The market rebounded strongly and staged stellar performance on the first day of March, backed by positive global cues, encouraging auto sales and economic data. All sectoral indices participated in the run.

The BSE Sensex rallied 749.85 points, or 1.53 percent, to 49,849.84, while the Nifty50 climbed 232.30 points, or 1.60 percent, to 14,761.50 amid volatile trade and formed small bullish candle which resembles Inside Bar kind of pattern on the daily charts.

"The market remained volatile moving in a narrow range of 100 points. It came down from the expected highs, but managed to survive at a lower level. It could be due to the massive trading activity on Friday. Tuesday may be an important day for the market as the dismissal of 14,830 would be extremely positive for the market and the dismissal of 14,600 would be negative," Shrikant Chouhan, Executive Vice-President, Equity Technical Research at Kotak Securities told Moneycontrol.

Be a level based trader on Tuesday, he advised.

The broader markets also participated in the rally with the Nifty Midcap 100 index and Smallcap 100 index rising 1.79 percent and 2.07 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,664.4, followed by 14,567.3. If the index moves up, the key resistance levels to watch out for are 14,832.7 and 14,903.9.

Nifty Bank

The Nifty Bank index jumped 492.40 points, or 1.41 percent, to 35,296 on March 1. The important pivot level, which will act as crucial support for the index, is placed at 34,992.84, followed by 34,689.67. On the upside, key resistance levels are placed at 35,590.14 and 35,884.27 levels.

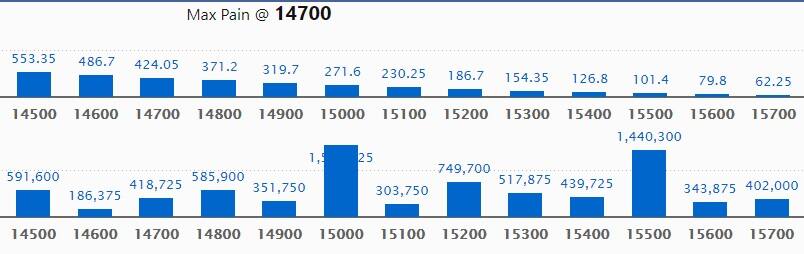

Call option data

Maximum Call open interest of 15.26 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,500 strike, which holds 14.40 lakh contracts, and 15,200 strike, which has accumulated 7.49 lakh contracts.

Call writing was seen at 15,500 strike, which added 97,950 contracts, followed by 15,600 strike which added 56,175 contracts and 14,800 strike which added 34,650 contracts.

Call unwinding was seen at 14,900 strike, which shed 82,350 contracts, followed by 15,000 strike which shed 75,375 contracts.

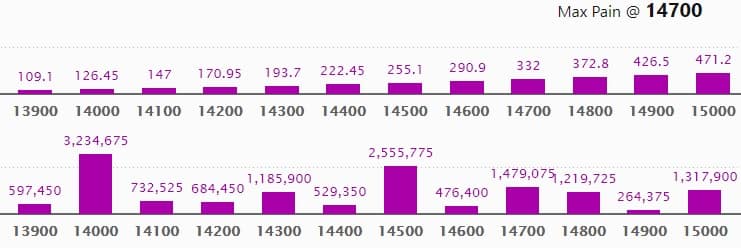

Put option data

Maximum Put open interest of 32.34 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the March series.

This is followed by 14,500 strike, which holds 25.55 lakh contracts, and 14,700 strike, which has accumulated 14.79 lakh contracts.

Put writing was seen at 14,700 strike, which added 1.05 lakh contracts, followed by 14,300 strike, which added 81,525 contracts and 14,500 strike which added 79,425 contracts.

Put unwinding was seen at 14,900 strike, which shed 57,525 contracts, followed by 14,100 strike which shed 27,900 contracts.

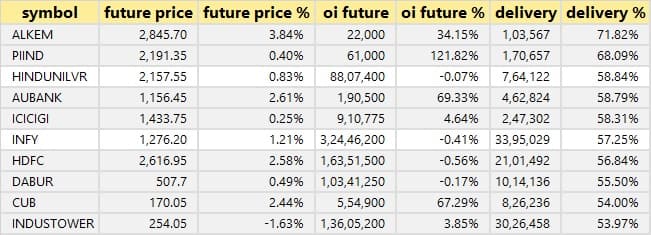

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

71 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

5 stocks saw long unwinding

Based on the open interest future percentage, here are the 5 stocks in which long unwinding was seen.

