The market gained for the first time in last seven consecutive sessions on May 16 but the volatility remained elevated, indicating that there is still discomfort for bulls and more volatile swings going ahead.

The BSE Sensex rose 180 points to 52,974 after losing more than 5 percent in previous six consecutive sessions, while the Nifty50 gained 60 points at 15,842 and formed Doji candlestick pattern on the daily charts indicating indecisiveness among bulls and bears.

"On the daily charts, the index formed a Classic Doji candle pattern which indicates indecision at current levels. For the past 2 days, the index has been trading in a range between 15,700-16,100. It has also managed to hold the low of 15,735 made on May 12," said Malay Thakkar, Technical Research Associate at GEPL Capital.

He further said that on the upside, the index faces resistance in the gap zone of 16,050-16,170. "The index has halted the fall and going ahead 15,735 would be a critical support on the downside and a break below the same level would drag the index lower towards 15,400 mark."

The Nifty Midcap 100 and Smallcap 100 indices have gained more than one percent each, outperforming benchmark indices, while the India VIX, which measures the expected volatility in the market, rose 4.43 percent to 24.53 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,729, followed by 15,615. If the index moves up, the key resistance levels to watch out for are 15,967 and 16,092.

Nifty Bank rallied 476 points or 1.4 percent to close at 33,598 on Monday. The important pivot level, which will act as crucial support for the index, is placed at 33,126, followed by 32,654. On the upside, key resistance levels are placed at 33,945 and 34,293 levels.

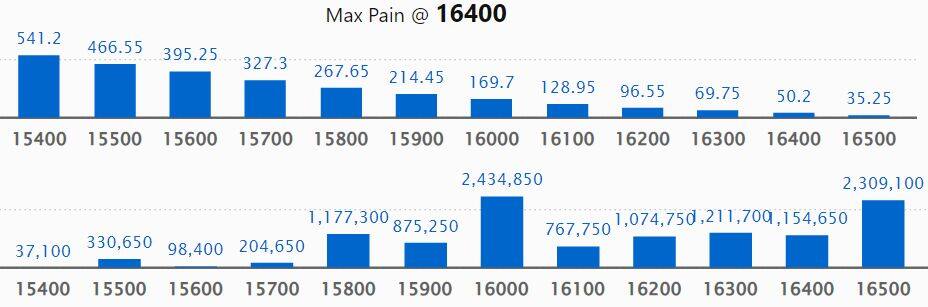

Maximum Call open interest of 39.86 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 16,000 strike, which holds 24.34 lakh contracts, and 16,500 strike, which has accumulated 23.09 lakh contracts.

Call writing was seen at 16,000 strike, which added 3.54 lakh contracts, followed by 17,000 strike which added 3.12 lakh contracts and 15,900 strike which added 1.97 lakh contracts.

Call unwinding was seen at 16,100 strike, which shed 1.76 lakh contracts, followed by 16,900 strike which shed 46,950 contracts and 14,900 strike which shed 600 contracts.

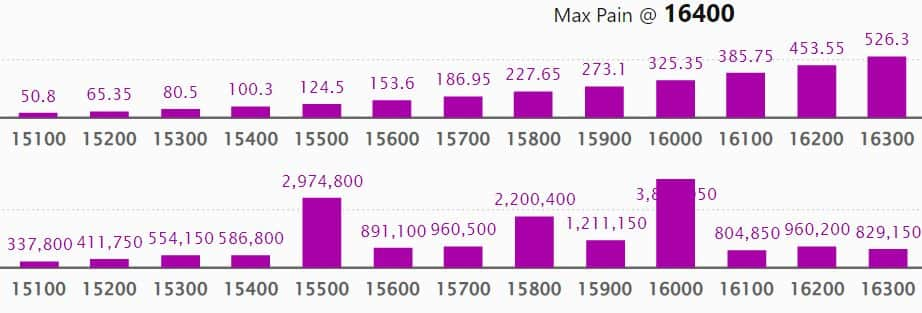

Maximum Put open interest of 38.07 lakh contracts was seen at 16,000 strike. This was followed by 15,000 strike, which holds 29.93 lakh contracts, and 15,500 strike, which has accumulated 29.74 lakh contracts.

