The market closed the rangebound session on a flat note on October 13 as the rally in IT stocks supported the market, but selling in banking and financials, pharmaceuticals, select automobiles and fast moving consumer goods (FMCG) stocks capped the gains.

The Sensex rose 31.71 points to close at 40,625.51 and the Nifty gained 3.50 points at 11,934.50, forming a Doji pattern on the daily charts as the closing was near its opening levels.

"Normally, a formation of Doji after a reasonable up move or down move could be considered as a warning signal for a trend reversal. Having formed this pattern beside the last negative candle could mean less predictive value for this Doji pattern," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"The uptrend of the last seven-to-eight sessions is intact. The consolidation movement of the last couple of sessions could be considered as a corrective move of the said uptrend. This signal a lack of selling participation at the swing highs, post the sharp up move. Similar consolidation pattern was formed in the past during the latter part of September (29-30) and eventually resulted in an uptrend continuation pattern," he explained.

The broader markets continued to underperform benchmarks with the Nifty Midcap index falling half a percent and Smallcap down 0.2 percent as five shares declined for every four advancing shares on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty According to pivot charts, the key support levels for the Nifty is placed at 11,886.2, followed by 11,837.9. If the index moves up, the key resistance levels to watch out for are 11,985.5 and 12,036.5.

Nifty Bank The Bank Nifty fell for second consecutive session, losing 220.60 points to close at 23,492.20 on October 13. The important pivot level, which will act as crucial support for the index, is placed at 23,357.4, followed by 23,222.6. On the upside, key resistance levels are placed at 23,701.1 and 23,910.

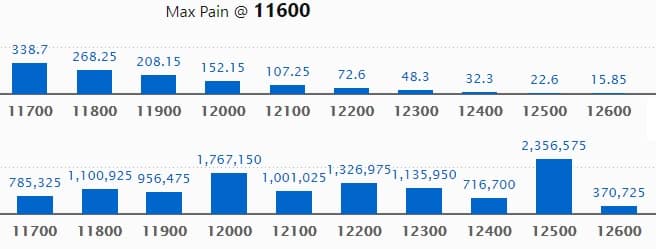

Call option data Maximum Call OI of 23.56 lakh contracts was seen at 12,500 strike, which will act as crucial resistance in the October series.

This is followed by 12,000, which holds 17.67 lakh contracts, and 12,200 strikes, which has accumulated 13.26 lakh contracts.

Call writing was seen at 11,900, which added 1.05 lakh contracts, followed by 12,500, which added 62,100 contracts, and 12,300 strikes, which added 46,800 contracts.

Call unwinding was seen at 11,200, which shed 33,075 contracts, followed by 11,500, which shed 22,950 contracts, and 11,400 strikes, which shed 22,125 contracts.

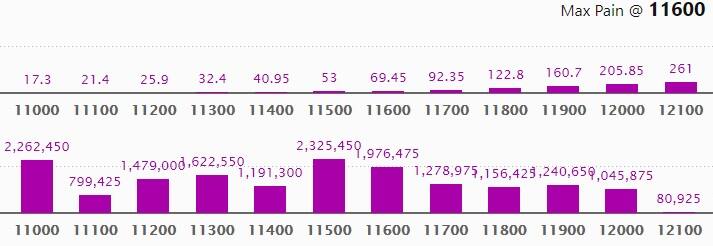

Put option data Maximum Put OI of 23.25 lakh contracts was seen at 11,500 strike, which will act as crucial support in the October series.

This is followed by 11,000, which holds 22.62 lakh contracts, and 11,600 strikes, which has accumulated 19.76 lakh contracts.

Put writing was seen at 11,600, which added 4.7 lakh contracts, followed by 11,900, which added 2.6 lakh contracts, and 11,700 strikes, which added 1.65 lakh contracts.

Put unwinding was witnessed at 11,200, which shed 1.12 lakh contracts, followed by 11,000 strikes, which shed 37,425 contracts.

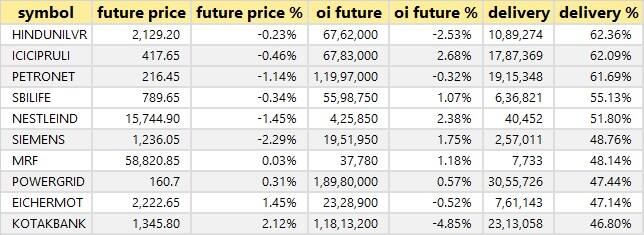

Stocks with a high delivery percentage A high delivery percentage suggests that investors are showing interest in these stocks.

