The market extended losses for the second straight session and fell more than 1 percent on April 25, as increasing COVID-led lockdown fear in China and hawkish commentary of Fed officials dampened sentiment.

The benchmark indices erased all previous two days' gains in the following two sessions (last Friday, and Monday). The BSE Sensex corrected 617 points to 56,580, while the Nifty50 plunged 218 points to 16,954 and formed yet another bearish candle on the daily charts.

"A small negative candle was formed on the daily chart with minor upper and lower shadows. Technically, this pattern signals a formation of a high wave-type candle pattern, which indicates high volatility in the market. Normally, such formations after a reasonable decline or near the crucial supports more often act as a reversal pattern," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Shetti further said Nifty is currently placed at the support of the previous swing low of April 19 and 200-day EMA (exponential moving average) around 16,850 levels. "The lower end of crucial Doji pattern of weekly chart of last week is placed at 16,850 levels and the market has witnessed a reasonable upside bounce from these levels in the recent past. Hence, there is a possibility of buying emerging from near 16,800 levels," the analyst added.

The selling pressure in broader space was more compared to frontline indices. The Nifty Midcap 100 index declined 1.92 percent and Smallcap 100 index fell 2.4 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,877, followed by 16,800. If the index moves up, the key resistance levels to watch out for are 17,043 and 17,131.

Bank Nifty fared much better than broader space as buying in private banks helped the index close 38 points higher at 36,082 on April 25. The important pivot level, which will act as crucial support for the index, is placed at 35,639, followed by 35,196. On the upside, key resistance levels are placed at 36,398 and 36,713 levels.

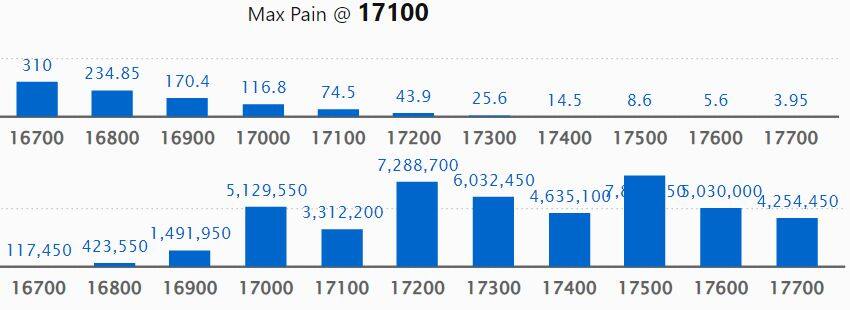

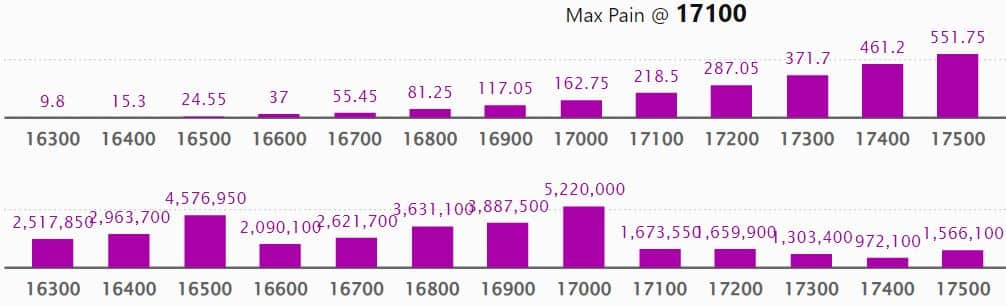

Maximum Call open interest of 82.3 lakh contracts was seen at 17,800 strike, which will act as a crucial resistance level in the April series.

This is followed by 17,500 strike, which holds 78.05 lakh contracts, and 18,000 strike, which has accumulated 74.53 lakh contracts.

Call writing was seen at 17,800 strike, which added 39.52 lakh contracts, followed by 17,000 strike which added 37.87 lakh contracts, and 17,200 strike which added 37.43 lakh contracts.

Call unwinding was seen at 18,000 strike, which shed 33.67 lakh contracts, followed by 18,100 strike which shed 5.09 lakh contracts and 17,400 strike which shed 4.59 lakh contracts.

Maximum Put open interest of 61.79 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the April series.

This is followed by 17,000 strike, which holds 52.2 lakh contracts, and 16,500 strike, which has accumulated 45.76 lakh contracts.

