The market gave a strong performance for the second straight day on May 18, with the Nifty50 closing above 15,100 levels and the Sensex above 50,000-mark. Buying was witnessed in banking & financials, auto, metals and IT stocks.

The BSE Sensex rallied 623 points or 1.26 percent to 50,203.73, while the Nifty50 jumped 184.90 points or 1.24 percent to 15,108.10 and formed a bullish candle on the daily charts.

"The short term trend of Nifty continues to be positive. The unfilled opening upside gap and a formation of small positive candle could hint at a possibility of profit booking emerging from the highs. Hence, bulls need to be cautious at the swing highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Nifty not showing any profit booking in the next couple of sessions could open the next upside levels of 15,450-15,500 in the near term. Immediate support is placed at 15,000 levels," he said.

The broader markets outperformed frontline indices with the Nifty Midcap 100 index rising 1.83 percent and the Nifty Smallcap 100 index climbing 1.59 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,055.47, followed by 15,002.83. If the index moves up, the key resistance levels to watch out for are 15,148.97 and 15,189.83.

Nifty Bank

The Nifty Bank rallied 463.10 points or 1.38 percent to 33,922.40 on May 18. The important pivot level, which will act as crucial support for the index, is placed at 33,720.9, followed by 33,519.4. On the upside, key resistance levels are placed at 34,133.4 and 34,344.4 levels.

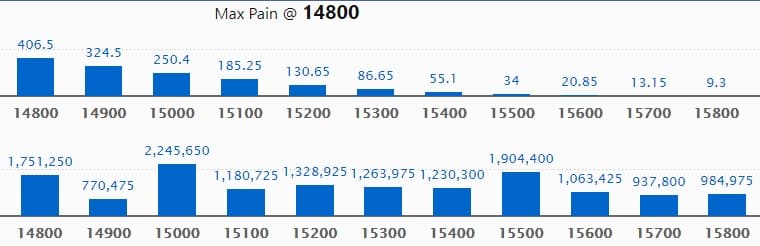

Call option data

Maximum Call open interest of 22.45 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 15,500 strike, which holds 19.04 lakh contracts, and 14,800 strike, which has accumulated 17.51 lakh contracts.

Call writing was seen at 15,800 strike, which added 5.27 lakh contracts, followed by 15,600 strike which added 3.59 lakh contracts and 15,700 strike which added 2.99 lakh contracts.

Call unwinding was seen at 14,700 strike, which shed 2.11 lakh contracts, followed by 14,800 strike which shed 2.02 lakh contracts, and 15,000 strike which shed 1.37 lakh contracts.

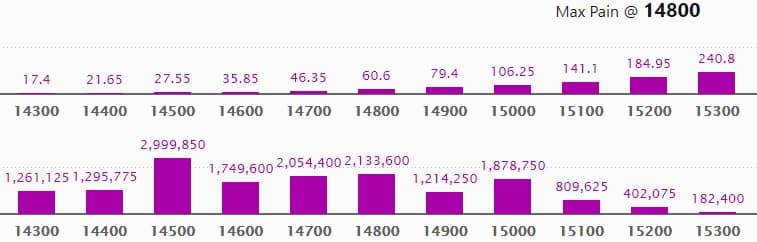

Put option data

Maximum Put open interest of 29.99 lakh contracts was seen at 14,500 strike, which will act as a crucial support level in the May series.

This is followed by 14,800 strike, which holds 21.33 lakh contracts, and 14,700 strike, which has accumulated 20.54 lakh contracts.

Put writing was seen at 15,000 strike, which added 7.12 lakh contracts, followed by 15,100 strike which added 6.63 lakh contracts and 14,900 strike which added 5.91 lakh contracts.

Put unwinding was seen at 14,300 strike which shed 54,675 contracts, followed by 14,400 strike, which shed 32,626 contracts.