17 stocks saw long build-up Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

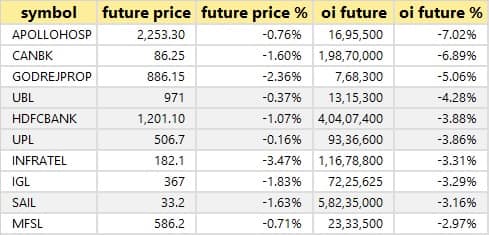

36 stocks saw long unwinding Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

58 stocks saw short build-up An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are top 10 stocks in which short build-up was seen.

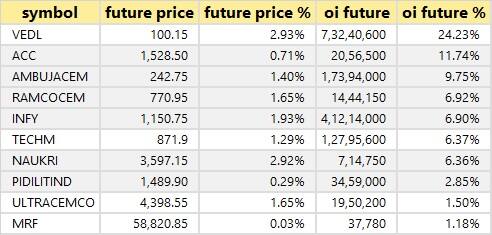

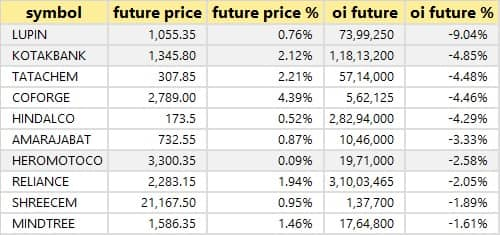

25 stocks witnessed short-covering A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

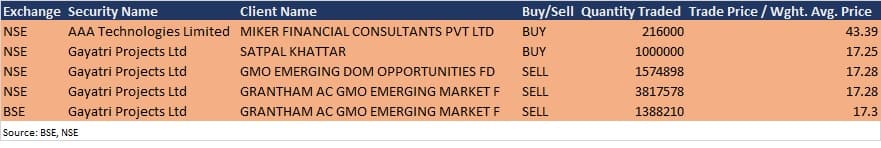

Bulk deals

(For more bulk deals, click here)

Results on October 14 Infosys, Aditya Birla Money, Tata Elxsi, Tata Steel BSL, Titagarh Wagons, CHD Chemicals, Den Networks, Goa Carbon, International Travel House, JTL Infra, Kilburn Chemicals, Modern Steels and Reliance Industrial Infrastructure are among the 16 companies that will announce their quarterly earnings on October 14.

Stocks in the news Wipro reported a dollar revenue growth of 3.7 percent at $1,992.4 million against $1,921.6 million QoQ. Management expects dollar revenue growth at 1.5-3.5 percent in Q3.

SRF: The QIP committee of the company is scheduled to be held on October 16 to determine the issue price.

PNB Gilts: CRISIL re-affirmed its credit rating of 'A1+' as assigned to its Rs 1,000 crore commercial paper programme.

Karnataka Bank reported a profit of Rs 119.44 crore in Q2 FY21 against Rs 105.91 crore, net interest income increased to Rs 575 crore from Rs 498.7 crore YoY.

CSL Finance's board approved the issuance of non-convertible debentures (NCDs) aggregating to Rs 10 crore on a private placement basis.

TVS Motor Company: LIC increased stake in company to 4.87 percent in September quarter from 3.18 percent in the June quarter.

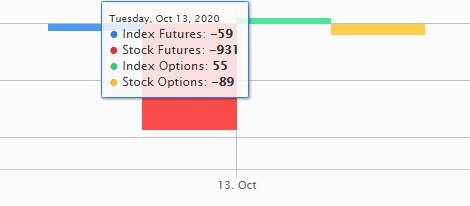

Fund flow

FII and DII data Foreign institutional investors (FIIs) net bought shares worth Rs 832.14 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,674.46 crore in the Indian equity market on October 13, as per provisional data available on the NSE.

Stock under F&O ban on NSE Seven stocks -- Adani Enterprises, Bharat Heavy Electricals (BHEL), Canara Bank, Escorts, Vodafone Idea, Jindal Steel & Power and Steel Authority of India (SAIL) -- are under the F&O ban for October 14. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!