Put writing was seen at 16,900 strike, which added 17.99 lakh contracts, followed by 16,000 strike, which added 17.45 lakh contracts and 16,800 strike which added 17.38 lakh contracts.

Put unwinding was seen at 17,200 strike, which shed 14.48 lakh contracts, followed by 17,300 strike which shed 10.13 lakh contracts, and 17,000 strike which shed 6.14 lakh contracts.

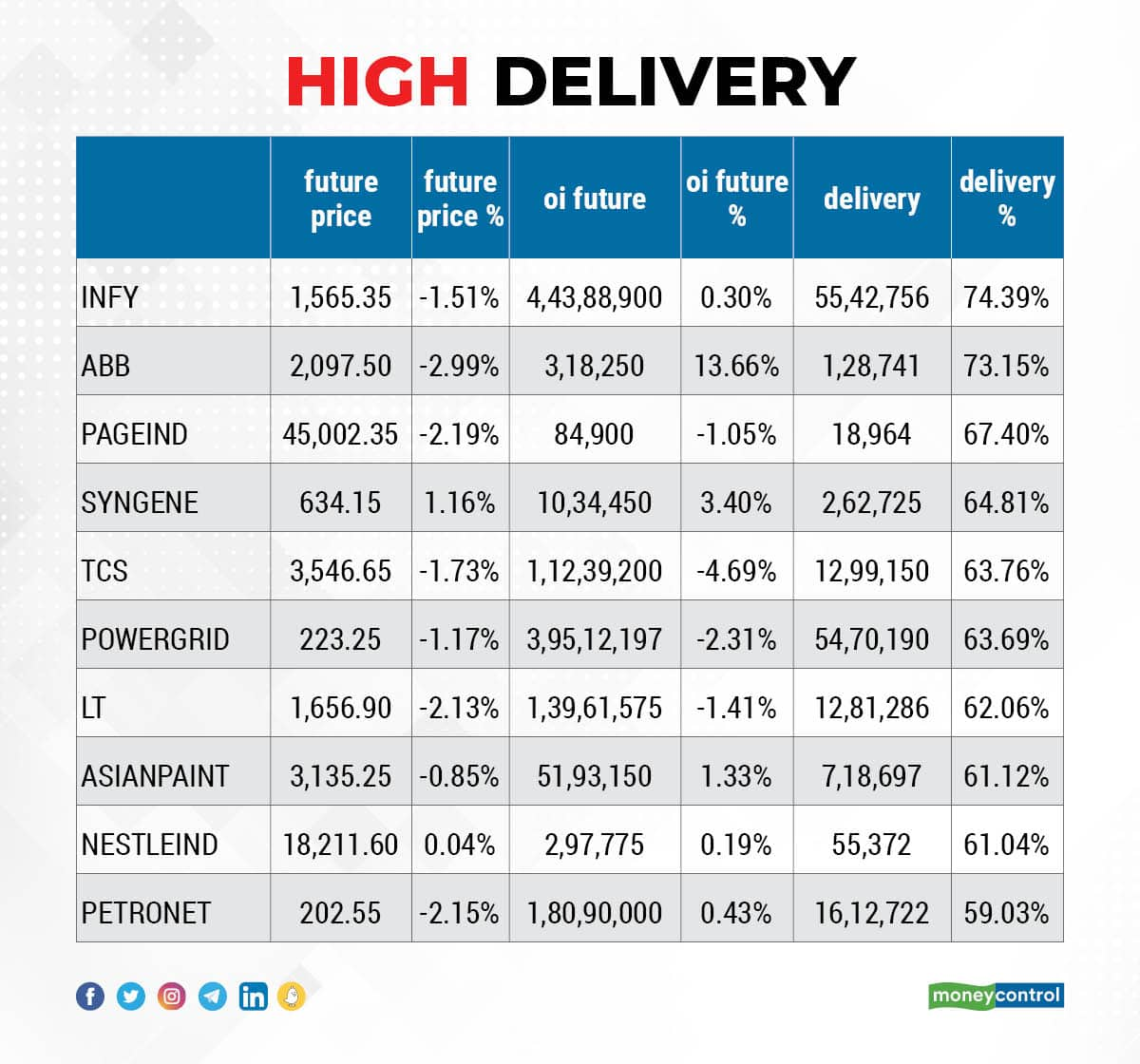

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Infosys, ABB India, Page Industries, Syngene International, and TCS, among others.

