The market turned lower after hitting a life high in early trade but managed to recoup those losses to end at a record closing high on December 14, supported by positive global cues and October industrial output data.

The BSE Sensex climbed 154.45 points to 46,253.46, while the Nifty50 rose 44.30 points to 13,558.20 and formed a Doji kind of pattern on the daily charts for the third consecutive session as closing was near opening levels.

"Since the last 3 days, the market is closing nearer to opening levels, which is an indication of the indecisive nature of the market. The most surprising part of the day was that the Bank Nifty traded in a narrow range of 200 points. Such type of activity gives birth to sudden volatility," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities told Moneycontrol.

On Tuesday, "the market would rally if it crosses 13,600 levels at the beginning and in that case we could even see the levels of 13,700 or 13,750. The support has shifted to 13,470 from 13,400 levels," he said.

The broader markets outperformed benchmark indices as the Nifty Midcap index was up 0.66 percent and Smallcap gained 0.82 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13,487.97, followed by 13,417.73. If the index moves up, the key resistance levels to watch out for are 13,612.97 and 13,667.73.

Nifty Bank

The Nifty Bank climbed 141 points to close at 30,745.90 The important pivot level, which will act as crucial support for the index, is placed at 30,631.46, followed by 30,517.03. On the upside, key resistance levels are placed at 30,853.07 and 30,960.23.

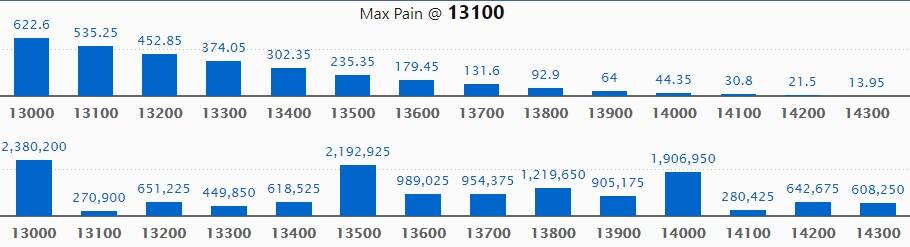

Call option data

Maximum Call open interest of 23.80 lakh contracts was seen at 13,000 strike, which will act as a crucial level in the December series.

This is followed by 13,500 strike, which holds 21.92 lakh contracts, and 14,000 strike, which has accumulated 19.06 lakh contracts.

Call writing was seen at 14,300 strike, which added 2.54 lakh contracts, followed by 13,600 strike which added 1.39 lakh contracts.

Call unwinding was seen at 14,100 strike, which shed 75,675 contracts, followed by 14,200 strike which shed 63,000 contracts.

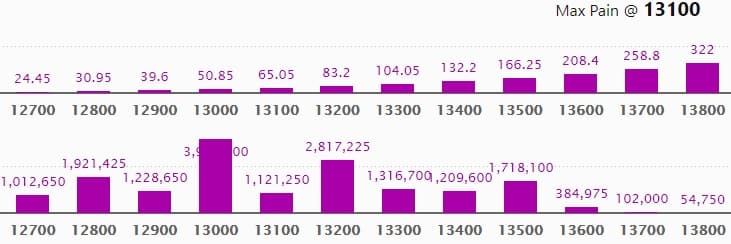

Put option data

Maximum Put open interest of 39.57 lakh contracts was seen at 13,000 strike, which will act as crucial support in the December series.

This is followed by 13,200 strike, which holds 28.17 lakh contracts, and 12,800 strike, which has accumulated 19.21 lakh contracts.

Put writing was seen at 13,200 strike, which added 4.22 lakh contracts, followed by 13,500 strike, which added 2.11 lakh contracts and 13,000 strike which added 1.57 lakh contracts.

A Put unwinding of 1.56 lakh contracts was seen at 12,800 strike on December 14.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

45 stocks saw long build-up

Based on the open interest future percentage, here are the 10 stocks in which a long build-up was seen.

