The correction in global counterparts after hotter-than-expected US inflation data, weakening rupee and FII selling pressure dented market sentiment on June 13. All sectoral indices closed in red with Nifty Bank, Auto, Financial Services, IT, Metal, Realty and Oil & Gas indices declining 2-4 percent.

The BSE Sensex plummeted 1,457 points or 2.68 percent to 52,847, while the Nifty50 fell 427 points or 2.64 percent to 15,774 and formed a bearish candle on the daily charts.

"A long negative candle was formed on the daily chart at the lows with a long lower shadow. Technically, this pattern reflects an ongoing downtrend in the market and an attempt at a downside breakout of the support of around 16,700 levels. Formation of long lower shadow signals an emergence of minor buying interest from the lows," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said, adding the Nifty is now placed at the edge of crucial support at 15,650-15,700 levels.

The short-term trend of the Nifty continues to be negative, the market expert feels.

Having reached crucial lower support of 15,700 levels and a formation of unfilled weekly opening downside gap, there is a possibility of an upside bounce from the lows of around 15,500-15,400 levels in the next 1-2 sessions, Shetti said.

The selling pressure was also seen in broader space as the Nifty Midcap 100 index declined 2.9 percent and Smallcap 100 index fell 3.9 percent. India VIX, which measures the expected volatility in the market, increased by 14.25 percent to 22.37 levels, which was a discomfort for bulls.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,677, followed by 15,579. If the index moves up, the key resistance levels to watch out for are 15,879 and 15,984.

Nifty Bank fell more than 1,000 points or 3 percent to close at 33,406 on Monday. The important pivot level, which will act as crucial support for the index, is placed at 33,153, followed by 32,900. On the upside, key resistance levels are placed at 33,716 and 34,027 levels.

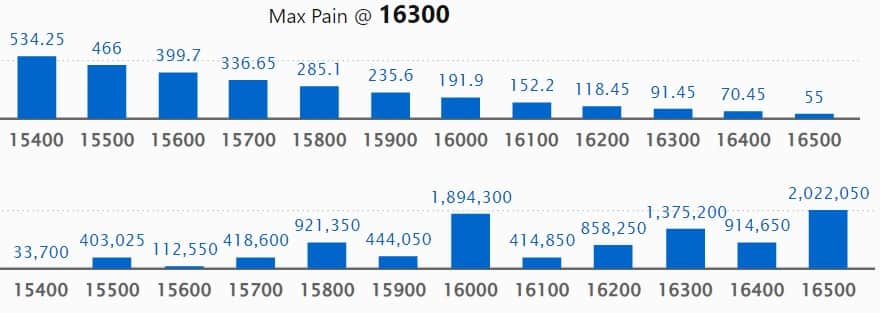

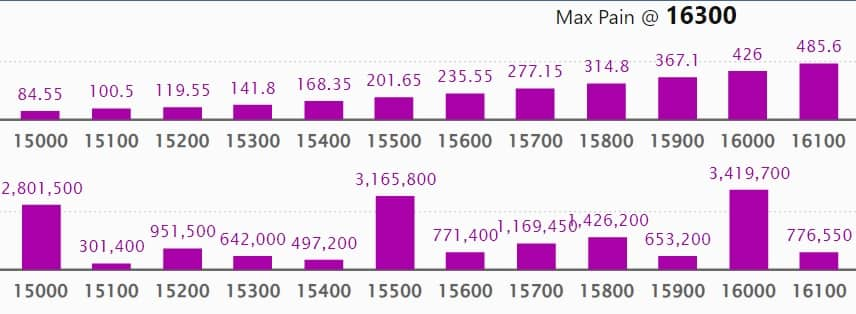

Maximum Call open interest of 25.66 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 16,500 strike, which holds 20.22 lakh contracts, and 16,000 strike, which has also accumulated 18.97 lakh contracts.

Call writing was seen at 15,800 strike, which added 7.17 lakh contracts, followed by 16,000 strike which added 6.71 lakh contracts and 15,700 strike which added 3.76 lakh contracts.

Call unwinding was seen at 17,200 strike, which shed 2.5 lakh contracts, followed by 17,500 strike which shed 1.92 lakh contracts and 16,800 strike which shed 1.91 lakh contracts.

