The market started off the week on a negative note as the benchmark indices corrected nearly a percent on December 13, ahead of meetings of central banks, including Federal Reserve and European Central Bank during the week.

The BSE Sensex fell 503.25 points or 0.86 percent to 58,283.42, while the Nifty50 declined 143 points or 0.82 percent to 17,368.30 and formed bearish engulfing pattern on the daily charts.

"The index started on a very positive note after a very positive hint from the global markets. However, the positivity was short lived, and the index faced rejection near the 17,600 mark and moved lower and ended the session with a bearish engulfing pattern," says Karan Pai, Technical Analyst at GEPL Capital.

Going ahead, he says they expect the 17,250 (100-Day SMA and Gap Area) to act as a strong support level. "We believe any dip towards the 17,300-17,320 might be a good buying opportunity with a strict stop loss of 17,250 on hourly closing basis."

According to him, if the index manages to breach below the 17,250 level, they might see the prices fill up a previous gap area and move lower towards 17,000-16,900.

The broader markets also corrected but saw less pressure in comparison with benchmarks. The Nifty Midcap 100 and Smallcap 100 indices declined 0.25 percent and 0.11 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,269.57, followed by 17,170.93. If the index moves up, the key resistance levels to watch out for are 17,553.17 and 17,738.13.

Nifty Bank

The Nifty Bank fell 180.40 points to 36,925.30 on December 13. The important pivot level, which will act as crucial support for the index, is placed at 36,664.37, followed by 36,403.53. On the upside, key resistance levels are placed at 37,383.57 and 37,841.94 levels.

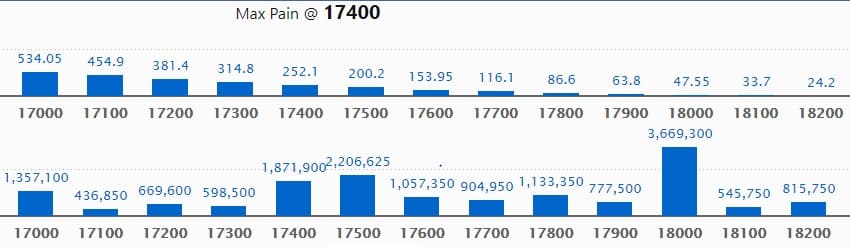

Call option data

Maximum Call open interest of 36.69 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17500 strike, which holds 22.06 lakh contracts, and 17400 strike, which has accumulated 18.71 lakh contracts.

Call writing was seen at 17400 strike, which added 5.26 lakh contracts, followed by 18000 strike which added 3.74 lakh contracts, and 17700 strike which added 1.72 lakh contracts.

Call unwinding was seen at 17500 strike, which shed 1.44 lakh contracts, followed by 17200 strike which shed 1.09 lakh contracts and 16500 strike which shed 56,425 contracts.

Put option data

Maximum Put open interest of 50.40 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the December series.

This is followed by 16000 strike, which holds 28.81 lakh contracts, and 16500 strike, which has accumulated 28 lakh contracts.

Put writing was seen at 17400 strike, which added 4.65 lakh contracts, followed by 17600 strike which added 97,700 contracts and 17300 strike which added 95,850 contracts.

Put unwinding was seen at 17200 strike, which shed 54,250 contracts, followed by 16500 strike which shed 12,500 contracts and 18000 strike which shed 6,000 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