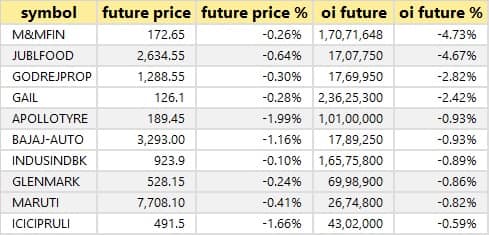

13 stocks saw long unwinding

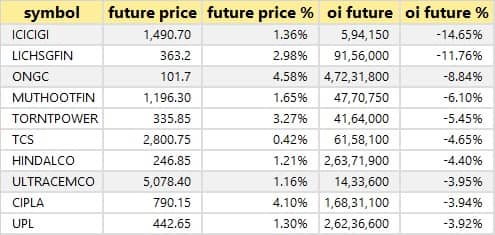

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

30 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

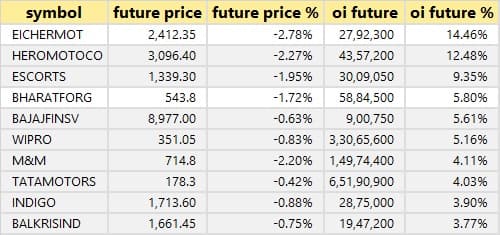

50 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Cipla: The company's officials will participate in Investec Manufacturing Conclave and meet GIC Private on December 15.

Gland Pharma: The company's officials will meet Axis AMC on December 15.

Chemcon Speciality Chemicals: Officials of the company will be interacting with a few investors & analysts (participants) on December 15.

Voltas: The company's officials will be meeting Haitong Securities on December 15 and Edelweiss Management e-Connect on December 16.

Mahindra Lifespace Developers: The company's officials will be meeting JM Financials on December 15, and Goldman Sachs and Banyan Capital and PGIM Investments on December 17.

Eicher Motors: The company's officials will be meeting Sengatii Capital on December 15 and Kotak MF on December 17.

Gokaldas Exports: The company's officials will be meeting Carnelian Capital on December 15.

Titan Company: Its officials will be meeting clients of Motilal Oswal Financial Services on December 15.

Rane (Madras): Board meeting is scheduled on December 17 to consider a fund-raising plan.

HDFC Bank: The bank will consider October-December quarter earnings on January 16.

KNR Constructions: The board meeting is scheduled on December 18 to consider the declaration of bonus shares and other related issues.

Stocks in the news

NMDC: Share buyback to open on December 17, close on December 31.

TCS: Star Alliance expanded strategic partnership with TCS to deliver enhanced customer experiences.

Bank of Maharashtra: The bank successfully raised capital of Rs 200.70 crore through a private placement of BASEL III- compliant Tier II bonds.

MBL Infrastructures: Learned Dispute Review Board comprising three independent members has unanimously recommended Rs 530.73 crore plus interest at 10 percent per annum till the payment of the amount in favour of MBL Infrastructures for one of its completed projects of NHAI.

Ashapura Minechem: Promoter entity Ashapura Industrial Finance increased stake in the company to 15.28 percent from 15.17 percent earlier.

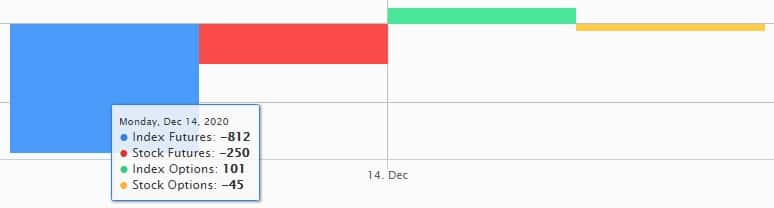

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,264.38 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,721.11 crore in the Indian equity market on December 14, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Canara Bank and Punjab National Bank - are under the F&O ban for December 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!