Maximum Put open interest of 34.19 lakh contracts was seen at 16,000 strike. This is followed by 15,500 strike, which holds 31.65 lakh contracts, and 15,000 strike, which has accumulated 28.01 lakh contracts.

Put writing was seen at 14,500 strike, which added 4.27 lakh contracts, followed by 15,800 strike, which added 3.73 lakh contracts and 15,700 strike which added 3.01 lakh contracts.

Put unwinding was seen at 16,000 strike, which shed 10.67 lakh contracts, followed by 16,200 strike which shed 4.9 lakh contracts, and 14,900 strike which shed 2.9 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in United Breweries, TCS, HDFC, ICICI Lombard General Insurance, and Infosys, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the four stocks - Honeywell Automation, Siemens, Pidilite Industries, and PI Industries - in which a long build-up was seen.

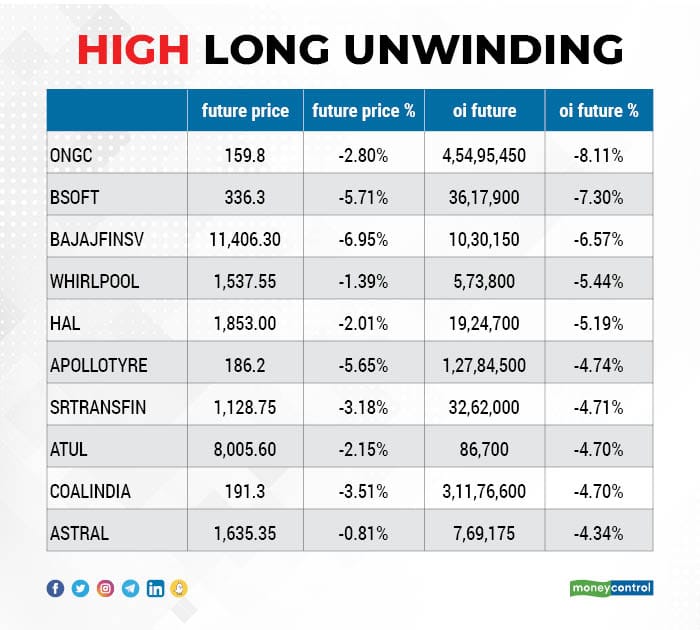

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including ONGC, Birlasoft, Bajaj Finserv, Whirlpool of India, and Hindustan Aeronautics, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including RBL Bank, Bharat Forge, Bank Nifty, Ramco Cements, and Crompton Greaves Consumer Electricals, in which a short build-up was seen.

Six stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the six stocks - Bajaj Auto, Marico, Nestle India, Syngene International, Ipca Laboratories, and Britannia Industries - in which short-covering was seen.

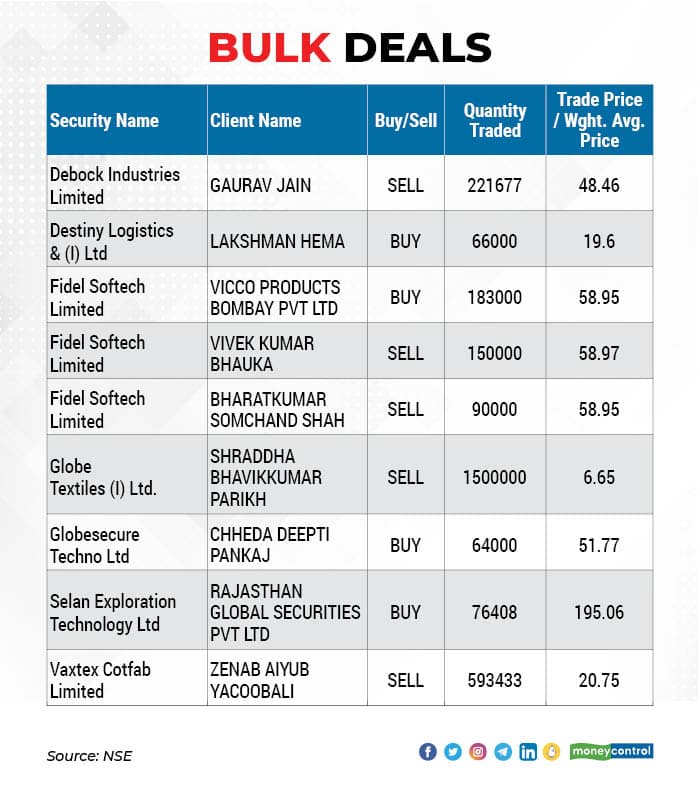

(For more bulk deals, click here)

Investors Meetings on June 14

Tata Communications: The company will be holding an Investor Day 2022.

