The market extended gains for second consecutive session on August 18 and closed at the highest level since February 27 despite mixed global cues. Banking and financials led the rally on August 18.

The Sensex climbed 477.54 points, or 1.26 percent, to 38,528.32, and the Nifty jumped 138.3 points, or 1.23 percent, to 11,385.4, forming a bullish candle on the daily charts.

The index has finally broken its consolidation on the upside and hit an intraday high of 11,400 mark, while the cooling down of volatility also favoured the bulls.

"The short term trend of Nifty continues to be positive. Nifty could encounter another overhead resistance around 11,500-11,600 levels in the next few sessions and there is a possibility of another round of minor profit booking from the highs by the weekend or by next week. Immediate support has now shifted to 11,350-11,300 levels," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

The broader markets also participated in rally with the Nifty Midcap and Smallcap indices rising 1.24 percent and 1.52 percent, respectively.

"The scenario might improve if we see the banking pack gaining some traction after the prolonged underperformance. Markets would continue to take cues from upbeat global markets in the absence of any major events. Besides talks between US-China and further developments on adjusted gross revenue (AGR) dues would also be in focus," Ajit Mishra, VP-Research at Religare Broking, said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty According to pivot charts, the key support level for the Nifty is placed at 11,291.77, followed by 11,198.23. If the index moves up, the key resistance levels to watch out for are 11,440.27 and 11,495.23.

Nifty Bank The Bank Nifty rose 469.75 points, or 2.16 percent, to 22,170.6. The important pivot level, which will act as crucial support for the index, is placed at 21,790.73, followed by 21,410.87. On the upside, key resistance levels are placed at 22,389.13 and 22,607.67.

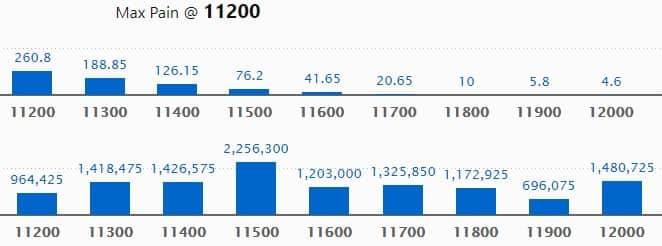

Call option data Maximum Call open interest of 22.56 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the August series.

This is followed by 12,000, which holds 14.80 lakh contracts, and 11,400 strikes, which has accumulated 14.26 lakh contracts.

Call writing was seen at 11,400, which added 1.77 lakh contracts, followed by 11,700, which added 1.46 lakh contracts, and 11,800 strikes, which added 1.45 lakh contracts.

Call unwinding was seen at 11,300, which shed 2.4 lakh contracts, followed by 11,200 strikes, which shed 2.11 lakh contracts.

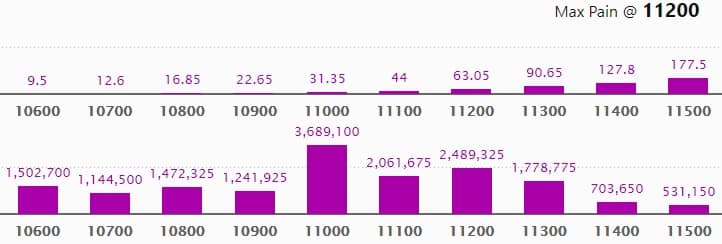

Put option data Maximum Put open interest of 36.89 lakh contracts was seen at 11,000 strike, which will act as crucial support in the August series.

This is followed by 11,200, which holds 24.89 lakh contracts, and 11,100 strikes, which has accumulated 20.61 lakh contracts.

Put writing was seen at 11,300, which added 6.14 lakh contracts, followed by 11,200, which added 5.02 lakh contracts, and 11,400 strikes, which added 4.65 lakh contracts.

Put unwinding was witnessed at 10,600, which shed 2.33 lakh contracts, followed by 10,700 strikes, which shed 40,275 contracts.

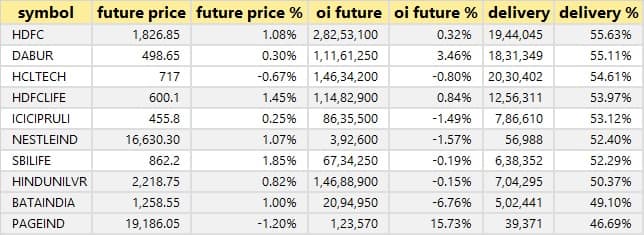

Stocks with a high delivery percentage A high delivery percentage suggests that investors are showing interest in these stocks.

