Buying in the last hour of the trade helped Nifty to close in the green on May 3. Banks were under pressure, but FMCG, metals, select IT, pharma and auto stocks supported the market.

At the close, the BSE Sensex stood at 48,718.52 levels, down 63.84 points while the Nifty50 rose 3.10 points to settle at 14,634.20. The index formed a bullish candle on the daily charts as the closing was higher than opening levels.

"Since the past 6-8 weeks, the index continues to consolidate within 15,000-14,200 levels, hence, going ahead 14,900-15,000 levels will remain a crucial resistance zone to watch for. On the daily chart, Nifty manages to hold its 100-day SMA support zone of 14,474 level, which remains a crucial support zone ahead," Rajesh Palviya, Head - Technical and Derivative Research at Axis Securities told Moneycontrol.

The next higher levels to be watched are around 14,700 levels, and any sustainable move above 14,700 may cause momentum towards 14,750-14,800 levels, Palviya said, adding on the downside, any violation of an intraday support zone of 14,600 levels may cause profit-booking towards 14,500-14,400 levels.

The broader markets outpaced benchmark indices. The Nifty Midcap 100 index was up 0.28 percent and Smallcap 100 index gained 1.09 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,475.67, followed by 14,317.13. If the index moves up, the key resistance levels to watch out for are 14,733.27 and 14,832.33.

Nifty Bank

The Nifty Bank index fell 316 points or 0.96 percent to close at 32,465.80 on May 3. The important pivot level, which will act as crucial support for the index, is placed at 32,059.4, followed by 31,653. On the upside, key resistance levels are placed at 32,719.4 and 32,973 levels.

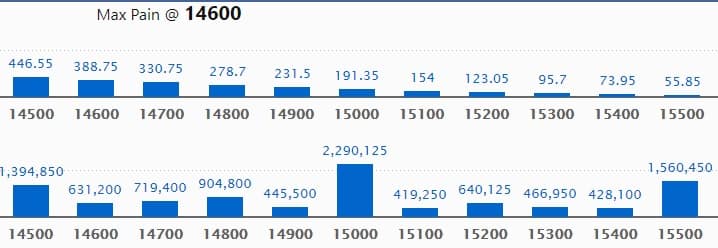

Call option data

Maximum Call open interest of 22.90 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 15,500 strike, which holds 15.60 lakh contracts, and 14,500 strike, which has accumulated 13.94 lakh contracts.

Call writing was seen at 14,500 strike, which added 4.13 lakh contracts, followed by 14,600 strike which added 3.32 lakh contracts and 14,700 strike which added 1.73 lakh contracts.

Call unwinding was seen at 15,400 strike, which shed 13,275 contracts, followed by 14,000 strike which shed 7,500 contracts and 14,100 strike which shed 2,100 contracts.

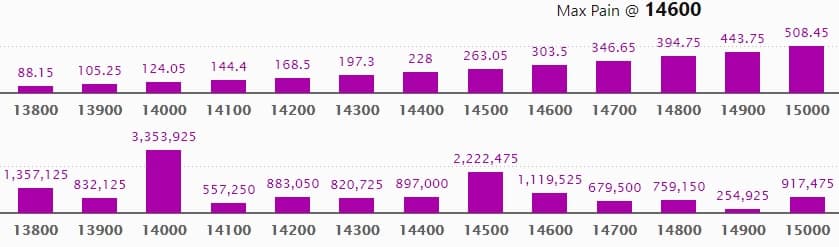

Put option data

Maximum Put open interest of 33.53 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the May series.

This is followed by 14,500 strike, which holds 22.22 lakh contracts, and 13,800 strike, which has accumulated 13.57 lakh contracts.

Put writing was seen at 14,500 strike, which added 4.33 lakh contracts, followed by 14,600 strike which added 3.06 lakh contracts and 14,000 strike which added 2.19 lakh contracts.

Put unwinding was seen at 14,300 strike which shed 30,900 contracts, followed by 14,900 strike, which shed 16,875 contracts, and 14,800 strike which shed 12,975 contracts.

