There was some correction after a day of rally on June 19, and as a result, the benchmark indices were off their record closing high. Weakness in global counterparts weighed on the sentiment.

Also, the fall in banks, auto, FMCG, and oil & gas stocks dragged the market down. The BSE Sensex plummeted 216 points to 63,168, while the Nifty50 shed 71 points to 18,756 and formed a Dark Cloud Cover kind of pattern on the daily charts, which is a trend reversal pattern to the downside.

"The index has formed Dark Cloud Cover on the daily charts which is a small reversal pattern in nature suggesting further downside till 18,600 can be seen once it breaches Monday's low in the next trading session," Gaurav Bissa, VP at InCred Equities said.

The broader markets outperformed benchmarks despite negative breadth, as the Nifty Midcap 100 and Smallcap 100 indices closed with moderate gains.

India VIX - the fear index - increased by 3.55 percent from 10.84 to 11.23 levels, favouring bears and giving discomfort to bulls.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

According to the pivot point calculator, the Nifty may find support at 18,723, followed by 18,685 and 18,623. If the index advances, then 18,847 will be the key resistance, followed by 18,886 and 18,948.

The fall was predominantly led by the Bank Nifty which was seen under intense pressure, falling 304 points to 43,634 and forming a bearish candlestick pattern on the daily scale with above-average volumes.

"The index relatively underperformed the broader markets. It has to cross 43,750 levels, to make a bounce towards 44,044, then 44,250 levels, whereas a hold below the same could see some weakness towards 43,500, then 43,333 levels," Chandan Taparia, Senior Vice President, Analyst-Derivatives at Motilal Oswal Financial Services said.

As per the pivot point calculator, the Bank Nifty is expected to find support at 43,519, followed by 43,392 and 43,186, while the resistance is likely to be at 43,931, then 44,058 and 44,264.

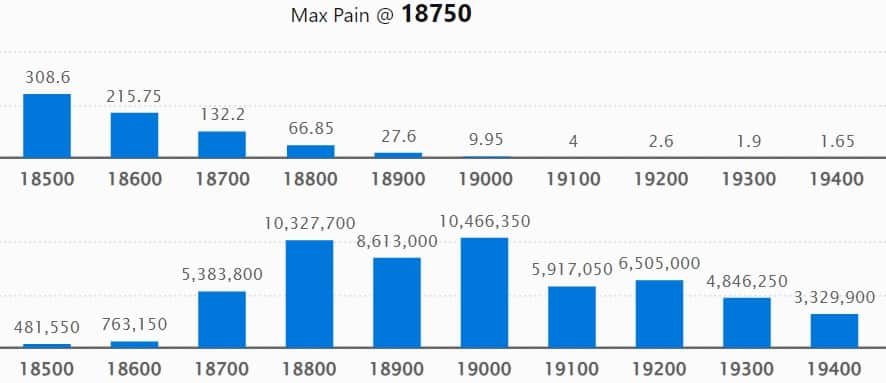

As per the weekly options data, the maximum Call open interest (OI) was at 19,000 strike, with 1.04 crore contracts, which is expected to be a crucial resistance level for the Nifty.

This was followed by 1.03 crore contracts at 18,800 strike, while 18,900 strike has 86.13 lakh contracts.

We have seen Call writing at 19,000 strike, which added 41.68 lakh contracts, followed by 18,900 strike and 18,800 strike, which added 39.32 lakh contracts, and 36.6 lakh contracts, respectively.

Maximum Call unwinding was at 18,700 strike, which shed 7.95 lakh contracts, followed by 18,500 and 17,600 strikes, which shed 1.55 lakh and 12,650 contracts, respectively.

