The market extended gains for the fourth consecutive session with the Nifty50 closing strongly above 14,900 mark on May 10, driven by buying in auto, metals, pharma and banking stocks.

The BSE Sensex gained 295.94 points to close at 49,502.41, while the Nifty50 rose 119.20 points to 14,942.40 and formed Doji kind of candlestick pattern on the daily charts as the closing was near its opening levels.

"With the current close, the index is now approaching it's two months multiple resistance zone of 15,000 mark which remains a crucial resistance zone to watch for. Any decisive breakout above this 15,000 levels on a closing basis may cause strength towards 15,200-15,250 levels," Rajesh Palviya, Head - Technical and Derivative Research at Axis Securities told Moneycontrol.

On the daily chart, "Nifty continues to hold its 100-day SMA (14,540) which acts as support on the short term charts. The next higher levels to be watched are around 15,000 levels. Any sustainable move above 14,850 levels may cause momentum towards 15,100-15,200 levels," he said.

"On the downside, any violation of an intraday support zone of 14,800 levels may cause profit booking towards 14,800-14,750 levels," he added.

The broader markets outpaced frontliners on Monday as the Nifty Midcap 100 index rallied 0.94 percent and Smallcap 100 index rose 1.53 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,900.9, followed by 14,859.5. If the index moves up, the key resistance levels to watch out for are 14,975.3 and 15,008.3.

Nifty Bank

The Nifty Bank traded in line with benchmarks, rising 237.90 points to close at 33,142.40 on May 10. The important pivot level, which will act as crucial support for the index, is placed at 33,014.47, followed by 32,886.54. On the upside, key resistance levels are placed at 33,283.97 and 33,425.54 levels.

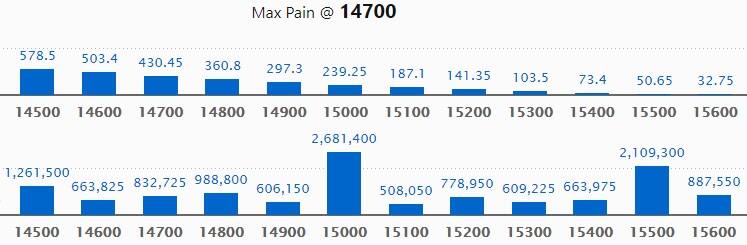

Call option data

Maximum Call open interest of 26.81 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 15,500 strike, which holds 21.09 lakh contracts, and 14,500 strike, which has accumulated 12.61 lakh contracts.

Call writing was seen at 15,700 strike, which added 2.4 lakh contracts, followed by 15,400 strike which added 93,150 contracts and 15,000 strike which added 81,900 contracts.

Call unwinding was seen at 14,700 strike, which shed 1.37 lakh contracts, followed by 14,600 strike which shed 96,900 contracts and 14,800 strike which shed 94,350 contracts.

Put option data

Maximum Put open interest of 44.51 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the May series.

This is followed by 14,500 strike, which holds 27.57 lakh contracts, and 14,600 strike, which has accumulated 15.19 lakh contracts.

Put writing was seen at 14,000 strike, which added 7.41 lakh contracts, followed by 15,000 strike which added 3.25 lakh contracts and 14,500 strike which added 2.76 lakh contracts.

Put unwinding was seen at 14,100 strike which shed 70,875 contracts, followed by 14,200 strike, which shed 65,475 contracts.

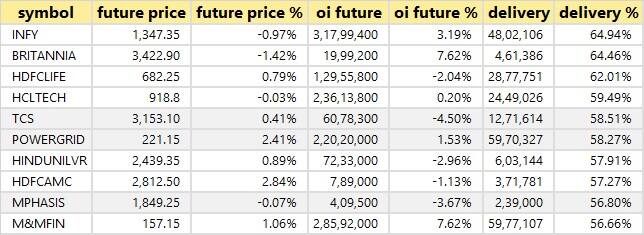

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

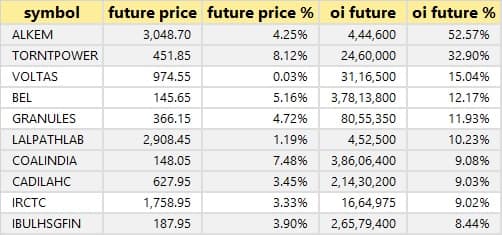

71 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

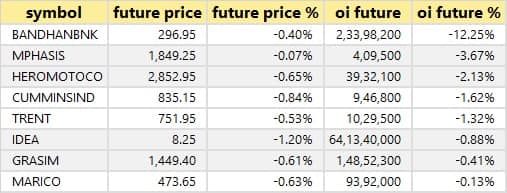

8 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 8 stocks in which long unwinding was seen.

