The market lost ground for the first time in the last eight consecutive sessions on October 19, owing to selling in the last hour of trade. FMCG, Metals, Pharma, and select bank stocks pulled the market down. However, the benchmark indices had a strong opening and hit fresh record highs today.

The BSE Sensex scaled the 62,000 mark, before falling 49.54 points to 61,716.05, while the Nifty50 jumped over 18,600 levels, before ending the session at 18,418.80, down 58.20 points and formed a Bearish Engulfing pattern on the daily charts.

"Profit-taking finally came into play but not before key indices had hit fresh highs in intraday trade. Markets may witness a select bout of profit-taking by investors after the recent upsurge. On daily charts, benchmark Nifty has formed a Bearish Candle formation which is broadly negative," said Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

He further said: "On intraday charts, the index has formed a lower top formation which also indicates intraday weakness. For day traders, 18,550-18,600 levels would be the immediate hurdle and below the same, the correction wave could continue up to 18,350-18,300."

On the other hand, "above 18,600, breakout continuation formation will continue up to 18,650-18,675 levels. Contra traders can take a long bet near the 18,300 support level with a strict stop loss at 18,250," he added.

The broader markets fell quite sharply in comparison to benchmarks. The Nifty Midcap 100 index was down 2.17 percent and Smallcap 100 index declined 1.69 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 18,329.53, followed by 18,240.27. If the index moves up, the key resistance levels to watch out for are 18,556.23 and 18,693.67.

Nifty Bank

The Nifty Bank also corrected, down 144.30 points at 39,540.50 on October 19. The important pivot level, which will act as crucial support for the index, is placed at 39,286.09, followed by 39,031.7. On the upside, key resistance levels are placed at 39,903 and 40,265.5 levels.

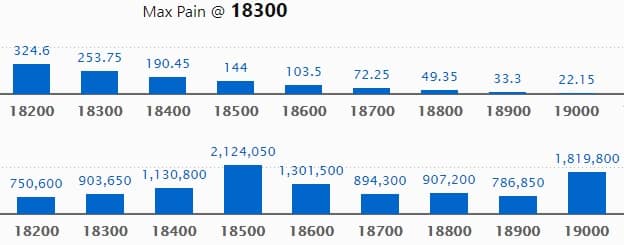

Call option data

Maximum Call open interest of 21.24 lakh contracts was seen at 18500 strike, which will act as a crucial resistance level in the October series.

This is followed by 19000 strike, which holds 18.19 lakh contracts, and 18600 strike, which has accumulated 13.01 lakh contracts.

Call writing was seen at 18600 strike, which added 3.25 lakh contracts, followed by 18400 strike, which added 3.03 lakh contracts and 18800 strike which added 2.34 lakh contracts.

Call unwinding was seen at 18000 strike, which shed 1.18 lakh contracts, followed by 18200 strike, which shed 1.01 lakh contracts, and 17900 strike which shed 69,500 contracts.

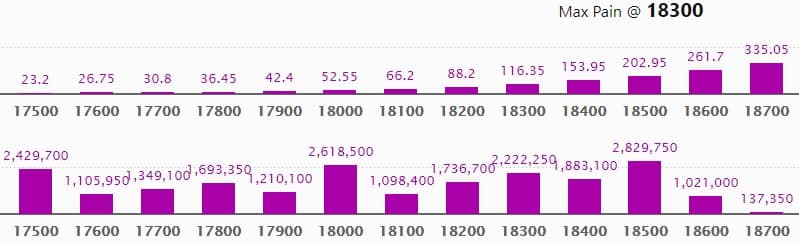

Put option data

Maximum Put open interest of 28.29 lakh contracts was seen at 18500 strike. This is followed by 18000 strike, which holds 26.18 lakh contracts, and 17500 strike, which has accumulated 24.29 lakh contracts.

