The market reversed all its gains in the previous week with the Nifty50 losing more than 100 points on April 11, weighed by weak global cues. The fall in technology stocks ahead of TCS earnings, and correction in select banking and financial services and FMCG stocks dragged the market down.

The BSE Sensex fell below the psychological 59,000 mark, down 483 points at 58,965, while the Nifty50 declined 109 points to 17,675 and formed a bearish candle on the daily charts.

"The index opened with a downward gap and remained lacklustre throughout the session. The daily price action has formed a small bearish candle and remained subdued within the last three sessions of the High-Low (17,850-17,600) range, indicating the absence of strength," Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities said.

He advised traders to keep a close watch on the 17,600 support zone as any violation of the same may cause profit booking towards 17,500-17,400 levels. However, "any sustainable move above 17,850 levels may lead to upside momentum towards 18,000-18,200 levels," he said.

The broader markets outperformed frontline indices with the Nifty Midcap 100 index rising 0.6 percent and Smallcap 100 index ending flat.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,624, followed by 17,573. If the index moves up, the key resistance levels to watch out for are 17,752 and 17,830.

Bank Nifty declined 138 points to close at 37,614 on April 11. The important pivot level, which will act as crucial support for the index, is placed at 37,445, followed by 37,276. On the upside, key resistance levels are placed at 37,862 and 38,111 levels.

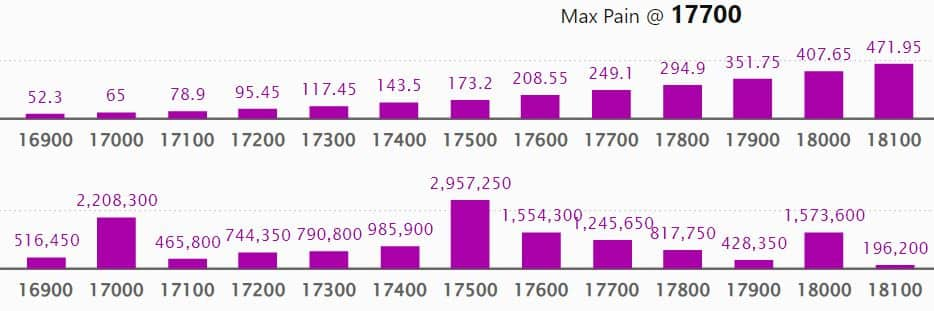

Maximum Call open interest of 24.10 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 19,000 strike, which holds 20.96 lakh contracts, and 18,500 strike, which has accumulated 16.73 lakh contracts.

Call writing was seen at 17,700 strike, which added 3.19 lakh contracts, followed by 17,800 strike which added 2.64 lakh contracts, and 18,000 strike which added 2.01 lakh contracts.

Call unwinding was seen at 19,000 strike, which shed 64,500 contracts, followed by 18,900 strike which shed 7,650 contracts and 17,100 strike which shed 600 contracts.

Maximum Put open interest of 29.57 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the April series.

This is followed by 17,000 strike, which holds 22.08 lakh contracts, and 16,500 strike, which has accumulated 21.99 lakh contracts.

Put writing was seen at 17,700 strike, which added 2.89 lakh contracts, followed by 17,600 strike, which added 1.57 lakh contracts and 16,500 strike which added 1.3 lakh contracts.

Put unwinding was seen at 18,500 strike, which shed 7,900 contracts, followed by 18,200 strike which shed 3,150 contracts, and 18,000 strike which shed 2,900 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Honeywell Automation, Bharti Airtel, Indus Towers, Petronet LNG, and Ipca Laboratories, among others.

