The market extended previous day's gains in the morning and rallied over 100 points on the Nifty50, but erased all those gains in afternoon to close flat on November 15. FMCG, IT and Pharma stocks supported the market, however, there was selling in Metal, and select banking & financials stocks.

The BSE Sensex rose 32.02 points to 60,718.71, while the Nifty50 was up 6.70 points at 18,109.50 and formed a bearish candle on the daily charts as the closing was lower than opening levels.

"On daily charts, Nifty has formed a small bearish candle, which indicates temporary weakness. However, at the same time, the index has been consistently taking support near the 20-day SMA (simple moving average - 18,068). Also, the index has maintained a higher bottom formation which is broadly positive," says Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

"We are of the view that the 20-day SMA would act as a trend decider level for the bulls, and above the same, the uptrend formation could continue up to 18,200-18,275 levels. On the other hand, the dismissal of 18,040 or 20-day SMA could possibly open another correction wave till 18,000-17,925," he adds.

There was a mixed trend in broader markets. The Nifty Midcap 100 index was up 0.32 percent and the Smallcap 100 index fell 0.25 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 18,050.4, followed by 17,991.4. If the index moves up, the key resistance levels to watch out for are 18,189.3 and 18,269.2.

Nifty Bank

The Nifty Bank fell 31.05 points to close at Rs 38,702.30 on November 15. The important pivot level, which will act as crucial support for the index, is placed at 38,500.3, followed by 38,298.2. On the upside, key resistance levels are placed at 39,010.8 and 39,319.2 levels.

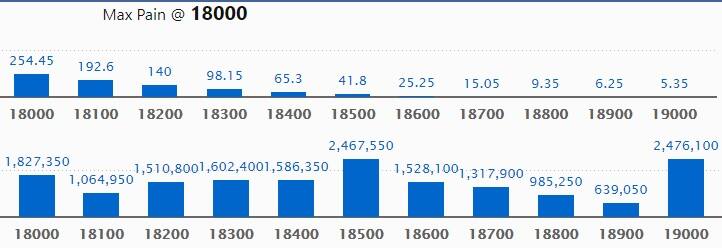

Call option data

Maximum Call open interest of 24.76 lakh contracts was seen at 19,000 strike, which will act as a crucial resistance level in the November series.

This is followed by 18,500 strike, which holds 24.67 lakh contracts, and 18,000 strike, which has accumulated 18.27 lakh contracts.

Call writing was seen at 18,300 strike, which added 3.07 lakh contracts, followed by 18,200 strike, which added 2.89 lakh contracts and 18,400 strike which added 2.41 lakh contracts.

Call unwinding was seen at 18,000 strike, which shed 8.13 lakh contracts, followed by 17,900 strike which shed 1.1 lakh contracts and 17,800 strike which shed 54,650 contracts.

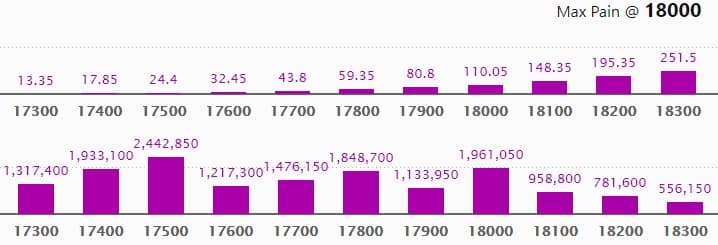

Put option data

Maximum Put open interest of 24.42 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the November series.

This is followed by 18,000 strike, which holds 19.61 lakh contracts, and 17,400 strike, which has accumulated 19.33 lakh contracts.

Put writing was seen at 18,100 strike, which added 4.05 lakh contracts, followed by 18,200 strike which added 1.4 lakh contracts and 17,800 strike which added 90,100 contracts.

Put unwinding was seen at 18,000 strike, which shed 3.78 lakh contracts, followed by 17,500 strike which shed 1 lakh contracts, and 17,700 strike which shed 96,900 contracts.