24 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

60 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

74 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

33 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

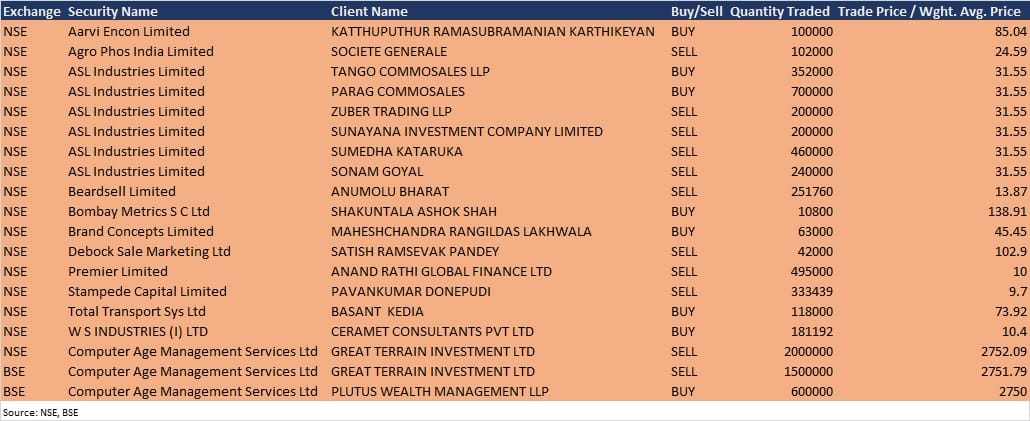

Bulk deals

Agro Phos India: Societe Generale sold 1.02 lakh equity shares in the company at Rs 24.59 per share on the NSE, the bulk deals data showed.

Beardsell: Promoter Anumolu Bharat sold 2,51,760 equity shares in the company at Rs 13.87 per share on the NSE, the bulk deals data showed.

Computer Age Management Services: Great Terrain Investment sold 20 lakh equity shares in the company at Rs 2,752.09 on the NSE, and 15 lakh shares at Rs 2,751.79 on the BSE, however, Plutus Wealth Management LLP acquired 6 lakh shares at Rs 2,750 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Voltas: The company's officials will meet Credit Suisse & Morgan Stanley on December 14, and Nomura and B&K Securities on December 15.

Jubilant Ingrevia: The company's officials will meet several investors on December 14.

Computer Age Management Services: The company's officials will meet Kayne Anderson Rudnick, on December 14 and White Oak Capital on December 15.

MTAR Technologies: The company's officials will interact with institutional investors on December 14.

Polycab India: The company's officials will participate in JP Morgan India Emerging Opportunities Forum 2021 on December 14, and Systematix Virtual Conference on December 15.

UltraTech Cement: The company's officials will meet GIC, Singapore, and Vontobel Asset Management on December 14.

Indian Energy Exchange: The company's officials will meet Myriad Asset Management on December 14, Millingtonia on December 16, Fidelity Investments on December 17, and Axiom Investors on December 21.

Sirca Paints India: The company's officials will meet Sarath Capital Management LLP on December 14.

Symphony: The company's officials will meet Goldman Sachs on December 17.

Stocks in News

Anand Rathi Wealth: The company will make its debut on the bourses on December 14. The price band for the offer has been fixed at Rs 550 per share.

PB Fintech: The company approved incorporation of the wholly owned subsidiary to carry on the business of an Account Aggregator (AA). The AA has to be licenced by the Reserve Bank of India (RBI).

SecureKloud Technologies: Healthcare Triangle Inc., USA, a step-down subsidiary of SecureKloud Technologies, has acquired DevCool Inc., USA, an electronic health record (EHR) focused healthcare IT and managed services company.

Shah Alloys: Income Tax Department carried out search operation at various locations of the company during the period from December 8 till December 11, 2021.

Greenlam Industries: The company announced prominent plans for a fast-tracked expansion, and investment of Rs 950 crore over a period of 2-3 years, towards setting up of third laminate plant and foray into plywood and particle board business.

Vedanta: The company has taken steps to settle all disputes related to imposition of retrospective tax and accordingly has withdrawn cases in the Delhi High Court as well as before an international arbitration tribunal retrospective tax dispute with the government.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,743.44 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,351.03 crore in the Indian equity market on December 13, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Escorts, Indiabulls Housing Finance and Vodafone Idea - are under the F&O ban for December 14. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!