The market climbed to a seven-month high on October 6, with the BSE Sensex rising 600 points and the Nifty closing above 11,600 mark amid expectations of better September quarter earnings season.

The buying in banking and financials, auto and select IT stocks led the market higher, while the broader markets gained around half a percent.

The benchmark indices gained for fourth consecutive session. The BSE Sensex jumped 600.87 points, or 1.54 percent, to close at 39,574.57, while the Nifty50 rose 159 points or, 1.38 percent, to 11,662.40, the highest closing level since February 26 this year, and formed bullish candle on the daily charts.

"The initial overhead resistance of downtrend line and also a previous swing high of September 16 has been surpassed on the upside around 11,550-11,620 levels and Nifty closed above it. We now observe three back to back unfilled opening upside gaps in the last three sessions," Nagaraj Shetti, technical research analyst at HDFC Securities, told Moneycontrol.

"The present upside breakout could be a positive indication and this market action seems to have negated the negative sequential movement of lower highs and lower lows. Hence, this could be positive indication and could open more upside for the short term," he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,591.03, followed by 11,519.67. If the index moves up, the key resistance levels to watch out for are 11,707.03 and 11,751.67.

Nifty Bank

The Bank Nifty also surged 482.75 points or 2.16 percent to close at 22,853.70 on October 6 and formed bullish candle on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 22,618.7, followed by 22,383.7. On the upside, key resistance levels are placed at 22,991.1 and 23,128.5.

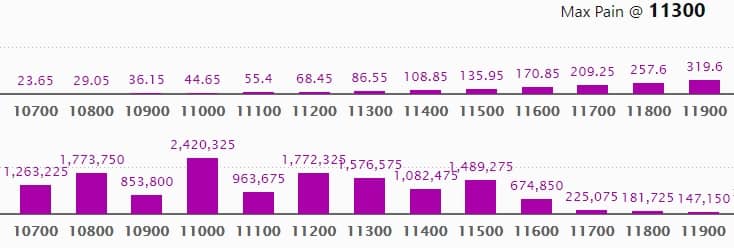

Call option data

Maximum Call open interest of 19.67 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the October series.

This is followed by 12,500 strike, which holds 17.70 lakh contracts, and 11,500 strike, which has accumulated 12.70 lakh contracts.

Call writing was seen at 12,000 strike, which added 1.56 lakh contracts, followed by 11,600, which added 1.37 lakh contracts, and 12,200 strike, which added 1.2 lakh contracts.

Call unwinding was seen at 11,500 strike, which shed 2.27 lakh contracts, followed by 11,400 strike, which shed 60,000 contracts and 11,200 strike which shed 57,675 contracts.

Put option data

Maximum Put open interest of 35.26 lakh contracts was seen at 10,500 strike, which will act as crucial support in the October series.

This is followed by 11,000 strike, which holds 24.20 lakh contracts, and 10,800 strike, which has accumulated 17.73 lakh contracts.

Put writing was seen at 11,600 strike, which added 3.59 lakh contracts, followed by 11,500 strike, which added 2.72 lakh contracts and 11,400 strike which added 1.65 lakh contracts.

Put unwinding was witnessed at 11,100 strike, which shed 68,550 contracts, followed by 10,900 strike which shed 40,950 contracts.

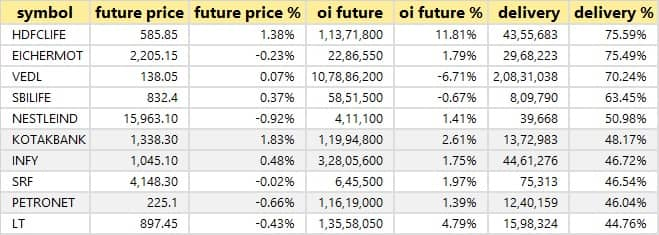

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

55 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

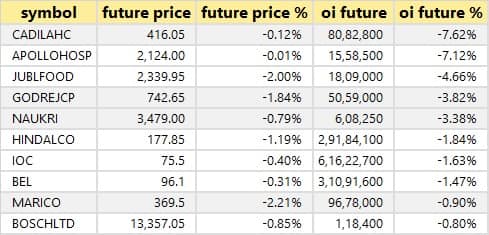

14 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

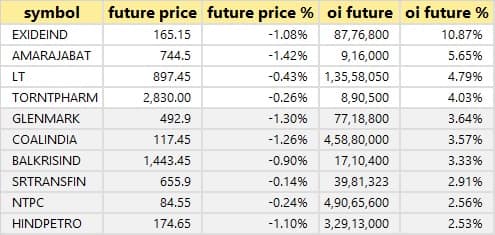

33 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are top 10 stocks in which short build-up was seen.

35 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

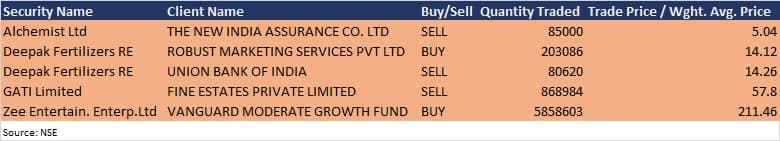

Bulk deals

(For more bulk deals, click here)

Results on October 7

Tata Consultancy Services, Majesco, MIC Electronics, Unity Infraprojects and Zee Learn will announce their quarterly earnings on October 7.

Stocks in the news

Reliance Industries: Abu Dhabi Investment Authority will invest Rs 5,512.50 crore into Reliance Retail Ventures.

PSP Projects: Tender for EPC design and build construction of proposed GIDC Tech-Hub at GIFT City, Gujarat in which the company emerged as L-1 Bidder has been cancelled by authority.

GMR Infrastructure: Promoter GMR Enterprises released pledge on over 15 crore equity shares.

Zodiac Clothing: ICRA revised the short term rating for Rs 65 crore line of credit of the company to A3+ from A2.

Linde India: Subhabrata Ghosh resigned as Chief Financial Officer of the company.

Indian Energy Exchange: Company approved the further investment of Rs 6.25 crore in subsidiary Indian Gas Exchange, by way of subscription to equity shares through rights issue.

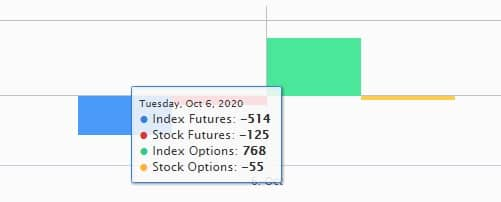

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,101.76 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 934.84 crore in the Indian equity market on October 6, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Two stocks - Vodafone Idea and Vedanta - are under the F&O ban for October 7. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!