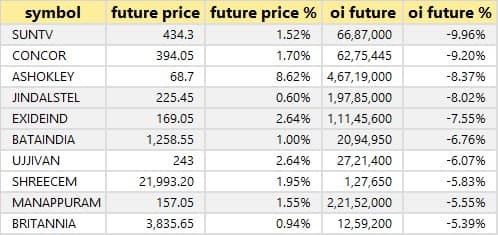

52 stocks saw long build-up

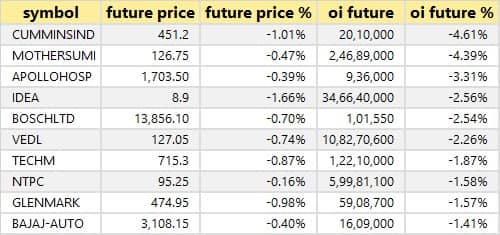

16 stocks saw long unwinding Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

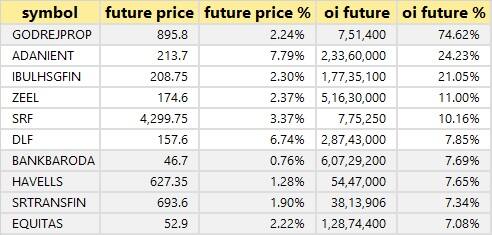

12 stocks saw short build-up An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

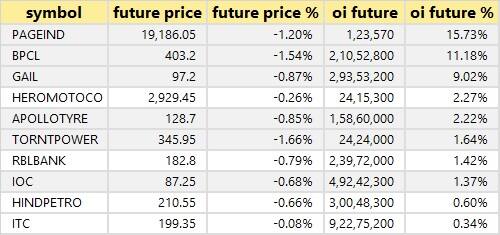

60 stocks witnessed short-covering A decrease in open interest, along with an increase in price, mostly indicates a short-covering.

Bulk deals CG Power & Industrial Solutions: Yes Bank sold 2.8 crore equity shares in CG Power at Rs 14.6 per share on the NSE and 2,38,27,756 shares at Rs 14.66 per share on the BSE. GDN Investments acquired 46 lakh shares at Rs 14.66 per share.

Satin Creditcare RE: Trishashna Holdings & Investments acquired 11,41,355 Rights Entitlement shares at Rs 20.45 per share on the NSE. Pankaj Jasraj Sahuji sold 1,29,875 RE shares at Rs 20.64 per share, Bhawani Finvest 2,74,521 shares at Rs 19.87 per share, Linkage Securities 2,53,257 shares at Rs 21.42 per share and Rajsonia Consultancy Services 3,70,442 shares at Rs 20.23 per share.

Som Distilleries & Breweries: Karst Peak Asia Master Fund sold 1,77,000 shares in company at Rs 46.96 per share.

Thejo Engineering: India Opportunities Fund offloaded 30,000 shares in company at Rs 617.4 per share.

Suumaya Lifestyle: Pranith Realities bought 1.6 lakh shares in company at Rs 31 per share.

Vikas Multicorp: Alankit Assignments acquired 43,91,000 shares in company at Rs 14.49 per share.

(For more bulk deals, click here)

Results on August 19 CSB Bank, Muthoot Finance, Ashapura Minechem, Asian Granito India, GKB Ophthalmics, Globus Spirits, Kennametal India, Ramky Infrastructure, Ruchi Soya Industries, Tide Water Oil, V2 Retail, etc will announce their quarterly earnings on August 19.

Stocks in the news Zee Entertainment Enterprises: Q1 profit at Rs 30.4 crore versus Rs 530.6 crore, revenue at Rs 1,312 crore versus Rs 2,008 crore YoY. Company appointed Subhash Chandra as Chairman Emeritus and R Gopalan as Chairman of the board.

Hindustan Aeronautics: Q1 profit at Rs 1,226 crore versus Rs 1,238.9 crore, revenue at Rs 10,239 crore versus Rs 10,159 crore YoY.

Agro Tech Foods: CRISIL reaffirmed long term credit rating to AA-, but revised outlook to stable from negative.

GTL Infrastructure: Q1 loss at Rs 208.41 crore versus loss Rs 206.99 crore, revenue at Rs 343.71 crore versus Rs 362.37 crore YoY.

Ajanta Pharma: Promoter Ravi Agrawal and Trustee Ravi Agrawal Trust has de-pledged additional 240,000 shares.

NIIT: Nippon Life India Trustee through various schemes of Nippon India Mutual Fund raised stake in company to 7.38 percent from 6.55 percent earlier.

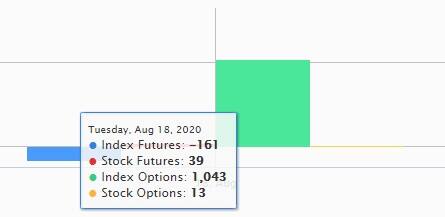

Fund flow

FII and DII data Foreign institutional investors (FIIs) bought shares worth Rs 1,134.57 crore whereas domestic institutional investors (DIIs) sold shares worth Rs 379.38 crore in the Indian equity market on August 18, as per provisional data available on the NSE.

Stock under F&O ban on NSE Twelve stocks -- Adani Enterprises, Aurobindo Pharma, Bank of Baroda, Bharat Heavy Electricals (BHEL), Indiabulls Housing Finance, Vodafone Idea, Jindal Steel & Power, Manappuram Finance, Steel Authority of India (SAIL), Sun TV Network, Vedanta and Zee Entertainment Enterprises -- are under the F&O ban for August 19.

Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!