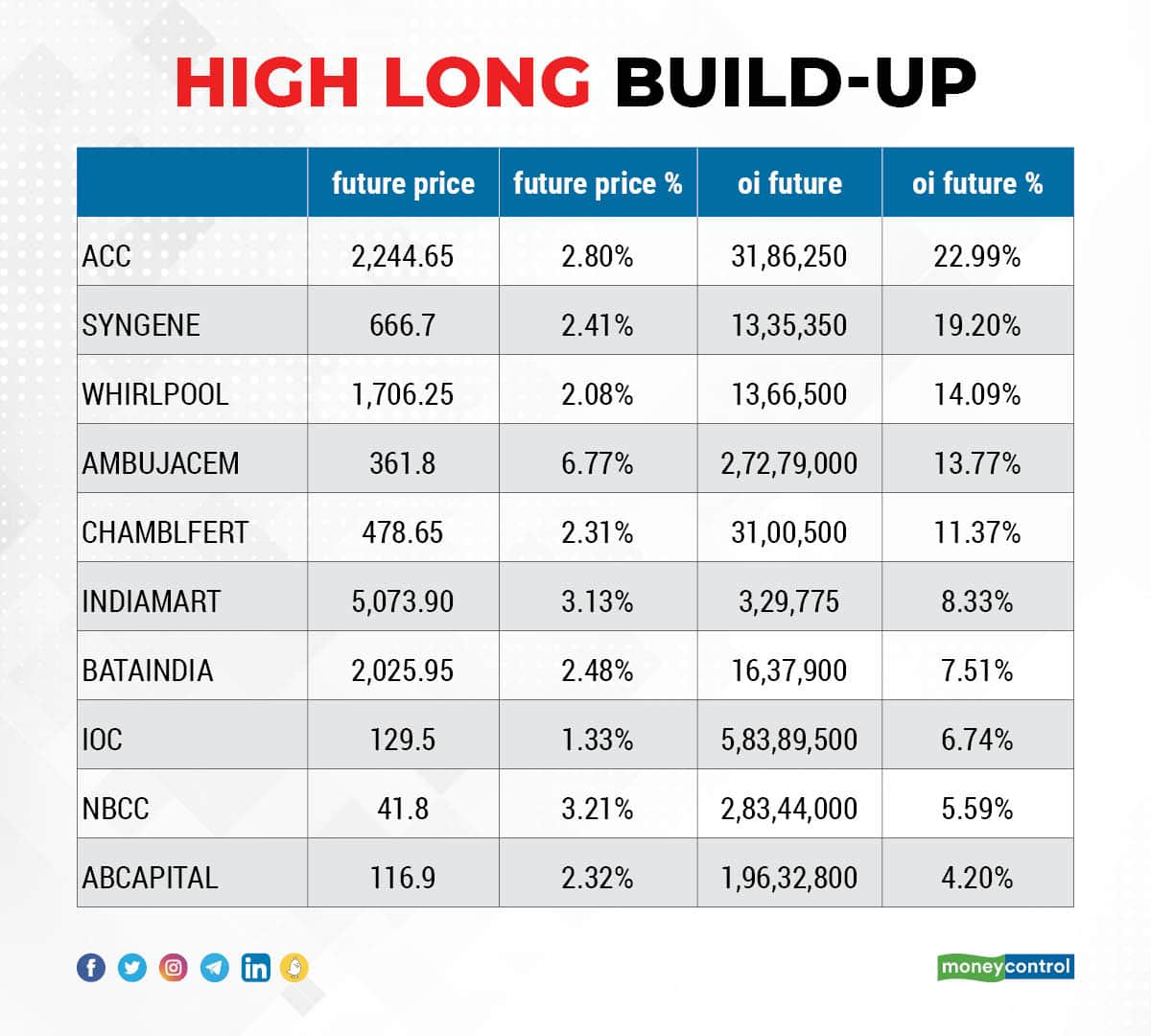

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including ACC, Syngene International, Whirlpool of India, Ambuja Cements, and Chambal Fertilizers, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Godrej Consumer Products, Escorts, Container Corporation, and Nifty, in which long unwinding was seen.

