The market ended the rangebound session with half a percent higher on March 23, backed by banks after Supreme Court's order against granting interest waiver and extension of moratorium period.

The BSE Sensex reclaimed the 50,000-mark, up 280.15 points to settle at 50,051.44, while the Nifty50 was up 78.40 points at 14,814.80 and formed a bullish candle on the daily charts.

"A small positive candle was formed with upper and lower shadow. Technically this pattern could be considered as a high wave type candle pattern and this indicates high volatility in the underlying," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Some time, such high wave formation after a reasonable upside or at the key resistance could result in a reversal of the upmove. Hence, any further indication of lack of strength to sustain highs could mean resumption of higher levels weakness in the market," he said.

"The short term trend of Nifty remains positive, but market's inability to sustain above the hurdle of 14,850 could be a cause of concern. A sustainable move above 14,850-14,900 levels could pull Nifty towards the next hurdle of 15,050 levels in the near term. Any failure could open weakness from the highs. Immediate support is placed at 14,700," he added.

The broader markets also closed higher with the Nifty Midcap 100 index, rising 0.87 percent and Smallcap 100 index gaining 0.36 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,721.67, followed by 14,628.53. If the index moves up, the key resistance levels to watch out for are 14,893.27 and 14,971.73.

Nifty Bank

The Nifty Bank index surged 581 points or 1.73 percent to close at 34,184.40 on March 23. The important pivot level, which will act as crucial support for the index, is placed at 33,750.9, followed by 33,317.4. On the upside, key resistance levels are placed at 34,489 and 34,793.6 levels.

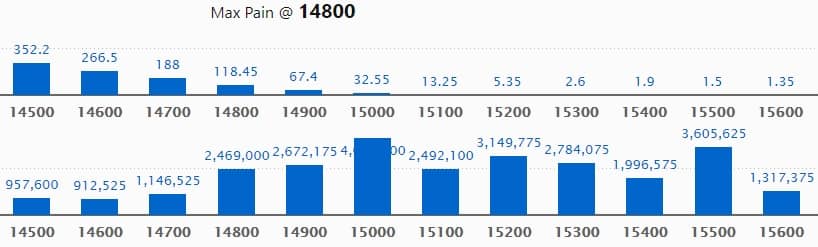

Call option data

Maximum Call open interest of 40.94 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,500 strike, which holds 36.05 lakh contracts, and 15,200 strike, which has accumulated 31.49 lakh contracts.

Call writing was seen at 14,900 strike, which added 3.84 lakh contracts, followed by 15,200 strike which added 3.64 lakh contracts and 15,100 strike which added 3.13 lakh contracts.

Call unwinding was seen at 15,500 strike, which shed 21.34 lakh contracts, followed by 14,700 strike which shed 5.15 lakh contracts and 15,600 strike which shed 3.93 lakh contracts.

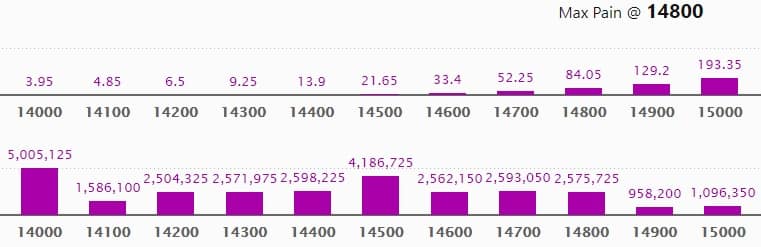

Put option data

Maximum Put open interest of 50.05 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the March series.

This is followed by 14,500 strike, which holds 41.86 lakh contracts, and 14,400 strike, which has accumulated 25.98 lakh contracts.

Put writing was seen at 14,800 strike, which added 13.79 lakh contracts, followed by 14,000 strike, which added 9.71 lakh contracts and 14,700 strike which added 7.47 lakh contracts.

Put unwinding was seen at 14,100 strike, which shed 1.13 lakh contracts, followed by 15,000 strike which shed 51,600 contracts and 15,500 strike which shed 10,950 contracts.