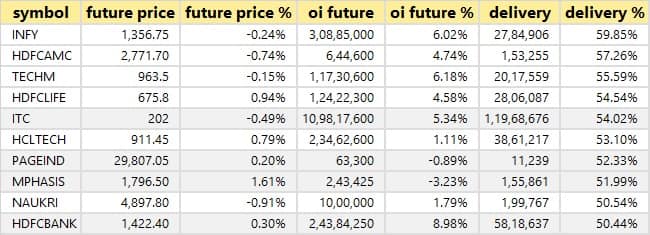

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

70 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

12 stocks saw long unwinding

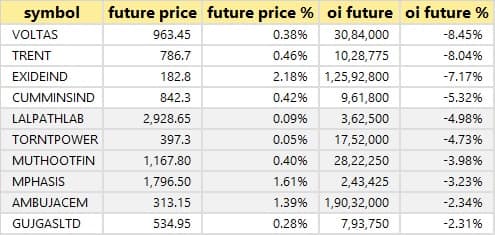

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

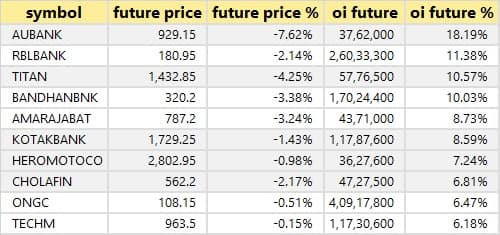

48 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

28 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

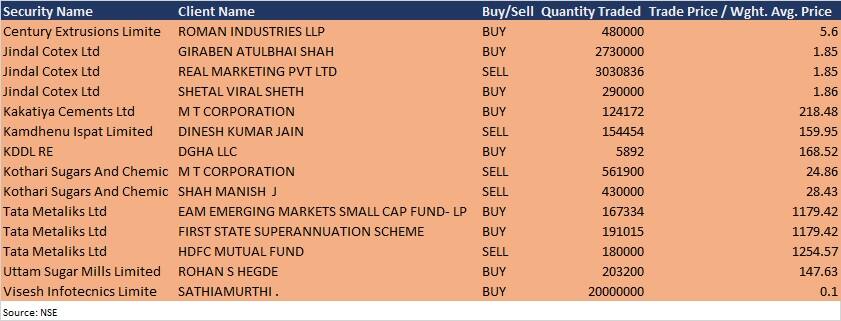

Bulk deals

(For more bulk deals, click here)

Results on May 4

Adani Ports and Special Economic Zone, Alembic Pharmaceuticals, Apollo Pipes, Adani Total Gas, Bhagiradha Chemicals, DCM Shriram, Dr Agarwals Eye Hospital, EIH Associated Hotels, Elango Industries, Elantas Beck India, Greaves Cotton, IIFL Securities, Larsen & Toubro Infotech, Morepen Laboratories, Procter & Gamble Hygiene & Health Care, RBL Bank, Skipper, Srikalahasthi Pipes, Suven Life Sciences, and Vikas WSP will release quarterly earnings on May 4.

Stocks in News

L&T Technology Services: The company reported consolidated profit of Rs 204.8 crore for Q4FY21 compared to Rs 186.1 crore in Q3FY21. Revenue rose to Rs 1,446.6 crore from Rs 1,400.7 crore QoQ.

Bafna Pharmaceuticals: The company has added two fully-automated packaging lines to its existing capacity and they have been approved by the UK-MHRA (Medicines and Healthcare products Regulatory Agency) for the United Kingdom and the European Union (EU).

JSW Energy: JSW Renew Energy, the wholly-owned subsidiary of JSW Future Energy, signed a Power Purchase Agreement with Solar Energy Corporation of India (SECI) for the contracted capacity of 540 MW out of total awarded capacity of 810 MW. This is the single largest PPA for wind/blended wind category in the industry, and marks the foray of the company into wind / blended wind energy generation segment.

Home First Finance Company India: The company reported higher profit at Rs 31 crore in Q4FY21 against Rs 12 crore in Q4FY20 while total income rose to Rs 136 crore from Rs 106 crore logged in the year-ago period.

Tata Chemicals: The company reported consolidated profit of Rs 29.26 crore in Q4FY21 against Rs 197.56 crore in Q4FY20, revenue increased to Rs 2,636.21 crore from Rs 2,378.09 crore YoY.

Motherson Sumi Systems: Subsidiary Motherson Rolling Stock Mexico, S. de R.L. de C.V. (MRSM) has completed acquisition of Bombardier Transportation's manufacturing site for electrical wiring interconnection systems in Huehuetoca, Mexico, upon receipt of related approval(s) and completion of other closing events.

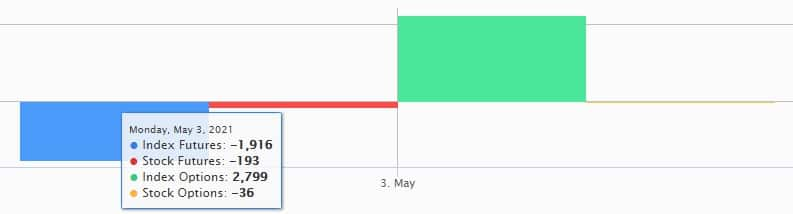

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,289.46 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 552.92 crore in the Indian equity market on May 3, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Sun TV Network - is under the F&O ban for May 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!