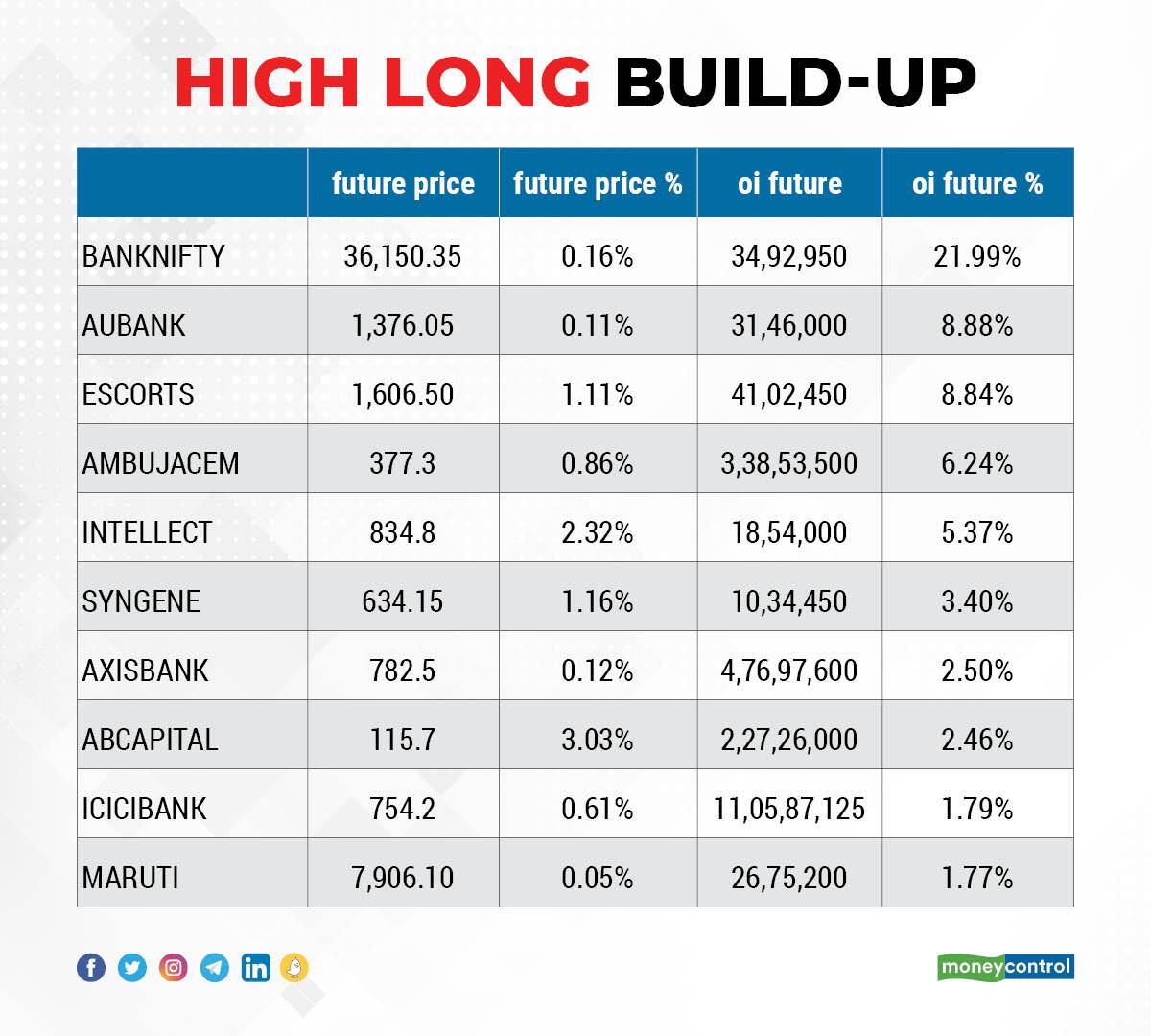

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Bank Nifty, AU Small Finance Bank, Escorts, Ambuja Cements, and Intellect Design Arena, in which a long build-up was seen.