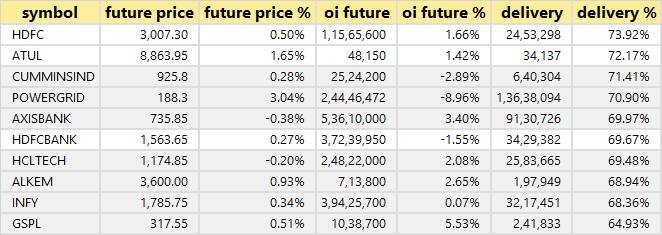

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

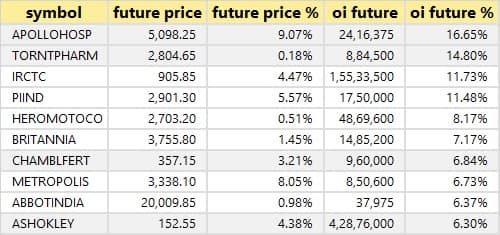

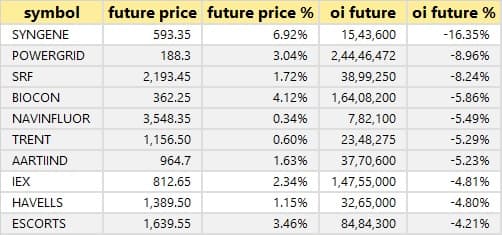

54 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

38 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 10 stocks in which long unwinding was seen.

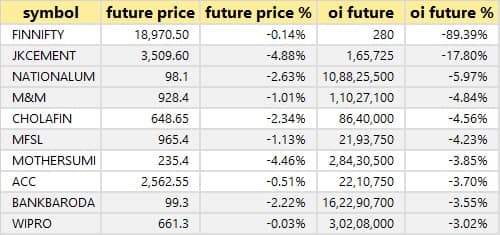

52 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

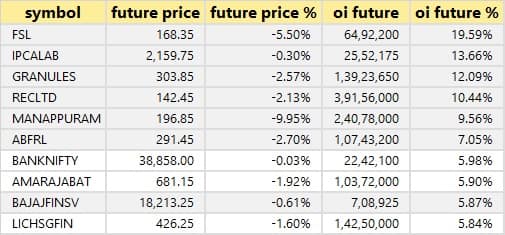

46 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

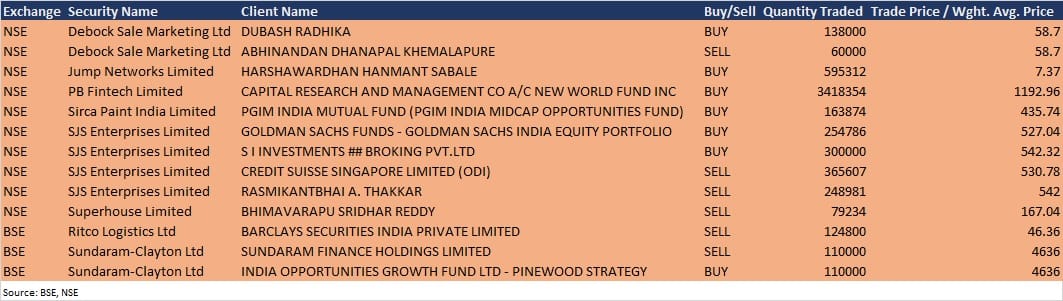

Bulk deals

Jump Networks: Harshawardhan Hanmant Sabale bought 5,95,312 equity shares in the company at Rs 7.37 per share on the NSE, the bulk deal data showed.

PB Fintech: Capital Research and Management Co A/C New World Fund Inc bought 34,18,354 equity shares in the company at Rs 1,192.96 per share on the NSE, the bulk deal data showed.

Sirca Paint India: PGIM India Mutual Fund (PGIM India Midcap Opportunities Fund) bought 1,63,874 equity shares in the company at Rs 435.74 per share on the NSE, the bulk deal data showed.