Put writing was seen at 18400 strike, which added 8.86 lakh contracts, followed by 18300 strike which added 7.46 lakh contracts and 18500 strike which added 4.34 lakh contracts.

Put unwinding was seen at 17500 strike, which shed 2.14 lakh contracts, followed by 17600 strike which shed 1.15 lakh contracts, and 17700 strike which shed 63,750 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

14 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

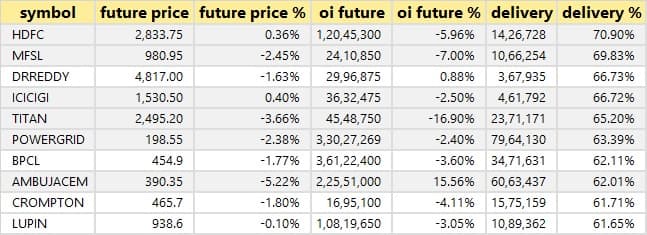

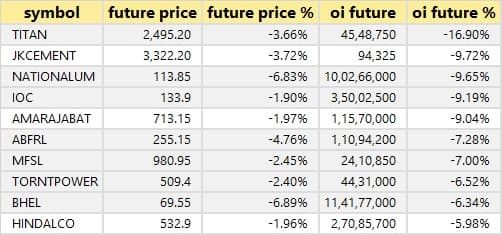

89 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

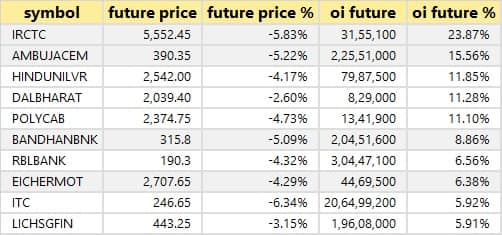

57 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen.

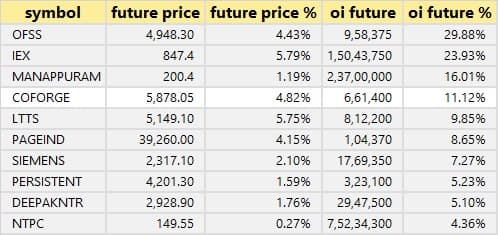

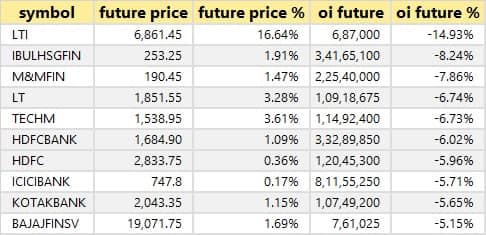

23 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

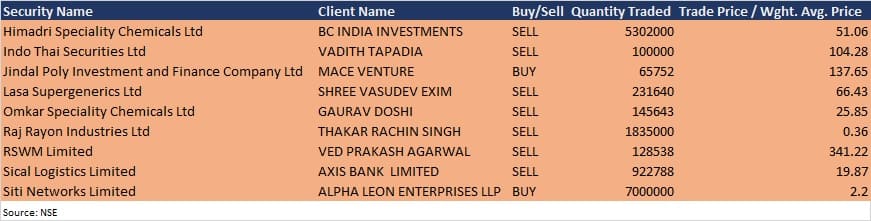

Bulk deals

Himadri Speciality Chemicals: BC India Investments sold 53,02,000 equity shares in the company at Rs 51.06 per share on the NSE, the bulk deals showed.

Jindal Poly Investment and Finance Company: Mace Venture acquired 65,752 equity shares in the company at Rs 137.65 per share on the NSE, the bulk deals data showed.

RSWM: Ved Prakash Agarwal sold 1,28,538 equity shares in the company at Rs 341.22 per share on the NSE, the bulk deals data showed.