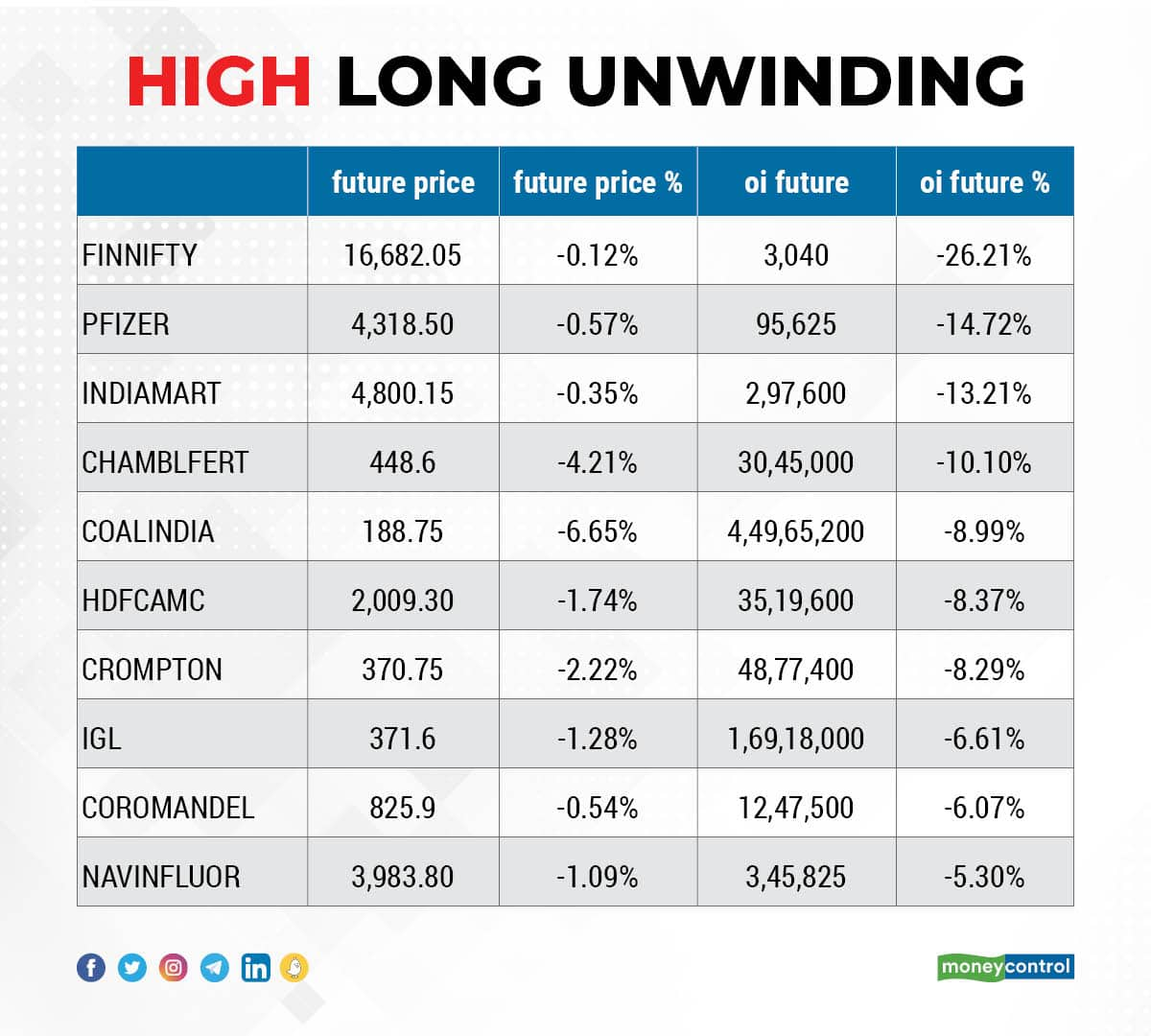

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Pfizer, IndiaMART InterMESH, Chambal Fertilizers, and Coal India, in which long unwinding was seen.

