The benchmark Nifty50 index failed to hold on to the psychological level of 15,000 on March 8 and eventually ended the volatile session with minor gains. Weak global cues and rising oil prices dented investor sentiment.

The BSE Sensex gained 35.75 points to 50,441.07, while the Nifty50 rose 18.10 points to 14,956.20 and formed a small bearish candle on the daily charts as the closing was lower than the opening levels.

"Technically, not much has changed on the daily chart; however, if we meticulously observe the hourly chart it seems the prices are trapped within a Symmetrical Triangle pattern. Today, prices twice faced resistance around the higher range of this pattern, and going ahead as long as we don't see a sustained trade above 15,100; intraday bounce may continue to get sold into," Rajesh Bhosale, Technical Analyst at Angel Broking told Moneycontrol.

On the lower side, 14,900 – 14,860 can be taken as the lower side of this pattern and a slide below it can trigger a much-awaited price correction, Bhosale added.

He advised traders to keep a tab on the above-mentioned levels and trade accordingly.

The broader markets outpaced benchmark indices as the Nifty Midcap 100 and Smallcap 100 indices have gained 0.30 percent and 0.45 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,880.33, followed by 14,804.47. If the index moves up, the key resistance levels to watch out for are 15,071.63 and 15,187.07.

Nifty Bank

The Nifty Bank index rose 47.60 points to close at 35,275.80 on March 8. The important pivot level, which will act as crucial support for the index, is placed at 34,968.64, followed by 34,661.47. On the upside, key resistance levels are placed at 35,705.14 and 36,134.47 levels.

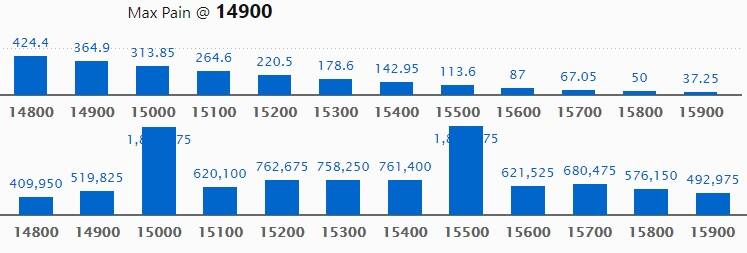

Call option data

Maximum Call open interest of 18.84 lakh contracts was seen at 15,500 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,000 strike, which holds 18.66 lakh contracts, and 15,200 strike, which has accumulated 7.62 lakh contracts.

Call writing was seen at 15,600 strike, which added 1.32 lakh contracts, followed by 15,900 strike which added 1.22 lakh contracts and 15,100 strike which added 98,025 contracts.

Call unwinding was seen at 14,800 strike, which shed 1.22 lakh contracts, followed by 14,900 strike which shed 68,625 contracts.

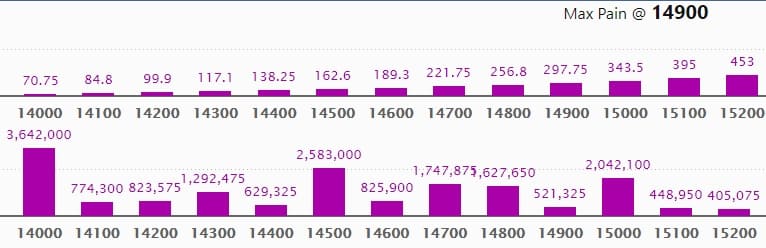

Put option data

Maximum Put open interest of 36.42 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the March series.

This is followed by 14,500 strike, which holds 25.83 lakh contracts, and 15,000 strike, which has accumulated 20.42 lakh contracts.

Put writing was seen at 15,000 strike, which added 2.08 lakh contracts, followed by 15,100 strike, which added 68,475 contracts and 14,700 strike which added 59,400 contracts.

Put unwinding was seen at 14,500 strike, which shed 2.96 lakh contracts, followed by 14,000 strike which shed 95,475 contracts.

