The market traded higher throughout the session and closed near day's high on August 2, driven by auto, IT, select banks, and FMCG stocks. It was a good start to the week after a consolidation seen in previous week.

The BSE Sensex gained 363.79 points to close at 52,950.63, while the Nifty50 rose 122.20 points to 15,885.20 and formed bullish candle which resembles Hanging Man kind of pattern on the daily charts.

"A small positive candle was formed with long lower shadow and gap up opening. This pattern signal an emergence of strength in the market to sustain the higher levels, after choppy movement of last few sessions. This is positive indication and one may expect further upside," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further said, "Bulls seem to have comeback, after a lacklustre type movement of last few sessions. A sustainable move above the initial hurdle of 15,880 levels is expected to pull the Nifty towards the next crucial area of 15,960-16,000 and higher in the short term." Immediate support is placed at 15,830 levels, Shetti added.

The broader markets outpaced frontliners, with the Nifty Midcap 100 index rising 1.56 percent and Smallcap 100 index up 0.91 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,848.97, followed by 15,812.73. If the index moves up, the key resistance levels to watch out for are 15,907.17 and 15,929.13.

Nifty Bank

The Nifty Bank climbed 125.70 points to 34,710 on August 2. The important pivot level, which will act as crucial support for the index, is placed at 34,578.2, followed by 34,446.4. On the upside, key resistance levels are placed at 34,851.8 and 34,993.6 levels.

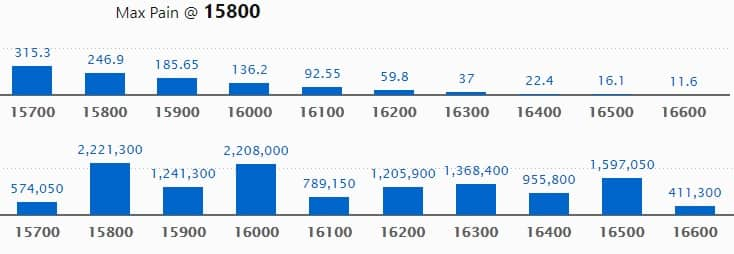

Call option data

Maximum Call open interest of 22.21 lakh contracts was seen at 15,800 strike, which will act as a crucial resistance level in the August series.

This is followed by 16,000 strike, which holds 22.08 lakh contracts, and 16,500 strike, which has accumulated 15.97 lakh contracts.

Call writing was seen at 15,900 strike, which added 3.3 lakh contracts, followed by 16,000 strike, which added 2.25 lakh contracts and 16,200 strike which added 1.86 lakh contracts.

Call unwinding was seen at 15,700 strike, which shed 93,700 contracts, followed by 15,600 strike which shed 49,150 contracts, and 16,500 strike which shed 27,950 contracts.

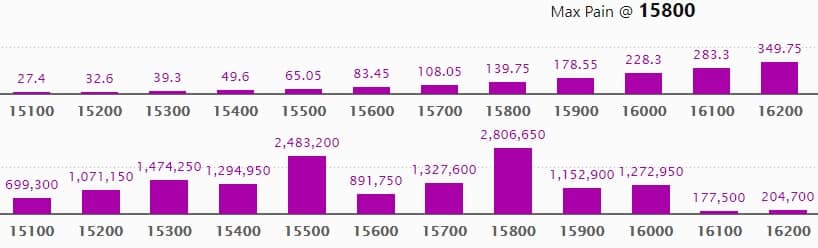

Put option data

Maximum Put open interest of 28.06 lakh contracts was seen at 15,800 strike, which will act as a crucial support level in the August series.

This is followed by 15,500 strike, which holds 24.83 lakh contracts, and 15,300 strike, which has accumulated 14.74 lakh contracts.

Put writing was seen at 15,900 strike, which added 5.89 lakh contracts, followed by 15,400 strike which added 4.35 lakh contracts, and 15,300 strike which added 3.86 lakh contracts.

Put unwinding was seen at 15,600 strike, which shed 1 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

76 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

6 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 6 stocks in which long unwinding was seen.

