The market rebounded sharply after a long weekend and recouped all previous day's losses to close with a percent gains on December 1, especially after better-than-expected GDP numbers for Q2FY21 and November auto sales data.

The buying in technology, metals, pharma, auto, and select banking and financials helped the BSE Sensex rise 505.72 points to 44,655.44, while the Nifty50 rose 140 points to 13,109 and formed small bodied bullish candle, which resembles Hanging Man kind of pattern on the daily charts.

"A small positive candle was formed with long lower shadow. Technically, this pattern could indicate a buy on dips opportunity in the market. Recently, we observe formation of few lower shadows in the daily candles, which signal that bulls are not willing to give up, despite new all-time highs and overhead resistances," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"The short-term trend of Nifty continues to be positive. Further upside above 13,145 is expected to negate couple of bearish patterns, as per daily and weekly timeframe chart and that is expected to open the next upside levels of 13,500 in the near term. Immediate support is placed at 12,960," he said.

The broader markets continued its run up seen last week as the Nifty MidCap and SmallCap indices gained nearly a percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 13,005.07, followed by 12,901.13. If the index moves up, the key resistance levels to watch out for are 13,170.67 and 13,232.33.

Nifty Bank

The Bank Nifty climbed 208.75 points to close at 29,817.80 on December 1. The important pivot level, which will act as crucial support for the index, is placed at 29,579.27, followed by 29,340.73. On the upside, key resistance levels are placed at 29,988.07 and 30,158.33.

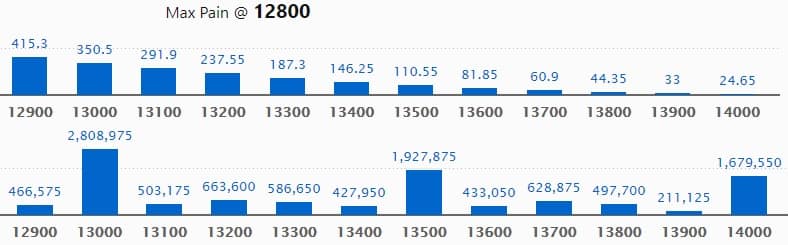

Call option data

Maximum Call open interest of 28.08 lakh contracts was seen at 13,000 strike, which will act as crucial resistance level in the December series.

This is followed by 13,500 strike, which holds 19.27 lakh contracts, and 14,000 strike, which has accumulated 16.79 lakh contracts.

Call writing was seen at 13,700 strike, which added 2.47 lakh contracts, followed by 14,000 strike which added 1.02 lakh contracts and 13,100 strike which added 99,075 contracts.

Call unwinding was seen at 12,500 strike, which shed 26,325 contracts, followed by 12,800 strike which shed 16,950 contracts and 13,300 strike which shed 13,125 contracts.

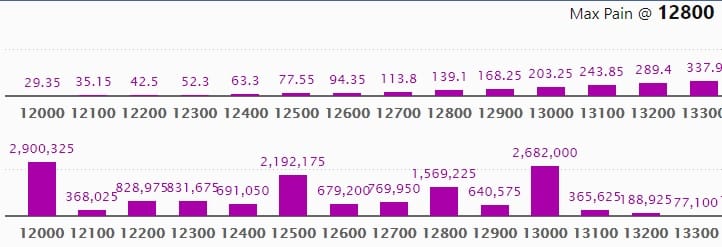

Put option data

Maximum Put open interest of 29 lakh contracts was seen at 12,000 strike, which will act as a crucial support in the December series.

This is followed by 13,000 strike, which holds 26.82 lakh contracts, and 12,500 strike, which has accumulated 21.92 lakh contracts.

Put writing was seen at 13,000 strike, which added 3.65 lakh contracts, followed by 13,100 strike, which added 1.65 lakh contracts and 12,000 strike which added 1.2 lakh contracts.

Put unwinding was seen at 12,200 strike, which shed 2.33 lakh contracts, followed by 12,600 strike, which shed 1.8 lakh contracts.

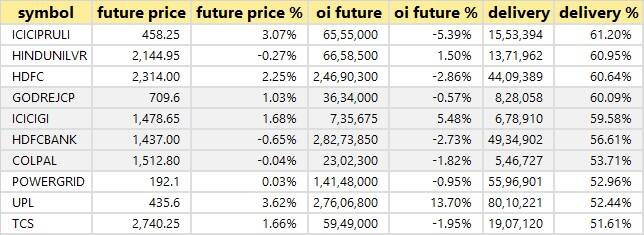

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

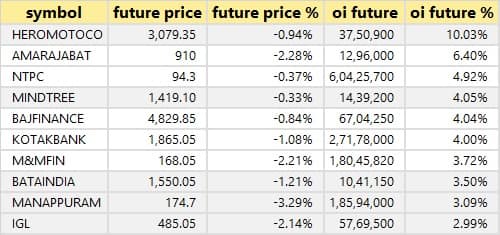

51 stocks saw long build-up

Based on the open interest future percentage, here are the 10 stocks in which long build-up was seen.

