The market extended gains for the third consecutive session with the Nifty50 hitting the 18,000 mark for the first time on October 11, driven by banking & financials, auto, FMCG, and select pharma stocks. The broader markets also continued to run along with frontliners, as the Nifty Midcap 100 index was up 0.61 percent and Smallcap 100 index gained 1.16 percent.

The BSE Sensex climbed 76.72 points to 60,135.78, while the Nifty50 rose 50.80 points to 17,946 and formed a bullish candle on the daily charts as the closing was higher than opening levels.

"The daily price action has formed a small bullish candlestick pattern, registering a new high at 18,041, indicating positive bias. The subsequent higher levels to watch are around 18,050 levels. Any sustainable move above 18,050 levels may cause momentum towards 18,100-18,200 levels," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

He further said that on the downside, any violation of an intraday support zone of 17,850 levels may cause profit booking towards 17,700-17,600 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,842.7, followed by 17,739.5. If the index moves up, the key resistance levels to watch out for are 18,045.5 and 18,145.1.

Nifty Bank

The Nifty Bank outperformed frontliners, rising 518.50 points or 1.37 percent to 38,293.80 on October 11. The important pivot level, which will act as crucial support for the index, is placed at 37,860.5, followed by 37,427.2. On the upside, key resistance levels are placed at 38,611.2 and 38,928.6 levels.

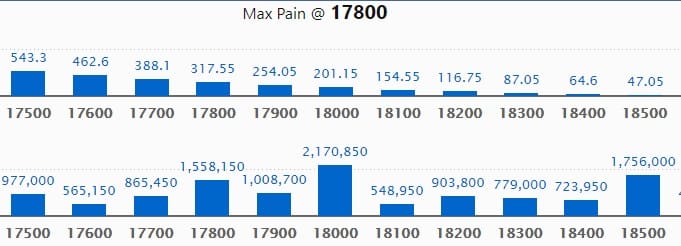

Call option data

Maximum Call open interest of 21.70 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the October series.

This is followed by 18500 strike, which holds 17.56 lakh contracts, and 17800 strike, which has accumulated 15.58 lakh contracts.

Call writing was seen at 18000 strike, which added 2.21 lakh contracts, followed by 18500 strike, which added 1.72 lakh contracts and 18400 strike which added 1.51 lakh contracts.

Call unwinding was seen at 17900 strike, which shed 1.44 lakh contracts, followed by 17500 strike, which shed 79,400 contracts, and 17800 strike which shed 78,400 contracts.

Put option data

Maximum Put open interest of 31.84 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the October series.

This is followed by 17500 strike, which holds 30.90 lakh contracts, and 17800 strike, which has accumulated 21.31 lakh contracts.

Put writing was seen at 18000 strike, which added 3.28 lakh contracts, followed by 17800 strike which added 2.18 lakh contracts and 17500 strike which added 99,100 contracts.

Put unwinding was seen at 17000 strike, which shed 1.61 lakh contracts, followed by 17100 strike which shed 1.34 lakh contracts, and 17600 strike which shed 28,500 contracts.

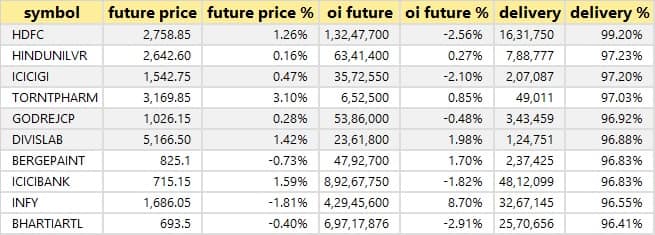

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

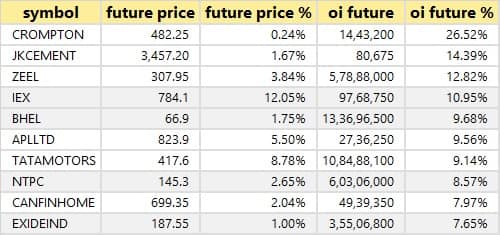

55 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

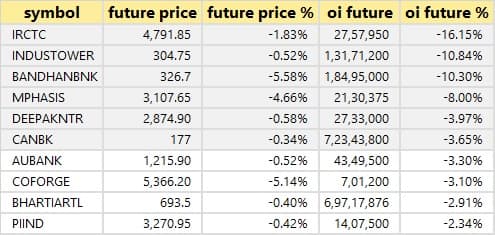

20 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

34 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen.

