The market extended the previous week's gains and hit an intraday record high amid volatility on November 23. The rally in oil and gas, technology, metals and pharma stocks supported the market, but the gains restricted due to selling in banks.

The BSE Sensex climbed 194.90 points to 44,077.15, while the Nifty50 rose 67.50 points to 12,926.50 and formed a small-bodied bearish candle which resembles the Hanging Man kind of pattern on the daily charts.

"The Nifty remains in a narrow range of 12,970-12,730 levels over the last few sessions. As long as it stays in a range, that could create a cushion for a sharp upside breakout of the hurdle of 13,000 levels," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"We observe a positive sequence of higher highs and lows on the daily timeframe chart and the daily 14-period RSI is hovering around 70 levels. Though Nifty is registering new all-time highs day by day, there is no indication of any significant reversal pattern at the highs and the buying is consistently emerging from the lows, during small corrections," he said.

According to him, a sustainable move above 13,000 mark is expected to bring sharp upside momentum back into action, which could later pull Nifty towards 13,500-13,600 levels in the near term. Inability to show upside breakout of 13,000 mark could result in further consolidation or minor weakness from the highs, he feels.

The broader markets remained strong with the Nifty Midcap index rising 1.3 percent and Smallcap up 2 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 12,845.2, followed by 12,763.9. If the index moves up, the key resistance levels to watch out for are 12,988.3 and 13,050.1.

Nifty Bank

The Bank Nifty underperformed Nifty50, falling 211.80 points to 29,024.20 on November 23. The important pivot level, which will act as crucial support for the index, is placed at 28,753.97, followed by 28,483.73. On the upside, key resistance levels are placed at 29,393.37 and 29,762.54.

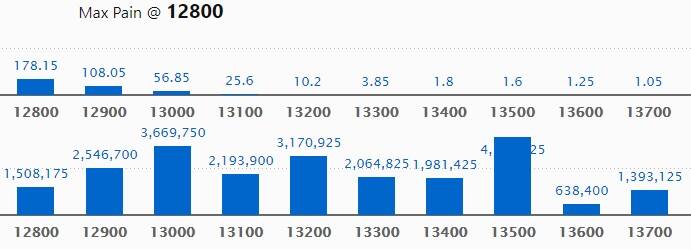

Call option data

Maximum Call open interest of 41.32 lakh contracts was seen at 13,500 strike, which will act as crucial resistance level in the November series.

This is followed by 13,000 strike, which holds 36.69 lakh contracts, and 13,200 strike, which has accumulated 31.7 lakh contracts.

Call writing was seen at 13,500 strike, which added 8.4 lakh contracts, followed by 13,200 strike which added 5.82 lakh contracts and 13,100 strike which added 5.4 lakh contracts.

Call unwinding was seen at 12,800 strike, which shed 6.55 lakh contracts, followed by 12,700 strike which shed 2.52 lakh contracts and 12,900 strike which shed 2.42 lakh contracts.

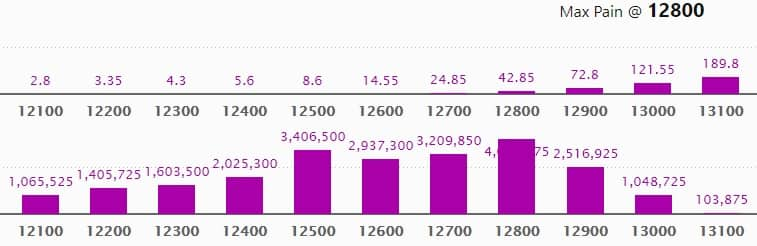

Put option data

Maximum Put open interest of 40.19 lakh contracts was seen at 12,800 strike, which will act as crucial support in the November series.

This is followed by 12,500 strike, which holds 34.06 lakh contracts, and 12,700 strike, which has accumulated 32.09 lakh contracts.

Put writing was seen at 12,900 strike, which added 10.49 lakh contracts, followed by 12,600 strike, which added 5.04 lakh contracts and 12,400 strike which added 4.08 lakh contracts.

