The market closed rangebound session on a flat note with a negative bias on September 29 as bulls preferred to take a breather after a run up in previous two trading sessions.

The BSE Sensex declined 8.41 points to 37,973.22, while the Nifty50 fell 5.10 points to 11,222.40 and formed bearish candle on the daily charts as closing was lower than opening tick.

"Nifty is placed at the immediate resistance of trend line, as per change in polarity at 11,240 and has struggled to sustain above that area on Tuesday. The complete filling of opening upside gap also signals a possibility of more consolidation with negative bias in the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The recent upside bounce from the lows of 10,800 could be considered as an upside bounce of a down trend and this up leg is expected to form a new lower top around 11,300-11,400, if it sustains above 11,250 levels in the near term. Tuesday's consolidation could rather signal a pause of a sharp upside bounce, than any sharp negative reversal at the highs," he added.

The broader negative chart pattern as per weekly chart is still intact and any upside bounce from here could be considered as a sell on rise opportunity in the near term, he advised.

The broader markets also closed moderately lower with the Nifty Midcap index falling 0.15 percent and Smallcap down 0.3 percent.

Among sectors, Bank and FMCG fell over a percent each, while Metal gained 2 percent.

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,167.13, followed by 11,111.87. If the index moves up, the key resistance levels to watch out for are 11,291.53 and 11,360.67.

Nifty Bank

The Bank Nifty corrected 254.20 points, or 1.17 percent, to close at 21,411.30 on September 29, underperforming Nifty50. The important pivot level, which will act as crucial support for the index, is placed at 21,190.77, followed by 20,970.23. On the upside, key resistance levels are placed at 21,721.67 and 22,032.04.

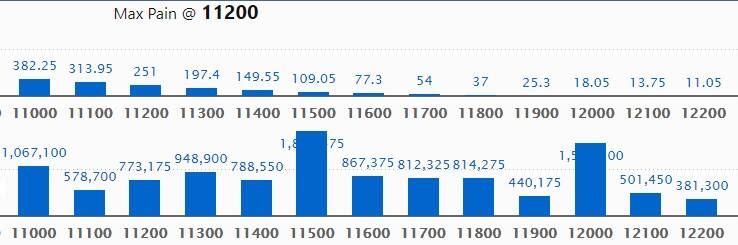

Call option data

Maximum Call open interest of 18.02 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the October series.

This is followed by 12,000 strike, which holds 15.53 lakh contracts, and 11,000 strike, which has accumulated 10.67 lakh contracts.

Call writing was seen at 11,600 strike, which added 1.14 lakh contracts, followed by 11,400, which added 71,250 contracts, and 11,900 strike, which added 65,400 contracts.

Call unwinding was seen at 11,200 strike, which shed 32,025 contracts, followed by 11,100 strike, which shed 24,075 contracts and 11,000 strike which shed 23,625 contracts.

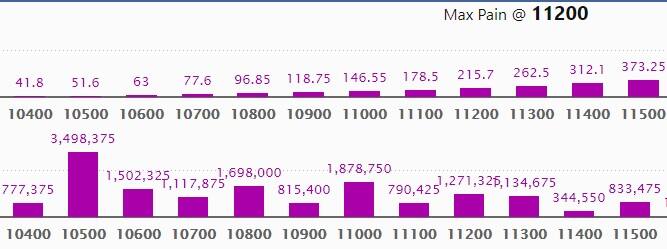

Put option data

Maximum Put open interest of 34.98 lakh contracts was seen at 10,500 strike, which will act as crucial support in the October series.

This is followed by 11,000 strike, which holds 18.78 lakh contracts, and 10,800 strike, which has accumulated 16.98 lakh contracts.

Put writing was seen at 10,900 strike, which added 1.55 lakh contracts, followed by 10,500 strike, which added 1.34 lakh contracts and 11,200 strike which added 80,925 contracts.

Put unwinding was witnessed at 11,000 strike, which shed 62,250 contracts, followed by 10,300 strike which shed 25,650 contracts and 10,200 strike which shed 25,500 contracts.

