The market continued its upside momentum, amid consolidation, for the third consecutive session on October 20 led by technology, select automobile and banks stocks. Fall in the number of COVID-19 infections, strong September quarter earnings and hope for further fiscal stimulus supported the market.

The Sensex ended up 112.77 points at 40,544.37 and the Nifty gained 23.8 points at 11,896.80. The latter formed a small bodied bullish candle on the daily charts, which resembles a Shooting Star kind of pattern.

The overall market breadth was slightly positive with minor gains registered in the midcap and smallcap indices.

"We are unlikely to see any sharp weakness. Any minor decline/consolidation could be a buy on dips opportunity for the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"The short term uptrend on the Nifty remains intact. The market could make an attempt to retest the crucial upper resistance of around 12,000-12,050 levels in the next few sessions. Immediate supports to be watched at 11,780," he added.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty According to pivot charts, the key support levels for the Nifty is placed at 11,839.6, followed by 11,782.4. If the index moves up, the key resistance levels to watch out for are 11,951.6 and 12,006.4.

Nifty Bank The Bank Nifty closed at 24,311.80, up 45.05 points, on October 20. The important pivot level, which will act as crucial support for the index, is placed at 24,097.43, followed by 23,883.07. On the upside, key resistance levels are placed at 24,468.53 and 24,625.27.

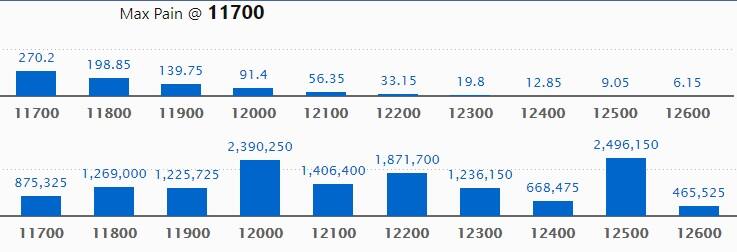

Call option data Maximum Call OI of 24.96 lakh contracts was seen at 12,500 strike, which will act as crucial resistance in the October series.

This is followed by 12,000, which holds 23.90 lakh contracts, and 12,200 strikes, which has accumulated 18.71 lakh contracts.

Call writing was seen at 12,000, which added 81,225 contracts, followed by 12,500, which added 69,450 contracts, and 12,600 strikes, which added 22,425 contracts.

Call unwinding was seen at 12,200, which shed 1.59 lakh contracts, followed by 11,800, which shed 80,100 contracts, and 11,700 strikes, which shed 64,350 contracts.

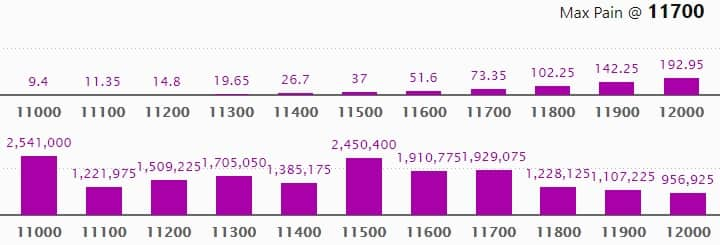

Put option data Maximum Put OI of 25.41 lakh contracts was seen at 11,000 strike, which will act as crucial support in the October series.

This is followed by 11,500, which holds 24.50 lakh contracts, and 11,700 strikes, which has accumulated 19.29 lakh contracts.

Put writing was seen at 11,900, which added 1.55 lakh contracts, followed by 12,000, which added 1.04 lakh contracts, and 11,500 strikes, which added 78,300 contracts.

Put unwinding was witnessed at 11,100, which shed 33,300 contracts, followed by 11,600 strikes, which shed 6,600 contracts.

Stocks with a high delivery percentage A high delivery percentage suggests that investors are showing interest in these stocks.

