The market has taken a breather after recent sharp fall and managed to close with moderate gains amid volatility on November 29, supported by buying in technology, Bajaj Finance, Kotak Mahindra Bank, HDFC Bank and Reliance Industries.

The BSE Sensex climbed 153.43 points to 57,260.58, while the Nifty50 was up 27.50 points at 17,054 and formed a Long Legged-Doji kind of pattern on the daily charts.

"The daily price action has formed a Long Legged-Doji representing extreme volatility on either side. Any sustainable move above 17,100 levels may cause upside momentum towards 17,200-17,300 levels," says Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

However, on the flip side, if the Nifty breaks below 17,000-16,900 levels, then it may continue its down move towards 16,800-16,700 in the near term, he says, adding the Nifty is trading below 20 and 50-day and 100-day SMA representing short-term bearish bias.

One should use any pullback towards 17,250-17,300 levels as a selling opportunity with a stop loss of 17,400, Palviya said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,837.3, followed by 16,620.7. If the index moves up, the key resistance levels to watch out for are 17,215.6 and 17,377.3.

Nifty Bank

The Nifty Bank fell 49.05 points to 35,976.45 on November 29. The important pivot level, which will act as crucial support for the index, is placed at 35,420.23, followed by 34,864.07. On the upside, key resistance levels are placed at 36,440.23 and 36,904.07 levels.

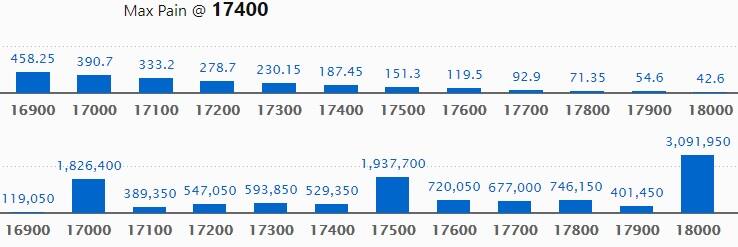

Call option data

Maximum Call open interest of 30.91 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17500 strike, which holds 19.37 lakh contracts, and 17000 strike, which has accumulated 18.26 lakh contracts.

Call writing was seen at 17000 strike, which added 3.89 lakh contracts, followed by 18000 strike which added 3.71 lakh contracts, and 16500 strike which added 91,650 contracts.

Call unwinding was seen at 17300 strike, which shed 31,050 contracts, followed by 17400 strike which shed 17,600 contracts.

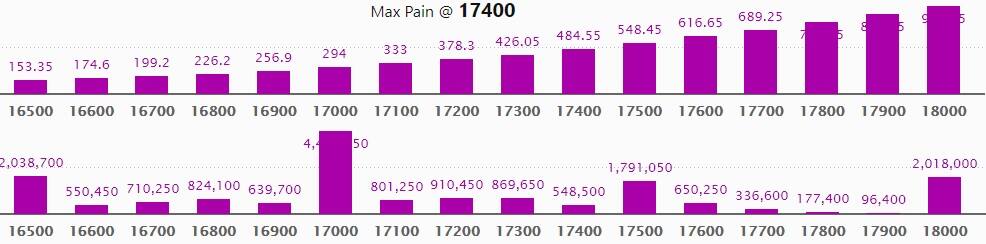

Put option data

Maximum Put open interest of 44.11 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the December series.

This is followed by 16500 strike, which holds 20.38 lakh contracts, and 18000 strike, which has accumulated 20.18 lakh contracts.

Put writing was seen at 17000 strike, which added 4.71 lakh contracts, followed by 16400 strike which added 1.07 lakh contracts and 16300 strike which added 74,050 contracts.

Put unwinding was seen at 16500 strike, which shed 2.16 lakh contracts, followed by 17500 strike which shed 1.85 lakh contracts, and 17600 strike which shed 1.5 lakh contracts.