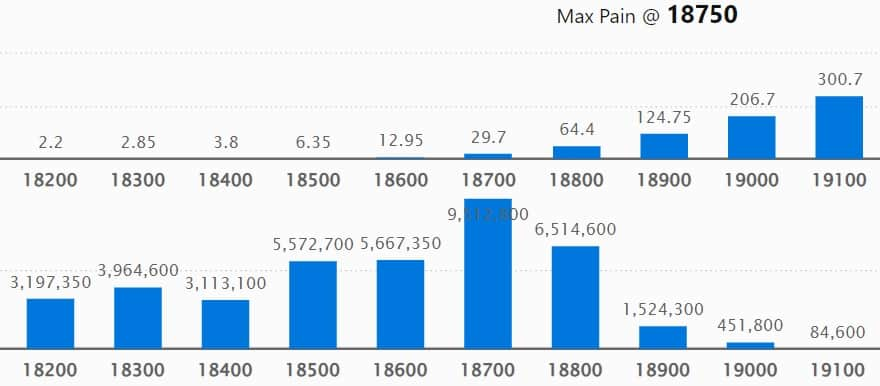

On the Put side, we have seen the maximum open interest at 18,700 strike, with 95.12 lakh contracts, which is expected to be a crucial support level for the Nifty50 in the coming sessions.

This was followed by the 18,800 strike, comprising 65.14 lakh contracts, and the 18,600 strike, which has 56.67 lakh contracts.

Put writing was seen at 18,300 strike, which added 13.74 lakh contracts, followed by 18,600 and 17,900 strikes, which added 9.81 lakh contracts and 3.5 lakh contracts, respectively.

Put unwinding was seen at 18,800 strike, which shed 28.16 lakh contracts, followed by 18,700 strike and 18,000 strike, which shed 24.6 lakh contracts, and 7.38 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Alkem Laboratories, HDFC, Godrej Consumer Products, Coal India, and Maruti Suzuki India among others.

An increase in open interest (OI) and price indicates a build-up of long positions. Based on the OI percentage, 37 stocks including Shriram Finance, Hindustan Aeronautics, Metropolis Healthcare, ICICI Prudential Life Insurance Company, and BHEL saw a long build-up.