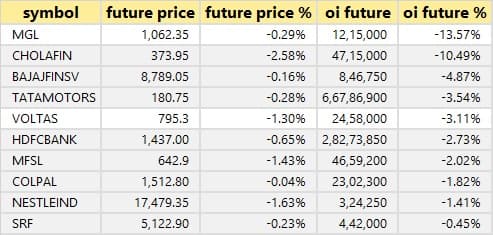

12 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

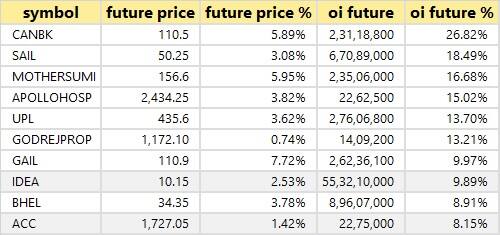

21 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

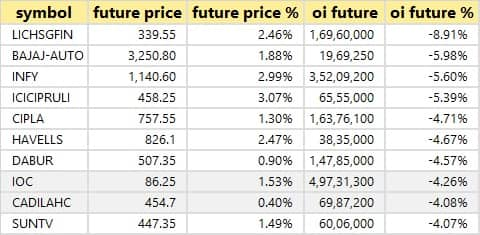

55 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

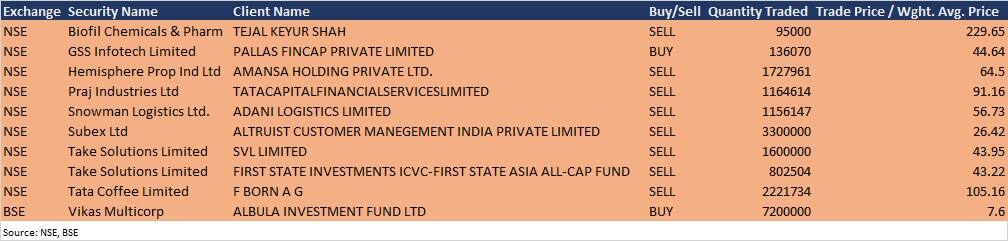

Bulk deals

(For more bulk deals, click here)

Analysts Meets/Board Meetings

Trident: Company's officials will interact with analysts/investors in a conference organised by Asian Markets Securities on December 2.

Cipla: Company's officials will interact with FIL India Virtual Trip 2020 on December 2.

Mahanagar Gas: Company's officials will interact with First State Stewart Asia on December 4.

Prince Pipes and Fittings: Company is participating in Asian Markets Securities Pvt. Ltd. conference to be held on December 2.

ABB Power Products and Systems India: Company's officials will interact with investors/analysts on December 2.

Amber Enterprises: Company's officials will be interacting with analyst on December 2 via video conference and/or conference calls.

Smartlink Holdings: Board meeting will be held on December 4 to consider the proposal for buyback.

Tube Investments of India: Meeting through digital access with an Analyst/Institutional Investor is scheduled on December 3.

Mahindra Holidays & Resorts India: Company's officials will interact with B&K Securities, BP Wealth, Smart Sync Services, Phillip Capital and Ashika Securities on December 2.

Welspun India: Company's officials will interact with Asian Markets Securities on December 3.

Stocks in the news

Sun Pharma Advanced Research Company: Promoter entity Raksha Sudhir Valia released 34 lakh equity shares of the company.

Dr Reddy's Labs: Company and Russian Direct Investment Fund (RDIF) commenced clinical trials for Sputnik V vaccine in India.

SML Isuzu: Company sold 516 vehicles in November 2020 against 521 vehicles sold in November 2019.

Godrej Industries: ICRA assigned 'A1+' rating to the company's issue of Commercial Paper Programme of upto Rs 1,500 crore.

Hero MotoCorp: Company sold 5,91,091 units of motorcycles and scooters in November 2020, against 5,16,775 units in November 2019.

Tata Motors: Company sold 49,650 vehicles in November 2020 against 41,124 units in November 2020.

Eicher Motors: Company sold 63,782 units of motorcycles in November 2020, against 60,411 units of motorcycles in November 2019.

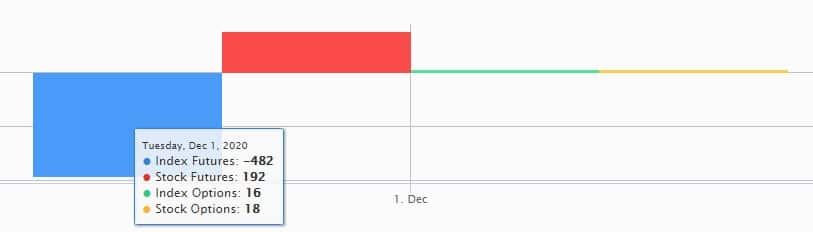

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 3,242 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,043.21 crore in the Indian equity market on December 1, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for December 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!