The market started off the week on a dismal note as it fell sharply with the benchmark indices correcting 3.5 percent on April 12, dented by rising COVID-19 cases.

The BSE Sensex plunged 1,707.94 points or 3.44 percent to 47,883.38, while the Nifty50 plummeted 524.10 points or 3.53 percent to 14,310.80 and formed Long Black Day candle on the daily charts.

"The daily price action has formed a sizeable bearish candle and has closed below the previous session's low indicating weakness. The Nifty50 has formed a 'Bearish Gap' area in the range of 14,785-14,652 which remains a crucial resistance zone in the near term," Rajesh Palviya, Head - Technical and Derivative Research at Axis Securities told Moneycontrol.

"On the daily chart, 20-day and 50-day SMA negative crossover also signals caution at current levels; however, with the previous session's low (14,248) Nifty has tested its 100-day SMA support of 14,265 and sustained above the same. Hence, in the near term, 14,265 level is an important support zone to watch out for," he said.

"The next higher levels to be watched are around 14,500-14,600 levels. Any pullback towards 14,500-14,600 should be used as an exit opportunity for short term traders," he added.

The broader markets corrected more than benchmark indices. The Nifty Midcap 100 and Smallcap 100 indices were down more than 5.5 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,155.5, followed by 14,000.2. If the index moves up, the key resistance levels to watch out for are 14,559.3 and 14,807.8.

Nifty Bank

The Nifty Bank index fell 1,656.05 points or 5.1 percent to close at 30,792 on April 12. The important pivot level, which will act as crucial support for the index, is placed at 30,308.83, followed by 29,825.67. On the upside, key resistance levels are placed at 31,486.63 and 32,181.27 levels.

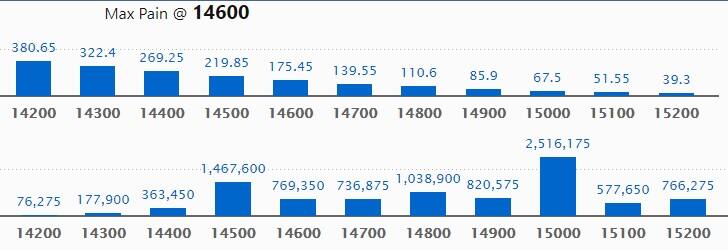

Call option data

Maximum Call open interest of 25.16 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 14,500 strike, which holds 14.67 lakh contracts, and 14,800 strike, which has accumulated 10.38 lakh contracts.

Call writing was seen at 14,500 strike, which added 5.94 lakh contracts, followed by 15,000 strike which added 3.93 lakh contracts and 14,800 strike which added 3.73 lakh contracts.

Call unwinding was seen at 15,200 strike, which shed 90,225 contracts, followed by 14,100 strike which shed 39,225 contracts.

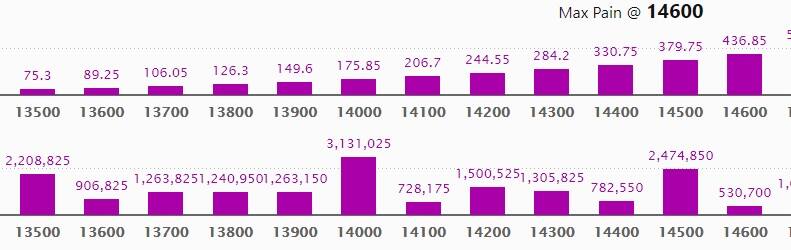

Put option data

Maximum Put open interest of 31.31 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

This is followed by 14,500 strike, which holds 24.74 lakh contracts, and 13,500 strike, which has accumulated 22.08 lakh contracts.

Put writing was seen at 14,300 strike, which added 1.59 lakh contracts, followed by 14,200 strike which added 90,300 contracts and 14,400 strike which added 40,800 contracts.

Put unwinding was seen at 14,500 strike, which shed 6.73 lakh contracts, followed by 14,000 strike which shed 5.02 lakh contracts.

