The market plunged 2.7 percent intraday but recouped some of losses in the afternoon trade to finally close more than 1.5 percent lower on April 5. The significant increase in COVID-19 cases dampened the sentiment.

The BSE Sensex fell 870.51 points or 1.74 percent to 49,159.32, while the Nifty50 was down 229.60 points or 1.54 percent at 14,637.80 and formed bearish candle on the daily charts.

"A long negative candle was formed on Monday on the daily chart with lower shadow. This indicate a sharp profit booking from the highs-resistance and the emergence of buying from the lower supports. The crucial overhead resistance of around 14,880 has proved to be a tough task for the market as of now (resistance as per change in polarity)," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"We observe that the market not able to sustain above this hurdle for the second occasions recently, despite closing at the edge of it," he said.

He feels the short term trend of Nifty remains rangebound around 14,900-14,400 levels.

"The pattern of selling at resistance and buying at support continued in the market. Present daily and intraday chart setup signal chances of yet another upside bounce towards 14,900 levels again in the short term, before showing another round of weakness from the highs. Intraday resistance is now placed at 14,700," he said.

In the broader space, the Nifty Midcap 100 index fell 1.32 percent and Smallcap 100 index declined 1.46 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,448.27, followed by 14,258.73. If the index moves up, the key resistance levels to watch out for are 14,838.57 and 15,039.33.

Nifty Bank

The Nifty Bank index plunged 1,179.20 points or 3.48 percent to 32,678.80 on April 5. The important pivot level, which will act as crucial support for the index, is placed at 32,106.73, followed by 31,534.66. On the upside, key resistance levels are placed at 33,474.33 and 34,269.87 levels.

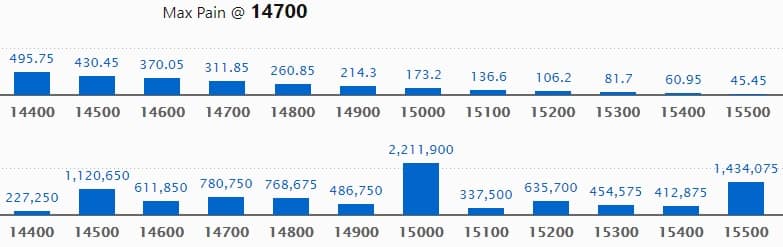

Call option data

Maximum Call open interest of 22.11 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 15,500 strike, which holds 14.34 lakh contracts, and 14,500 strike, which has accumulated 11.20 lakh contracts.

Call writing was seen at 14,700 strike, which added 1.94 lakh contracts, followed by 15,000 strike which added 1.7 lakh contracts and 14,600 strike which added 1.21 lakh contracts.

Call unwinding was seen at 15,400 strike, which shed 45,750 contracts, followed by 15,300 strike which shed 23,400 contracts and 14,500 strike which shed 14,850 contracts.

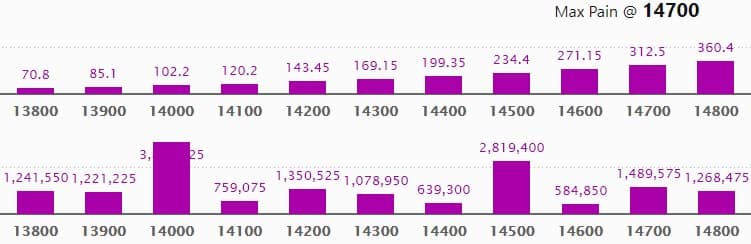

Put option data

Maximum Put open interest of 38.62 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

This is followed by 14,500 strike, which holds 28.19 lakh contracts, and 14,700 strike, which has accumulated 14.89 lakh contracts.

Put writing was seen at 13,900 strike, which added 2.05 lakh contracts, followed by 14,300 strike which added 88,650 contracts and 15,000 strike which added 50,175 contracts.