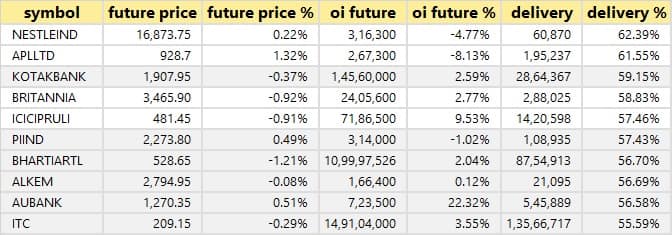

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

43 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

18 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

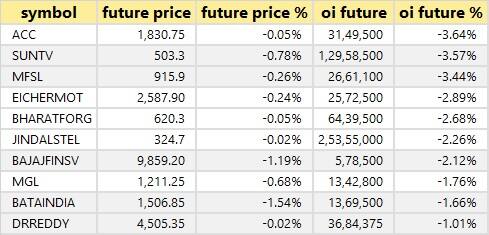

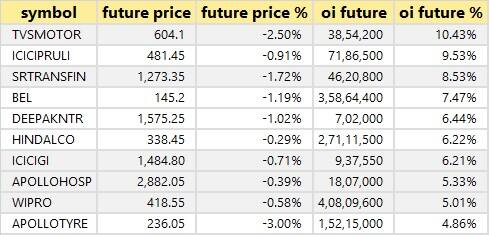

53 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

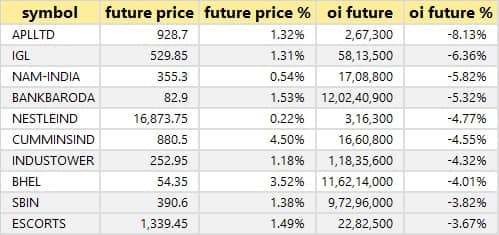

43 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

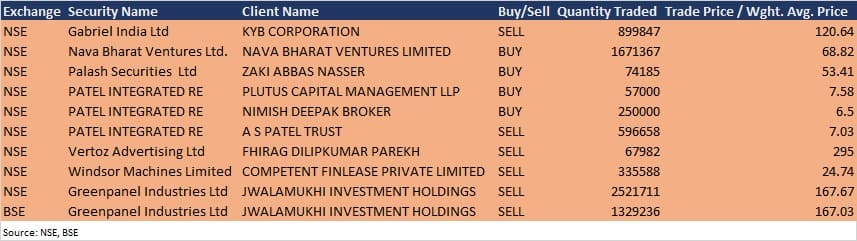

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

eClerx Services: The company's officials will interact with Edelweiss Broking (Wealth Management Research) on March 9.

Prism Johnson: The company's officials will interact with HDFC Securities on March 9.

Ugro Capital: The management of the company will be attending the 6th Annual Analyst Conference organised by Valorem Advisors, to be held on March 10.

CRISIL: The company's officials will interact with NIPPON Mutual Fund and Enam Asset Management on March 10.

HEG: The senior management of the company is scheduled to meet investors virtually on March 9 as organised by Jefferies.

Tata Motors: The company's officials will meet Analyst / Institutional Investors from March 9 to March 12.

Indo Count Industries: The officials of the company will be interacting with investors on March 9.

Westlife Development: The company's officials would be having a group investor interaction through call/ video conference during B&K Securities interaction, on March 9.

Stocks in the news

Wipro: Appirio, a Wipro company, is helping National Grid transform its business with an omnichannel customer experience by unifying its engagement with 68 million customers across two continents.

Dhunseri Ventures: The company divested its entire shareholding of 25 percent in Tastetaria Foods in favour of its existing JV partner Choicest Enterprises (CEL) of Ambuja Neotia group. Consequent to the stake sale, Tastetaria Foods has ceased to be the company's joint venture company.

Zodiac Clothing: Pari Washington India Master Fund exited the company by selling entire 2.3 percent equity stake via open market transaction.

Biocon: Biocon Biologics (BBL) has approved allotment of 1,97,99,305 equity shares at an issue price of Rs 280.31 per share to the investor. The subscription money aggregating around Rs 555 crore have been received by BBL from Beta Oryx, a wholly-owned subsidiary of ADQ.

Ankit Metal & Power: Suresh Kumar Patni has resigned from the post of Chairman and Director of the company with immediate effect.

VIP Clothing: Maxwell Capital Management Pvt Ltd & PACs increased stake in the company to 53.03% from 53.00% via open market transaction.

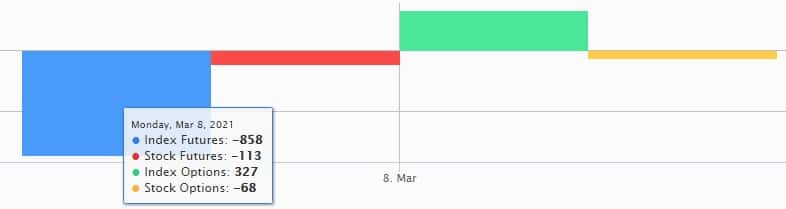

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,494 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 484 crore in the Indian equity market on March 8, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - Bank of Baroda, BHEL, Punjab National Bank, SAIL and Sun TV Network - are under the F&O ban for March 9. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!