The market recouped its previous three-day losses and closed 1.7 percent higher on May 17, aided by banking & financials, auto and metals after falling COVID-19 cases below 3 lakh mark.

The BSE Sensex jumped 848.18 points to 49,580.73, while the Nifty50 climbed 245.40 points to 14,923.20 and formed bullish candle on the daily charts.

"With the current close, the index approaching its two months "Multiple Resistance Zone" of 15,000 which remains a crucial level to watch for. The index has strongly bounced from its 100-Day SMA (14,575) which remains a short term support zone," Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities told Moneycontrol.

"Any decisive breakout above this 15,000 levels on a closing basis may cause strength towards 15,200-15,250 levels. On the downside, any violation of an intraday support zone of 14,850 levels may cause profit booking towards 14,750-14,700 levels," he said.

The broader markets also gained strength with the Nifty Midcap 100 index rising 1.84 percent and Nifty Smallcap 100 index climbing 1.15 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,786.33, followed by 14,649.47. If the index moves up, the key resistance levels to watch out for are 14,999.03 and 15,074.87.

Nifty Bank

The Nifty Bank outpaced the benchmark indices, surging 1,289.80 points or 4.01 to 33,459.30 on May 17. The important pivot level, which will act as crucial support for the index, is placed at 32,682.97, followed by 31,906.73. On the upside, key resistance levels are placed at 33,871.17 and 34,283.13 levels.

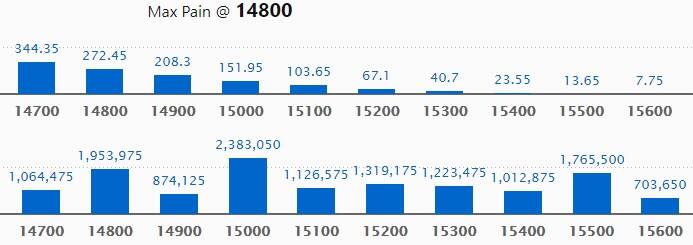

Call option data

Maximum Call open interest of 23.83 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 14,800 strike, which holds 19.53 lakh contracts, and 15,500 strike, which has accumulated 17.65 lakh contracts.

Call writing was seen at 15,300 strike, which added 3.08 lakh contracts, followed by 15,400 strike which added 2.55 lakh contracts and 15,700 strike which added 1.34 lakh contracts.

Call unwinding was seen at 15,000 strike, which shed 4.64 lakh contracts, followed by 14,800 strike which shed 1.08 lakh contracts.

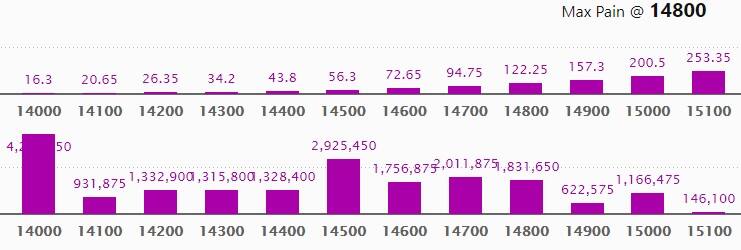

Put option data

Maximum Put open interest of 42.42 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the May series.

This is followed by 14,500 strike, which holds 29.25 lakh contracts, and 14,700 strike, which has accumulated 20.11 lakh contracts.

Put writing was seen at 14,800 strike, which added 5.49 lakh contracts, followed by 14,700 strike which added 4.36 lakh contracts and 14,900 strike which added 2.7 lakh contracts.

Put unwinding was seen at 14,300 strike which shed 58,950 contracts, followed by 15,700 strike, which shed 1,350 contracts.

