The market gradually recouped losses and turned positive in the last one-and-half-hour of trade on June 21, led by banking & financials, and index heavyweights.

The BSE Sensex rallied 230.01 points to 52,574.46, while the Nifty50 climbed 63.10 points to close at 15,746.50 and formed bullish candle on the daily charts.

"A long range bull candle was formed on the daily chart (within a high low range of 260 points) and the Nifty closed at the high of the previous two candle at 15,760. This is positive indication and it signal a comeback of bulls from the lower levels. A sustainable move above 15,800 levels could open further upside for the market," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

He feels the short term trend of Nifty has turned up after a dramatic fall and a swift upside bounce of the last two sessions. "A sustainable move above 15,800 levels is likely to pull the market into new all-time highs in the next few sessions. Any weakness could find support around 15,650-15,600 levels," he said.

The broader markets outperformed frontliners with the Nifty Midcap 100 and Smallcap 100 indices rising 0.79 percent and 0.65 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,579.73, followed by 15,412.97. If the index moves up, the key resistance levels to watch out for are 15,839.23 and 15,931.97.

Nifty Bank

The Nifty Bank jumped 313.30 points to close at 34,871.30 on June 21. The important pivot level, which will act as crucial support for the index, is placed at 34,230, followed by 33,588.7. On the upside, key resistance levels are placed at 35,220.1 and 35,568.9 levels.

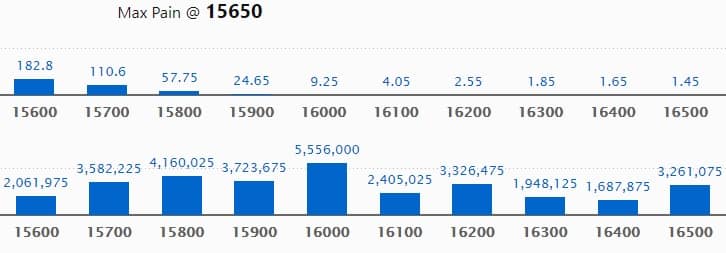

Call option data

Maximum Call open interest of 55.56 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the June series.

This is followed by 15800 strike, which holds 41.60 lakh contracts, and 15900 strike, which has accumulated 37.23 lakh contracts.

Call writing was seen at 16000 strike, which added 10.9 lakh contracts, followed by 15900 strike which added 6.62 lakh contracts, and 15600 strike which added 4.04 lakh contracts.

Call unwinding was seen at 16500 strike, which shed 4.47 lakh contracts, followed by 16400 strike which shed 1.09 lakh contracts, and 16100 strike which shed 93,300 contracts.

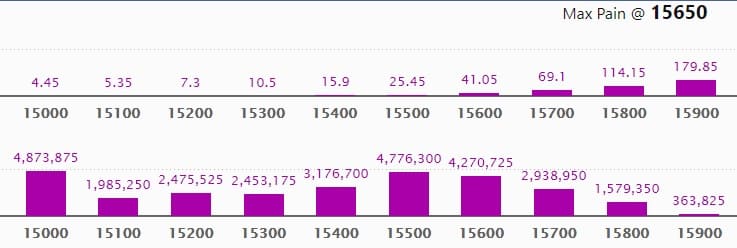

Put option data

Maximum Put open interest of 48.73 lakh contracts was seen at 15000 strike, which will act as a crucial support level in the June series.

This is followed by 15500 strike, which holds 47.76 lakh contracts, and 15600 strike, which has accumulated 42.7 lakh contracts.

Put writing was seen at 15600 strike, which added 14.14 lakh contracts, followed by 15500 strike which added 9.69 lakh contracts, and 15400 strike which added 7.4 lakh contracts.

Put unwinding was seen at 15000 strike which shed 2.75 lakh contracts, followed by 15200 strike which shed 92,700 contracts and 16000 strike which shed 77,400 contracts.

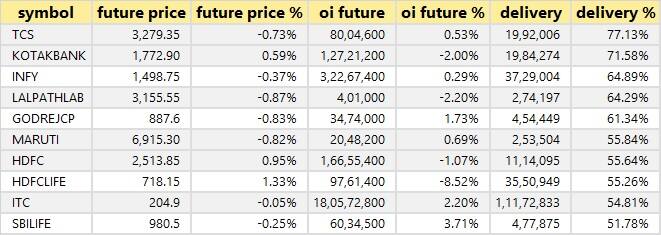

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

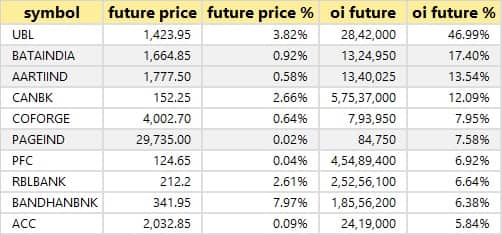

64 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

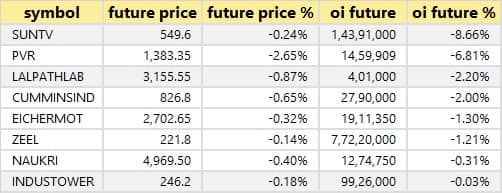

8 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 8 stocks in which long unwinding was seen.