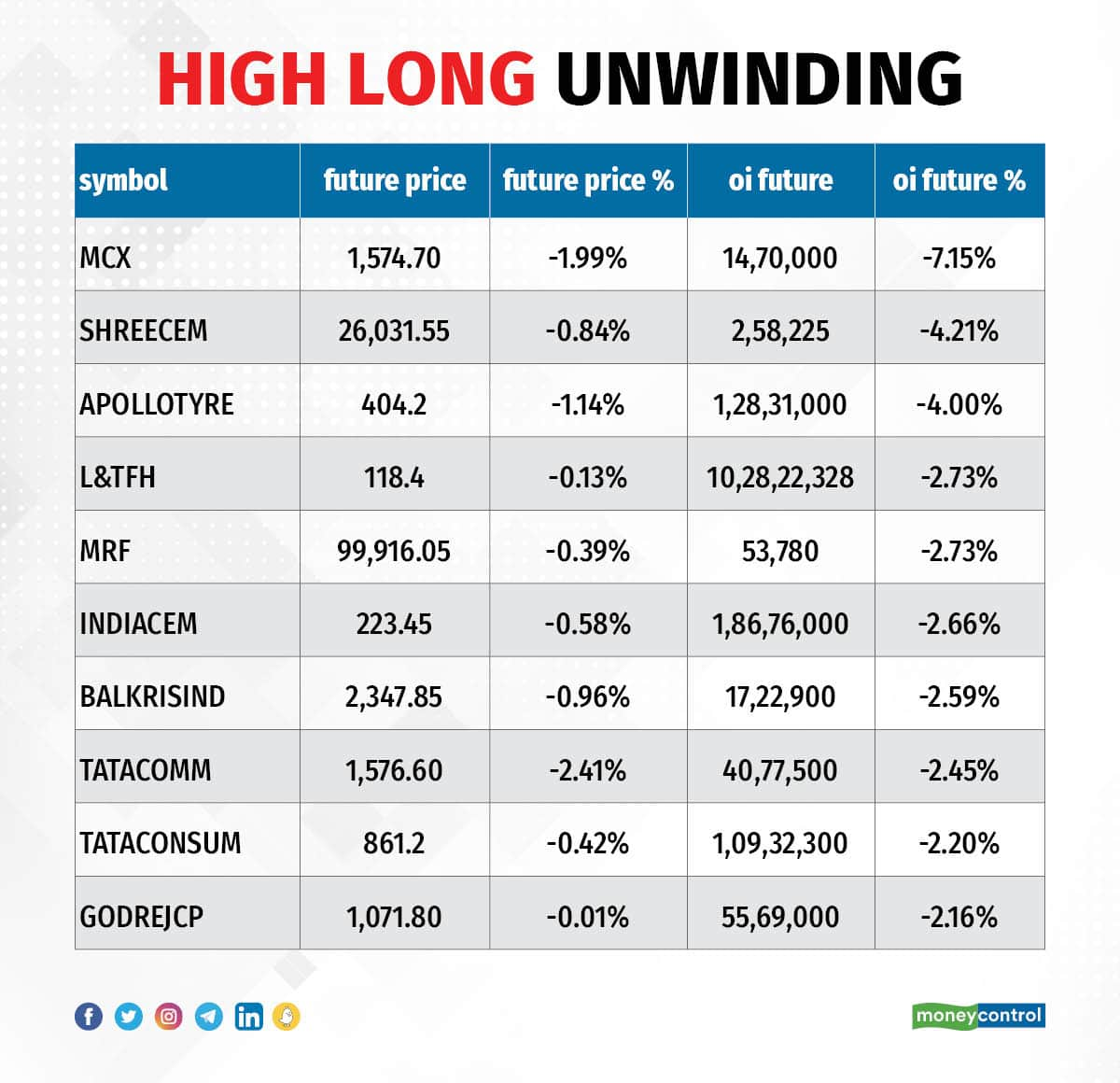

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 57 stocks including MCX India, Shree Cements, Apollo Tyres, L&T Finance Holdings, and MRF saw a long unwinding.

61 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 61 stocks including HDFC AMC, Adani Enterprises, NMDC, Atul, and Exide Industries saw a short build-up.

