"A small negative candle was formed at the new highs with minor upper and lower shadow, as per daily timeframe chart. Technically, this pattern indicate tiredness in the market after a strong upmove of Monday. This consolidation movement so far not showing any negative implication on the trend and the market could resume its uptrend soon," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The next upside levels to be watched for Nifty is 15,800 levels, which could be reached in the next 3-4 sessions. At the same time, one needs to be cautious about long positions at the new highs. Immediate support is placed at 15,500 levels," he said.

The broader markets also ended lower. The Nifty Midcap 100 index was down 0.1 percent and the Nifty Smallcap 100 index fell 0.65 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,515.13, followed by 15,455.47. If the index moves up, the key resistance levels to watch out for are 15,647.63 and 15,720.47.

Nifty Bank

The Nifty Bank fell 189.45 points to close at 35,337.20 on June 1. The important pivot level, which will act as crucial support for the index, is placed at 35,147.63, followed by 34,958.07. On the upside, key resistance levels are placed at 35,620.33 and 35,903.46 levels.

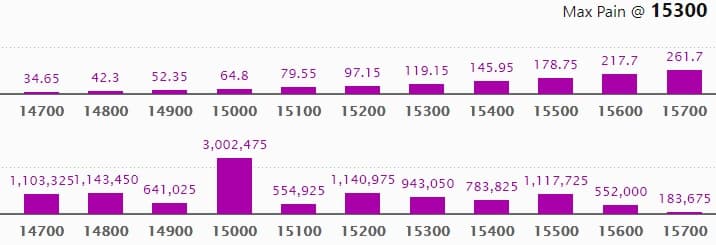

Call option data

Maximum Call open interest of 24.47 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 15,500 strike, which holds 15.36 lakh contracts, and 15,800 strike, which has accumulated 9.61 lakh contracts.

Call writing was seen at 15,600 strike, which added 1.26 lakh contracts, followed by 16,100 strike which added 1.13 lakh contracts, and 16,200 strike which added 79,050 contracts.

Call unwinding was seen at 15,300 strike, which shed 69,150 contracts, followed by 15,400 strike which shed 63,675 contracts, and 15,800 strike which shed 58,575 contracts.

Put option data

Maximum Put open interest of 30.02 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the June series.

This is followed by 14,800 strike, which holds 11.43 lakh contracts, and 15,200 strike, which has accumulated 11.4 lakh contracts.

Put writing was seen at 15,600 strike, which added 2.76 lakh contracts, followed by 15,500 strike which added 2.18 lakh contracts, and 15,000 strike which added 1.75 lakh contracts.

Put unwinding was seen at 14,700 strike which shed 85,725 contracts, followed by 14,900 strike, which shed 6,675 contracts.

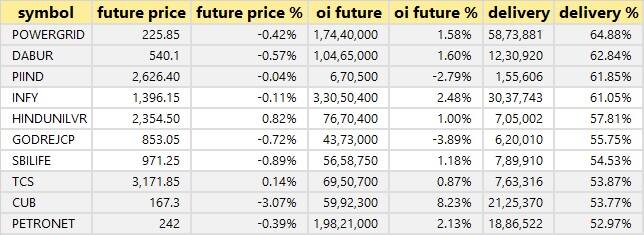

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

19 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

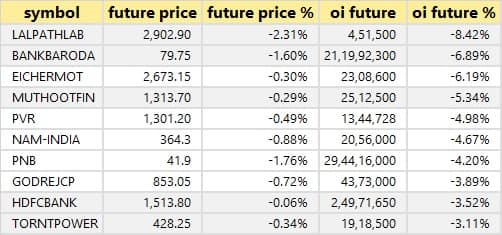

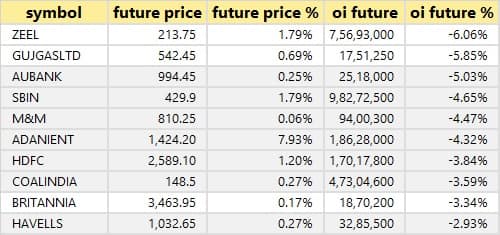

46 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

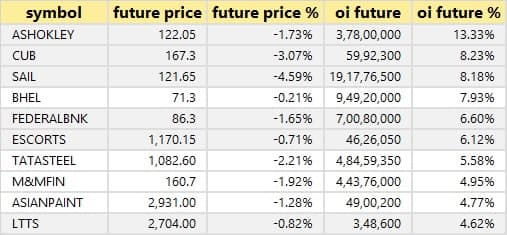

57 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

36 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

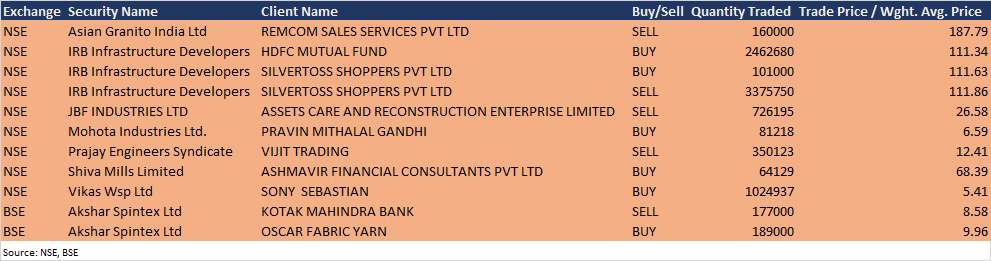

Bulk deals

(For more bulk deals, click here)

Results on June 2

Motherson Sumi Systems, MTAR Technologies, Muthoot Finance, PVR, Burnpur Cement, Garodia Chemicals, Jenburkt Pharmaceuticals, Lyka Labs, NRB Bearings, Octaware Technologies, Panacea Biotec, and Ratnamani Metals & Tubes will release their quarterly earnings on June 2.

Stocks in News

ITC: The company reported standalone profit at Rs 3,748.4 crore for Q4FY21 against Rs 3,797 crore in Q4FY20. Revenue jumped to Rs 13,294.66 crore from Rs 10,842.28 crore in the year-ago period.

Route Mobile: The company announced an agreement with Emirates Integrated Telecommunications Company (EITC) – du, UAE's second integrated telecom service provider, by offering a turnkey solution using Route Mobile's Smart Messaging Hub. This enables du to launch a highly scalable revenue-generating messaging platform to enable A2P wholesale transit business.

Hero MotoCorp: The world's largest motorcycles and scooters manufacturer sold 1,83,044 units of two-wheelers in May 2021, against 1,12,682 units sold in May 2020.

Eicher Motors: The company sold 27,294 motorcycles in May 2021, against 19,113 motorcycles sold in May 2020.

NGL Fine Chem: The company reported consolidated profit of Rs 13.83 crore in Q4FY21 against loss of Rs 0.2 crore in Q4FY20, while revenue jumped to Rs 71.77 crore from Rs 35.44 crore YoY.

Gujarat Gas: The company reported sharp increase in its consolidated profit at Rs 350.86 crore in Q4FY21 against Rs 250.46 crore in Q4FY20. Revenue jumped to Rs 3,489.31 crore from Rs 2,722.17 crore in the corresponding quarter of the previous fiscal. The company approved the acquisition or transfer of city gas distribution business for Amritsar and Bhatinda Geographical Area as a going concern, on slump sale basis, from Gujarat State Petronet (GSP) for Rs 163.31 crore.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 449.86 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 230.49 crore in the Indian equity market on June 1, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Bank of Baroda, SAIL, and Sun TV Network - are under the F&O ban for June 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!