The market rebounded after correcting on October 26. The Sensex climbed 376.60 points to 40,522.10 and the Nifty rallied 121.60 points to 11,889.40, forming a bullish candle on the daily charts.

Sectors like banking & financials, automobile, FMCG and pharma stocks witnessed buying interest.

"A reasonable positive candle was formed on Tuesday, just besides the long negative candle of Monday. Technically, this pattern signals a smart comeback for the bulls from lower levels. In the last few occasions, the formation of such long bear candles have failed to show any reasonable follow-through declines after its formation," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, explained.

"Hence, the upside bounce of Tuesday, after a long negative candle of the previous session, could indicate the possibility of more upside in the market. This signals an inherent strength for the bulls below the key overhead resistance of 12,000 mark. Such repeated actions below this hurdle could eventually open doors for a decisive upside above 12,000 in the near term," he said.

The market breadth was slightly in favour of declines due to marginal upside in the smallcap index, which gained 0.3 percent, while the midcap index rose 1.22 percent.

We have collated 15 data points to help you spot profitable trades: Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty According to pivot charts, the key support level for the Nifty is placed at 11,775.27, followed by 11,661.13. If the index moves up, the key resistance levels to watch out for are 11,951.27 and 12,013.13.

Nifty Bank The Bank Nifty outperformed the Nifty, rising 694.05 points, or 2.88 percent, to 24,769.50 on October 27. The important pivot level, which will act as crucial support for the index, is placed at 24,192.57, followed by 23,615.63. On the upside, key resistance levels are placed at 25,078.07 and 25,386.63.

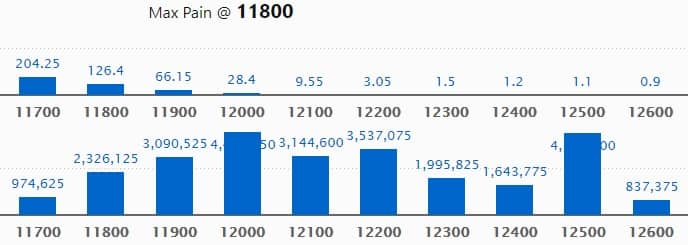

Call option data Maximum Call OI of 44.03 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the October series.

This is followed by 12,500, which holds 43.63 lakh contracts, and 12,200 strikes, which has accumulated 35.37 lakh contracts.

There was hardly any Call writing.

The highest Call unwinding was seen at 12,500, which shed 12.33 lakh contracts, followed by 12,000, which shed 8.41 lakh contracts, and 11,900 strikes, which shed 8.39 lakh contracts.

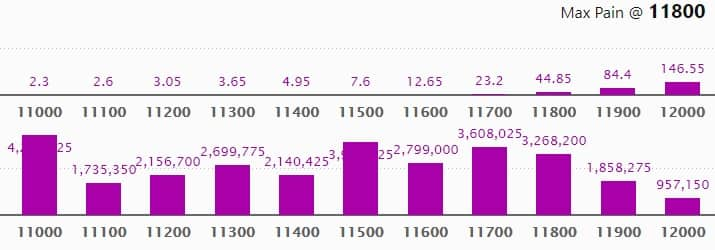

Put option data Maximum Put OI of 42.87 lakh contracts was seen at 11,000 strike, which will act as crucial support in the October series.

This is followed by 11,500, which holds 39.03 lakh contracts, and 11,700 strikes, which has accumulated 36.08 lakh contracts.

Put writing was seen at 11,800, which added 10.15 lakh contracts, followed by 11,700, which added 10.12 lakh contracts, and 11,000 strikes, which added 9.7 lakh contracts.

Put unwinding was witnessed at 12,000, which shed 24,150 contracts, followed by 12,500 strikes, which shed 20,925 contracts, and 12,200 strikes, which shed 12,375 contracts.

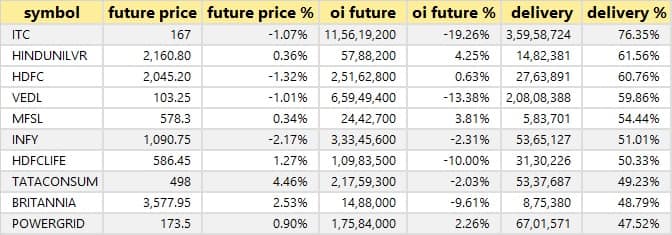

Stocks with a high delivery percentage A high delivery percentage suggests that investors are showing interest in these stocks.

44 stocks saw long build-up Based on OI future percentage, here are the top 10 stocks in which long build-up was seen.