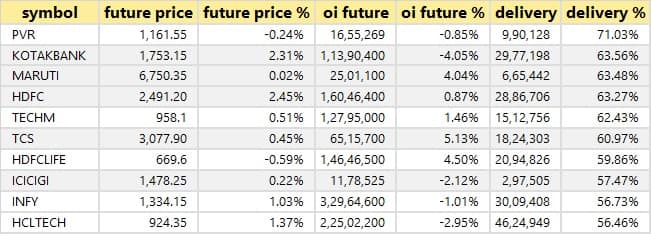

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

63 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

15 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

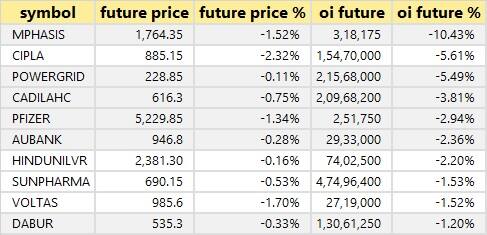

20 stocks saw short build-up

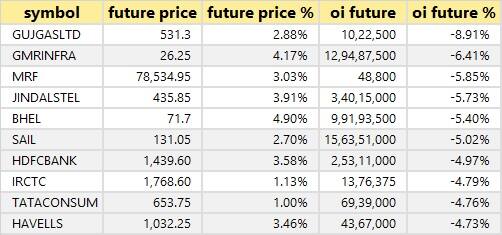

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

60 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

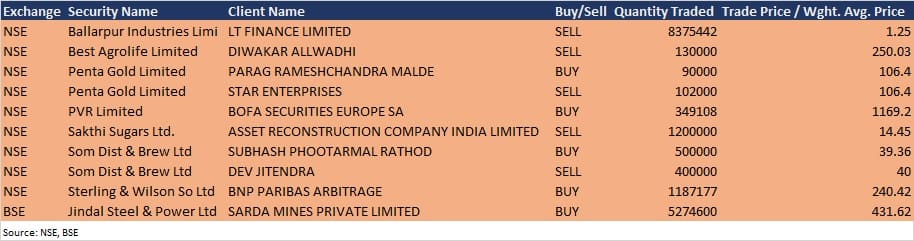

Bulk deals

(For more bulk deals, click here)

Results on May 18

Tata Motors, Canara Bank, Aarti Industries, Abbott India, Torrent Pharmaceuticals, Ujjivan Small Finance Bank, Arfin India, Astral, Biogen Pharmachem Industries, Brigade Enterprises, Century Enka, Chalet Hotels, Coromandel Engineering Company, Diamines & Chemicals, Dolat Investments, Ester Industries, GSK Pharma, Gujarat Alkalies & Chemicals, Gulshan Polyols, IIFL Wealth Management, JBM Auto, Jindal Stainless (Hisar), JSL Industries, Jyothy Labs, Kalyani Investment Company, Kalyani Steels, Minda Corporation, PI Industries, Pioneer Embroideries, Route Mobile, Shilp Gravures, Umang Dairies, Upsurge Investment & Finance, and Xtglobal Infotech will release quarterly earnings scorecard on May 18.

Stocks in News

Bharti Airtel: The company reported consolidated profit at Rs 759.2 crore in Q4FY21 against Rs 853.6 crore in Q3FY21, revenue fell to Rs 25,747.3 crore from Rs 26,517.8 crore QoQ.

Strides Pharma Science: Promoter Group of the company have released substantial pledge of over 38 percent, taking the current overall promoter group pledge at 25.98% of the promoter holding and 7.71% of the paid up capital of the company.

Orient Cement: The company reported sharply higher profit at Rs 99.87 crore in Q4FY21 against Rs 44.06 crore in Q4FY20, revenue jumped to Rs 831.61 crore from Rs 654.52 crore YoY.

Wabco India: The company reported higher profit at Rs 47.63 crore in Q4FY21 against Rs 31.49 crore in Q4FY20, revenue jumped to Rs 712.32 crore from Rs 404.85 crore YoY.

Gland Pharma: The company reported higher consolidated profit at Rs 260.4 crore in Q4FY21 against Rs 194.79 crore in Q4FY20, revenue rose to Rs 887.7 crore from Rs 635.2 crore YoY.

HCL Technologies: The company announced the expansion of investment in United Kingdom with the hiring of 1,000 technology professionals to support its clients in the UK and around the world.

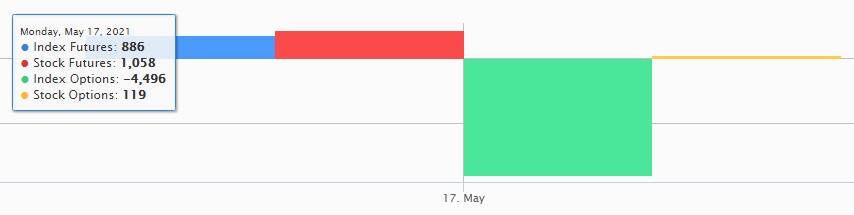

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,255.84 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,948.48 crore in the Indian equity market on May 17, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - BHEL, Cadila Healthcare, Canara Bank, Punjab National Bank, SAIL and Sun TV Network - are under the F&O ban for May 18. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!