32 stocks saw short build-up

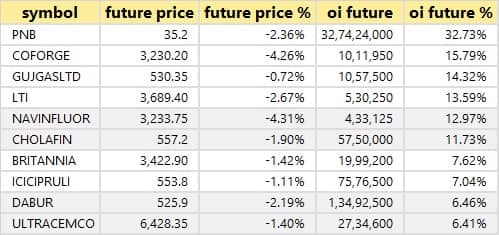

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

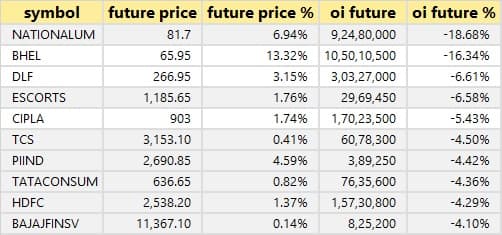

48 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

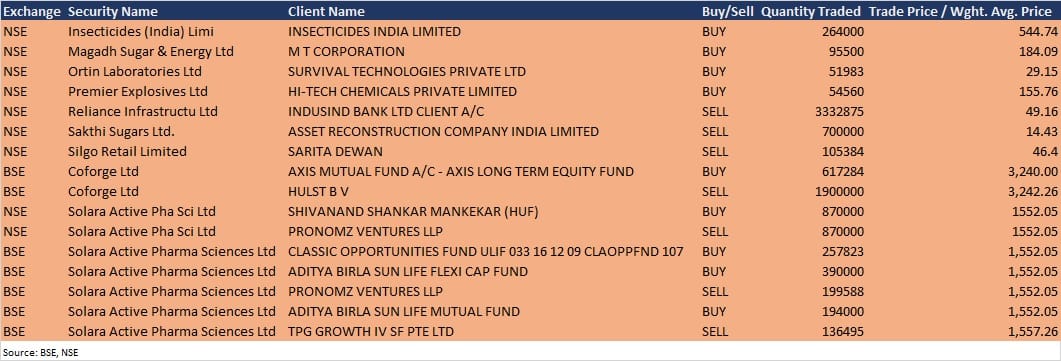

Bulk deals

(For more bulk deals, click here)

Results on May 11

Siemens, Alembic, Andhra Paper, BASF India, Bliss GVS Pharma, Dishman Carbogen Amcis, Firstsource Solutions, Godrej Consumer Products, Granules India, Huhtamaki India, Kalpataru Power Transmission, KEC International, Linde India, Magadh Sugar & Energy, Mahindra EPC Irrigation, Matrimony.com, Neuland Laboratories, Orient Abrasives, Pervasive Commodities, Remedium Lifecare, Savani Financials, Shreyans Industries, Solid Containers, Stovec Industries, Tainwala Chemicals & Plastics, Transcorp International, Ultracab (India), and Wardwizard Innovations & Mobility will release quarterly earnings on May 11.

Stocks in News

HFCL: The company reported higher consolidated profit at Rs 84.67 crore in Q4FY21 against Rs 5.78 crore in Q4FY20, revenue rose to Rs 1,391.4 crore from Rs 663.19 crore YoY.

JMC Projects: The company reported consolidated profit at Rs 41.44 crore in Q4FY21 against loss of Rs 54.76 crore in Q4FY20, revenue rose to Rs 1,392.22 crore from Rs 976.28 crore YoY. The company approved the appointment of Azad Shaw as a Chief Financial Officer.

HSIL: The company reported profit at Rs 33.02 crore in Q4FY21 against Rs 3.38 crore in Q4FY20, revenue jumped to Rs 633.21 crore from Rs 461.03 crore YoY.

Chambal Fertilisers and Chemicals: The company reported sharply higher profit at Rs 447.89 crore in Q4FY21 against Rs 197.55 crore in Q4FY20, revenue fell to Rs 1,640.76 crore from Rs 1,969.09 crore YoY.

Paushak: The company reported higher profit at Rs 11.01 crore in Q4FY21 against Rs 6.37 crore in Q4FY20, revenue increased to Rs 38.74 crore from Rs 29.28 crore YoY.

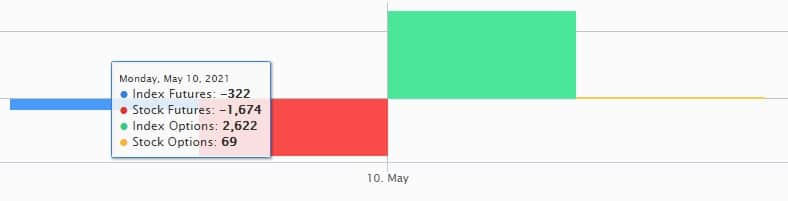

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 583.69 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 476.26 crore in the Indian equity market on May 10, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - NALCO, Punjab National Bank and Sun TV Network - are under the F&O ban for May 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!