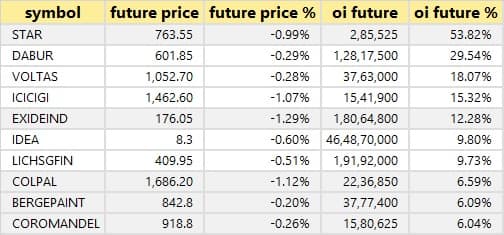

28 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

53 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

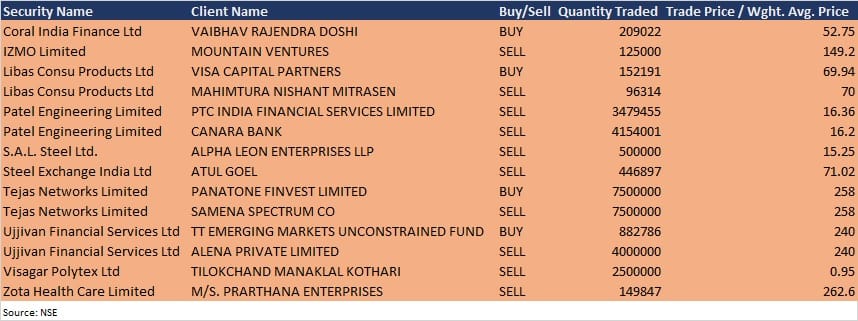

Bulk deals

Tejas Networks: Tata Sons' subsidiary Panatone Finvest acquired additional 75 lakh equity shares in the company at Rs 258 per share on the NSE. Public shareholder Samena Spectrum was the seller in this deal, offloading same number of shares at the same price, the bulk deal data showed.

Ujjivan Financial Services: TT Emerging Markets Unconstrained Fund acquired 8,82,786 equity shares in the company at Rs 240 per share, whereas Alena Private Limited sold 40 lakh equity shares at the same price on the NSE, the bulk deal data showed.

(For more bulk deals, click here)

Results on August 3, and Analysts/Investors Meeting

Results on August 3: Bharti Airtel, Adani Enterprises, Adani Ports and Special Economic Zone, Bajaj Healthcare, Bank of India, Barbeque-Nation Hospitality, CARE Ratings, Dabur India, Dhampur Sugar Mills, Prataap Snacks, ELGI Equipments, Everest Industries, Godrej Properties, IIFL Wealth Management, Inox Leisure, Indian Overseas Bank, Kajaria Ceramics, Kalpataru Power Transmission, Munjal Showa, Neuland Laboratories, NOCIL, Shipping Corporation of India, Simplex Realty, Tata Consumer Products, Transport Corporation of India, and TRF will release their quarterly earnings on August 3.

Welspun India: The company's officials will meet JM Financial Institutional Securities on August 3.

Dr Reddy's Laboratories: The company's officials will meet Investec Capital Services on August 3.

Carborundum Universal: The company's officials will meet analysts and investors on August 3 to discuss financial results.

Axis Bank: The company's officials will meet analysts and investors in a group meeting arranged by Goldman Sachs Symposium, on August 4.

Mindtree: The company's officials will meet analysts and investors in a group meeting arranged by Goldman Sachs Indian Banks + Fintech Symposium, on August 4.

Godrej Consumer Products: The company's officials will meet analysts and investors on August 4 to discuss financial results.

Oriental Carbon & Chemicals: The company's officials will meet investors and analysts on August 6 to discuss the financial and operational performance.

OnMobile Global: The company's officials will meet analysts and investors on August 9 to discuss financial results.

Balrampur Chini Mills: The company's officials will meet analysts and investors on August 10, to discuss financial results.

Havells India: The company's officials will meet analysts and investors in group conference meetings arranged by Emkay Global Financial Services on August 10, and Edelweiss Securities on August 17.

Stocks in News

Mangalore Chemicals & Fertilizers: The company reported profit at Rs 24.32 crore in Q1FY22 against Rs 11.01 crore in Q1FY21, revenue jumped to Rs 687.19 crore from Rs 529.8 crore YoY.

Adani Enterprises: Adani Wilmar, a 50:50 joint venture company between the Adani group and the Wilmar group, filed its draft red herring prospectus with the Sebi to raise Rs 4,500 crore via IPO.

RBL Bank: The bank reported standalone loss of Rs 459.47 crore in Q1FY22 against profit of Rs 141.22 crore in Q1FY21, net interest income fell to Rs 969.50 crore from Rs 1,041.30 crore YoY.

Punjab National Bank: The bank reported higher standalone profit at Rs 1,023.46 crore in Q1FY22 against Rs 308.45 crore in Q1FY21, net interest income increased to Rs 7,226.58 crore from Rs 6,781.55 crore YoY.

Balaji Amines: The company reported consolidated profit at Rs 97.39 crore in Q1FY22 against Rs 31.58 crore in Q1FY21, revenue jumped to Rs 450.68 crore from Rs 222.91 crore YoY.

Tata Motors: The company will increase prices of its passenger vehicles, on an average of 0.8 percent, depending on the variant and model, with effect from August 3.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,539.88 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,505.82 crore in the Indian equity market on August 2, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Sun TV Network - is under the F&O ban for August 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!