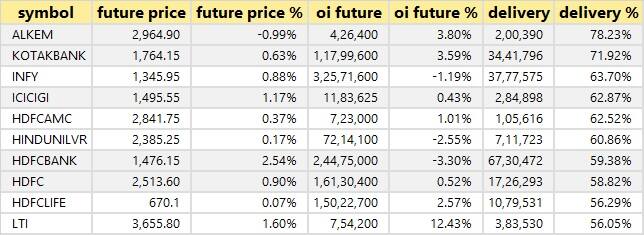

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

64 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

13 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

14 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

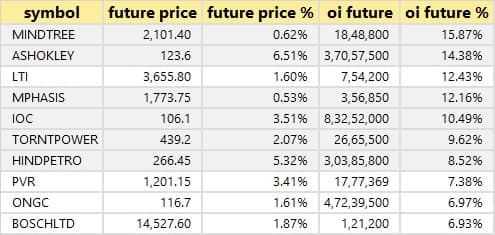

66 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

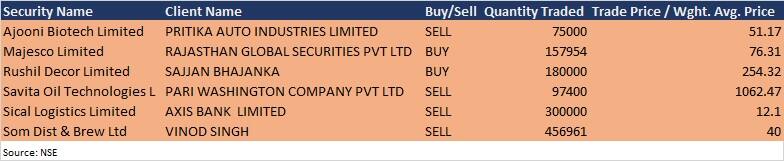

Bulk deals

(For more bulk deals, click here)

Results on May 19

Indian Oil Corporation, Indiabulls Housing Finance, Angel Fibers, Clariant Chemicals, Endurance Technologies, Gravita India, Heritage Foods, Indo Rama Synthetics, Ineos Styrolution India, JK Tyre & Industries, Kaya, Mangal Credit and Fincorp, Man Infraconstruction, MAS Financial Services, Morarjee Textiles, Niyogin Fintech, Prism Johnson, Rane Engine Valve, Redex Protech, RS Software India, SML Isuzu, Shriram Asset Management, Tanla Platforms, TCI Express, TD Power Systems, and Zuari Agro Chemicals will release quarterly earnings on May 19.

Stocks in News

Laxmi Organic Industries: Laxmi Organic will set up a wholly-owned subsidiary company in United States.

Tata Motors: The company posted consolidated loss of Rs 7,605 crore in Q4FY21 against loss of Rs 9,894.25 crore in Q4FY20, revenue jumped to Rs 88,627.9 crore from Rs 62,492.96 crore in the year-ago period.

Torrent Pharma: The company posted profit of Rs 324 crore in Q4FY21 against Rs 314 crore in Q4FY20, revenue fell to Rs 1,937 crore from Rs 1,946 crore YoY.

Axis Bank: The Specified Undertaking of the Unit Trust of India (SUUTI) will sell up to 3.6 crore equity shares of Axis Bank, via offer for sale, on May 19 and May 20, with an option to additionally sell 2,20,78,568 equity shares. The floor price for the offer is fixed at Rs 680 per share.

Sun Pharma: Life Insurance Corporation of India acquired 4,83,66,975 equity shares (2.016% of paid up equity) in Sun Pharma, increasing shareholding to 7.026% from 5.010% earlier.

Brigade Enterprises: The company reported higher consolidated profit at Rs 39.57 crore in Q4FY21 against Rs 2.68 crore in Q4FY20, revenue increased to Rs 791.24 crore from Rs 635.92 crore YoY.

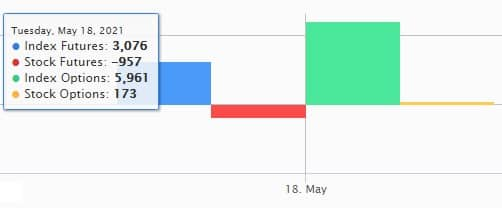

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 618.49 crore, while domestic institutional investors (DIIs) net acquired shares worth Rs 449.52 crore in the Indian equity market on May 18, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - BHEL, Cadila Healthcare, NALCO, Punjab National Bank, SAIL and Sun TV Network - are under the F&O ban for May 19. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!