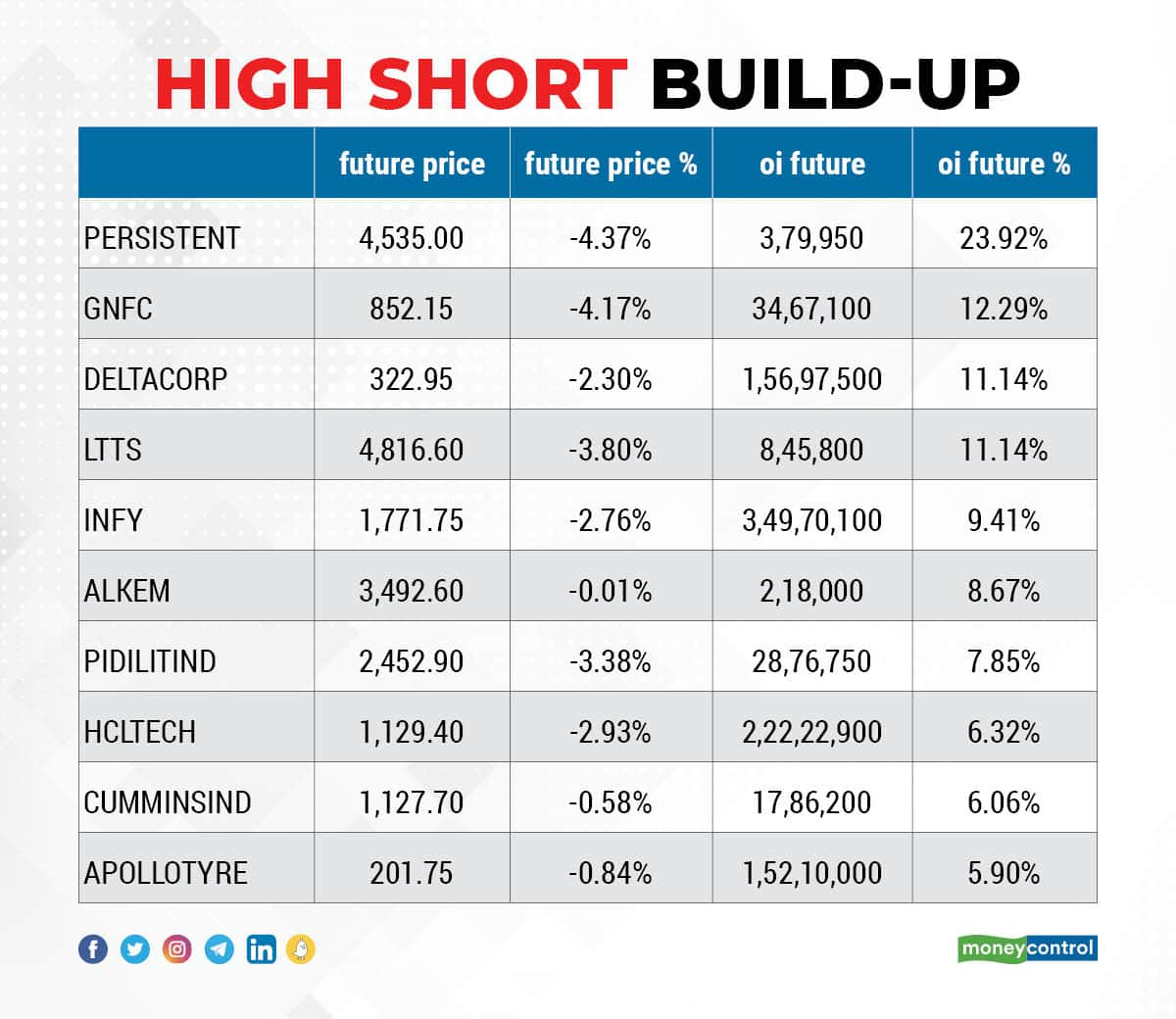

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Persistent Systems, GNFC, Delta Corp, L&T Technology Services, and Infosys, in which a short build-up was seen.