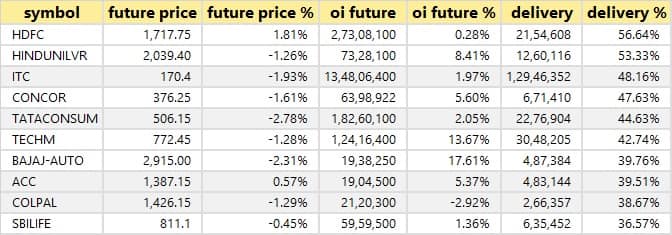

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

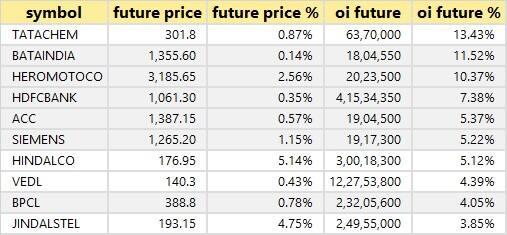

29 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

32 stocks saw long unwinding

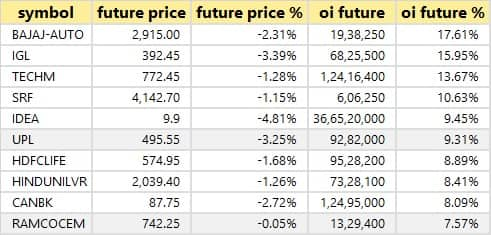

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

58 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are those 3 stocks in which short build-up was seen.

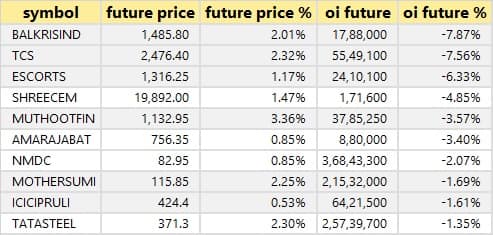

19 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

Bulk deals

GMM Pfaudler: Plutus Wealth Management LLP acquired 1.65 lakh shares in company at Rs 3,528.75 per share on the NSE.

IRB Infrastructure Developers: Virendra Dattatraya Mhaiskar bought 19 lakh shares in company at Rs 114.45 per share on the NSE.

(For more bulk deals, click here)

Analysts/Board Meetings

Shriram City Union Finance: Company's officials will meet Hara Global Capital Management, and Ruane, Cunniff and Goldfarb, Inc via conference call on September 30.

Graphite India: Senior management of the company is scheduled to virtually meet analysts / investors on September 30.

Metropolis Healthcare: Officials of the company will hold investor meeting on October 1.

Rane Engine Valve: Company on October 23 to consider September quarter earnings.

Jamna Auto Industries: Company's officials will hold conference call with analysts/ institutional investors on October 1.

Chambal Fertilisers & Chemicals: PhillpCapital (India) will be organizing an investors group meeting (virtual) with representative of the company on September 30.

Godawari Power & Ispat: Management of the company will be meeting with Investor/Analyst/Advisers/Fund House /Institutional /Broker etc. on September 30.

3i Infotech: Company on October 22 to consider September quarter earnings.

Stocks in the news

Indraprastha Gas: ICRA reaffirmed credit rating of IGL for Rs 4,000 crore at AAA and A1+. Outlook on the long term rating is stable.

Sumitomo Chemical India: Promoter entity Sumitomo Chemical Company to sell up to 1,64,83,654 equity shares in company on September 30 and October 1. Floor price for the sale is fixed at Rs 270 per share.

Garware Polyester: CARE reaffirmed long term credit rating at A and revised outlook from stable to positive.

Bandhan Bank: Company appointed Rahul Parikh as Chief Marketing & Digital Officer.

VA Tech Wabag: Company approved the allotment of 75 lakh equity shares at a price of Rs 160 per equity share aggregating to Rs 120 crore by way of preferential issue to Rekha Rakesh Jhunjhunwala (50 lakh shares), Basera Home Finance (15 lakh shares), and Sushma Anand Jain and Anand Jaikumar Jain (Joint Holding) (10 lakh shares).

Welspun Corp: Company received multiple orders of approximately 147 KMT valuing close to Rs 1,400 crore. With these orders, total order book stands at 755 KMT valued at approximately Rs 6,300 crore.

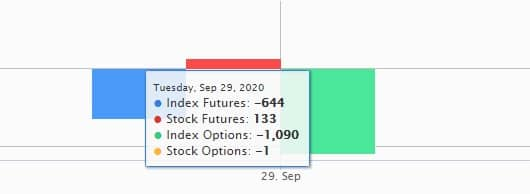

Fund flow

Stock under F&O ban on NSE

One stock - Vedanta - is under the F&O ban for September 30. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!