The market regained strength on September 1 after a day of major correction seen in the last three months. The rally was driven by auto, financial services, FMCG, metals and pharma stocks.

The BSE Sensex climbed 272.51 points to 38,900.80, while the Nifty50 rose 82.80 points to 11,470.30, forming Long Legged Doji kind of pattern on the daily charts as closing was near opening levels.

"Tuesday's upside bounce may be a minor cheering factor for bulls to make a comeback, but the market is expected to reverse down from the highs in the next 1-2 sessions. The recent swing high of 11,794 is unlikely to be breached on the upside in the short term. Immediate support is placed at 11,365," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"Daily RSI has turned below crucial 60 levels. As per its bullish high low range of 75-40 levels, it could slide down to lower 40 over the period of time. Hence one needs to be careful about the resumption of further weakness from slightly higher levels," he said.

The broader markets also gained ground with Nifty Midcap index rising 0.82 percent and Smallcap up 0.37 percent.

"After the dismal GDP data, market participants are now hoping for more stimulus package announcements from the government. Meanwhile, participants would keep a close watch on India-China border tension and global markets for cues. Indications are in the favour of consolidation," Ajit Mishra, VP-Research, Religare Broking, said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,373.57, followed by 11,276.93. If the index moves up, the key resistance levels to watch out for are 11,560.17 and 11,650.13.

Nifty Bank

The Bank Nifty gained 57.65 points to close at 23,812 on September 1. The important pivot level, which will act as crucial support for the index, is placed at 23,456.9, followed by 23,101.8. On the upside, key resistance levels are placed at 24,183.4 and 24,554.8.

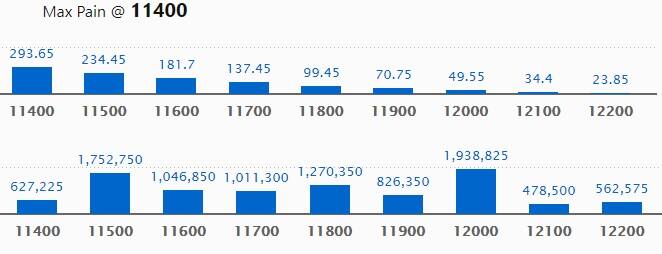

Call option data

Maximum Call open interest of 19.38 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the September series.

This is followed by 11,500 strike, which holds 17.52 lakh contracts, and 11,800 strike, which has accumulated 12.70 lakh contracts.

Call writing was seen at 12,200 strike, which added 54,975 contracts, followed by 12,100, which added 26,550 contracts.

Call unwinding was seen at 11,400 strike, which shed 72,225 contracts, followed by 11,600 strike, which shed 66,675 contracts and 11,500 strike, which shed 62,400 contracts.

Put option data

Maximum Put open interest of 28.30 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 11,300 strike, which holds 14.38 lakh contracts, and 11,200 strike, which has accumulated 12.68 lakh contracts.

Put writing was seen at 11,000 strike, which added 2.21 lakh contracts, followed by 11,300 strike, which added 1.35 lakh contracts and 11,200 strike which added 99,675 contracts.

Put unwinding was witnessed at 11,500, which shed 92,100 contracts, followed by 11,400 strike which shed 65,550 contracts.

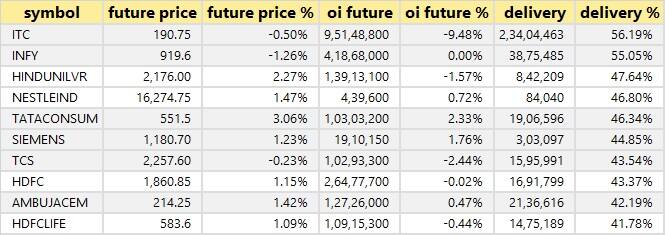

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

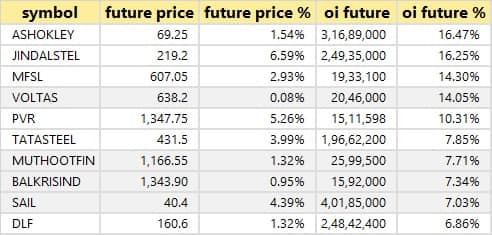

44 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

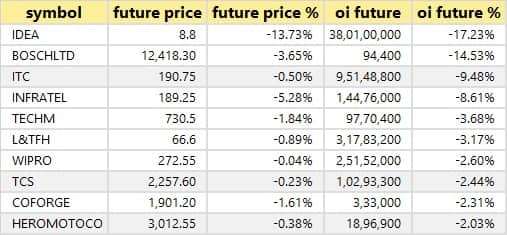

18 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

21 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

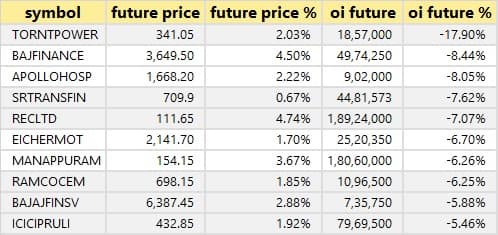

54 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

CG Power and Industrial Solutions: Finquest Financial Solutions sold 40 lakh shares in the company at Rs 23.80 per share via bulk deals on the BSE.

Future Enterprises DVR Class B shares (Series 1): Vivek Saraogi sold 4,69,351 shares in company at Rs 22.72 per share.

Future Market Networks: Jugalkishore Mohanlal Maheshwari sold 4,38,311 shares in company at Rs 29.3 per share.

(For more bulk deals, click here)

Earnings on September 2

Coal India, Arvind Fashions, Bannari Amman Sugars, Dish TV India, Infibeam Avenues, Jubilant FoodWorks, Kernex Microsystems, Navkar Corporation, Sadbhav Engineering, Sandur Manganese, Satin Creditcare Network etc will announce their June quarter earnings on September 1.

Stocks in the news

Coal India: August provisional offtake rose to 44.3 million tonnes versus 40.6 million tonnes YoY.

Hero MotoCorp: Sales in August 2020 jumped to 5.84 lakh units versus 5.43 lakh units YoY.

NMDC: Total August iron ore sales at 1.79 million tonne versus 1.49 million tonne YoY.

Spandana Sphoorty Financial Q1: Profit at Rs 58.93 crore versus Rs 93.37 crore, revenue at Rs 325.96 crore versus Rs 298.2 crore YoY.

JB Chemcials and Pharma: Tau Investments Holdings Pte Ltd & PACs acquired 10 percent stake in the company via off-market transactions during August 31 and September 1, at a price of Rs 745 per share.

ONGC Q1: Standalone profit at Rs 496 crore versus loss of Rs 3,098.3 crore, revenue at Rs 13,011.3 crore versus Rs 21,456.2 crore QoQ.

Infosys: The company increased the US hiring commitment to 25,000 by 2022.

TVS Motor: Total sales at 2.87 lakh units in August 2020 against 2.90 lakh units in August 2019.

VST Tillers and Tractors: Power Tillers sales at 2,638 units in August 2020 against 1,437 units in August 2019. Tractors at 897 units against 813 units in the same period.

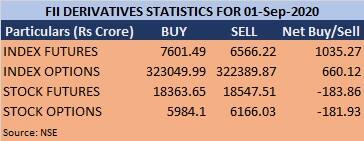

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 486.09 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 775.23 crore in the Indian equity market on September 1, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Two stocks -- Indiabulls Housing Finance and Vodafone Idea -- are under the F&O ban for September 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!