43 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Torrent Power, RBL Bank, Bharat Electronics, Apollo Hospitals, and Info Edge, in which short-covering was seen.

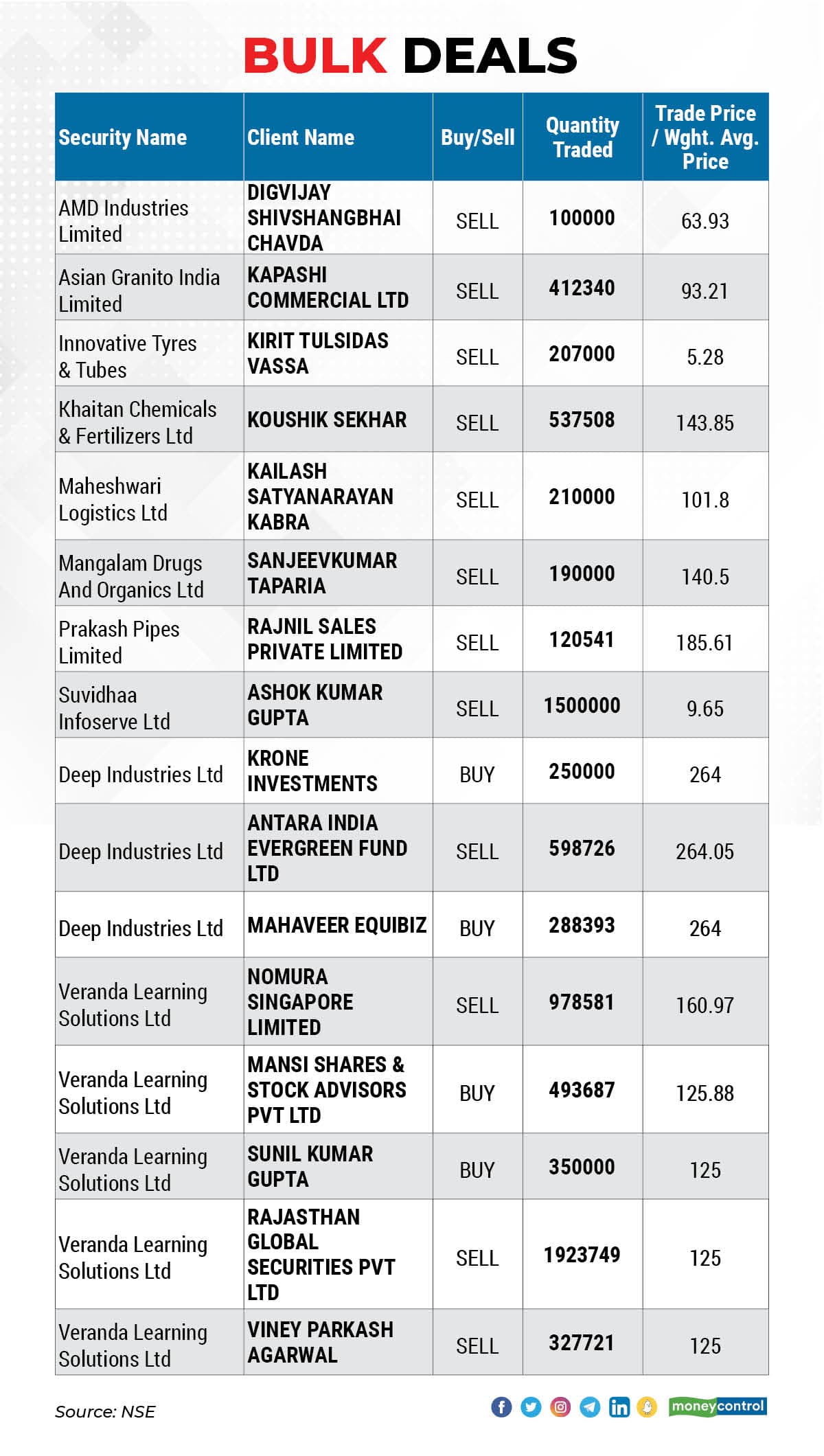

Veranda Learning Solutions: Nomura Singapore sold 9,78,581 equity shares in the company via open market transactions at an average price of Rs 160.97 per share on the BSE.

