The market witnessed sharp rebound on March 26 and had a good start to the April series backed by buying and short covering in banking & financials, auto, FMCG and metals stocks.

The market will open on Tuesday after a long weekend.

The BSE Sensex climbed 568.38 points, or 1.17 percent, to close at 49,008.50, while the Nifty50 rose 182.40 points, or 1.27 percent, to 14,507.30 and witnessed Doji kind of formation on daily charts as the closing was near opening levels. During the week ended March 26, the index fell 1.6 percent and formed small bearish candle on the daily charts.

"Nifty on the weekly chart has bounce back from the weekly 10-period EMA (exponential moving average) during the week. The moving average is now at 14,590 and the Nifty closed just below it, as per week's close. Previously, such downside violations of this EMA have offered strong upside bounce in the subsequent weeks," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The next upside level to be watched out for is 14,700. On the dips, 14,400-14,350 could offer support for the markets," he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,423.37, followed by 14,339.43. If the index moves up, the key resistance levels to watch out for are 14,582.07 and 14,656.83.

Nifty Bank

The Nifty Bank index jumped 311.80 points to close at 33,318.20 on March 26. The important pivot level, which will act as crucial support for the index, is placed at 33,119.34, followed by 32,920.47. On the upside, key resistance levels are placed at 33,563.84 and 33,809.47 levels.

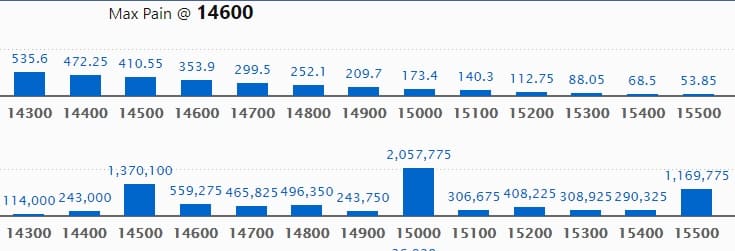

Call options data

Maximum Call open interest of 20.57 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 14,500 strike, which holds 13.70 lakh contracts, and 15,500 strike, which has accumulated 11.69 lakh contracts.

Call writing was seen at 14,600 strike, which added 2.13 lakh contracts, followed by 15,500 strike which added 1.85 lakh contracts and 14,500 strike which added 1.39 lakh contracts.

Call unwinding was seen at 15,000 strike, which shed 1.13 lakh contracts, followed by 14,700 strike which shed 68,700 contracts and 14,800 strike which shed 46,275 contracts.

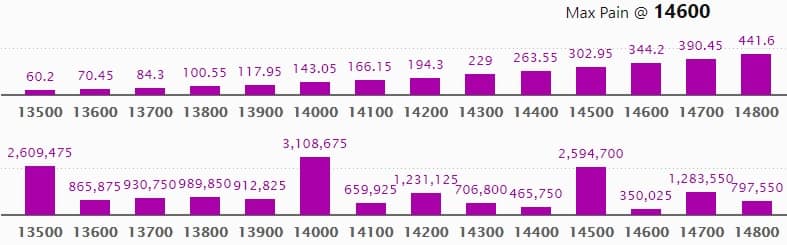

Put options data

Maximum Put open interest of 31.08 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

This is followed by 13,500 strike, which holds 26.09 lakh contracts, and 14,500 strike, which has accumulated 25.94 lakh contracts.

Put writing was seen at 13,500 strike, which added 4.3 lakh contracts, followed by 14,500 strike which added 3.24 lakh contracts and 13,600 strike which added 1.01 lakh contracts.

Put unwinding was seen at 14,000 strike, which shed 77,925 contracts, followed by 15,000 strike which shed 17,550 contracts and 13,700 strike which shed 9,375 contracts.

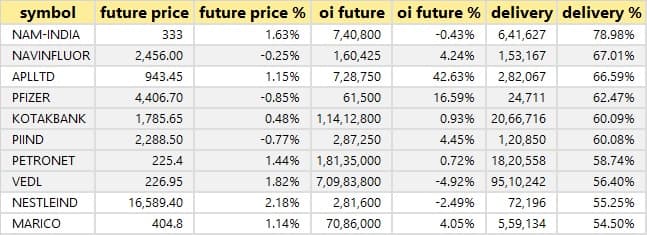

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

89 stocks saw long build-up

An increase in open interest, along with a increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

1 stock saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here is the 1 stock in which long unwinding was seen.

