The market snapped three-day losing streak and closed higher on November 2 following positive global cues, backed by banking and financials after ICICI Bank earnings, and ahead of US presidential elections.

The BSE Sensex rose 143.51 points to 39,757.58, while the Nifty50 gained 26.80 points to close at 11,669.20, but formed small bodied bearish candle which resembles a Hammer kind of pattern on the daily charts.

"Minor negative candle was formed with long lower shadow, which indicates an emergence of buying from the lower levels. We observed back to back formation of two identical candle patterns in the last two sessions. These patterns have formed just below the key overhead resistance of 11,750 levels. This action could signal that the bulls are preparing to surpass the hurdle shortly," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"We observe a formation of minor degree of lower highs on the daily chart and any upside bounce from here could open another lower high around 11,800-11,850 levels. This upside could emerge only after the sustainable movement above the 11,750 levels (resistance as per the concept of change in polarity)," he said.

The broader markets ended mixed with advance decline ratio favouring bears. The Nifty Midcap index was up 0.4 percent, but Smallcap fell 1.55 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,575.83, followed by 11,482.47. If the index moves up, the key resistance levels to watch out for are 11,744.13 and 11,819.07.

Nifty Bank

The Bank Nifty surged 991.60 points or 4.15 percent to 24,892.50 and outperformed Nifty50 on November 2. The important pivot level, which will act as crucial support for the index, is placed at 24,295.73, followed by 23,698.97. On the upside, key resistance levels are placed at 25,314.13 and 25,735.77.

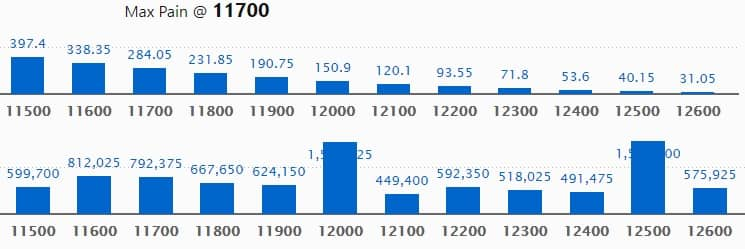

Call option data

Maximum Call open interest of 15.55 lakh contracts was seen at 12,500 strike, which will act as crucial resistance in the November series.

This is followed by 12,000 strike, which holds 15.26 lakh contracts, and 11,600 strike, which has accumulated 8.12 lakh contracts.

Call writing was seen at 12,500 strike, which added 2.01 lakh contracts, followed by 11,600 strike which added 1.02 lakh contracts and 12,100 strike which added 1 lakh contracts.

Call unwinding was seen at 12,000 strike, which shed 43,500 contracts, followed by 11,500 strike which shed 7,725 contracts.

Put option data

Maximum Put open interest of 26.44 lakh contracts was seen at 11,000 strike, which will act as crucial support in the November series.

This is followed by 11,500 strike, which holds 21.08 lakh contracts, and 10,800 strike, which has accumulated 12.52 lakh contracts.

Put writing was seen at 11,000 strike, which added 4.7 lakh contracts, followed by 10,800 strike, which added 1.11 lakh contracts and 11,200 strike which added 75,375 contracts.

Put unwinding was witnessed at 12,000 strike, which shed 22,650 contracts, followed by 11,800 strike which shed 17,850 contracts and 11,500 strike, which shed 16,650 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

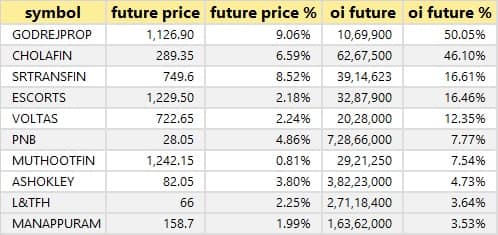

32 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

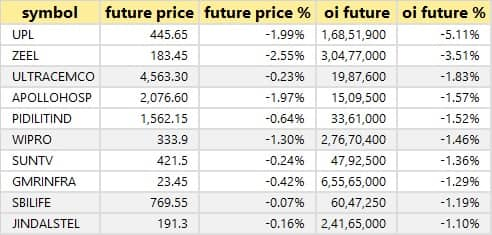

19 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

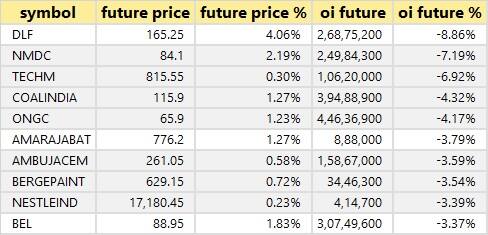

36 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are top 10 stocks in which short build-up was seen.

49 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

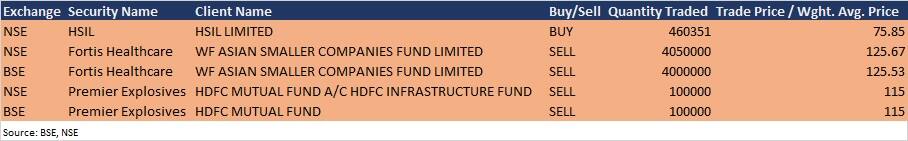

Bulk deals

(For more bulk deals, click here)

Results on November 3

Sun Pharmaceutical Industries, Adani Gas, Adani Ports, Ajanta Pharma, CARE Ratings, Dabur India, Deepak Fertilisers, Dhanlaxmi Bank, Eris Lifesciences, Godrej Properties, Jagran Prakashan, JSW Energy, Kansai Nerolac Paints, Muthoot Finance, PVR, Ramco Systems, Transport Corporation of India and Varun Beverages among 90 companies will declare their quarterly earnings on November 3.

Stocks in the news

Tata Motors: Company recorded higher domestic sales at 49,669 units in October against 39,152 units YoY.

Punjab National Bank: Bank reported higher profit at Rs 620.8 crore in Q2FY21 against Rs 308.5 crore, NII grew to Rs 8,393.2 crore from Rs 6,748.4 crore QoQ.

City Union Bank: Bank reported lower profit at Rs 157.7 crore in Q2FY21 against Rs 193.5 crore, NII rose to Rs 475.1 crore from Rs 411.5 crore YoY.

Zee Entertainment Enterprises: Company reported lower profit at Rs 93.4 crore in Q2FY21 against Rs 413 crore, revenue fell to Rs 1,722.7 crore from Rs 2,122 crore YoY.

Cadila Healthcare: Company reported higher profit at Rs 473 crore in Q2FY21 against Rs 107 crore, revenue increased to Rs 3,820 crore from Rs 3,366 crore YoY.

NTPC: Company reported higher standalone profit at Rs 3,504.8 crore in Q2FY21 against Rs 3,262.4 crore, revenue rose to Rs 24,677.1 crore from Rs 22,764.6 crore YoY.

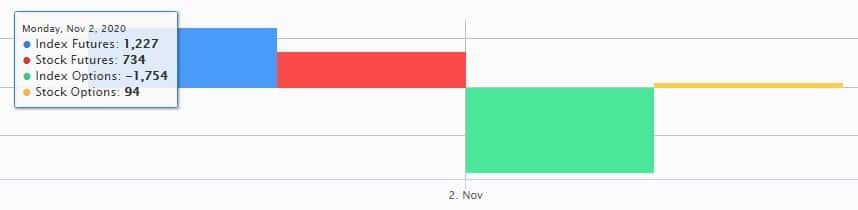

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 740.61 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 533.97 crore in the Indian equity market on November 2, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Not a single stock is under the F&O ban for November 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!