Put unwinding was seen at 14,000 strike, which shed 77,100 contracts, followed by 14,500 strike which shed 65,400 contracts and 14,800 strike which shed 50,625 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

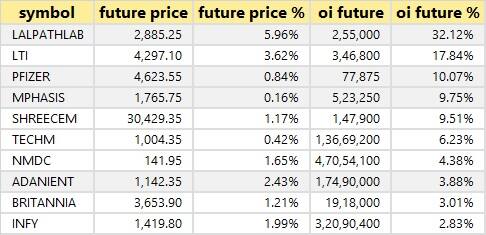

18 stocks saw long build-up

An increase in open interest, along with a increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

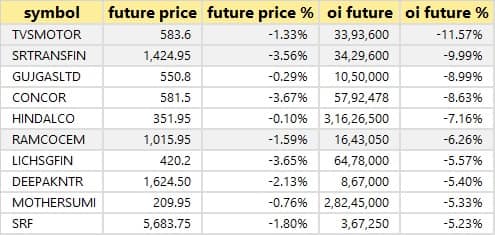

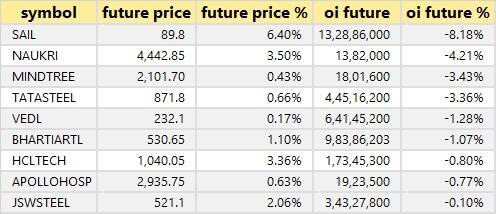

70 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

62 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

9 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the 9 stocks in which short-covering was seen.

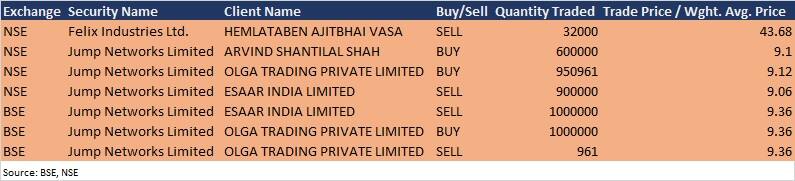

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Usha Martin: The company's officials will interact with Aditya Birla Sun Life Mutual Fund on April 7.

Tech Mahindra: A meeting of the board of directors of the company is scheduled to be held on April 26-27 to consider the audited financial results for the fourth quarter and financial year ended March 31, 2021.

Tata Metaliks: A meeting of the board of directors of the company will be held on April 14 to consider the audited standalone financial statements and results for the quarter and financial year ended March 31, 2021 and also consider recommending dividend, if any, for the financial year ended March 31, 2021.

Stocks in the news

Maruti Suzuki India: Maruti reported production of 1,72,433 vehicles in March 2021, against 92,540 vehicles produced in the corresponding period. Passenger vehicles production increased to 1,70,036 vehicles from 91,602 vehicles in same period, the company said in its BSE filing.

Jindal Steel and Power: JSPL has ended the fiscal year on a strong note with sales hitting a new record of 7,86,000 tonnes in March 2021, up 61% YoY. Combination of robust domestic demand, attractive export markets (accounting for 38% of sales) and wide range of products have all contributed to JSPL reporting the steepest rise in monthly sales in FY21, said the company in its BSE filing.

Panacea Biotec: Panacea Biotec in its BSE filing said the company and Russian Direct Investment Fund has agreed for cooperation to produce 100 million doses per year of Sputnik V.

Burger King India: ICRA has upgraded company's long term and short term credit rating to A- & A2+, from BBB+ & A2 respectively and revised outlook to stable from negative, due to prepayment of entire debt on its balance sheet following successful completion of IPO in December 2020.

Sobha: Sobha in its BSE filing said new sales in Q4FY21 increased to 13,37,707 square feet, compared to 9,05,710 square feet in the corresponding period, but full year sale declined to 40,13,381 square feet from 40,71,704 square feet in FY20. Total sales value stood at Rs 1,072 crore in Q4FY21, increasing from Rs 694.5 crore in Q4FY20.

IRCON International: The company in its BSE filing said the board of directors have approved the issuance of fully paid up bonus shares in the ratio of 1:1 (one fully paid up equity share for every one fully paid up equity share held).

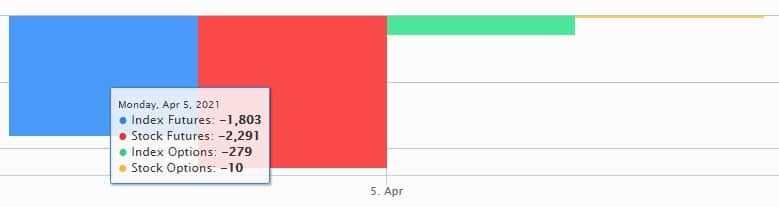

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 931.66 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 75.48 crore in the Indian equity market on April 5, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for April 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!