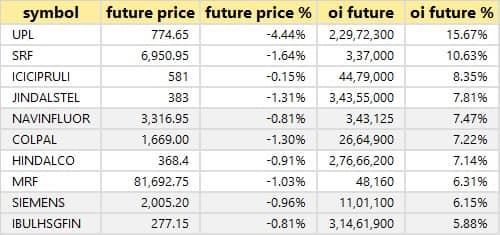

40 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

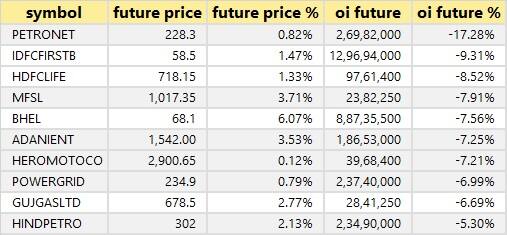

46 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

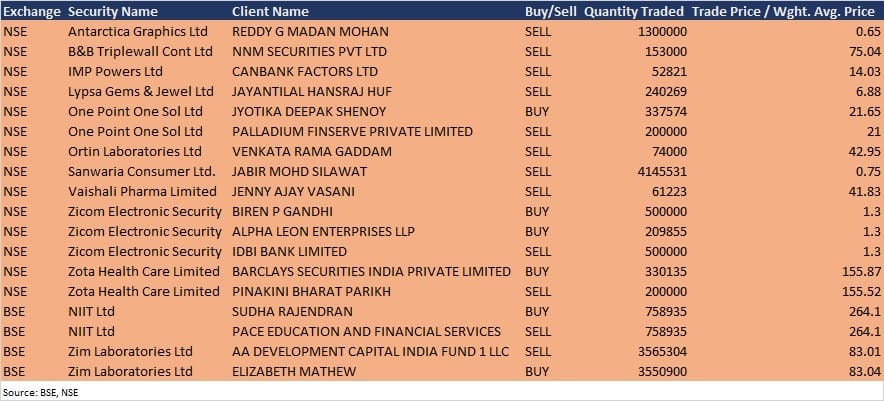

Bulk deals

One Point One Solutions: Jyotika Deepak Shenoy acquired 3,37,574 equity shares in the company at Rs 21.65 per share, whereas Palladium Finserve sold 2 lakh shares at Rs 21 per share, the NSE bulk deals data showed.

Zota Health Care: Barclays Securities India acquired 3,30,135 equity shares in the company at Rs 155.87 per share, whereas Pinakini Bharat Parikh sold 2 lakh shares in the company at Rs 155.52 per share, the NSE bulk deals data showed.

Zim Laboratories: AA Development Capital India Fund 1 LLC sold 35,65,304 equity shares in the company at Rs 83.01 per share, whereas Elizabeth Mathew bought 35,50,900 equity shares at Rs 83.04 per share, the BSE bulk deals data showed.

(For more bulk deals, click here)

Results on June 22, and Analysts/Investors Meeting

Results on June 22: NMDC, Ashapura Minechem, Aster DM Healthcare, Bharat Electronics, BL Kashyap and Sons, Gandhi Special Tubes, GE Power India, ITI, Jaypee Infratech, Max India, Omax Autos, Peninsula Land, PNB Gilts, Religare Enterprises, and Sobha will release quarterly earnings on June 22.

Home First Finance Company: The company's officials will meet Motilal Oswal Securities on June 23.

Anupam Rasayan India: The company's officials will meet Motilal Oswal Financial Services on June 22, and Mirae Asset MF on June 23.

Sudarshan Chemical Industries: The company's officials will meet Enam AMC and Vallum Capital on June 22, attend IIFL's Agriculture & Chemicals Conference on June 23.

Multi Commodity Exchange of India: The company's officials will meet Spark Capital Advisors on June 22, PineBridge Investments on June 23, and Kayne Anderson Rudnick Investment Management on June 24.

Blue Star: The company's officials will meet IDFC Mutual Fund on June 22.

Phoenix Mills: The company's officials will meet TT International on June 22, and Motilal Oswal AMC on June 24.

Kirloskar Brothers: The company's officials will meet investors/analysts on June 23.

Rossari Biotech: The company's officials will meet First State Investments, and Anand Rathi Securities on June 22, and Enam AMC on June 24.

Stocks in News

Jaiprakash Associates: The company reported lower consolidated profit at Rs 424.41 crore in Q4FY21 against Rs 3,068.10 crore in Q4FY20, revenue rose to Rs 2,517.2 crore from Rs 1,876.03 crore YoY.

PG Electroplast: The company approved Rs 76.6 crore incoming investment from Baring Private Equity India, Ananta Capital and others.

State Bank of India: The Central Board of the bank accorded approval for raising fresh Additional Tier 1 (AT 1 ) capital up to an amount of Rs 14,000 crore subject to Government of India concurrence.

VST Tillers Tractors: The company reported profit at Rs 12.93 crore in Q4FY21 against loss of Rs 3.38 crore in Q4FY20, revenue rose to Rs 194.74 crore from Rs 119.80 crore YoY.

Dish TV India: The board approved the raising of funds up to Rs 1,000 crore through rights issue, at a price of Rs 10.

KPIT Technologies: The company signed a definitive agreement to acquire a controlling stake in PathPartner Technology.

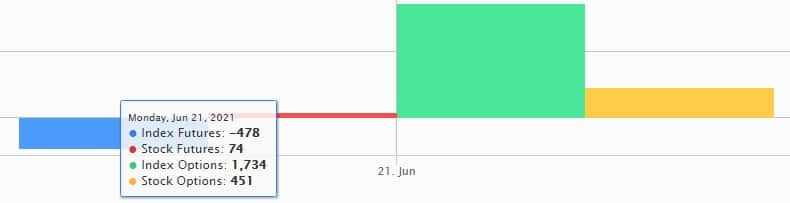

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,244.71 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 138.09 crore in the Indian equity market on June 21, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Vodafone Idea, and Sun TV Network - are under the F&O ban for June 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!