The market recouped previous day's losses on December 27 as the Nifty50 hit 17,100-mark intraday before closing with half a percent gains . The broader markets also gained some strength with the Nifty Midcap 100 and Smallcap 100 indices rising 0.44 percent and 0.2 percent, respectively.

The BSE Sensex jumped 296 points to 57,420, while the Nifty50 recovered 253 points from day's low and settled with 82.50 points gains at 17,086, forming bullish candle on the daily charts. Earlier, the benchmark indices had seen a gap down opening.

"Looking at price action we believe that the index is witnessing some buying pressure near the 16,800 mark, thereby indicating that this level might act as demand zone in the sessions to come," says Karan Pai, Technical Analyst at GEPL Capital.

On the upside, the 17,200-17,300 zone remains the key level to watch, Pai says. "As long as the prices do not breach the 16,800 or the 17,300 mark we can expect the prices to remain in a range and move between the above mentioned levels."

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,908.9, followed by 16,731.6. If the index moves up, the key resistance levels to watch out for are 17,187.8 and 17,289.4.

Nifty Bank

The Nifty Bank gained 200.80 points to close at 35,057.90 on December 27. The important pivot level, which will act as crucial support for the index, is placed at 34,479.37, followed by 33,900.84. On the upside, key resistance levels are placed at 35,390.07 and 35,722.23 levels.

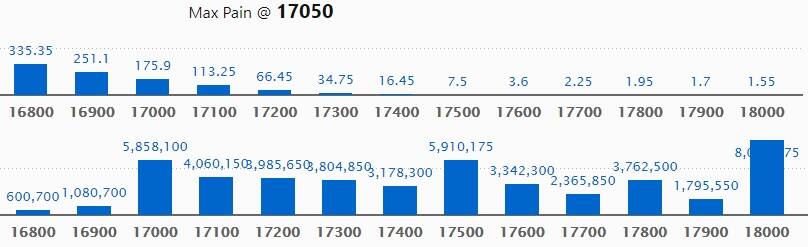

Call option data

Maximum Call open interest of 80.12 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17,500 strike, which holds 59.10 lakh contracts, and 17,000 strike, which has accumulated 58.58 lakh contracts.

Call writing was seen at 17,000 strike, which added 19.14 lakh contracts, followed by 18,000 strike which added 7.36 lakh contracts, and 17,600 strike which added 6.67 lakh contracts.

Call unwinding was seen at 17,900 strike, which shed 16.99 lakh contracts, followed by 17,200 strike which shed 13.05 lakh contracts and 17,300 strike which shed 1.04 lakh contracts.

Put option data

Maximum Put open interest of 92.78 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the December series.

This is followed by 16,500 strike, which holds 62.09 lakh contracts, and 16,000 strike, which has accumulated 60.90 lakh contracts.

Put writing was seen at 17,000 strike, which added 37.48 lakh contracts, followed by 16,900 strike which added 17.99 lakh contracts and 16,000 strike which added 22.19 lakh contracts.

Put unwinding was seen at 17,200 strike, which shed 71,050 contracts, followed by 17,500 strike which shed 57,450 contracts and 17,300 strike which shed 19,150 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

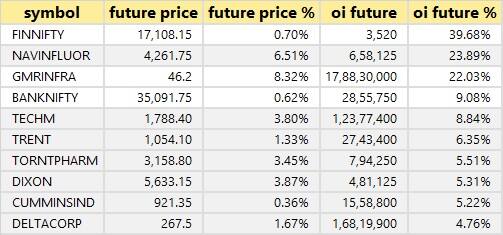

54 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

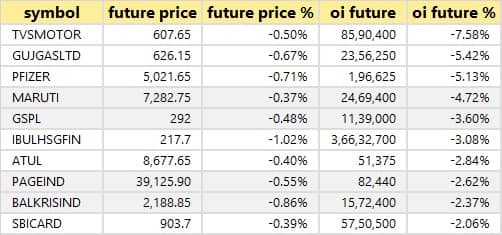

23 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

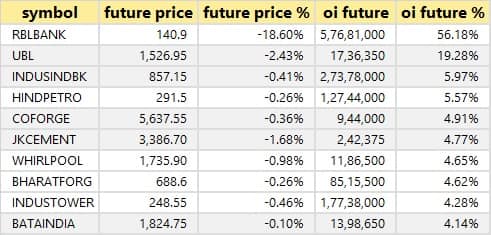

35 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen. RBL Bank witnessed the maximum short build-up, followed by UBL and IndusInd Bank.

