The recovery in second half of session helped the market end at record closing high on June 14, supported by Reliance Industries, Infosys, L&T and Bajaj Finance.

The benchmark indices settled with moderate gains amid volatility. The BSE Sensex rose 76.77 points to 52,551.53, while the Nifty50 gained 12.50 points at 15,811.90 and formed Hanging Man kind of pattern on the daily charts.

"On the daily chart, Nifty continues to form a series of higher Tops and higher Bottom formation indicating a sustained strength. The next higher levels to be watched are around 15,850 levels. Any sustainable move above 15,850 levels may cause momentum towards 15,900-16,000 levels," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

"On the downside, any violation of an intraday support zone of 15,750 levels may cause profit booking towards 15,700-15,600 levels. The daily strength indicator RSI has turned bullish along with a positive crossover which signals strength ahead," he added.

The broader markets closed in red as the Nifty Midcap 100 index was down 0.48 percent and Smallcap 100 index fell 0.34 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,671.2, followed by 15,530.6. If the index moves up, the key resistance levels to watch out for are 15,887.7 and 15,963.6.

Nifty Bank

The Nifty Bank declined 96.80 points to close at 34,950.60 on June 14. The important pivot level, which will act as crucial support for the index, is placed at 34,551.63, followed by 34,152.66. On the upside, key resistance levels are placed at 35,172.34 and 35,394.0 levels.

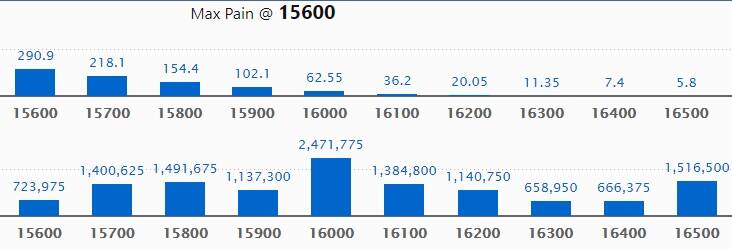

Call option data

Maximum Call open interest of 24.71 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the June series.

This is followed by 16500 strike, which holds 15.16 lakh contracts, and 15800 strike, which has accumulated 14.91 lakh contracts.

Call writing was seen at 15700 strike, which added 2.39 lakh contracts, followed by 15800 strike which added 1.44 lakh contracts, and 16500 strike which added 1.14 lakh contracts.

Call unwinding was seen at 16200 strike, which shed 85,800 contracts, followed by 16300 strike which shed 39,900 contracts, and 15500 strike which shed 37,350 contracts.

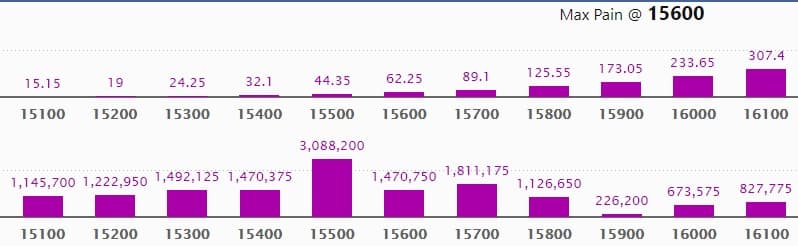

Put option data

Maximum Put open interest of 30.88 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the June series.

This is followed by 15700 strike, which holds 18.11 lakh contracts, and 15300 strike, which has accumulated 14.92 lakh contracts.

Put writing was seen at 15500 strike, which added 3.09 lakh contracts, followed by 15600 strike which added 2.3 lakh contracts, and 15300 strike which added 1.77 lakh contracts.

Put unwinding was seen at 16100 strike which shed 96,300 contracts, followed by 16000 strike which shed 48,750 contracts and 15900 strike which shed 12,600 contracts.

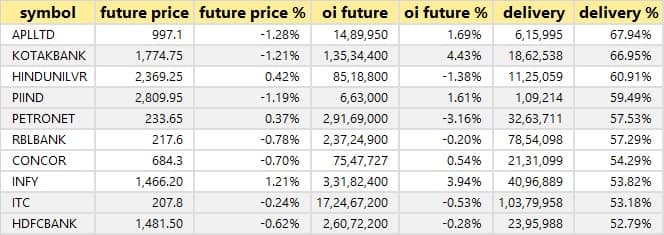

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

28 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

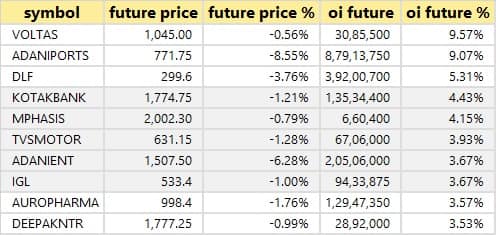

58 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

31 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

Adani Group stocks witnessed short build up on Monday especially after reports of the National Securities Depository Ltd (NSDL) freezing three Foreign Portfolio Investors' accounts that own shares in four of the listed Adani firms emerged. Later in the day, the group said the reports were erroneous and the accounts had not been frozen. NSDL data, however, showed that the accounts were indeed frozen. Adani Ports' open interest increased 9.07 percent along with 8.55 percent decline in price, while Adani Enterprises' open interest rose 3.67 percent along with 6.28 percent decline in price.

