The market climbed another milestone of 12,800 on the Nifty and ended the one-hour Muhurat trading session for Samvat 2077 at a record closing high on November 14, backed by buying across sectors. The sectoral indices gained in the range of 0.4-0.8 percent.

The BSE Sensex rose 194.98 points to 43,637.98, while the Nifty50 was up 60.30 points at 12,780.30, but formed a small-bodied bearish candle on the daily charts as closing was lower than opening levels. During the week, both indices gained 4.2 percent.

The broader markets also participated in the runup as the Nifty Midcap index gained half a percent and the Smallcap index was up 0.75 percent amid strong breadth. About four shares advanced for every share declining on the NSE.

"The market is consolidating and slowly inching higher towards 12,900/13,000 levels. The breadth of the broader market is quite satisfactory, which is indicating a firm grip of bulls and would not allow the Nifty to fall below 12600 levels in the normal circumstances," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities, told Moneycontrol.

The market was shut on Monday for Diwali Balipratipada.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 12,743.57, followed by 12,706.93. If the index moves up, the key resistance levels to watch out for are 12,822.77 and 12,865.33.

Nifty Bank

The Bank Nifty also traded in line with Nifty50, rising 128.60 points to 28,594.30 on November 14. The important pivot level, which will act as crucial support for the index, is placed at 28,433.27, followed by 28,272.23. On the upside, key resistance levels are placed at 28,753.87 and 28,913.43.

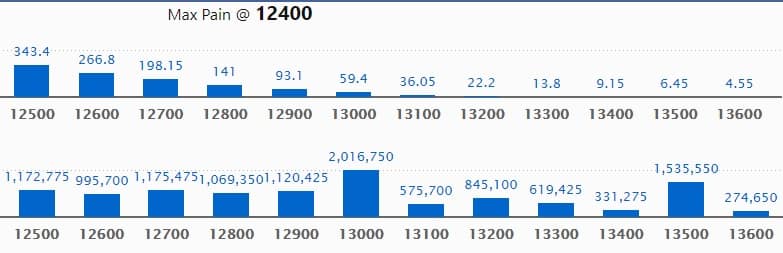

Call option data

Maximum Call open interest of 20.16 lakh contracts was seen at 13,000 strike, which will act as a crucial resistance level in the November series.

This is followed by 13,500 strike, which holds 15.35 lakh contracts, and 12,700 strike, which has accumulated 11.75 lakh contracts.

Call writing was seen at 12,800 strike, which added 87,975 contracts, followed by 13,200 strike which added 60,150 contracts and 13,100 strike which added 55,800 contracts.

Call unwinding was seen at 12,900 strike, which shed 95,325 contracts, followed by 12,600 strike which shed 33,825 contracts and 12,700 strike which shed 23,550 contracts.

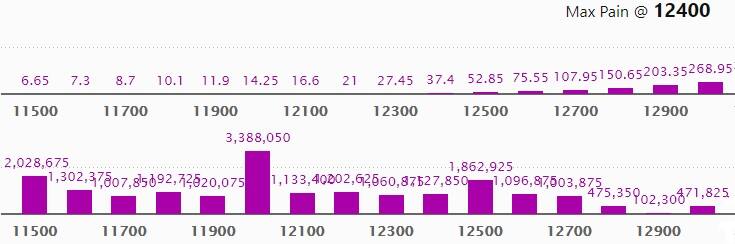

Put option data

Maximum Put open interest of 33.88 lakh contracts was seen at 12,000 strike, which will act as crucial support in the November series.

This is followed by 11,500 strike, which holds 20.28 lakh contracts, and 12,500 strike, which has accumulated 18.62 lakh contracts.

Put writing was seen at 12,800 strike, which added 1.46 lakh contracts, followed by 12,500 strike, which added 1.44 lakh contracts and 12,600 strike which added 1.33 lakh contracts.

Put unwinding was seen at 12,100 strike, which shed 1.14 lakh contracts, followed by 11,700 strike, which shed 28,800 contracts.