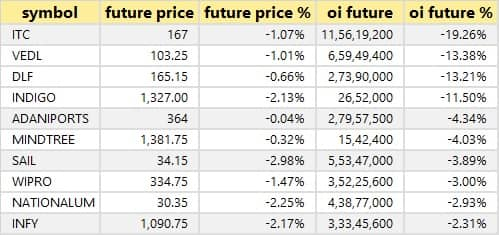

22 stocks saw long unwinding Based on OI future percentage, here are the top 10 stocks in which long unwinding was seen.

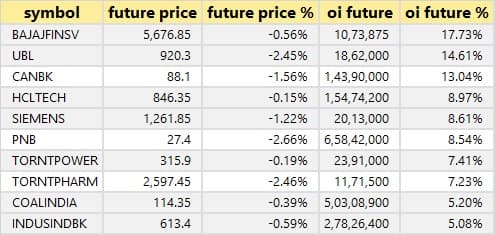

24 stocks saw short build-up An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are top 10 stocks in which short build-up was seen.

48 stocks witnessed short-covering A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on OI future percentage, here are the top 10 stocks in which short-covering was seen.

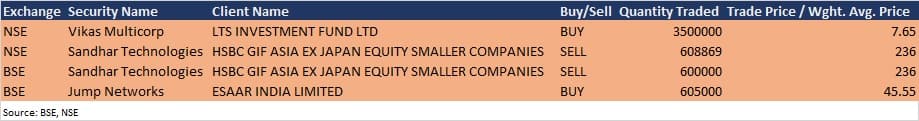

Bulk deals  (For more bulk deals, click here)

(For more bulk deals, click here)

Results on October 28 L&T, Axis Bank, Hero MotoCorp, Dr Reddy's Laboratories, Titan Company, APL Apollo Tubes, Aptech, AU Small Finance Bank, Balaji Amines, Blue Star, Can Fin Homes, Carborundum Universal, CG Power and Industrial Solutions, Cummins India, Firstsource Solutions, GSK Pharma, Heritage Foods, HSIL, IIFL Wealth Management, ICICI Securities, Marico, Max India, MCX, MOIL, Navin Fluorine International, Piramal Enterprises, PI Industries, PNB Housing Finance, Radico Khaitan, RBL Bank, Route Mobile, Schaeffler India, Tata Coffee, Texmo Pipes & Products, Thyrocare Technologies, UTI Asset Management Company and V-Guard Industries are among 69 companies to announce quarterly earnings on October 28.

Stocks in the news Tata Motors reported a consolidated loss of Rs 314.5 crore in Q2 FY21 against a loss of Rs 216.6 crore. Revenue fell to Rs 53,530 crore from Rs 65,431 crore YoY.

Bharti Airtel reported a consolidated loss of Rs 763.2 crore in Q2 FY21 against a loss of Rs 15,933.1 crore. Revenue rose to Rs 25,785 crore from Rs 23,938.7 crore QoQ. .

ICICI Prudential Life Insurance Company reported a profit of Rs 302.46 crore in Q2 FY21 against Rs 301.84 crore YoY. Net premium income rose to Rs 8,572.2 crore from Rs 8,064.7 crore YoY.

Network18 Media & Investments reported a Q2 profit of Rs 68 crore against a loss of Rs 25 crore. Revenue came in at Rs 1,061 crore against Rs 1,174 crore YoY.

TV18 Broadcast reported higher profit of Rs 115 crore in Q2 FY21 against Rs 46 crore, revenue at Rs 1,013 crore against Rs 1,127 crore YoY.

Castrol India reported higher profit at Rs 204.6 crore in Q2 against Rs 188.4 crore, revenue rose to Rs 883.1 crore from Rs 849.2 crore YoY.

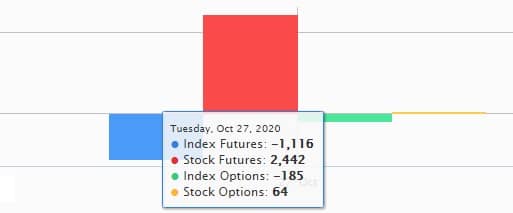

Fund flow

FII and DII data Foreign institutional investors (FIIs) net bought shares worth Rs 3,514.89 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,570.8 crore in the Indian equity market on October 27, as per provisional data available on the NSE.

Stock under F&O ban on NSE Two stocks - Coforge and Vodafone Idea - are under the F&O ban for October 28. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: TV18 Broadcast is a subsidiary of Network18 Media & Investments Ltd which publishes Moneycontrol.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!