Put writing was seen at 15,000 strike, which added 1.93 lakh contracts, followed by 14,500 strike, which added 1.85 lakh contracts and 14,600 strike which added 1.29 lakh contracts.

Put unwinding was seen at 16,100 strike, which shed 2.31 lakh contracts, followed by 15,800 strike which shed 1.76 lakh contracts, and 16,300 strike which shed 59,000 contracts.

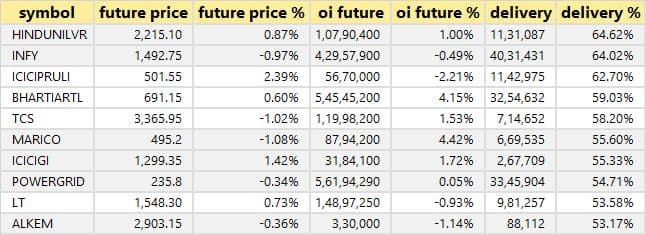

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Hindustan Unilever, Infosys, ICICI Prudential Life Insurance, Bharti Airtel, and TCS, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Bajaj Finserv, ACC, Eicher Motors, Aditya Birla Fashion & Retail, and Ipca Laboratories, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including ABB India, Gujarat Gas, Crompton Greaves Consumer Electricals, Wipro, and Can Fin Homes, in which long unwinding was seen.

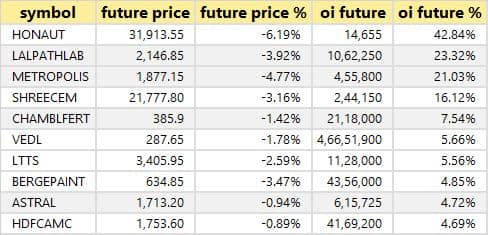

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Honeywell Automation, Dr Lal PathLabs, Metropolis Healthcare, Shree Cements, and Chambal Fertilizers, in which a short build-up was seen.

72 stocks witnessed short-covering

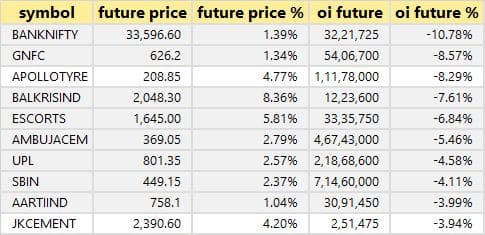

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Bank Nifty, GNFC, Apollo Tyres, Balkrishna Industries, and Escorts, in which short-covering was seen.

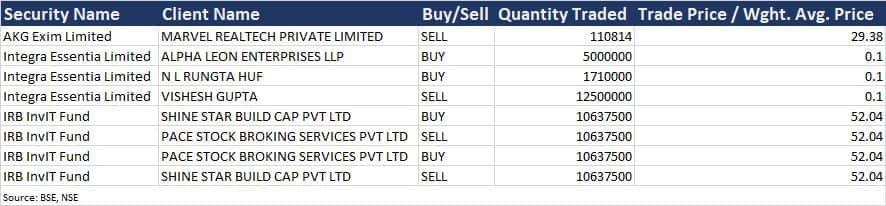

(For more bulk deals, click here)

Bharti Airtel, Indian Oil Corporation, DLF, PI Industries, Abbott India, Bajaj Electricals, Bajaj Healthcare, EID Parry (India), Indoco Remedies, IRB Infrastructure Developers, Jubilant Ingrevia, Kajaria Ceramics, Dr Lal PathLabs, Minda Corporation, Sapphire Foods India, Fairchem Organics, Galaxy Surfactants, GMR Infrastructure, NOCIL, Nucleus Software Exports, Sun Pharma Advanced Research Company, and Zydus Wellness will be in focus ahead of March quarter earnings on May 17.

