The market recouped its early-hour losses amid rangebound trade and closed moderately lower on September 13, the first day of the week after a long weekend. On the other side, the broader market continued its uptrend with the Nifty Midcap 100 index rising 0.45 percent and Smallcap 100 index gaining 0.54 percent.

Selling in private banks and index heavyweight Reliance Industries pulled the market down, but the buying in IT and metals capped the losses. The BSE Sensex declined 127.31 points to close at 58,177.76, while the Nifty50 fell 14 points to 17,355.30 and formed a Doji kind of pattern on the daily charts, indicating indecisiveness among market participants.

"Nifty witnessed selling for the first half of the session. In the latter half, we saw some buying at lower levels. The daily price action has formed a Doji candle indicating indecisiveness amongst market participants," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

He further said on the downside, any violation of an intraday support zone of 17,300 levels may cause profit booking towards 17,250-17,200 levels.

"The next higher levels to be watched are around 17,400 levels. Any sustainable move above 17,400 levels may cause momentum towards 17,500-17,600 levels," he added.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,290.23, followed by 17,225.17. If the index moves up, the key resistance levels to watch out for are 17,399.34 and 17,443.37.

Nifty Bank

The Nifty Bank dropped 211.40 points to close at 36,471.80 on September 13. The important pivot level, which will act as crucial support for the index, is placed at 36,290.97, followed by 36,110.14. On the upside, key resistance levels are placed at 36,688.77 and 36,905.73 levels.

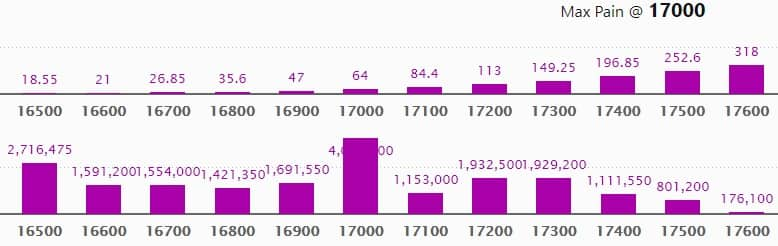

Call option data

Maximum Call open interest of 17.52 lakh contracts was seen at 17,500 strike, which will act as a crucial resistance level in the September series.

This is followed by 17,300 strike, which holds 15.98 lakh contracts, and 17,400 strike, which has accumulated 15.43 lakh contracts.

Call writing was seen at 17,300 strike, which added 1.71 lakh contracts, followed by 17,800 strike, which added 81,650 contracts and 17,900 strike which added 57,650 contracts.

Call unwinding was seen at 17,200 strike, which shed 78,500 contracts, followed by 17,100 strike, which shed 50,600 contracts, and 17,500 strike which shed 46,150 contracts.

Put option data

Maximum Put open interest of 40.43 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the September series.

This is followed by 16,500 strike, which holds 27.16 lakh contracts, and 17,200 strike, which has accumulated 19.32 lakh contracts.

Put writing was seen at 17,300 strike, which added 2.16 lakh contracts, followed by 17,200 strike which added 96,250 contracts, and 17,500 strike which added 41,900 contracts.

Put unwinding was seen at 17,000 strike, which shed 1.98 lakh contracts, followed by 16,800 strike which shed 1.23 lakh contracts and 16,500 strike which shed 88,650 contracts.