(For more bulk deals, click here)

Anand Rathi Wealth, GM Breweries, Hathway Cable & Datacom, Tinplate Company of India, Evexia Lifecare, and Gayatri Bioorganics will release quarterly earnings on April 12.

Stocks In News

TCS: The IT services provider recorded a profit of Rs 9,926 crore for the quarter ended March 2022, a 7.4 percent growth over a year-ago period, while revenue during the March 2022 quarter increased by 15.8 percent year-on-year to Rs 50,591 crore. Revenue growth in constant currency terms was 14.3 percent YoY. The company recorded the highest ever order book TCV (total contract value) of $11.3 billion in Q4FY22 and the full year order book stood at $34.6 billion.

Kesoram Industries: The company posted a loss of Rs 46.14 crore for the March 2022 quarter, which widened from Rs 31.97 crore loss in the previous quarter. It had recorded a profit of Rs 96.41 crore in the year-ago period. An increase in power, fuel and finance costs impacted the bottom line to a major extent. Revenue increased by 20 percent to Rs 1,031.78 crore compared to the year-ago period and the sequential growth was 18 percent.

UltraTech Cement: The cement major has been declared as a preferred bidder for Diggaon limestone block. The company participated in the e-auction conducted by the Karnataka government. The block is adjacent to the company's Rajashree unit and has total cement grade geological resources of 530 million tonnes of limestone over an area of 7.86 square km.

JSW Steel: JSW Utkal Steel, a subsidiary of JSW Steel, has received the environmental clearance for setting up a greenfield integrated steel plant (ISP) with a capacity of 13.2 million tonnes per annum (MTPA) crude steel, from the government. The capital expenditure for the said steel plant project is expected to be Rs 65,000 crore.

Gufic Biosciences: The company has received permission from the Central Drugs Standard Control Organisation (CDSCO), Ministry of Health and Family Welfare to manufacture Isavuconazonium Sulfate API and finished formulation Isavuconazole for injection 200 mg/vial. Isavuconazole is indicated for the treatment of invasive aspergillosis and invasive mucormycosis.

Delta Corp: The gaming and hospitality company has reported a lower profit at Rs 48.11 crore for the quarter ended March 2022, compared to profit of Rs 57.77 crore in the year-ago period, while revenue for the quarter has seen a moderate growth at Rs 218.32 crore, up from Rs 211.34 crore YoY. The company also approved amalgamation of Daman Entertainment, and Daman Hospitality with itself.

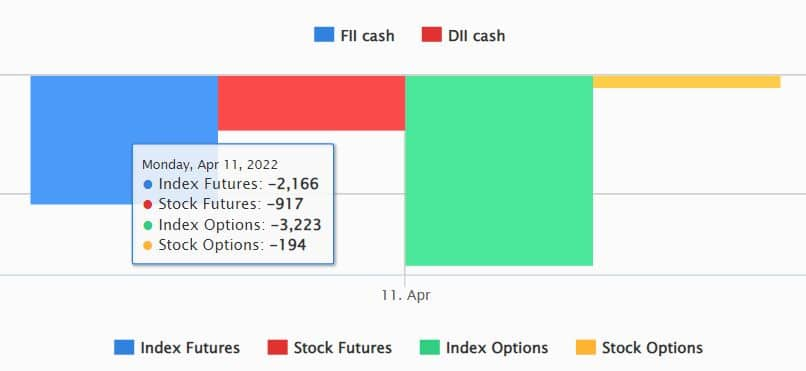

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 1,145.24 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 486.51 crore on April 11, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Delta Corp and RBL Bank - are under the F&O ban for April 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!