The market after volatility was caught in a bear trap in the last hour of trade and closed nearly a percent lower on May 4, dented by global weakness. Pharma, select private banks, auto, IT, FMCG and metals stocks pulled the market down.

The BSE Sensex fell 465.01 points or 0.95 percent to close at 48,253.51, while the Nifty50 declined 137.70 points or 0.94 percent to 14,496.50 and formed a bearish candle on the daily charts.

"A long negative candle was formed after opening higher and the negative candle has engulfed more than 3/4th of the previous bullish candle of Monday. This is a negative indication and signals a lack of strength in the market to sustain highs or sharp sell on rise is underway. This pattern could signal further weakness down to the immediate support of 14,400 or lower in the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

According to him, a decisive move below 14,400 could pull Nifty down to a crucial lower support band of 14,200-14,150 levels and that support area is expected to offer support for the market from the lower levels. The higher bottom formation at the low of 14,416 of Monday has not been confirmed on Tuesday and that pattern is now placed at the danger of negation, he said.

On the way up 14,600-14,650 could act as a hurdle, he added.

The broader markets also closed in the red as the Nifty Midcap 100 index was down 0.39 percent and the Nifty Smallcap 100 index slipped 0.89 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,397.53, followed by 14,298.57. If the index moves up, the key resistance levels to watch out for are 14,659.43 and 14,822.37.

Nifty Bank

The Nifty Bank index was down 195.45 points to close at 32,270.35 on May 4. The important pivot level, which will act as crucial support for the index, is placed at 31,970.6, followed by 31,670.9. On the upside, key resistance levels are placed at 32,790.8 and 33,311.3 levels.

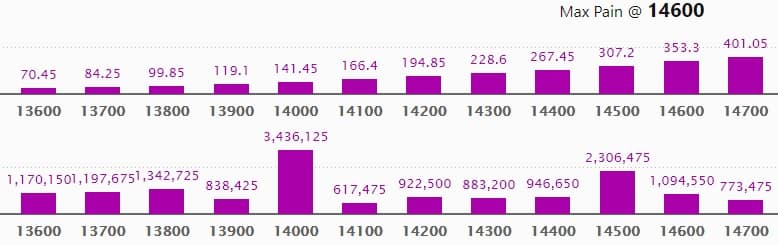

Call option data

Maximum Call open interest of 25.55 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 14,500 strike, which holds 13.48 lakh contracts, and 14,800 strike, which has accumulated 8.61 lakh contracts.

Call writing was seen at 15,000 strike, which added 2.65 lakh contracts, followed by 14,700 strike which added 56,175 contracts and 15,100 strike which added 40,500 contracts.

Call unwinding was seen at 14,500 strike, which shed 45,975 contracts, followed by 14,800 strike which shed 43,500 contracts and 15,200 strike which shed 26,100 contracts.

Put option data

Maximum Put open interest of 34.36 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the May series.

This is followed by 14,500 strike, which holds 23.06 lakh contracts, and 13,800 strike, which has accumulated 13.42 lakh contracts.

Put writing was seen at 14,700 strike, which added 93,975 contracts, followed by 14,500 strike which added 84,000 contracts and 14,000 strike which added 82,200 contracts.

Put unwinding was seen at 14,800 strike which shed 84,600 contracts, followed by 14,600 strike, which shed 24,975 contracts, and 14,900 strike which shed 21,225 contracts.