Stocks in News

Shares of PSU stocks will be under focus ahead of the Life Insurance Corporation of India's listing on May 17. The grey market premium trading at discount of Rs 30 a share. LIC likely to list at flat to negative on exchanges amid volatility in the global equity markets, analysts said.

Shares of InterGlobe Aviation will be in focus after the firm said it got DGCA communications on handling of special child at Ranchi Airport. DGCA prima facie found Indigo's handling of special child at Ranchi Airport inappropriate. DGCA will issue a show cause notice to Indigo to explain. The firm said it will respond the matter in due course.

Aditya Birla Capital said on exchanges that the firm has received whistleblower complaint where allegations were made against Aditya Birla Sun Life and employees. The firm said an independent committee investigating the complaint did not find any merit in any allegations. The firm also said that the complaint did not level allegations against CEO Ajay Srinivasan. Srinivasan had express interest in taking on a new role within the group leading to him to stepping down as CEO of Aditya Birla Capital. The firm also said that there have been no employee exit in Aditya Birla Capital and Aditya Birla Sun Life AMC due to the allegations.

IRB Infrastructure on exchanges said its April gross toll collections stood at Rs 327 crore versus Rs 306.66 crore in March. The gross toll collections in April last year was at Rs 196.64 crore. The firm said on April 21 the toll collection was suspended on account of farmers agitation.

KEC International won orders worth Rs 1,150 crore across its various businesses. The company said the diverse orders in the Civil business, further strengthen its portfolio diversification and reaffirms the company's confidence in the continued strong growth of this business going forward.

State-owned SJVN Ltd will develop another hydro power project Arun-4 worth Rs 4,900 crore in Nepal. A Memorandum of Understanding (MoU) for the development of the 490 MW Arun-4 hydro electric project in Nepal has been signed in Lumbini, Nepal in the presence of Prime Minister Narendra Modi and Prime Minister of Nepal Sher Bahadur Deuba, the company said in a statement.

GlaxoSmithKline Pharmaceuticals on Monday reported a Rs 55 crore consolidated net loss from continuing operations for the fourth quarter. The drug firm had reported a net profit of Rs 4 crore for the January-March quarter of the 2020-21 fiscal. Revenue from operations rose to Rs 810 crore for the fourth quarter compared to Rs 744 crore in the year-ago period, GlaxoSmithKline Pharmaceuticals said in a regulatory filing.

VIP Industries said it reported a profit of Rs 12 crore in the March quarter from a loss of Rs 4 crore a year ago. Revenue for the quarter stood at Rs 356 crore versus Rs 243 crore last year. EBITDA was at Rs 33 crore against Rs 3 crore.

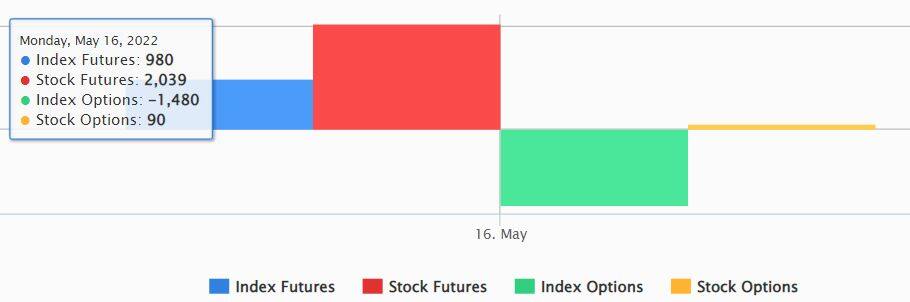

Fund Flow

Foreign institutional investors (FIIs) net sold shares worth Rs 1,788.93 crore, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 1,428.39 crore worth of shares on May 16, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - GNFC, Indiabulls Housing Finance, and Punjab National Bank - are under the F&O ban for May 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!