![]()

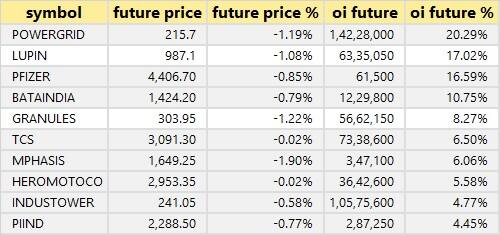

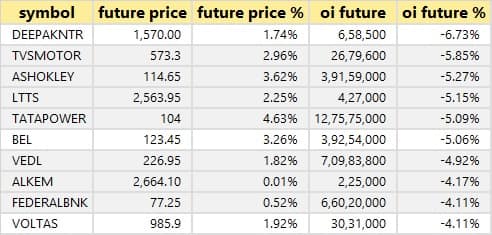

20 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

46 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

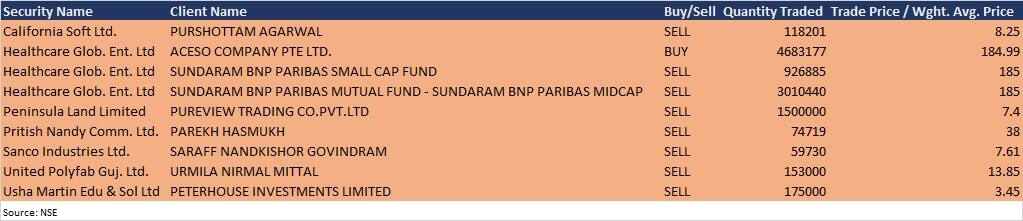

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Gati: The company's officials will be meeting investors-analysts on March 31.

Mahindra Holidays & Resorts India: The company's officials will interact with HDFC Securities on March 31.

Inox Leisure: The company's officials will interact with Skale Investments on March 30.

Stocks in the news

Mukand: Mukand completed the transfer of approximately 55 acres of surplus leasehold land at Thane to NTT Global Data Centers Nav2 fo Rs 801.51 crore which will be utilised for debt repayment. The company will complete the second and final tranche of sale of shares approximately Rs 500 crore in the joint venture, Mukand Sumi Special Steel to Jamnalal Sons in April. As a result, the total finance cost have reduced substantially and is expected to be further brought down in the coming years.

Minda Industries: The board of Minda Industries, the flagship company of UNO Minda Group, approved the expansion plans in its two businesses i.e. Four Wheel (4W) Lighting and 4W Alloy Wheel, considering the improved market scenario and increased demand, wherein the said businesses have been operating at near capacity.

Adani Transmission: Adani Transmission has signed definitive agreements with Essel Infraprojects for acquisition of Warora-Kurnool Transmission (WKTL). As per the agreement, WKTL will develop, operate, and maintain transmission lines aggregating to around 1,750 ckt km. The two significant, 765 kV inter-state transmission lines link Warora to Warangal and Chilakaluripeta to Kurnool via Hyderabad, with a new 765/400 kV sub-station at Warangal, which shall be built & operated as a part of the agreement.

Vascon Engineers: Vascon Engineers has received letter of acceptance amounting to Rs 515.63 crore from Uttar Pradesh Public Works Department for establishment of new medical colleges. The work has to be completed within 18 months from the date of receipt of letter of acceptance.

Lumax Industries: Lumax Industries approved capital expenditure amounting up to Rs 80 crore for setting up of new manufacturing unit(s) in Sanand, Gujarat to cater to the orders received from MG Motors and other customers. The total capex will be funded by mix of debt and internal accruals and peak annualized turnover is expected to be approximately Rs 150 crore post commissioning. The project is expected to be operational by Q3 FY22.

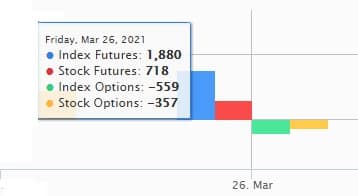

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 50.13 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,703.14 crore in the Indian equity market on March 26, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for March 30. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!