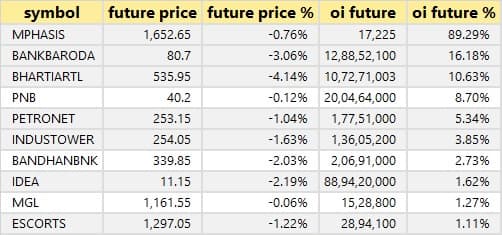

11 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

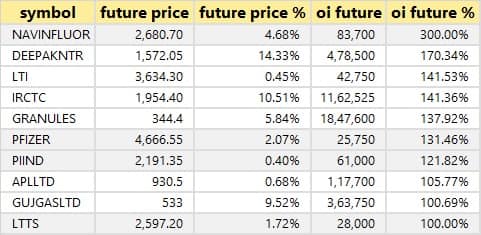

72 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

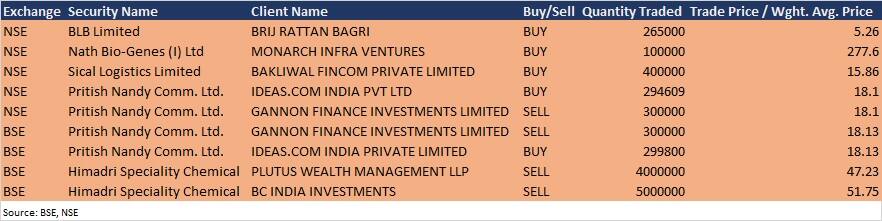

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Indostar Capital Finance: The company would be attending the Midcap BFSI Day Virtual Conference organised by Prabhudas Lilladher on March 2 to discuss the performance of the company for quarter and nine months ended December 2020.

Sudarshan Chemical Industries: The company's officials will meet HDFC Mutual Fund on March 2.

Torrent Power: The company's officials will meet BOB Capital Markets on March 3.

Equitas Small Finance Bank: The company's officials will attend Prabhudas Lilladher BFSI Mid Cap Conference on March 3, and Yes Securities Mid-Sized Specialized Lenders Conference on March 5.

Syngene International: The company's officials will meet Genesis Investment Management on March 2, and Somerset Capital Management on March 4.

Kirloskar Oil Engines: The company's officials will meet institutional investors in a virtual call Organised by Anand Rathi Stock Brokers Pvt Ltd.

Tata Chemicals: The company's officials will meet Blackrock HK on March 3.

Mcdowell Holdings: The board meeting is scheduled on March 9 to consider the un-audited financial results for the quarter/nine months ended December 2020.

Stocks in the news

BPCL, IOC, HPCL: BPCL board approved sale of entire stake in Numaligarh Refinery for Rs 9,875 crore. Oil India, Engineers India and Government of Assam will be picking up the stake.

Shipping Corporation of India: DIPAM Secretary said multiple expressions of interest received for privatisation of Shipping Corporation and the said transaction will now move to the second stage.

Hero MotoCorp: Total sales in February 2020 increased to 5.05 lakh units versus 4.98 lakh units YoY.

UPL: The company signed long-term pact with FMC Corporation for Rynaxypyr active ingredient.

Eicher Motors: Total motorcycle sales in February 2020 rose to 69,659 units versus 68,877 units MoM.

NMDC: Production in February 2020 increased to 3.86 million tonnes from 3.24 million tonnes YoY and sales rose to 3.25 million tonnes from 2.91 million tonnes YoY.

Savita Oil Technologies: Pari Washington India Master Fund reduced stake in the company to 3.21% from 5.33% via open market transaction.

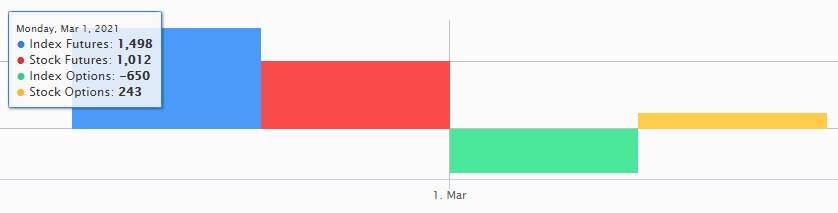

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 125.15 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 194.88 crore in the Indian equity market on March 1, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are in the beginning of March series, not a single is under the F&O ban for March 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!