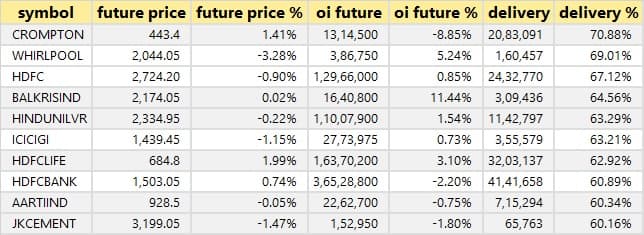

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

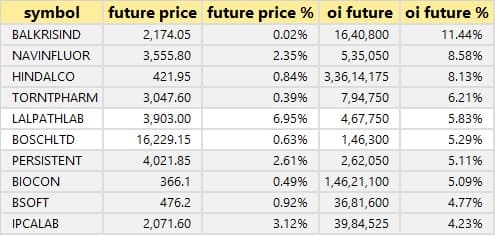

30 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

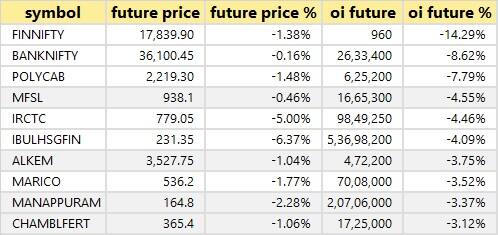

55 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

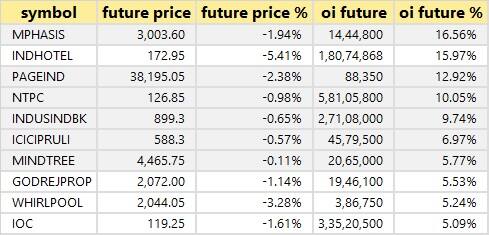

85 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

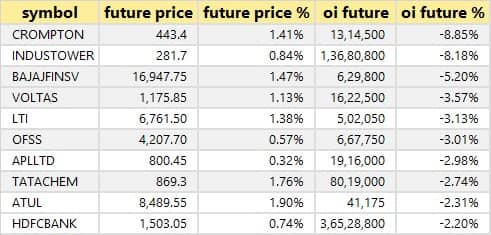

21 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

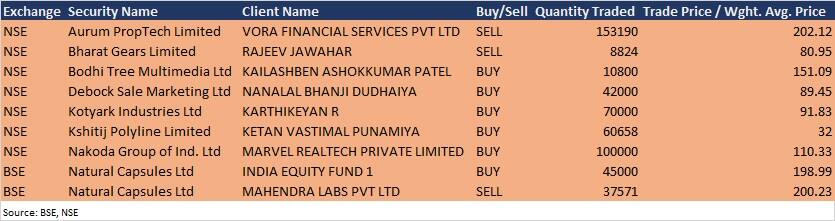

Bulk deals

(For more bulk deals, click here)

Analysts/Investors Meeting

Shoppers Stop: The company's officials will meet DSP Black Rock Mutual Fund on November 30.

Apollo Tyres: The company's officials will meet investors on November 30.

Allcargo Logistics: The company's officials will meet Centrum PMS on November 30.

UltraTech Cement: The company's officials will meet Amundi Asset Management on November 30.

Nuvoco Vistas Corporation: The company's officials will meet Fidelity International on November 30.

Tata Consumer Products: The company's officials will meet Stewart Investors on November 30, and Phillip Capital (India) on December 2.

Brigade Enterprises: The company's officials will meet Emkay Global on December 1.

Sterlite Technologies: The company's officials will meet Alliance Bernstein LP, Petercam SA, and Legal and General Group on December 1.

Voltas: The company's officials will meet ICICI Securities on December 1, Enam Asset Management Company on December 6, and Dam Capital on December 10.

Torrent Pharma: The company's officials will attend Ambit India Healthcare Conclave on December 3.

Stocks in News

Go Fashion India: The company will make a debut on the BSE and the NSE on November 30. The issue price has been fixed at Rs 690 per share.

Tatva Chintan Pharma Chem: As a part of future need, the company has acquired an industrial land admeasuring 50,399.16 square metre at Dahej-III GIDC Estate, Gujarat.

Sayaji Hotels: Subsidiary Sayaji Hotels Management (SHML) has signed and entered into 8 management agreements/franchise agreements/ term sheets for the expansion of SHML by having new properties in Madhya Pradesh, Maharashtra, and Gujarat.

KSS: The company approved the divestment of its entire equity shareholding in material wholly owned subsidiary K Sera Sera Box Office Private Limited by way of sale to Birla Financial Distribution Limited (purchaser).

Ratnamani Metals & Tubes: The company has received new domestic orders aggregating to Rs 297.87 crore from the oil and gas sector, to be executed between February 2022 and January 2023.

James Warren Tea: The company approved a proposal to buy back shares worth Rs 24.86 crore at a price of Rs 295 per share.

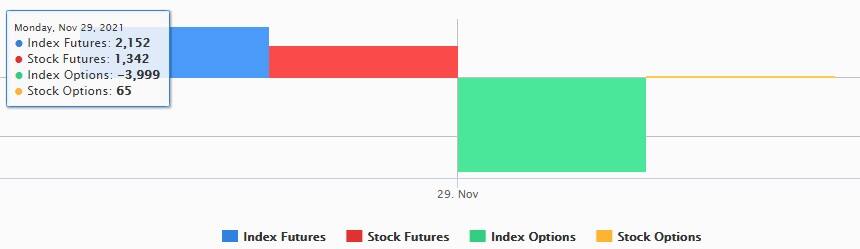

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 3,332.21 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 4,611.41 crore in the Indian equity market on November 29, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Indiabulls Housing Finance - is under the F&O ban for November 30. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!