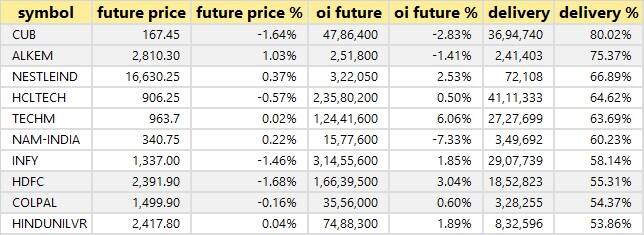

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

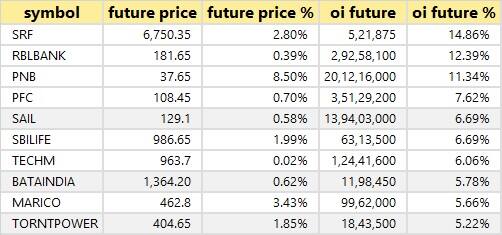

31 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

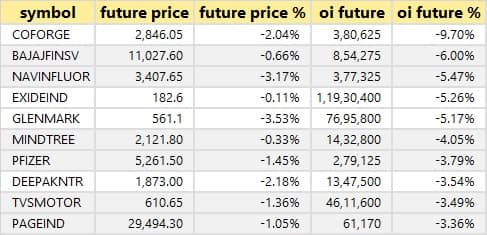

40 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

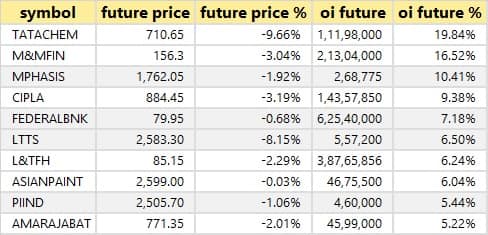

72 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

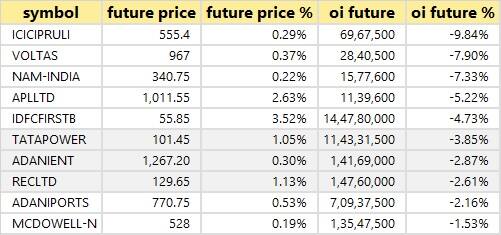

14 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

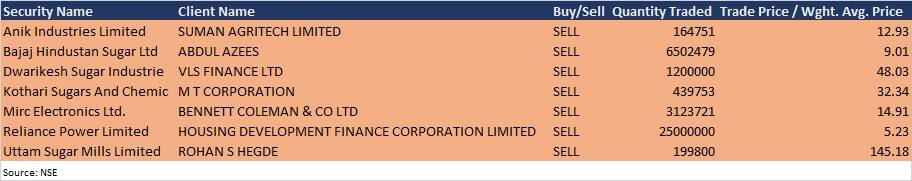

Bulk deals

(For more bulk deals, click here)

Results on May 5

Tata Steel, Adani Enterprises, Adani Green Energy, Angel Broking, Blue Dart Express, Ceat, Coral India Finance & Housing, Craftsman Automation, Deepak Nitrite, Gillette India, Integra Garments and Textiles, JM Financial, Kirloskar Ferrous Industries, Maithan Alloys, Megasoft, Oracle Financial Services Software, ABB Power Products and Systems India, Sangam (India), Shalby, and Surana Solar will release quarterly earnings on May 5.

Stocks in News

Larsen & Toubro Infotech: The company reported a higher consolidated profit at Rs 545.7 crore in Q4FY21 against Rs 519.3 crore in Q3FY21; revenue rose to Rs 3,269.4 crore from Rs 3,152.8 crore QoQ.

Greaves Cotton: The company reported sharply higher consolidated profit at Rs 13.65 crore in Q4FY21 against Rs 0.55 crore in Q4FY20; revenue jumped to Rs 520.4 crore from Rs 386.19 crore YoY.

Procter & Gamble Hygiene and Health Care: The company declared a special interim dividend for the financial year 2020-21 of Rs 150 per equity share. It reported a higher profit at Rs 98.33 crore in Q3FY21 against Rs 91.1 crore in Q3FY20. Revenue rose to Rs 759.66 crore from Rs 656.05 crore YoY.

Hindustan Aeronautics: The company and Rolls-Royce have signed MoU to establish packaging, installation, marketing and services support for Rolls-Royce MT30 marine engines in India.

Adani Total Gas: The company reported a higher consolidated profit at Rs 143.73 crore in Q4FY21 against Rs 121.41 crore in Q4FY20; revenue jumped to Rs 614.47 crore from Rs 490.32 crore YoY.

RBL Bank: The company reported a lower profit at Rs 75.34 crore in Q4FY21 against Rs 114.36 crore in Q4FY20; net interest income fell to Rs 906.04 crore from Rs 1,020.98 crore YoY.

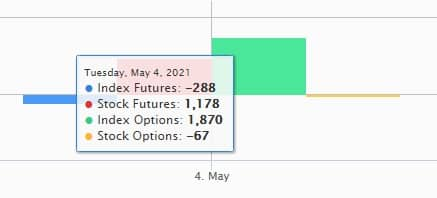

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,772.37 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 987.34 crore in the Indian equity market on May 4, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Sun TV Network - is under the F&O ban for May 5. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!