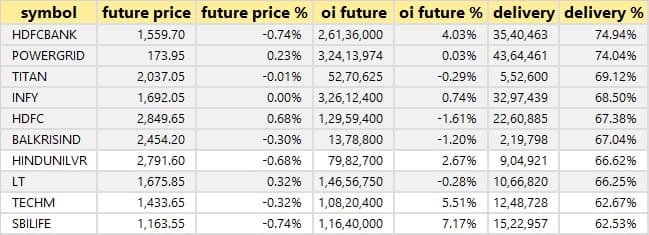

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

60 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

26 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

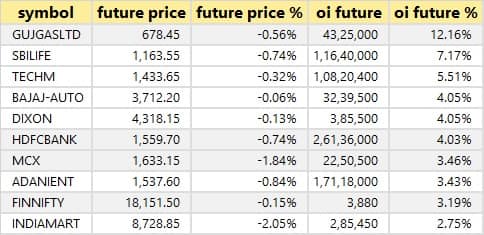

39 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

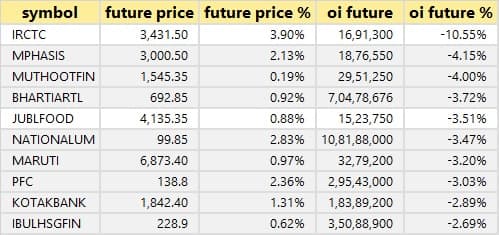

46 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

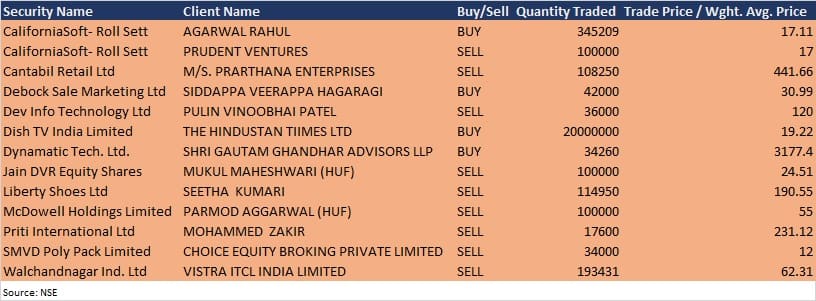

Bulk deals

Dish TV India: The Hindustan Tiimes acquired 2 crore equity shares in the company at Rs 19.22 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Barbeque-Nation Hospitality: The company's officials will meet investors in Motilal Oswal Conference 2021 during September 14-15.

S P Apparels: The company's officials will meet JHP Securities & Equitree Capital Advisors on September 14.

Coromandel International: The company's officials will meet institutional investors and analysts in Non-Deal Roadshow on September 14.

Mahindra Holidays & Resorts: The company's officials will meet Yes Securities on September 14.

Indostar Capital Finance: The company's officials will meet investors in Motilal Oswal Annual Investor Conference on September 14 to discuss the performance for the quarter ended June 2021.

Voltamp Transformers: The company's officials will meet investors in DART India Virtual Conference Series 2021 on September 14.

Capital Trust: The company's officials will meet Dimensional Securities on September 14.

Tata Motors: The company's officials will meet several analysts and institutional investors on September 14 and September 15.

Indo Count Industries: The company's officials will meet investors on September 15.

Symphony: The company's officials will meet Quantum Advisors on September 15.

Stocks in News

Vijaya Diagnostic Centre: The stock will make its debut on the bourses on September 14. The final issue price has been fixed at Rs 531 per share.

Ami Organics: The company will list its equity shares on the BSE and the NSE on September 14. The offer price has been fixed at Rs 610 per equity share.

Redington (India): Step down subsidiary Arena Bilgisayar Sanayi Ve Ticaret A.S. Turkey concluded its binding Share Purchase Agreement to acquire 100 percent shares of Brightstar Telekomünikasyon Dagitim Ltd. Sti, for $35 million.

DCM Shriram: The company has approved the proposal to acquire 17,32,500 equity shares of Rs 10 each of Shriram Axiall (SAPL), from Axiall LLC USA, being entire 50 percent of stake held by Axiall LLC in SAPL. Shriram Axiall is a 50:50 joint venture.

KNR Constructions: The company received a Letter of Acceptance for Hyderabad Growth Corridor (HGCL) - widening of existing service roads from Nanakramguda to TSPA and Narsingi to Kollur and BT Overlay of Bitumen pavement from Gachibowli to Shamshabad of Outer Ring Road, Hyderabad. The contract is worth Rs 312.79 crore and is to be completed within a period of 15 months from the date of signing of the agreement.

Dilip Buildcon: Subsidiary Bangalore Malur Highways has received the letter of the appointed date from the National Highways Authority of India and had declared the appointed w.e.f. September 15.

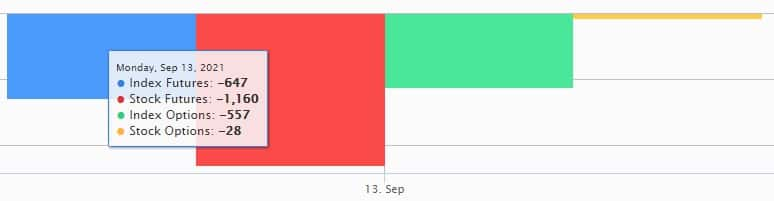

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,419.31 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 559.59 crore in the Indian equity market on September 13, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - Canara Bank, Exide Industries, Indiabulls Housing Finance, LIC Housing Finance and NALCO - are under the F&O ban for September 14. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!