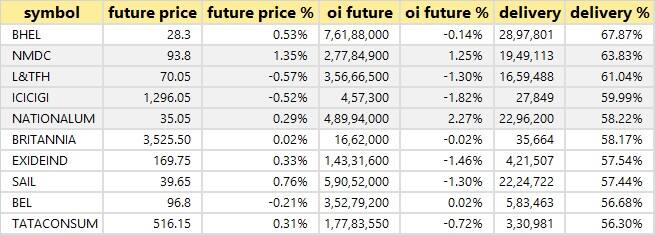

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

30 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

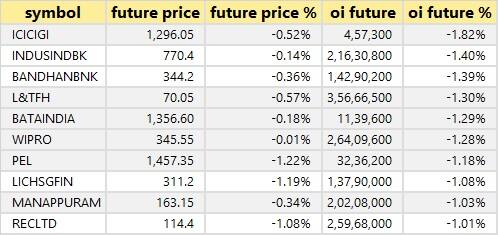

43 stocks saw long unwinding

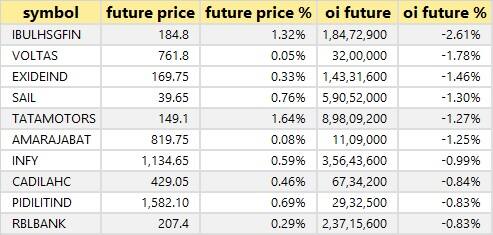

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

13 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

50 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

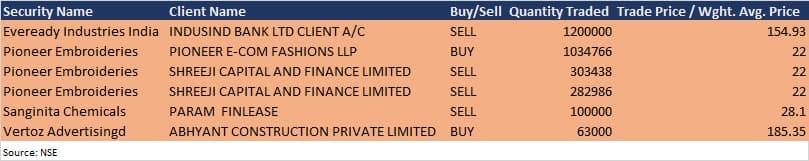

Bulk deals

(For more bulk deals, click here)

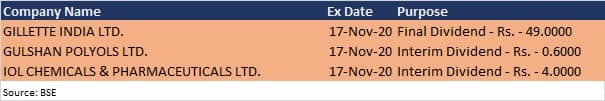

Corporate Action, and Results on November 17

Advance Lifestyles, ICL Organic Dairy Products, Jagson Airlines, Mohota Industries and Vallabh Steels will declare their quarterly earnings on November 17.

Stocks in the news

Reliance Industries: Reliance Retail Ventures acquired 96 percent equity shares of Urban Ladder Home Decor Solutions for Rs 182.12 crore.

Rajesh Exports: The company reported consolidated profit at Rs 173 crore in Q2FY21 compared to Rs 315.6 crore, revenue rose to Rs 1,02,149.8 crore from Rs 66,827.3 crore YoY.

Great Eastern Shipping: The company signed a contract to buy a second-hand Capesize bulk carrier. The 2014 Philippines built vessel is expected to join the company's fleet in H2 FY21.

Ducon Infratechnologies: The board approved the issuance and allotment of 5,70,00,000 equity shares and 5,96,34,400 warrants convertible into equity shares to Arun Govil, Promoter and Managing Director of the company, and 1,50,00,000 equity shares to Atul Kumar, non-promoter of the company.

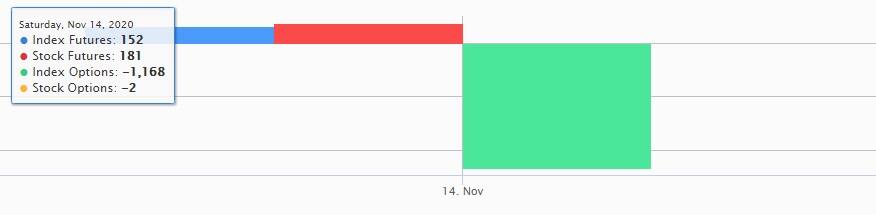

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 78.53 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 20.27 crore in the Indian equity market on November 14, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Eight stocks - BHEL, Canara Bank, Indiabulls Housing Finance, Jindal Steel & Power, LIC Housing Finance, SAIL, Sun TV Network and Tata Motors - are under the F&O ban for November 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!