The market opened the week on a negative note on September 20 with the Nifty50 falling over a percent amid weakness in global peers ahead of central bank policy meetings. Nifty Metal fell the most, down 6.6 percent followed by PSU Bank, which corrected 4.2 percent. Bank, Auto, Financial Services, Pharma and Realty indices were down 1.4-2 percent whereas FMCG bucked the trend, rising 0.91 percent.

The BSE Sensex was down 524.96 points to close at 58,490.93, while the Nifty50 fell 188.30 points to 17,396.90 and formed a bearish candle on the daily charts.

"On the daily chart, the index has formed a bearish candle with a long upper shadow, indicating selling pressure as well as resistance at higher levels. The chart pattern suggests that if Nifty crosses and sustains above 17,450 level, it would witness buying which would lead the index towards 17,550-17,650 levels," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

"However, if the index breaks below 17,350 level, it would witness selling which would take the index towards 17,250-17,200. Nifty is trading above its 20-day simple moving average (SMA) which indicates a positive bias in the short term," he added. Nifty continues to remain in an uptrend in the medium and long term, so buying on dips continues to be our preferred strategy, he advised.

The broader markets also corrected sharply with the Nifty Midcap 100 index falling 2.16 percent and Smallcap 100 index down 1.73 percent.

The volatility also surged in the market as the India VIX, which measures the expected volatility in the market, increased by 14.83 percent to 17.49.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,298.2, followed by 17,199.5. If the index moves up, the key resistance levels to watch out for are 17,559.2 and 17,721.5.

Nifty Bank

The Nifty Bank plunged 666.25 points or 1.76 percent to 37,145.70 on September 20. The important pivot level, which will act as crucial support for the index, is placed at 36,875.14, followed by 36,604.57. On the upside, key resistance levels are placed at 37,609.54 and 38,073.37 levels.

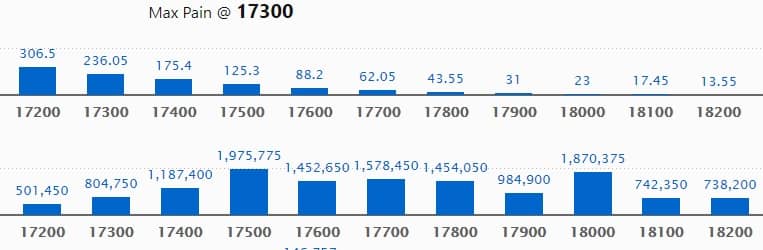

Call option data

Maximum Call open interest of 19.75 lakh contracts was seen at 17,500 strike, which will act as a crucial resistance level in the September series.

This is followed by 18,000 strike, which holds 18.70 lakh contracts, and 17,700 strike, which has accumulated 15.78 lakh contracts.

Call writing was seen at 17,500 strike, which added 5.45 lakh contracts, followed by 17,700 strike, which added 3.05 lakh contracts, and 18,000 strike which added 2.12 lakh contracts.

Call unwinding was seen at 17300 strike, which shed 1.13 lakh contracts, followed by 16600 strike, which shed 75,350 contracts, and 18,100 strike which shed 49,250 contracts.

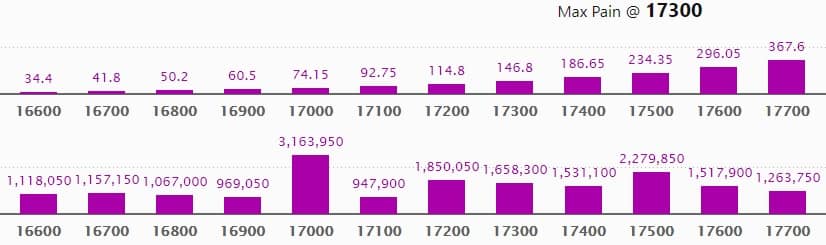

Put option data

Maximum Put open interest of 31.63 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the September series.

This is followed by 17,500 strike, which holds 22.79 lakh contracts, and 17200 strike, which has accumulated 18.5 lakh contracts.

Put writing was seen at 17,200 strike, which added 1.61 lakh contracts, followed by 17,400 strike which added 85,900 contracts, and 17,100 strike which added 17,900 contracts.

Put unwinding was seen at 17,600 strike, which shed 2.56 lakh contracts, followed by 17,700 strike which shed 2.43 lakh contracts, and 17,800 strike which shed 1.69 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

5 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the five stocks in which a long build-up was seen.