Sical Logistics: Axis Bank sold 9,22,788 equity shares in the company at Rs 19.87 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/investors meeting and results calendar

Results on October 20: Jubilant FoodWorks, Havells India, L&T Finance Holdings, Angel Broking, Arihant Superstructures, Deep Polymers, Hathway Cable & Datacom, Just Dial, Menon Bearings, Moschip Technologies, Reliance Industrial Infrastructure, Rane (Madras), Shoppers Stop, Snowman Logistics, Supreme Petrochem, Suryalakshmi Cotton Mills, Syngene International, TajGVK Hotels & Resorts, Tata Communications, Tata Steel Long Products, Tejas Networks, and TT Ltd will release September quarter earnings on October 20.

Craftsman Automation: The company's officials will meet Enam Holdings and GIC on October 20.

Ganesh Housing Corporation: The company's officials will meet analysts and investors on October 20 to discuss Corporate Presentation.

Rallis India: The company's officials will meet analysts and investors on October 20 following September quarter results.

Infibeam Avenues: The company's officials will meet Hila Capital on October 21.

Antony Waste Handling Cell: The company's officials will meet investors and analysts on October 20 and October 21.

Crompton Greaves Consumer Electricals: The company's officials will meet analysts and investors on October 25 to discuss financial results.

Home First Finance Company India: The company's officials will meet analysts and institutional investors on October 26 to discuss financial results.

Larsen & Toubro: The company's officials will meet analysts and investors on October 27 to discuss financial performance.

Zensar Technologies: The company's officials will meet analysts and investors on October 27 post-earnings.

Motilal Oswal Financial Services: The company's officials will meet analysts and investors on October 29 to discuss financial performance.

Stocks in News

ACC: The company reported a sharply higher standalone profit at Rs 449.04 crore in Q2FY22 against Rs 363.09 crore in Q2FY21, revenue rose to Rs 3,748.90 crore from Rs 3,537.31 crore YoY.

ICICI Prudential Life Insurance Company: The company reported higher standalone profit at Rs 444.57 crore in Q2FY22 against Rs 303.22 crore in Q2FY21, net premium income increased to Rs 9,286.53 crore from Rs 8,572.19 crore YoY.

Deepak Fertilisers & Petrochemicals Corporation: The company launched a qualified institutional placement issue on October 19 and approved the floor price for the same at Rs 422.48 per equity share.

Navin Fluorine International: The company reported lower consolidated profit at Rs 63.22 crore in Q2FY22 against Rs 67.81 crore in Q2FY21, revenue rose to Rs 338.95 crore from Rs 318.92 crore YoY. Ketan Sablok resigned as Chief Financial Officer and a Key Managerial Personnel of the company. Basant Kumar Bansal is appointed as Chief Financial Officer and a Key Managerial Personnel of the company.

L&T Technology Services: The company reported a higher consolidated profit at Rs 230 crore in Q2FY22 against Rs 216.2 crore in Q1FY22, revenue rose to Rs 1,607.7 crore from Rs 1,518.4 crore QoQ.

Nestle India: The company reported higher profit at Rs 617.3.7 crore in Q3CY21 against Rs 587.09 crore in Q3CY20, revenue rose to Rs 3,882.6 crore from Rs 3,541.7 crore YoY.

Fund flow

FII and DII data

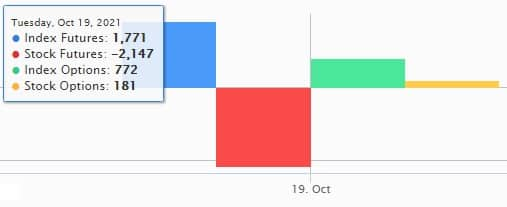

Foreign institutional investors (FIIs) net sold shares worth Rs 505.79 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 2,578.22 crore in the Indian equity market on October 19, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Nine stocks - Amara Raja Batteries, BHEL, Escorts, Vodafone Idea, IRCTC, NALCO, Punjab National Bank, SAIL, and Sun TV Network - are under the F&O ban for October 20. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!