SJS Enterprises: Goldman Sachs Funds - Goldman Sachs India Equity Portfolio acquired 2,54,786 equity shares in the company at Rs 527.04 per share and SI Investments ## Broking Pvt Ltd purchased 3 lakh shares in the company at Rs 542.32 per share; however, CREDIT Suisse Singapore Limited (ODI) sold 3,65,607 equity shares in the company at Rs 530.78 per share, and Rasmikantbhai A Thakkar offloaded 2,48,981 equity shares in the company at Rs 542 per share on the NSE, the bulk deal data showed.

Ritco Logistics: Barclays Securities India sold 1,24,800 equity shares in the company at Rs 46.36 per share on the BSE, the bulk deal data showed.

Sundaram-Clayton: Sundaram Finance Holdings sold 1.1 lakh equity shares in the company at Rs 4,636, however, India Opportunities Growth Fund - Pinewood Strategy was the buyer for those shares at same price on the BSE, the bulk deal data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Eicher Motors: The company's officials will participate in UBS India Virtual Conference 2021 on November 16, Morgan Stanley Asia Pacific Summit & Centrum Annual Investor Conference on November 17, and CLSA India Forum 2021 & B&K Securities Investor Conference on November 18.

Vodafone Idea: The company's officials will meet institutional investors in 'CITIC CLSA India Forum 2021' on November 16.

Trident: The company's officials will participate in B&K Securities Investor Conference on November 16.

NIIT: The company's officials will meet investors at 'B&K Securities: Periscope 2021' on November 16.

Triveni Turbine: The company's officials will attend Nirmal Bang Investor Meet on November 16, and Centrum Broking Annual Investor Conclave on November 17.

Tata Consumer Products: The company's officials will attend Centrum Annual Investor Conclave, & B&K Securities - Periscope Conference on November 16.

Kotak Mahindra Bank: The company's officials will meet investors at KIE BFSI Forum 2021 on November 16 and November 17.

Manappuram Finance: The company's officials will attend Nirmal Bang Conference on November 16, CLSA Conference on November 17, and B&K Securities Conference on November 18.

Lemon Tree Hotels: The company's officials will participate in 24th Annual CITIC CLSA India Forum 2021 on November 17.

Vaibhav Global: The company's officials will meet Centrum Broking on November 18.

Stocks in News

MSP Steel & Power: The company reported higher consolidated profit at Rs 9.36 crore in Q2FY22 against Rs 6.54 crore in Q2FY21, revenue increased to Rs 571.74 crore from Rs 445.74 crore YoY.

Capri Global Capital: Raj Kumar Ahuja resigned as Group Chief Financial Officer of the company.

Foods & Inns: The company has obtained approval from National Stock Exchange of India for listing of its equity shares on NSE's trading platform.

Graphite India: ICRA reaffirmed the long term rating at AA+ and short term rating at A1+ for Rs 1,000 crore bank working capital facilities of the company. The outlook on the long-term rating is revised to Stable from Negative. ICRA assigned short-term rating at A1+ for Rs 300 crore commercial paper programme of the company.

Phoenix Mills: Canada Pension Plan Investment Board through its entity CPP Investment Board Private Holdings (4) Inc to invest up to Rs 1,350 crore in multiple tranches in company's subsidiary Plutocrat Commercial Real Estate (PCREPL) against 49 percent stake.

Escorts: The company will increase the prices of its tractors effective November 21, and consider raising funds via debentures/QIP/rights issue on November 18.

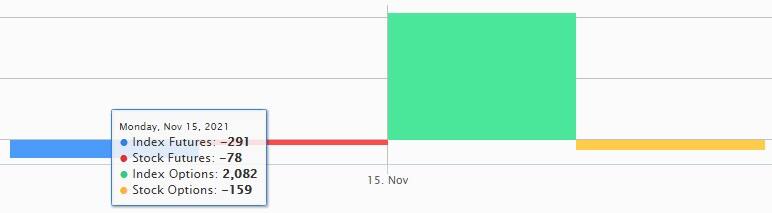

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 424.74 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,524.67 crore in the Indian equity market on November 15, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Nine stocks - Bank of Baroda, BHEL, Escorts, Indiabulls Housing Finance, IRCTC, NALCO, Punjab National Bank, SAIL and Sun TV Network - are under the F&O ban for November 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!