The market continued its uptrend with the benchmark indices hitting a fresh record high on January 5, driven by technology, banking, and financial stocks.

Both the indices ended at record closing peaks. The BSE Sensex rallied 260.98 points to 48,437.78, while the Nifty50 climbed 66.60 points to 14,199.50 and formed a bullish candle on the daily charts.

"A long bull candle was formed on Tuesday, which indicates a confirmation of small upside breakout of the range at 14,000 levels, which is a positive indication. New swing high was formed at 14,215 and Nifty closed near the highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The long term charts like monthly timeframe signal sharp upside breakout of the intermediate trend line with confirmation (connecting monthly top to top at 12,750-12,800 levels) and this area is going to be a strong support during any sharp profit booking in the market," he said.

"The short term trend of Nifty remains positive. Though intraday profit booking is emerging from the new highs on daily basis, the strong buying is also witnessing on dips. The next Fibonacci projection resistance is at 14,310 and the near term upside targets to be watched around 14,600-14,800 levels. Immediate support is placed at 14,080," he added.

The broader markets also gained further, with the Nifty Midcap and Smallcap indices rising more than 0.6 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,093.27, followed by 13,987.03. If the index moves up, the key resistance levels to watch out for are 14,260.67 and 14,321.83.

Nifty Bank

The Nifty Bank outperformed Nifty50, rising 509.80 points or 1.63 percent to close at 31,722.30 on January 5. The important pivot level, which will act as crucial support for the index, is placed at 31,182.63, followed by 30,643.07. On the upside, key resistance levels are placed at 32,014.73 and 32,307.27.

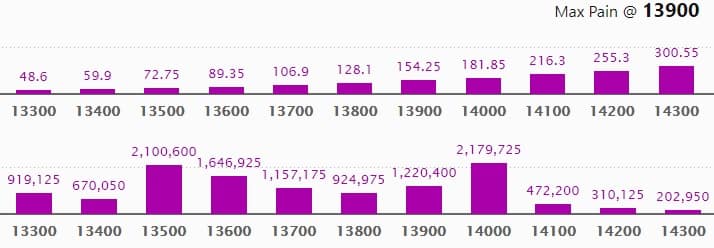

Call option data

Maximum Call open interest of 20.15 lakh contracts was seen at 14,000 strike, which will act as a crucial level in the January series.

This is followed by 14,500 strike, which holds 13.22 lakh contracts, and 15,000 strike, which has accumulated 12.67 lakh contracts.

Call writing was seen at 14,600 strike, which added 94,425 contracts, followed by 14,300 strike which added 71,925 contracts and 14,400 strike which added 54,450 contracts.

Call unwinding was seen at 14,200 strike, which shed 1.37 lakh contracts, followed by 14,000 strike which shed 83,250 contracts.

Put option data

Maximum Put open interest of 21.79 lakh contracts was seen at 14,000 strike, which will act as crucial support level in the January series.

This is followed by 13,500 strike, which holds 21 lakh contracts, and 13,600 strike, which has accumulated 16.46 lakh contracts.

Put writing was seen at 13,700 strike, which added 2.99 lakh contracts, followed by 14,000 strike, which added 2.59 lakh contracts and 14,100 strike which added 1.32 lakh contracts.

There was hardly any Put unwinding seen on January 5.

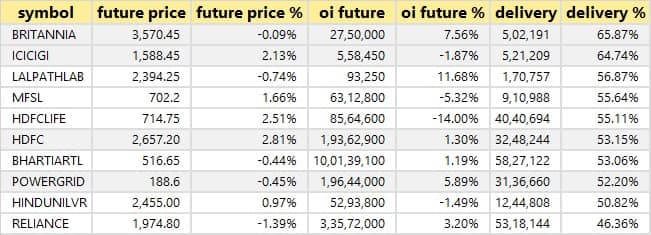

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

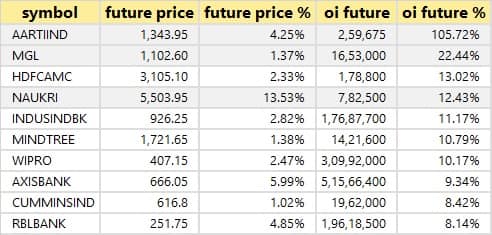

52 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

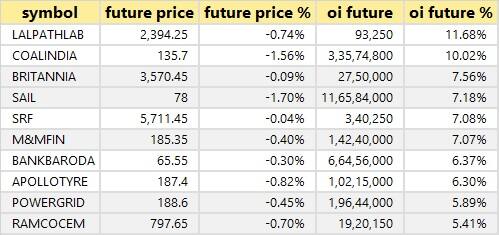

16 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

38 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

31 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Eicher Motors: Company's officials will interact with Antique Stock Broking on January 6 and Quantum Advisors on January 7.

Mahindra & Mahindra: Company's officials to interact with IDFC Mutual Fund on January 6 and Axis Mutual Fund on January 7.

Endurance Technologies: Telephonic or virtual meeting with GIC Mumbai have been scheduled for January 6.

Indoco Remedies: Company's officials to interact with L&T Mutual Fund on January 6.

Mishra Dhatu Nigam: Company's officials interact with investors/analysts on January 6.

Garware Polyester: Company's officials to interact with ANS Wealth and Milars on January 7, and Ambit Capital on January 8.

JSW Steel: Company's officials will attend Investec India ESG Conclave on January 7.

Motherson Sumi Systems: The management of the company will attend the investor conference organised by Prabhudas Lilladher on January 7.

Centum Electronics: Company's officials will interact with Acacia Partners on January 7.

ONGC: Board meeting is scheduled for January 11 to consider the allotment of proposed NCDs.

L&T Finance Holdings: Company will hold a conference call with the institutional investor(s) and analyst(s) on January 18 to discuss Q3 FY2021 financial performance and provide updates on strategy.

Federal Bank: Company will declare its December quarter earnings on January 20.

Aditya Birla Fashion and Retail: Investor Call will be held on February 8 to discuss the financial results for the December quarter and the business outlook.

Stocks in the news

Hero MotoCorp: Life Insurance Corporation of India increased its stake in the company to 9.166% from 7.145% earlier.

Tips Industries: Board in-principally agreed to explore the demerger of the film business of Tips Industries into a separate entity.

BEML: Company bagged orders for supply of high mobility vehicles from Ministry of Defence, at an approximate value of Rs 758 crore.

UTI AMC: Mirae Asset Mutual Fund raised its stake in the company to 5.003% from 4.984% earlier.

ACC: Company announced the commissioning of new cement production facility at the company's existing Sindri Grinding Unit in Jharkhand.

Bajaj Finance: RBI imposed a Rs 2.5 crore penalty on the company for breach of risk management and outsourcing norms.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 986.3 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 490.03 crore in the Indian equity market on January 5, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for January 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!