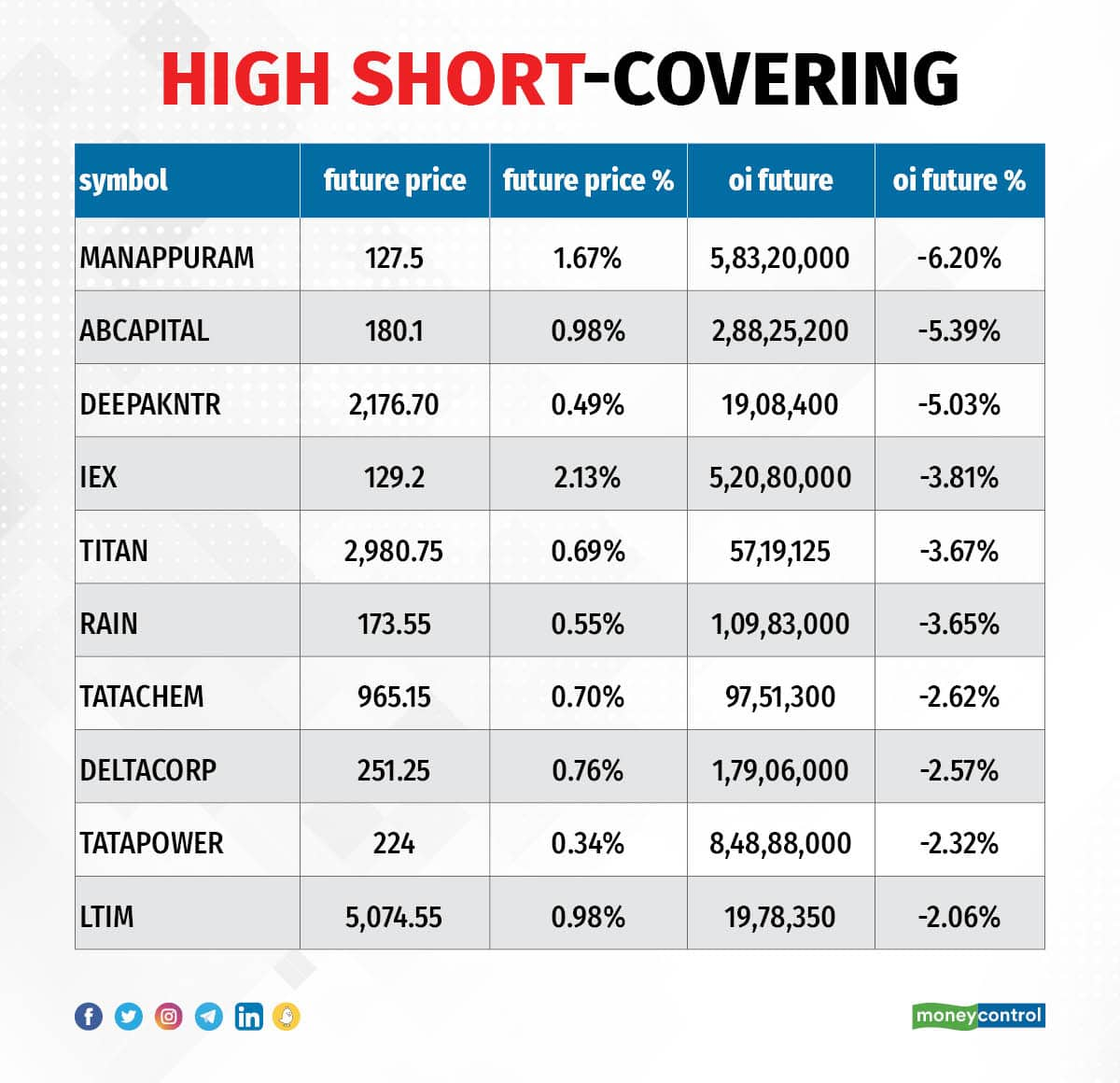

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 34 stocks were on the short-covering list. These included Manappuram Finance, Aditya Birla Capital, Deepak Nitrite, Indian Energy Exchange, and Titan Company.

