Bulls retained their charge at Dalal Street for the second consecutive session of the January series. The benchmark indices surged 1.6 percent, as buying was seen across sectors, barring pharma.

The BSE Sensex rallied more than 1,000 points intraday, before settling at 59,183.22 with 929.40 points, while the Nifty50 jumped 271.70 points to close at 17,625.70 and formed a bullish candle on the daily charts.

"The index opened with an upward gap and the buying momentum throughout the session led it to close near the day's high. The daily price action has formed a sizable bullish candle forming higher High-Low, as compared to the previous session. It also closed above the previous session's high, indicating further strength," says Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

On the daily chart, the index continues to scale upward forming a series of higher tops and bottoms. One should use any pullback rally towards 17,400-17,300 levels as a buying opportunity with a stop loss of 17,150 with an upside towards 17,800-18,000 levels, Rajesh advised.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,457.1, followed by 17,288.5. If the index moves up, the key resistance levels to watch out for are 17,720.5 and 17,815.3.

Nifty Bank

The Nifty Bank also joined the rally, climbing 940.20 points or 2.65 percent to close at 36,421.90 on January 3. The important pivot level, which will act as crucial support for the index, is placed at 35,801.63, followed by 35,181.37. On the upside, key resistance levels are placed at 36,767.13 and 37,112.37 levels.

Call option data

Maximum Call open interest of 19.92 lakh contracts was seen at 17500 strike. This is followed by 18000 strike, which holds 19.21 lakh contracts, and 18500 strike, which has accumulated 10.58 lakh contracts.

Call writing was seen at 18200 strike, which added 1.94 lakh contracts, followed by 17600 strike which added 1.9 lakh contracts, and 18100 strike which added 1.57 lakh contracts.

Call unwinding was seen at 17300 strike, which shed 2.01 lakh contracts, followed by 17200 strike which shed 1.55 lakh contracts and 17400 strike which shed 1.09 lakh contracts.

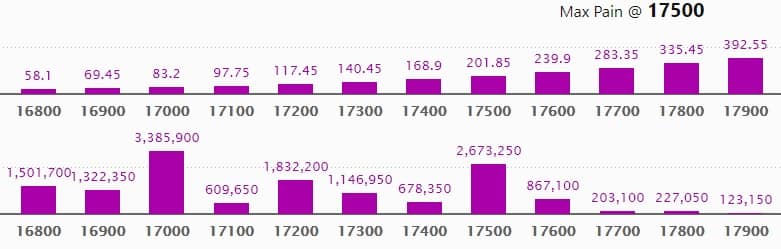

Put option data

Maximum Put open interest of 33.85 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the January series.

This is followed by 17500 strike, which holds 26.73 lakh contracts, and 17200 strike, which has accumulated 18.32 lakh contracts.

Put writing was seen at 17500 strike, which added 6.51 lakh contracts, followed by 17600 strike, which added 2.74 lakh contracts, and 17300 strike which added 2.59 lakh contracts.

Put unwinding was seen at 16800 strike, which shed 20,550 contracts, followed by 18500 strike which shed 4,750 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

105 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

Eight stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the eight stocks in which long unwinding was seen.

24 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

63 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

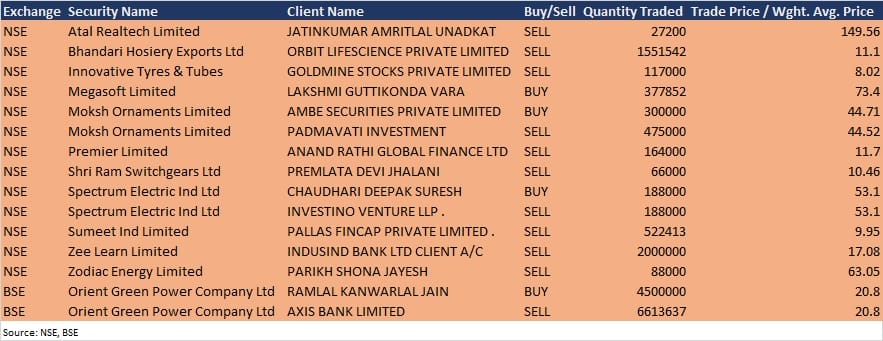

Bulk deals

(For more bulk deals, click here)

Analysts/Investors Meeting

Container Corporation of India: The company's officials will meet HSBC Securities & Capital Market India on January 4, and Nomura Financial Advisory & Securities India on January 5.

Ajmera Realty & Infra India: The company's officials will meet Renaissance Investment on January 4, and Antique Stock Broking on January 6.

Godawari Power & Ispat: The company's officials will meet Nirmal Bang on January 4.

Balrampur Chini Mills: The company's officials will meet IDFC Mutual Fund on January 4, and Nippon India on January 5.

Gland Pharma: The company's officials will meet investors and analysts on January 21 to discuss Q3FY22 earnings.

Stocks in News

Lemon Tree Hotels: Goldman Sachs (Singapore) Pte.- ODI acquired 30,02,214 equity shares in the company at Rs 46.6 per share via a block deal on the BSE. Zaaba Pan Asia Master Fund was the seller.

Krishna Institute of Medical Sciences: Goldman Sachs (Singapore) Pte.- ODI acquired 72,009 equity shares in the company at Rs 1,425.65 per share via a block deal on the BSE. Zaaba Pan Asia Master Fund was the seller.

Vedanta: The company announced total aluminium production at 5.79 lakh tonnes for Q3FY22, up 16 percent from 4.97 lakh tonnes in Q3FY21.

Dilip Buildcon: The company has received a letter of acceptance (LOA) for overburden removal contract mining work for Amadand OCP, Jamuna Kotma Area, in Madhya Pradesh valued at Rs 2,683.02 crore by the South Eastern Coalfield (SECL), a subsidiary of Coal India. The authority has issued a Provisional Completion Certificate for the project 'Four Laning of NH-161 from Mangloor to Telangana/Maharastra border in Telangana' under Bharatmala Pariyojana on Hybrid Annuity Mode.

Maruti Suzuki India: The company produced 1,52,029 vehicles in December 2021, against 1,55,127 vehicles in December 2020. The company exported 2,05,450 vehicles in 2021, the highest ever in a calendar year.

Ajmera Realty & Infra India: The company will build high-end residences at Juhu in Mumbai, focusing on urban rejuvenation. Funded through a mix of debt and equity, this project is estimated to accrue a sales value of Rs 150 crore.

Marico: Revenue growth in Q3FY22 was in double digits, while volumes were flat, owing to the weaker consumption sentiment and a strong base. The International business delivered high-teen constant currency growth on a healthy base. All markets fared positively, led by Bangladesh and a smart recovery in Vietnam.

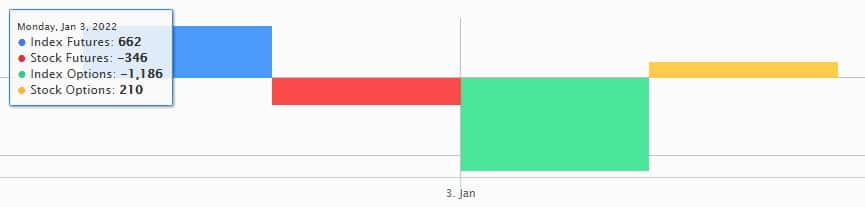

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 902.64 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 803.11 crore in the Indian equity market on January 3, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are at the beginning of the January series, there is not a single stock under the F&O ban for January 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!