108 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

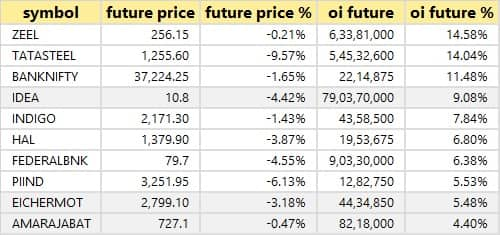

50 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

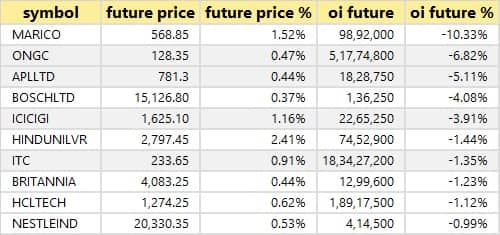

11 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

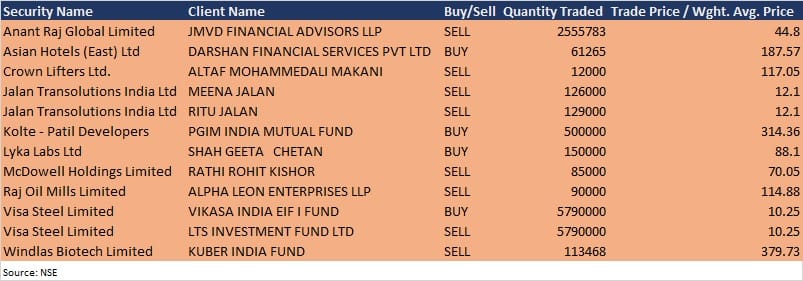

Bulk deals

Anant Raj Global: JMVD Financial Advisors LLP sold 25,55,783 equity shares in the company at Rs 44.8 per share on the NSE, the bulk deals data showed.

Kolte - Patil Developers: PGIM India Mutual Fund bought 5 lakh equity shares in the company at Rs 314.36 per share on the NSE, the bulk deal data showed.

Visa Steel: Vikasa India EIF I Fund acquired 57.9 lakh equity shares in the company at Rs 10.25 per share, whereas LTS Investment Fund was the seller in the deal, selling the same number of shares at the same price on the NSE, the bulk deal data showed.

Windlas Biotech: Kuber India Fund sold 1,13,468 equity shares in the company at Rs 379.73 per share on the NSE, the bulk deal data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Dollar Industries: The company's officials will meet KC Capital on September 21.

Voltas: The company's officials will meet Haitong Securities on September 21.

IOL Chemicals & Pharmaceuticals: The company's officials will meet investors in PhillipCapital “Resurgent India virtual conference” on September 21.

Bajaj Electricals: The company's officials will meet investors in PhillipCapital's “Resurgent India virtual conference” on September 21.

Macrotech Developers: The company's officials will meet investors in JP Morgan - Emerging Markets Credit Conference on September 21, and JP Morgan - India Investor Summit 2021 on September 22.

Max Healthcare Institute: The company's officials will meet investors and analysts on September 21, 22, and 23.

Rail Vikas Nigam: The company's officials will meet HDFC Mutual Fund on September 22.

Advanced Enzyme Technologies: The company's officials will meet Dalton Investments (Los Angeles), and Marvel Capital (Toronto) on September 22; Myriad Asset Management (Hong Kong) on September 28.

Indo Count Industries: The company's officials will meet analysts in Arihant Capital Conference on September 29.

Stocks in News

Kitex Garments: The company has signed the Memorandum of Understanding (MoU) with Telangana State Government for investing Rs 2,406 crore in Telangana.

Websol Energy System: Sumit Kumar Shaw, Chief Financial Officer has tendered resignation.

Universal Autofoundry: The company on October 1 will consider the issue of bonus shares, and migration from BSE SME Segment to the Main Board of BSE.

HCL Technologies: The company announced a five-year, digital transformation deal with MKS Instruments Inc., a global provider of instruments, systems, subsystems, and solutions for advanced manufacturing processes, to improve performance, productivity, and speed to market.

The Mandhana Retail Ventures: Rakesh Jhunjhunwala sold additional 98,094 equity shares in the company on September 17 and September 20, reducing shareholding to 10.32% from 10.77% earlier.

Action Construction Equipment: The company launched its Qualified Institutions Placement for fundraising. The floor price has been fixed at Rs 254.55 per share for the offer.

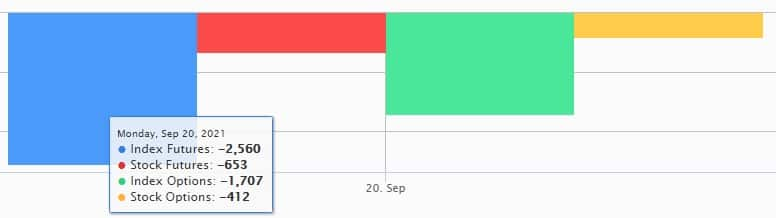

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 92.54 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 1,626.58 crore in the Indian equity market on September 20, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Eight stocks - Exide Industries, Indiabulls Housing Finance, Vodafone Idea, IRCTC, NALCO, Punjab National Bank, SAIL, and Sun TV Network - are under the F&O ban for September 21. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!