Put unwinding was seen at 12,000 strike, which shed 2.97 lakh contracts, followed by 12,100 strike, which shed 2.41 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

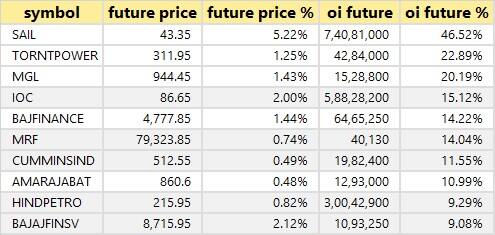

53 stocks saw long build-up

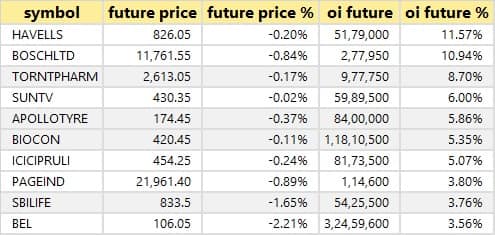

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

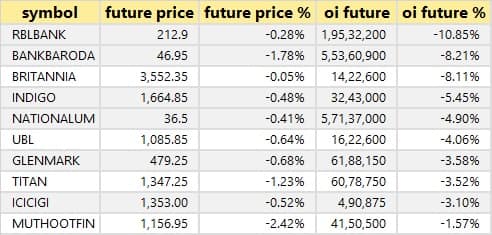

17 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

26 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

43 stocks witnessed short-covering

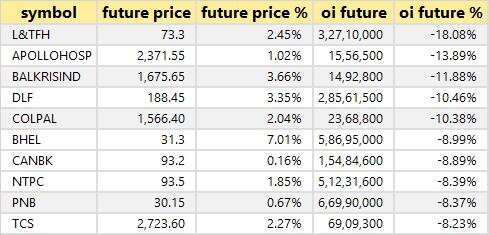

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

(For more bulk deals, click here)

Analysts Meets/Board Meetings

Gravita India: The company's officials will meet various institutional investors on November 24.

Laurus Labs: The company's officials will attend Ambit's Healthcare Conclave on November 24.

Mahindra Holidays & Resorts: The company's officials will meet Enam AMC on November 24, and Unifi Capital and Nirmal Bang on November 25.

Remi Sales & Engineering: A board meeting is scheduled on November 26 to consider the voluntary delisting of equity shares.

Affle India: The company's officials will meet Enam Asset Management and Franklin Templeton on November 24, and Manulife and Malabar Investments on November 25.

Solara Active Pharma Sciences: The company will be interacting with various investors/analysts on November 24 over a conference call.

Tech Mahindra: The company's officials will attend Edelweiss India e-Conference 2020 on November 25, and Institutional Investor meeting on November 27.

Tata Steel: The company's officials will meet Ishana Capital on November 25.

Welspun Corp: The company will be attending 'Virtual Investor Conference' organised by Kotak Securities on November 24.

IRCTC: The company will be participating in non-deal road shows and shall be meeting prospective investors from November 24 to November 27.

Stocks in the news

Coal India: Four trade unions serve notice for a strike on November 26. The company to increase non-coking coal price by Rs 10 per tonne effective December 1.

Ingersoll-Rand India: Ingersoll-Rand Inc proposed to sell up to 14,25,798 equity shares in Ingersoll-Rand (India) via offer for sale on November 24-25.

Opto Circuits: The company reported a loss of Rs 4.67 crore in Q2FY21 against loss of Rs 1,270.8 crore, revenue fell to Rs 17.5 crore from Rs 39.5 crore YoY.

Exide Industries: The company further invested Rs 33.17 crore in its subsidiary (joint venture company) Exide Leclanche Energy and increased its shareholding to 80.15 percent.

HFCL: Promoter entity MN Ventures acquired 5 lakh equity shares in the company via open market transaction.

Wockhardt: Promoter entity Themisto Trustee Company Pvt Ltd released pledge on 14 lakh equity shares.

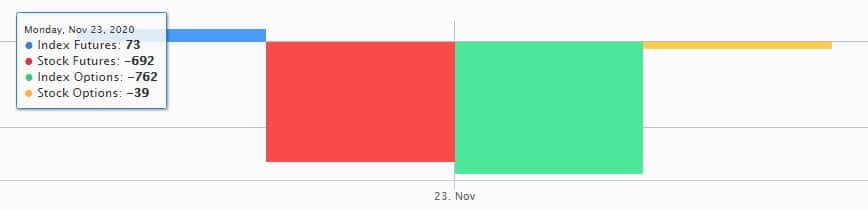

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 4,738.44 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,944.05 crore in the Indian equity market on November 23, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - Adani Enterprises, Bank of Baroda, Federal Bank, Indiabulls Housing Finance, NALCO and SAIL - are under the F&O ban for November 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!