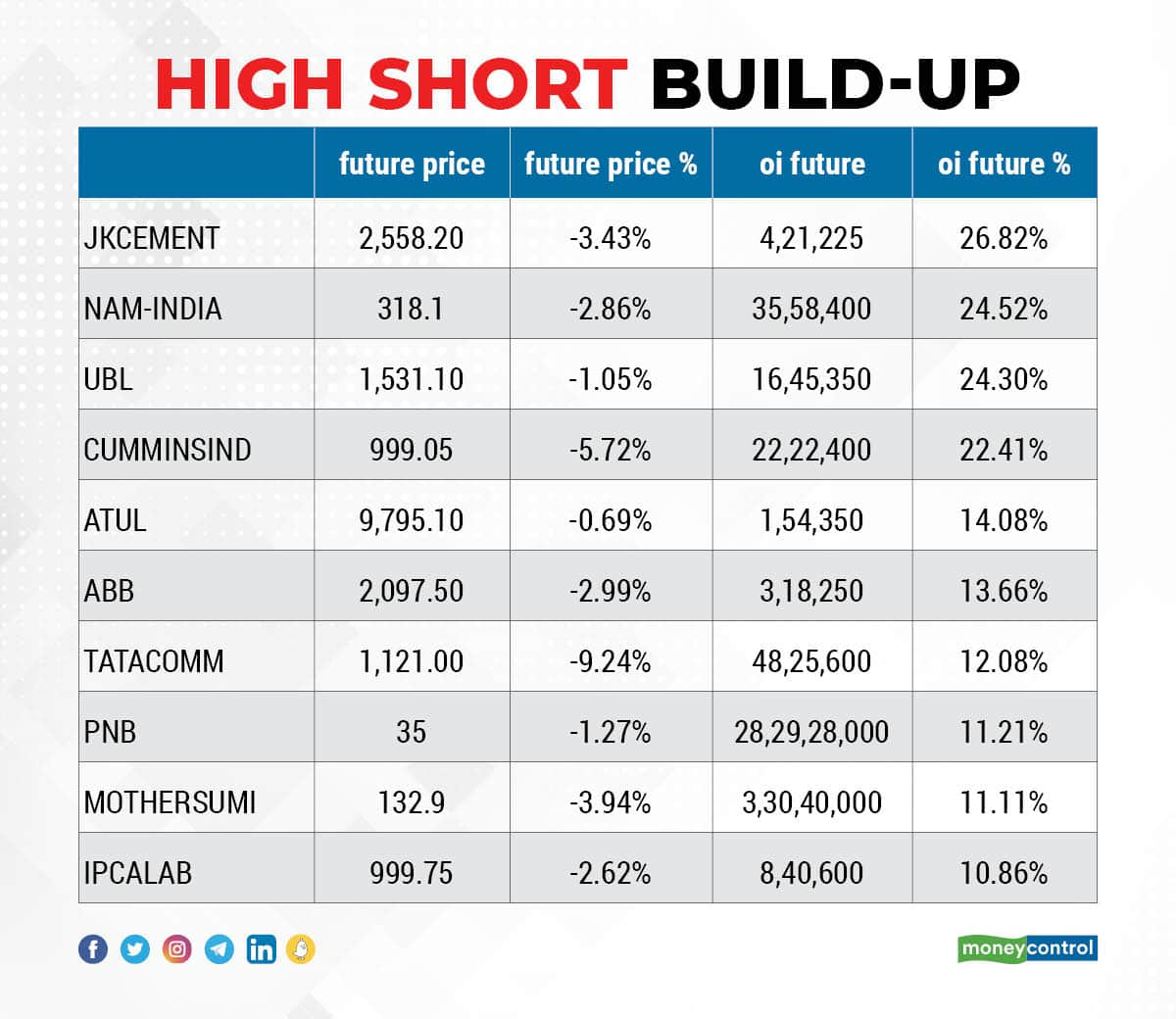

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including JK Cement, Nippon Life India Asset Management, United Breweries, Cummins India, and Atul, in which a short build-up was seen.

13 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Dixon Technologies, Dr Lal PathLabs, Gujarat Gas, Polycab India, and Bajaj Auto, in which short-covering was seen.