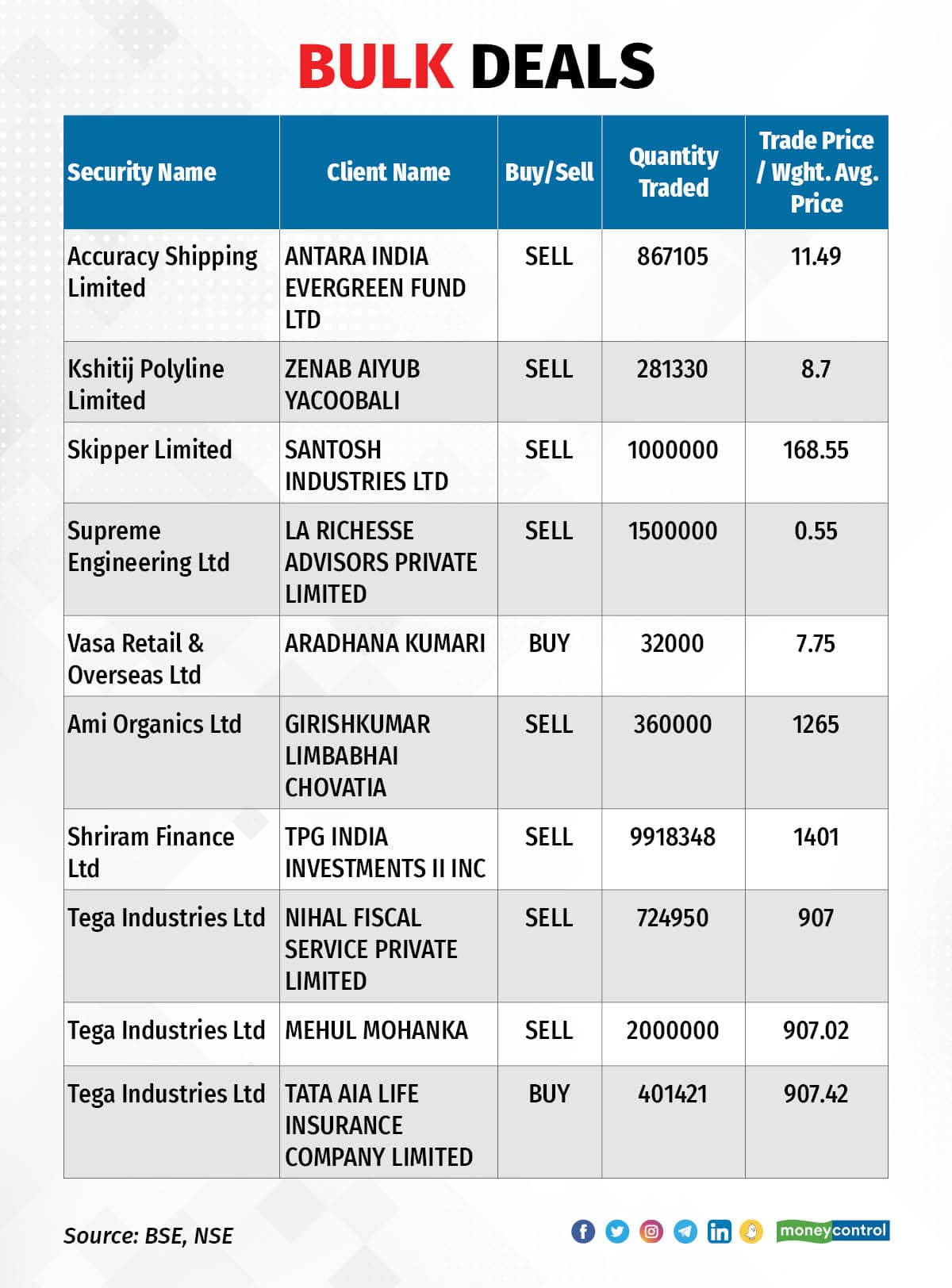

(For more bulk deals, click here)

Investors Meetings on June 20

Stocks in the news

HDFC Asset Management Company: Abrdn Investment Management (formerly Standard Life Investments) is expected to exit HDFC AMC by selling entire 2.18 crore equity shares or 10.2 percent stake via block deals on June 20. The selling price is likely in the range of Rs 1,800-1,892.45 per share, a 0.0-4.9 percent discount to the closing price of June 19.

Timken India: Promoter Timken Singapore Pte Ltd is expected to offload 63 lakh equity shares or 8.4 percent stake in the ball and roller bearing manufacturing company via block deals on June 20. The floor price for the transaction is at around Rs 3,000 per share, a 14 percent discount to the closing price of June 19. The offer size could be Rs 1,890 crore or $231 million.

Sun Pharmaceutical Industries: Subsidiary Sun Pharma Canada Inc has received approval from Health Canada for WINLEVI (clascoterone cream 1 percent). WINLEVI is the first and only androgen receptor inhibitor indicated for the topical treatment of acne vulgaris (acne) in patients 12 years of age and older.

Aether Industries: The specialty chemical manufacturing company launched its qualified institutional placement (QIP) issue on June 19. The floor price for the offer has been fixed at Rs 984.90 per share by the fundraising committee. As per CNBC-TV18's sources, the fundraising is expected to be around Rs 750 crore.

Can Fin Homes: The housing finance company has received board approval for raising funds up to Rs 4,000 crore via debt instruments, and up to Rs 1,000 crore via qualified institutional placement (QIP), preferential allotment, or Rights issue. The board also sought approval for fund raising from shareholders.

InterGlobe Aviation: The low-cost airline has placed an order for 500 Airbus A320 Family aircraft. The order will be delivered between 2030 and 2035. Now IndiGo’s order book comprises a mix of A320NEO, A321NEO and A321XLR aircraft.

IIFL Securities: The Sebi has banned brokerage IIFL Securities from onboarding new clients in the stock broking operations for two years. As per Sebi's order, IIFL has mixed clients' funds with proprietary funds, used credit-balance client accounts to settle obligations of debit-balance client accounts, and used credit-balance client accounts to settle proprietary-trade obligations.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 1,030.90 crore, while domestic institutional investors (DII) offloaded shares worth Rs 365.20 crore on June 19, provisional data from the National Stock Exchange shows.

Stocks under F&O ban on NSE

The National Stock Exchange has added Hindustan Aeronautics to its F&O ban list for June 20, and retained Delta Corp, Indiabulls Housing Finance, India Cements, L&T Finance Holdings, Manappuram Finance, Tata Chemicals, and Zee Entertainment Enterprises to the list. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!