Escorts: Officials of the company will meet various investors through CLSA.

ISGEC Heavy Engineering: Officials of the company will meet Goldman Sachs Asset Management.

Crompton Greaves Consumer Electricals: Officials of the company will meet Amansa Capital, and WCM Investment Management (USA).

Voltas: Officials of the company will meet Wellington Management, Morgan Stanley Investment Management, T Rowe Price & Associates, First Sentier Investors, and Kotak Mahindra Asset Management.

Greaves Cotton: Officials of the company will meet Mathews Asia, Suyash Advisors, Nayan M Vala Securities, and Seven Canyon.

Indian Energy Exchange: Officials of the company will meet Spark Capital.

Asian Paints: Officials of the company will meet Trident Capital Investments.

Century Enka: Officials of the company will meet Guardian Capital.

Gokaldas Exports: Officials of the company will meet Zaaba Capital, and L&T Mutual Fund.

IIFL Finance: Officials of the company will meet White Oak Capital Management Consultants LLP, ICICI Prudential Mutual Fund, HDFC MF, DSP Mutual Fund, and Alchemy Capital Management.

Vedanta: Officials of the company will meet BlackRock.

Devyani International: Officials of the company will participate in CLSA UK & EU Virtual Access Day.

Stocks in News

Delta Corp: HDFC Mutual Fund acquired an additional 2.15 percent equity stake in the company via open market transactions on June 10. With this, its shareholding in the company stands increased to 9.21 percent, up from 7.06 percent earlier.

Torrent Power: The company has completed the acquisition of a 50 MW solar power plant from SkyPower Group in Telangana. The enterprise value for this acquisition is Rs 416 crore. The long-term power purchase agreement (PPA) for the project is with Northern Power Distribution Company of Telangana (NPDCTL) for a period of 25 years at a fixed tariff of approximately Rs 5.35 per kWh, with remaining useful life of approximately 20 years.

Capri Global Capital: Life Insurance Corporation of India bought additional 35.41 lakh equity shares in the company via open market transactions. With this, LIC's shareholding in the company stands increased to 7.059 percent, up from 5.043 percent earlier.

Dynamatic Technologies: The company has won the contract to manufacture the escape hatch door for Airbus A220 aircraft. The contract was placed by Stelia Aeronautique Canada Inc., a subsidiary of Airbus Atlantic SAS.

WPIL: The company has received an order from the Government of West Bengal for the execution of a turnkey project comprising commissioning of a clear water reservoir and a ground-level reservoir. The contract is valued at Rs 430.87 crore and the same will be completed over a period of 24 months.

Aether Industries: SBI Mutual Fund acquired additional 3.23 lakh equity shares in the company via open market transactions. With this, its shareholding in the company stands increased to 5.1775 percent, up from 4.9180 percent earlier.

Fund Flow

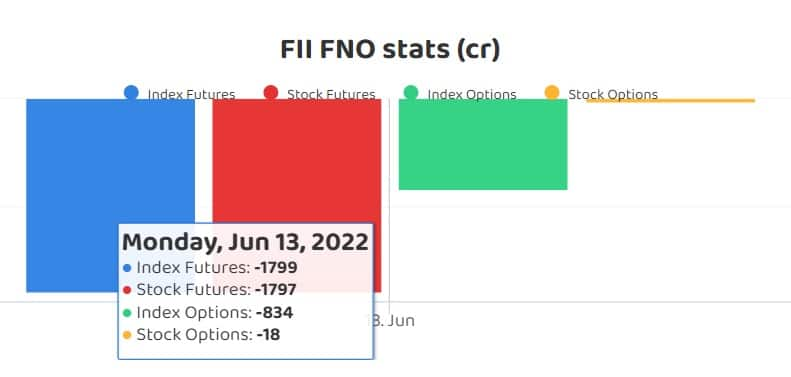

Foreign institutional investors (FIIs) have net sold Rs 4,164.01 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 2,814.50 crore worth of shares on June 13, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - RBL Bank, and Delta Corp - are under the NSE F&O ban for June 14. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!