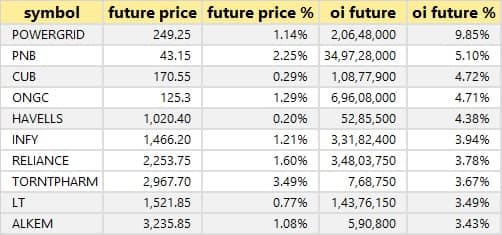

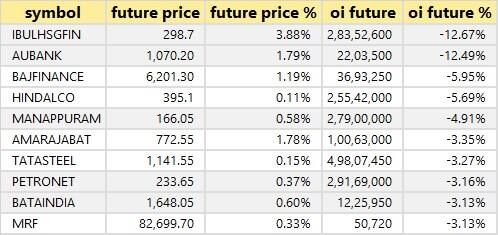

39 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

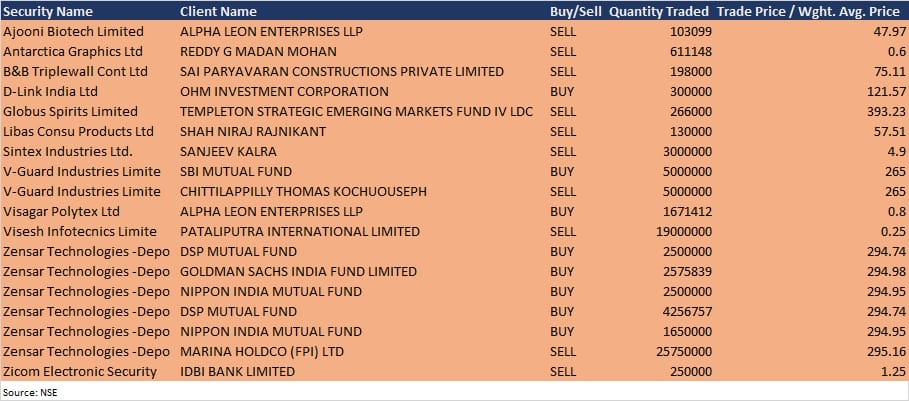

Bulk deals

Globus Spirits: Templeton Strategic Emerging Markets Fund IV LDC sold another 2.66 lakh equity shares in Globus Spirits at Rs 393.23 per share on the NSE, the bulk deals data showed.

V-Guard Industries: SBI Mutual Fund acquired 50 lakh equity shares in V-Guard Industries at Rs 265 per share, whereas promoter Chittilappilly Thomas Kochuouseph was the seller, offloading same number of shares at a same price on the NSE, the bulk deals data showed.

Zensar Technologies-Depo: Marina Holdco (FPI) sold 2,57,50,000 equity shares in the company at Rs 295.16 per share on the NSE. However, DSP Mutual Fund acquired 67,56,757 lakh equity shares in the company at Rs 294.74, Goldman Sachs India Fund bought 25,75,839 equity shares at Rs 294.98 per share, and Nippon India Mutual Fund bought 41.5 lakh equity shares at Rs 294.95 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Results on June 15

Jubilant FoodWorks, Power Finance Corporation, LIC Housing Finance, Easy Trip Planners, Entertainment Network (India), Flexituff Ventures International, India Home Loan, JMD Ventures, BLS International Services, Centum Electronics, Lemon Tree Hotels, Manaksia, Salzer Electronics, Spencers Retail, and Whirlpool of India will release quarterly earnings on June 15.

Stocks in News

Coal India: The company reported lower consolidated profit at Rs 4,588.96 crore in Q4FY21 against Rs 4,625.7 crore in Q4FY20, revenue fell to Rs 26,700.14 crore from Rs 27,568.23 crore YoY.

Jaiprakash Power Ventures: The company reported consolidated profit at Rs 215.32 crore in Q4FY21 against loss of Rs 70.91 crore in Q4FY20, revenue increased to Rs 956.87 crore from Rs 698.47 crore YoY.

Va Tech Wabag: Porinju Veliyath-owned Equity Intelligence India Pvt Ltd & EQ India Fund sold over 7.64 lakh equity shares or 1.23% stake in Va Tech Wabag via open market transaction on June 10, reducing shareholding to 0.64% from 1.87% earlier.

NHPC: NHPC signed a Memorandum of Understanding (MoU) with Bihar State Hydro-Electric Power Corporation (BSHPCL) for execution of Dagmara HE Project (130.1 MW) in Bihar on ownership basis.

Satin Creditcare Network: The company reported higher standalone profit at Rs 42.76 crore in Q4FY21 against Rs 12.48 crore in Q4FY20, revenue fell to Rs 372.58 crore from Rs 375 crore YoY.

Uttam Sugar Mills: The company reported lower profit at Rs 27.83 crore in Q4FY21 against Rs 34.93 crore in Q4FY20, revenue fell to Rs 553.36 crore from Rs 556.72 crore YoY.

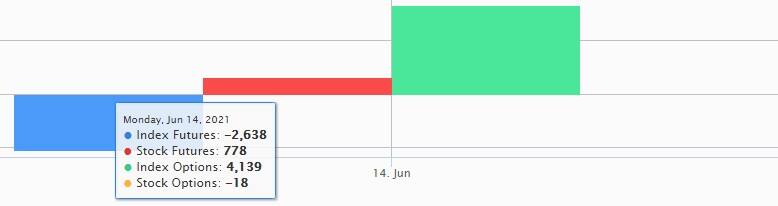

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 503.51 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 544.26 crore in the Indian equity market on June 14, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - Canara Bank, Indiabulls Housing Finance, NALCO, Punjab National Bank, and Sun TV Network - are under the F&O ban for June 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!