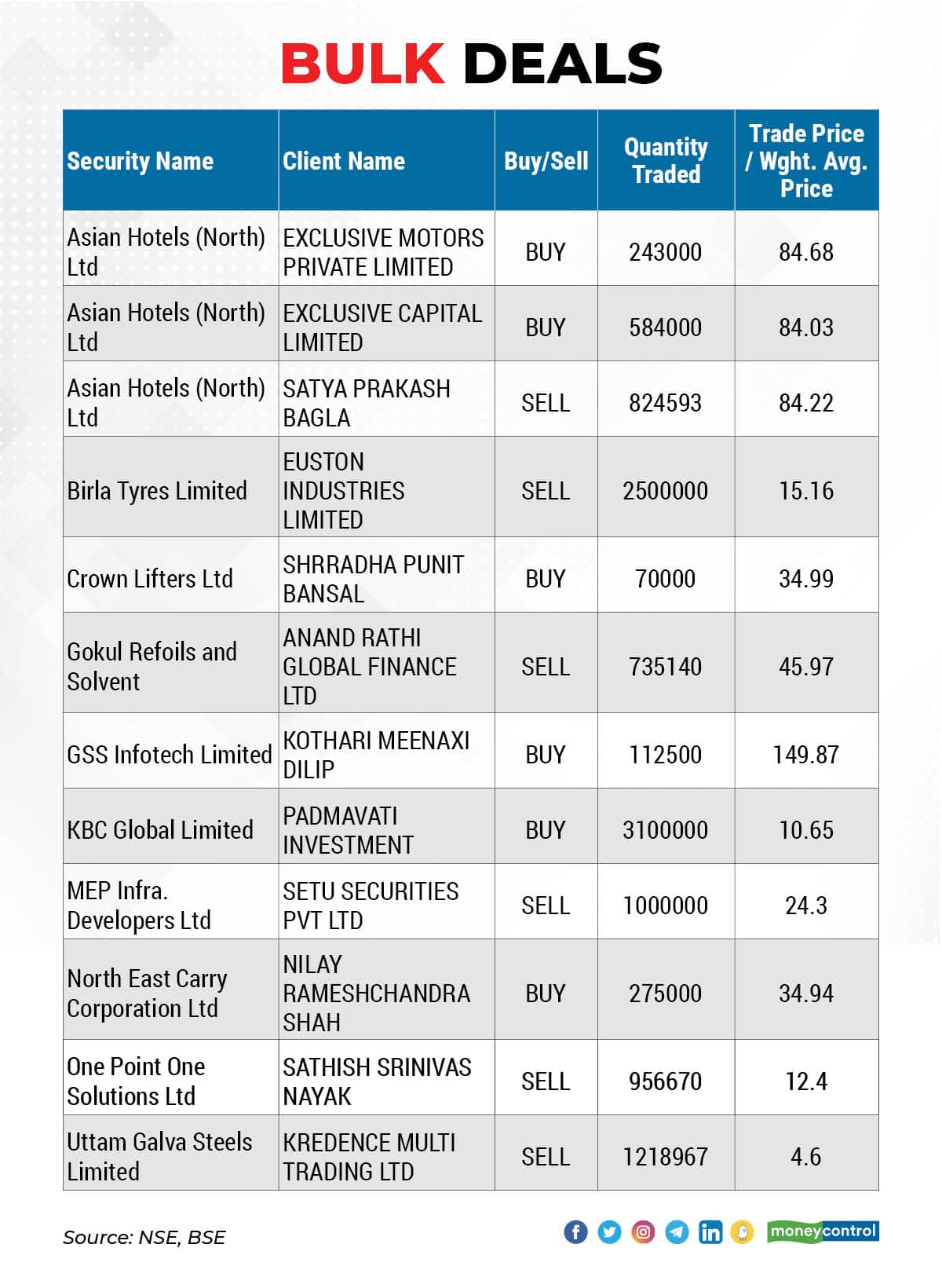

(For more bulk deals, click here)