77 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

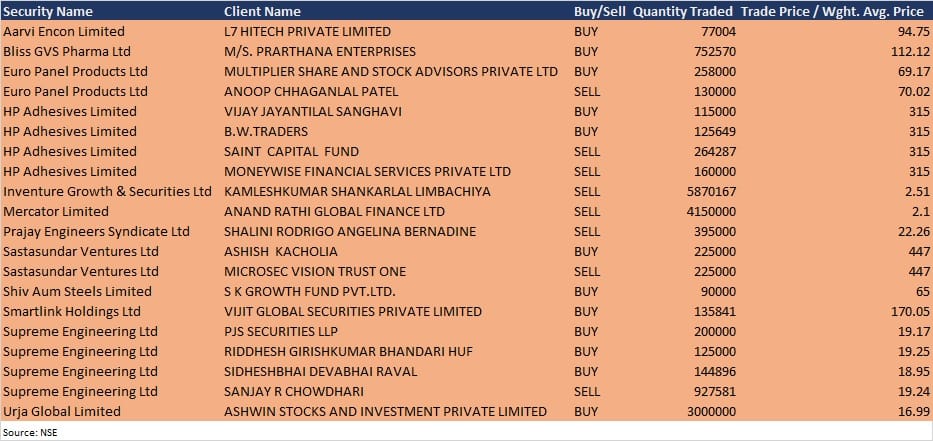

Bulk deals

Sastasundar Ventures: Ace investor Ashish Kacholia acquired 2.25 lakh equity shares in the company at Rs 447 per share. However, Microsec Vision Trust One sold 2.25 lakh shares at same price on the NSE, the bulk deal data showed.

Bliss GVS Pharma: Prarthana Enterprises bought 7,52,570 equity shares in the company at Rs 112.12 per share on the NSE, the bulk deal data showed.

HP Adhesives: Foreign investor Saint Capital Fund exited the company, selling 2,64,287 equity shares at Rs 315 per share and investor Moneywise Financial Services sold 1.6 lakh shares at same price; however, Vijay Jayantilal Sanghavi acquired 1.15 lakh shares in the company at Rs 315 per share and BW Traders bought 1,25,649 shares at Rs 315 per share on the NSE, the bulk deal data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Gokaldas Exports: The company's officials will meet Girik Capital on December 28.

PSP Projects: The company's officials will meet Monarch AIF on December 28.

Tata Cosumer Products: The company's officials will meet Nirmal Bang Institutional Equities on December 28.

Mahindra Holidays & Resorts India: The company's officials will meet Dolat Capital on December 28.

Kirloskar Industries: The company's officials will meet Anmol Sekhri Consultants, and Ventura Securities on December 28.

Balrampur Chini Mills: The company's officials will meet Kotak MF on December 28.

IRIS Business Services: The company's officials will meet Seven Canyons Advisors on December 28.

IIFL Finance: The company's officials will meet Centrum PMS on December 29.

Themis Medicare: The company's officials will meet Bellwether Capital on December 30.

Gujarat Themis Biosyn: The company's officials will meet ASK Investments on December 30.

Stocks in News

Supriya Lifescience: The company will make its debut on the bourses on December 28. The final issue price is fixed at Rs 274 per share.

Gokaldas Exports: ICRA has upgraded the long-term rating for the captioned Line of Credit (LOC) of company to A- (positive) from BBB (stable). The outlook has been revised to Positive from Stable. Similarly, the rating agency has upgraded the short-term rating for the captioned LOC to A2+ from A3+.

Shyam Metalics and Energy: The company announced 20% increase in sponge iron manufacturing capacity, boosting from 1.39 MTPA to 1.67 million tonnes per annum.

Maharashtra Seamless: The company has successfully bagged Rs 150.70 crore orders from PSU companies for supply of ERW and seamless pipes.

GR Infraprojects: The Provisional Completion certificate has been issued by the Independent Engineer for "development of Purvanchal Expressway (Package-VII) from Mojrapur to Bijaura (Ghazipur) in Uttar Pradesh on EPC basis, and has declared the project fit for entry into commercial operation.

Siemens: A joint venture between TRIL Urban Transport, a Tata Group company, and Siemens Project Ventures GmbH, a subsidiary of Siemens Financial Services, under public private partnership route (PPP) will develop the metro corridor from Hinjewadi to Shivajinagar, Pune. The joint venture has formed a special purpose company called Pune IT City Metro Rail Limited.

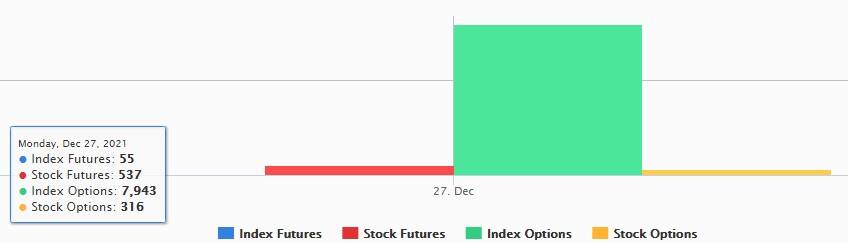

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,038.25 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 955.79 crore in the Indian equity market on December 27, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks - Escorts, Indiabulls Housing Finance, Vodafone Idea, and RBL Bank - are under the F&O ban for December 28. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!