The market extended previous day's gains to jump a percent higher on April 27, driven by banking & financials, metals, select auto, FMCG and IT stocks.

The BSE Sensex rallied 557.63 points or 1.15 percent to close at 48,944.14, while the Nifty50 climbed 168 points or 1.16 percent to 14,653 and formed bullish candle on the daily charts.

"A long bull candle was formed, which signal an emergence of strong buying in the market. After showing higher levels weakness at the immediate hurdles for few occasions, Nifty finally showed initial sign of strength today by closing above the hurdle of previous opening downside gap around 14,600 levels (April 19). This is positive indication and signal more upside in the near term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

He feels the bearish pattern of sell on rise has been negated and a sustainable upside bounce was seen from the lower range of 14,200. This is positive indication and one may expect Nifty to test the upper range of 14,900-15,000 levels in the next one week, he said.

Any intra-week dips down to the support of 14,500-14,400 levels could be a buying opportunity, he advised.

The Nifty Midcap 100 index gained 1.57 per cent and Smallcap 100 index rose 1.74 per cent, outshining the frontliners.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,536.03, followed by 14,419.07. If the index moves up, the key resistance levels to watch out for are 14,718.73 and 14,784.47.

Nifty Bank

The Nifty Bank index climbed 460.15 points or 1.43 percent to 32,735.30 on April 27. The important pivot level, which will act as crucial support for the index, is placed at 32,323.1, followed by 31,910.9. On the upside, key resistance levels are placed at 32,977.3 and 33,219.3 levels.

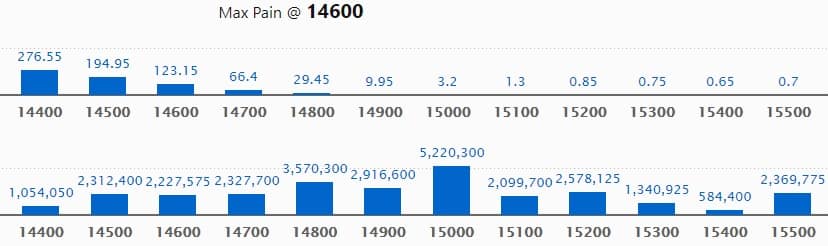

Call option data

Maximum Call open interest of 52.20 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 14,800 strike, which holds 35.70 lakh contracts, and 14,900 strike, which has accumulated 29.16 lakh contracts.

Call writing was seen at 14,900 strike, which added 1.92 lakh contracts, followed by 15,200 strike which added 1.42 lakh contracts and 14,800 strike which added 99,750 contracts.

Call unwinding was seen at 14,500 strike, which shed 4.88 lakh contracts, followed by 14,400 strike which shed 3.48 lakh contracts and 15,000 strike which shed 3.03 lakh contracts.

Put option data

Maximum Put open interest of 59.87 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

This is followed by 14,500 strike, which holds 55.07 lakh contracts, and 14,400 strike, which has accumulated 36.70 lakh contracts.

Put writing was seen at 14,500 strike, which added 22.88 lakh contracts, followed by 14,600 strike which added 18.65 lakh contracts and 14,400 strike which added 9.68 lakh contracts.

Put unwinding was seen at 15,000 strike, which shed 1.53 lakh contracts, followed by 14,800 strike which shed 26,400 contracts, and 15,500 strike which shed 19,050 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

90 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

8 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 8 stocks in which long unwinding was seen.

19 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

41 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

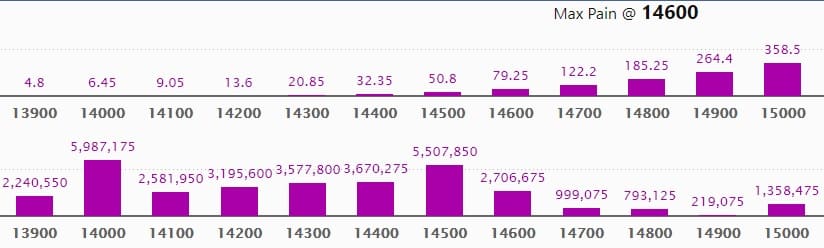

Bulk deals

(For more bulk deals, click here)

Results on April 28

Bajaj Finserv, Biocon, Bombay Dyeing & Manufacturing, Carborundum Universal, Chennai Petroleum Corporation, Enkei Wheels, GHCL, Hathway Cable & Datacom, KPIT Technologies, KPR Mill, KSB, Maharashtra Scooters, Mastek, Mega Fin (India), Nelco, Pacheli Industrial Finance, Shree Digvijay Cement, SIS, Sundaram-Clayton, Tata Communications and UTI Asset Management Company will release quarterly earnings on April 28.

Stocks in News

Britannia Industries: The company reported lower profit at Rs 360.1 crore in Q4FY21 against Rs 372.3 crore in Q4FY20, revenue rose to Rs 3,130.7 crore from Rs 2,867.7 crore YoY.

Bajaj Finance: The company reported sharply higher consolidated profit at Rs 1,347 crore in Q4FY21 against Rs 948 crore in Q4FY20, consolidated net interest income fell to Rs 4,659 crore from Rs 4,684 crore YoY.

Axis Bank: The company reported profit at Rs 2,677 crore in Q4FY21 against loss of Rs 1,388 crore in Q4FY20, net interest income jumped to Rs 7,555 crore from Rs 6,808 crore YoY.

HDFC AMC: The company reported sharply higher profit at Rs 316.1 crore in Q4FY21 against Rs 250 crore in Q4FY20, revenue rose to Rs 503 crore from Rs 476.1 crore YoY.

ABB India: The company reported sharply higher profit at Rs 141 crore in Q4FY21 against Rs 64.6 crore in Q4FY20, revenue increased to Rs 1,629.1 crore from Rs 1,522.2 crore YoY.

TVS Motor Company: The company reported sharply higher profit at Rs 289.24 crore in Q4FY21 against Rs 73.87 crore in Q4FY20, revenue rose to Rs 5,321.93 crore from Rs 3,481.42 crore YoY.

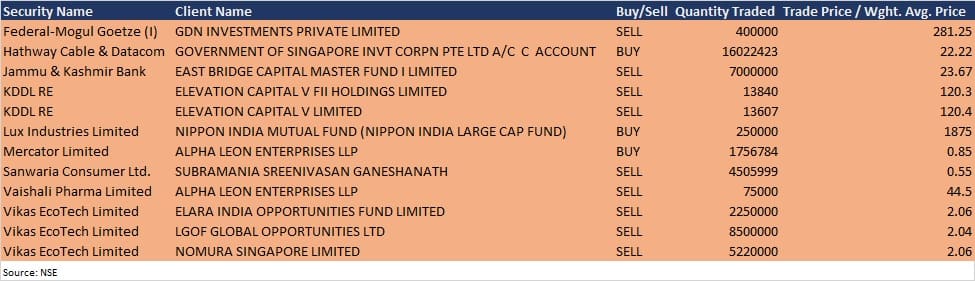

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,454.75 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,463.44 crore in the Indian equity market on April 27, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for April 28. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!