74 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

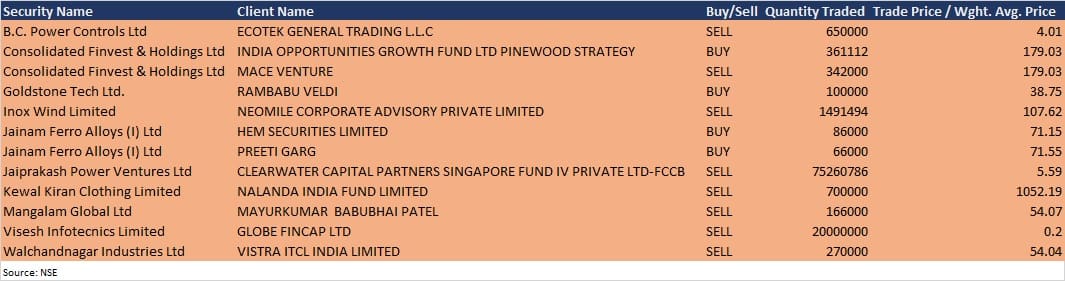

Bulk deals

Inox Wind: Neomile Corporate Advisory sold 14,91,494 equity shares in the company at Rs 107.62 per share on the NSE, the bulk deals data showed.

Jainam Ferro Alloys: Hem Securities acquired 86,000 equity shares and Preeti Garg bought 66,000 equity shares in the company at Rs 71.55 per share on the NSE, the bulk deals data showed.

Jaiprakash Power Ventures: Clearwater Capital Partners Singapore Fund IV Private LTD-FCCB sold 7,52,60,786 equity shares in the company at Rs 5.59 per share on the NSE, the bulk deals data showed.

Kewal Kiran Clothing: Nalanda India Fund sold 7 lakh shares in the company at Rs 1,052.19 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting & Results Calendar

Results on October 12: Bhansali Engineering Polymers, GM Breweries, Indbank Merchant Banking Services, Ind Bank Housing, JTL Infra, and DRC Systems India will announce their quarterly earnings on October 12.

Tata Metaliks: The company's officials will meet Monarch Networth Capital on October 12.

Fine Organic Industries: The company's officials will meet investors and analysts on October 12.

GTPL Hathway: The company's officials will meet investors and analysts on October 18 to discuss the unaudited financial results.

Mahindra Lifespace Developers: The company's officials will meet analysts and investors in earnings conference call on October 27.

Affordable Robotic & Automation: The company's officials will meet investors/analysts on October 30.

Stocks in News

Delta Corp: The company posted consolidated loss at Rs 22.57 crore in Q2FY22 against loss of Rs 54.91 crore in Q2FY21, revenue jumped to Rs 74.72 crore from Rs 38.37 crore YoY.

HFCL: The company reported higher consolidated profit at Rs 85.94 crore in Q2FY22 against Rs 53.32 crore in Q2FY21, revenue rose to Rs 1,122.05 crore from Rs 1,054.32 crore YoY.

Bharat Dynamics: Life Insurance Corporation of India sold 37.60 lakh equity shares in the company via open market transactions, reducing shareholding to 8.44 percent from 10.49 percent earlier.

PI Industries: The company has executed two joint venture agreements with Polymath Holdings, LLC for undertaking the business of manufacturing and selling the products for biochemistry processes and biochemical-enabled pharmaceutical intermediates.

Schaeffler India: The company on October 28 will consider subdivision of equity shares.

Tata Metaliks: The company reported lower profit at Rs 54.62 crore in Q2FY22 against Rs 82.20 crore in Q2FY21, revenue rose to Rs 644.84 crore from Rs 519.63 crore YoY.

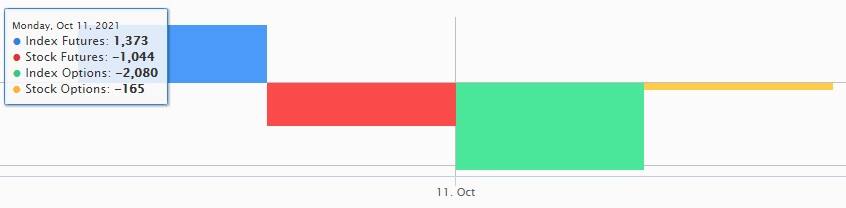

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,303.22 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 373.28 crore in the Indian equity market on October 11, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Nine stocks - Bank of Baroda, BHEL, Canara Bank, Indiabulls Housing Finance, IRCTC, NALCO, Punjab National Bank, SAIL, and Sun TV Network - are under the F&O ban for October 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!