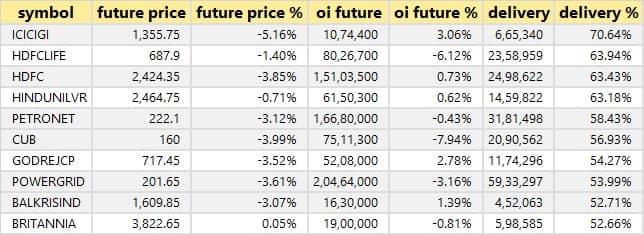

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

3 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the 3 stocks in which a long build-up was seen.

110 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

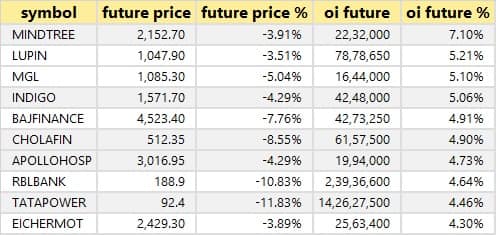

44 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

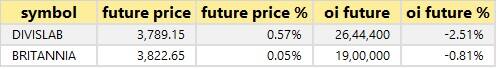

2 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the 2 stocks in which short-covering was seen.

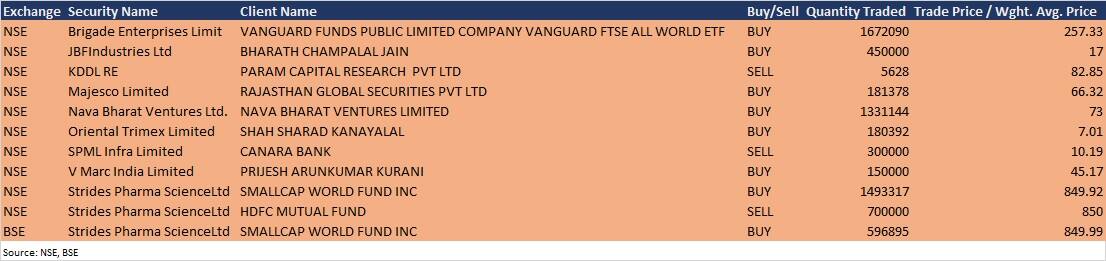

Bulk deals

(For more bulk deals, click here)

Results on April 13 and April 14

Alliance Integrated Metaliks and Pulsar International will announce quarterly earnings on April 13, while Infosys, Jyoti Structures, Reliance Industrial Infrastructure and Tata Metaliks will release quarterly numbers on April 14.

The market will remain shut on April 14 for Dr Baba Saheb Ambedkar Jayanti.

Stocks in News

Tata Consultancy Services: TCS reported 6.3% sequential growth in Q4FY21 consolidated profit at Rs 9,246 crore while revenue grew by 4% QoQ to Rs 43,705 crore. Revenue growth in constant currency stood at 4.2 percent QoQ.

Power Mech Projects: CARE revised credit rating on company's long-term bank facilities to 'A-' from A, while maintaining stable outlook.

Satin Creditcare Network: The company's assets under management (AUM) stood at Rs 7,274 crore as on March 2021, a growth of 5.3% QoQ, indicating that the growth has started kicking in, said Satin, adding for FY21, the company maintained sufficient liquidity of Rs 1,469 crore and raised Rs 4,312 crore including direct assignment transactions of Rs 743 crore. The collection efficiency trend was 98.2% in December 2020, 95.6% in January 2021, 97.3% in February 2021, and 105.0% in March 2021.

Texmaco Infrastructure & Holdings: CARE assigned 'A-' rating (stable outlook) to company's long term bank facilities and 'A1' rating to short term bank facilities, which factored in company's plan to venture into real estate segment.

Hindustan Copper: Hindustan Copper closed its qualified institutional placement issue and approved the issue price of Rs 119.60 per equity share for the issue.

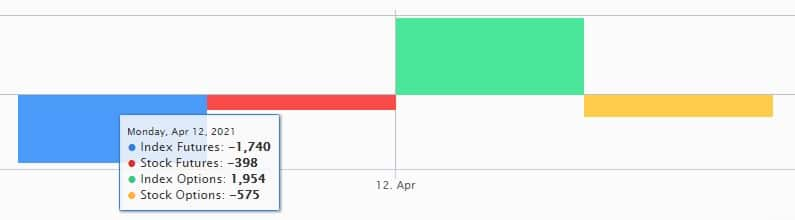

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,746.43 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 232.76 crore in the Indian equity market on April 12, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for April 13. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!