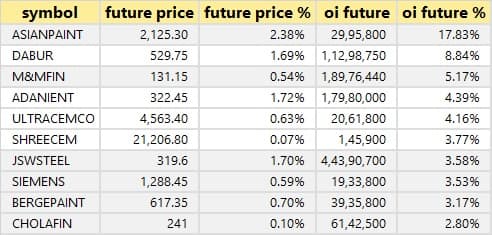

28 stocks saw long build-up Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

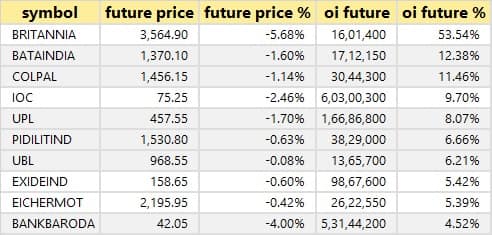

28 stocks saw long unwinding Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

34 stocks saw short build-up An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are top 10 stocks in which short build-up was seen.

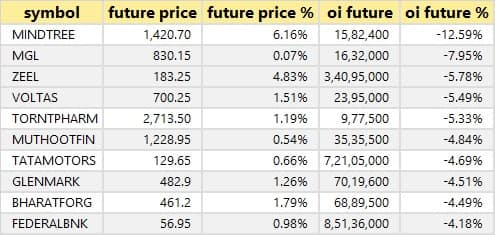

47 stocks witnessed short-covering A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are top 10 stocks in which short-covering was seen.

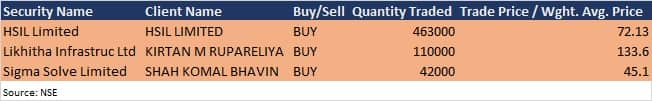

Bulk deals  (For more bulk deals, click here)

(For more bulk deals, click here)

Results on October 21 Bajaj Finance, Bajaj Finserv, UltraTech Cement, Chennai Petroleum Corporation, Colgate-Palmolive, Syngene International, Asian Tea & Exports, Arihant Superstructures, Agro Tech Foods, Avantel, Bliss GVS Pharma, DB Corp, GMM Pfaudler, Indo Count Industries, JK Tyre & Industries, KPIT Technologies, National Peroxide, Newgen Software Technologies, Sagar Cements, Sasken Technologies, SE Power, Shanthi Gears and Tejas Networks are among 31 companies to announce quarterly earnings on October 21.

Stocks in the news Mahindra CIE Automotive reported a profit of Rs 60.7 crore in Q3 CY20 against Rs 61.17 crore YoY. Revenue fell to Rs 1,694.3 crore from Rs 1,868.5 crore YoY.

Brigade Enterprises: Subsidiary Mysore Projects entered into a liability partnership agreement with Prestige Estates Projects in Prestige OMR Ventures for a 30 percent contribution.

Bajaj Auto: LIC increased stake in the company to 6.4 percent in the September quarter from 4.76 percent in the June quarter.

Indian Energy Exchange reported a profit of Rs 44.33 crore in Q2 FY21 against Rs 48.8 crore. Revenue increased to Rs 70.91 crore from Rs 67.45 crore YoY.

Bombay Dyeing reported loss of Rs 90.68 crore in Q2 FY21 against a profit of Rs 89.51 crore. Revenue fell to Rs 217 crore from Rs 555 crore YoY.

L&T: LIC holds 1.1 percent stake at the end of the September quarter. Foreign portfolio investors (FPIs) increased stake to 28.16 percent from 26.95 percent in the June quarter. Mutual funds (MFs) reduced their stake to 6.96 percent from 9.32 percent in the same period.

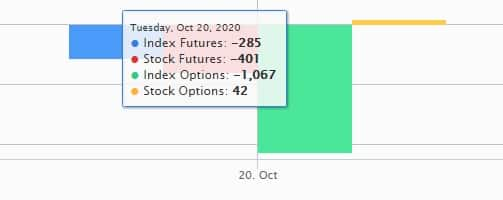

Fund flow

FII and DII data Foreign institutional investors (FIIs) net bought shares worth Rs 1,585.07 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,633.23 crore in the Indian equity market on October 20, as per provisional data available on the NSE.

Stock under F&O ban on NSE Ten stocks - Bharat Heavy Electricals (BHEL), Canara Bank, Indiabulls Housing Finance, Vodafone Idea, Jindal Steel & Power, Mindtree, National Aluminium Company (Nalco), Punjab National Bank, Steel Authority of India (SAIL) and Tata Motors - are under the F&O ban for October 21. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!