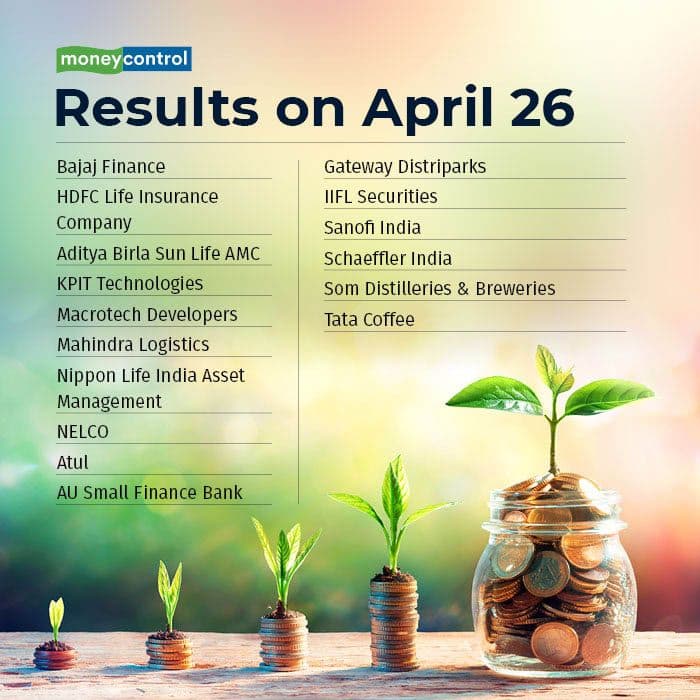

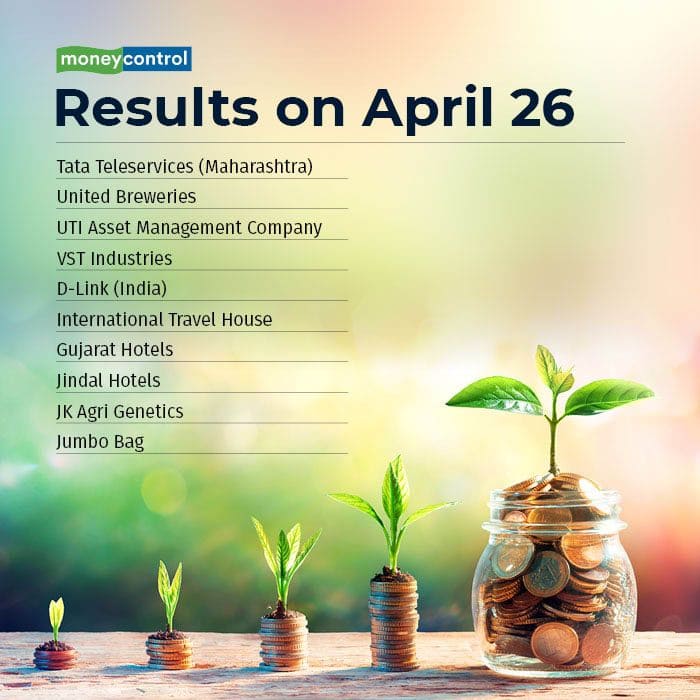

Bajaj Finance, HDFC Life Insurance Company, Aditya Birla Sun Life AMC, KPIT Technologies, Macrotech Developers, Mahindra Logistics, Nippon Life India Asset Management, NELCO, Atul, AU Small Finance Bank, Gateway Distriparks, IIFL Securities, Sanofi India, Schaeffler India, Som Distilleries & Breweries, Tata Coffee, Tata Teleservices (Maharashtra), United Breweries, UTI Asset Management Company, VST Industries, D-Link (India), International Travel House, Gujarat Hotels, Jindal Hotels, JK Agri Genetics, and Jumbo Bag are slated to release their quarterly earnings on April 26.

Stocks in News

Veranda Learning Solutions: The learning solutions provider has acquired T.I.M.E. (Advanced Educational Activities Pvt Ltd), the leading test-prep institute with a pan-India presence operating through 188 centres. The company bought T. I. M. E. for Rs 287 crore.

Lemon Tree Hotels: The company has signed a License Agreement for a 60 room hotel at Kharar, near Chandigarh under the brand 'Lemon Tree Hotel'. The hotel is expected to be operational by November, 2025. Its subsidiary Carnation Hotels will be operating and marketing this hotel.

Mahindra CIE Automotive: Profit in the quarter ended March 2022 grew by 1,499 percent year-on-year to Rs 161.43 crore due to lower tax expenses and higher revenue growth. Topline increased 18.2 percent to Rs 2,588.4 crore compared to corresponding period last fiscal.

Aarti Industries: Life Insurance Corporation of India acquired additional 2.24 lakh equity shares in the company via open market transactions on April 22. With this, LIC's stake in the company stands increased to 5.03 percent, up from 4.97 percent earlier.

Gujarat Mineral Development Corporation: The company recorded consolidated profit at Rs 177 crore for the quarter ended March 2022, against loss of Rs 184.64 crore in same period last year, driven by topline. Revenue grew by 87 percent year-on-year to Rs 1,057.3 crore in the same period.

The Ruby Mills: The company has repaid its entire term loans and all unsecured loans of Rs 145 crore.

Tatva Chintan Pharma Chem: The company reported a 17 percent year-on-year decline in profit at Rs 17.51 crore for March 2022 quarter, dented by lower topline and operating income. Revenue fell 9.3 percent to Rs 98.53 crore during the same period, with margin declining 200 bps YoY.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 3,302.85 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 1,870.45 crore on April 25, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for April 26. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!