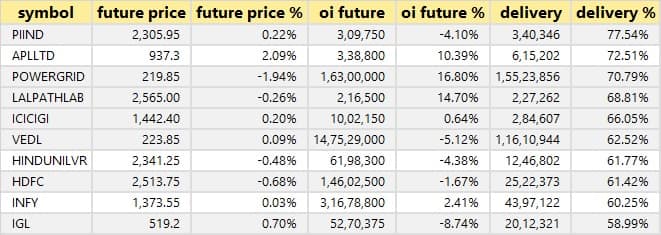

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

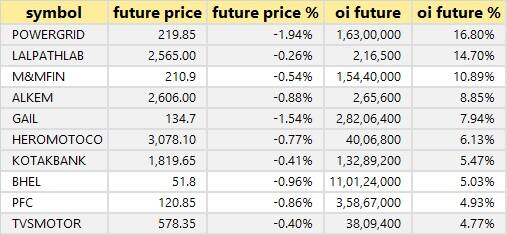

32 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

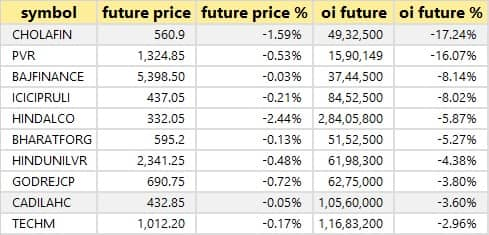

29 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

24 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

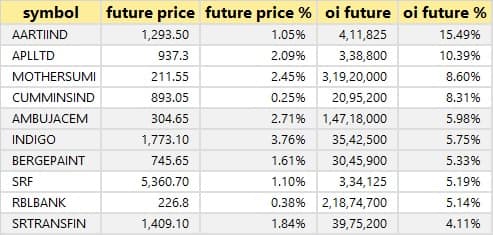

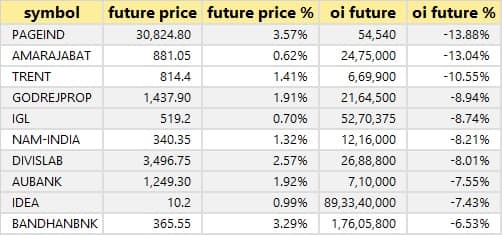

73 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

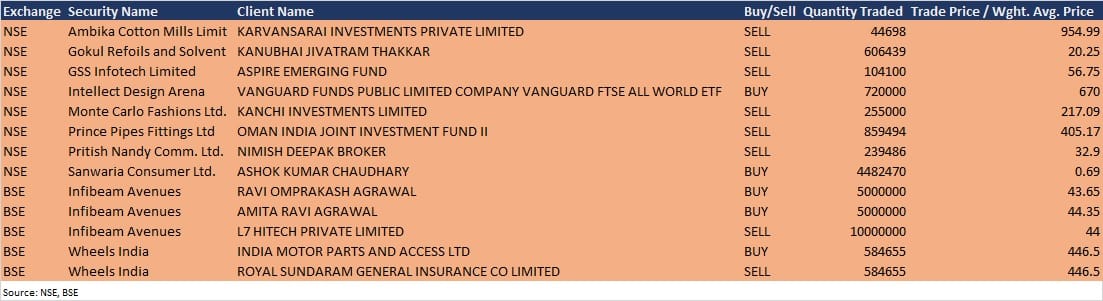

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Amber Enterprises India: The officials of the company will be interacting with investors on March 24.

Dr Lal PathLabs: The company's officials will interact with Enam AMC on March 24.

Antony Waste Handling Cell: The officials of the company will be attending the Investor Conference on March 24 and 25 organised by Motilal Oswal Financial Services.

Pricol: The representative(s) of the company will have a conference call with ICICI Securities and list of participants organised by Motilal Oswal under - 'Motilal Oswal 4th Ideation Conference' on March 25.

HEG: The senior management of the company is scheduled to meet investors-analyst virtually on March 25 in the Motilal Oswal Ideation Conference 2021 organised by Motilal Oswal Financial Services.

Transwarranty Finance: The meeting of the board of directors of the company is scheduled on March 30 to consider the raising of funds by issue of secured and/or unsecured redeemable non-convertible debentures on private placement.

Stocks in the news

Rossari Biotech: Rossari Biotech approved issuance of 30,12,046 equity shares on a preferential basis, at a price of Rs 996 per equity share. The company raised nearly Rs 300 crore through preferential issue to SBI Mutual Fund, Ramesh Siyani, Arpit Kbandelwal, Malabar Select Fund, Malabar India Fund, Malabar Value Fund and India Acom Fund.

Rail Vikas Nigam: The Government of India will sell 20,85,02,010 equity shares of Rail Vikas Nigam or 10% of total paid up equity, via offer for sale route on March 24-25. In case of oversubscription, the government will sell additional 10,42,51,005 equity shares or 5% shareholding in the company.

India Glycols: India Ratings & Research has placed India Glycols' Long-term Issuer Ratings of 'A-' on Rating Watch Positive (RWP).

Vascon Engineers: Vascon Engineers has emerged as lowest bidder for 2 projects of Uttar Pradesh Public Works Department.

Laurus Labs: Rating agency CARE retained credit rating of the company's long-term banking facilities as 'AA-', but revised outlook to Positive from Stable.

Deepak Nitrite: ICRA has upgraded long-term rating from AA- to AA on bank facilities of Deepak Nitrite. The outlook on the long-term rating has been revised from Positive to Stable.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 108.24 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 529.69 crore in the Indian equity market on March 23, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Vodafone Idea and SAIL - are under the F&O ban for March 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!