The market gained for the third consecutive session on October 5, though it was a volatile day as the Supreme Court deferred its decision on the moratorium interest waiver case. The recovery in US President Donald Trump's health after testing COVID-19 positive and rally in IT stocks after TCS' share buyback plan aided sentiment.

The BSE Sensex was up 276.65 points to close at 38,973.70, while the Nifty50 climbed 86.40 points to 11,503.40 and formed a small-bodied bullish candle which resembles a Shooting Star kind of pattern on the daily charts.

"A small positive candle was formed with gap up opening and with long upper and lower shadow. This pattern indicates a formation of a high wave-type candle pattern at these highs. Normally, a formation of high wave after a reasonable rise could signal a confused state of mind among participants, and some times, it acts as a reversal pattern, after the confirmation. The opening upside gap of Monday, which was a second back-to-back gap remained unfilled," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Nifty is currently closed just above the resistance of down sloping trend line at 11,500 (taken from the swing high of 11,794 and connected lower high) and we observe intraday strength in the market around the hurdle. Hence, one may expect a further attempt of upside breakout of 11,550-11,600 levels in the coming sessions," he said.

Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities also feels the texture of charts clearly suggests the short-term trend is still up but a strong possibility of intraday correction cannot be ruled out if the index trades below 11,450.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,444.4, followed by 11,385.5. If the index moves up, the key resistance levels to watch out for are 11,570.1 and 11,636.9.

Nifty Bank

The Bank Nifty rose 125 points to end at 22,371 on October 5. The important pivot level, which will act as crucial support for the index, is placed at 22,155.87, followed by 21,940.83. On the upside, key resistance levels are placed at 22,677.27 and 22,983.63.

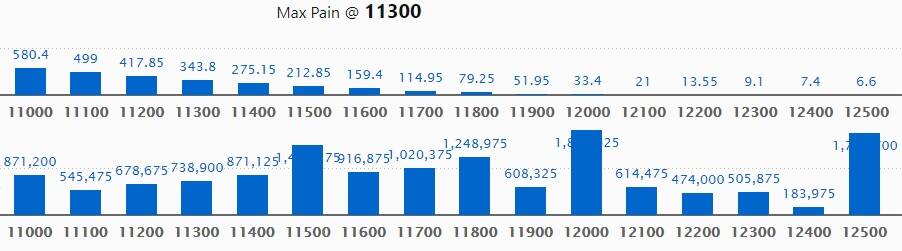

Call option data

Maximum Call open interest of 18.11 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the October series.

This is followed by 12,500 strike, which holds 17.45 lakh contracts, and 11,500 strike, which has accumulated 14.98 lakh contracts.

Call writing was seen at 11,800 strike, which added 2.12 lakh contracts, followed by 12,100, which added 1.27 lakh contracts, and 12,200 strike, which added 1.15 lakh contracts.

Call unwinding was seen at 11,500 strike, which shed 1.58 lakh contracts, followed by 11,000 strike, which shed 1.5 lakh contracts and 11,300 strike which shed 1.3 lakh contracts.

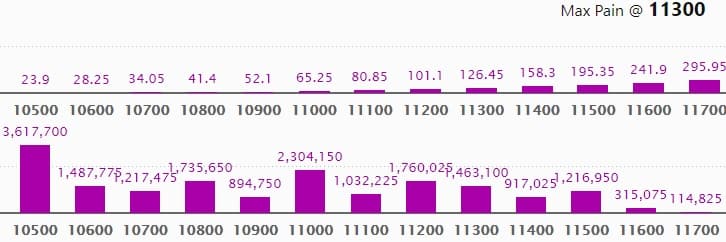

Put option data

Maximum Put open interest of 36.17 lakh contracts was seen at 10,500 strike, which will act as crucial support in the October series.

This is followed by 11,000 strike, which holds 23.04 lakh contracts, and 11,200 strike, which has accumulated 17.60 lakh contracts.

Put writing was seen at 11,500 strike, which added 3.46 lakh contracts, followed by 11,400 strike, which added 2.65 lakh contracts and 11,200 strike which added 2.01 lakh contracts.

Put unwinding was witnessed at 12,000 strike, which shed 25,575 contracts, followed by 10,500 strike which shed 11,100 contracts.

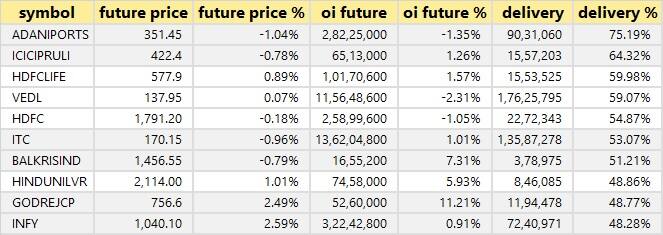

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

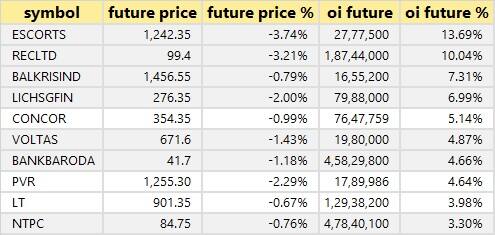

47 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

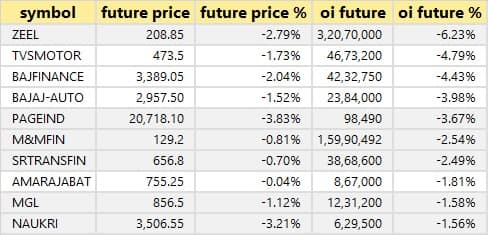

20 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

37 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are top 10 stocks in which short build-up was seen.

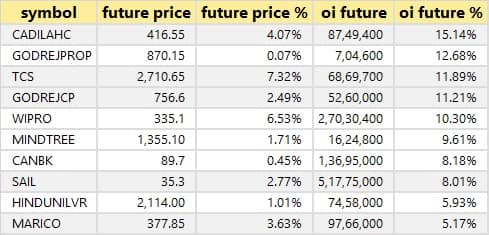

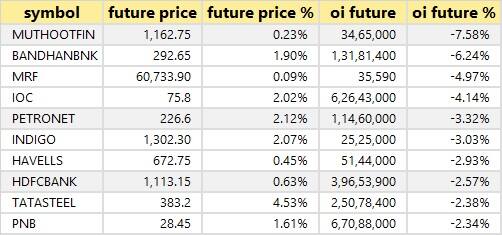

32 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

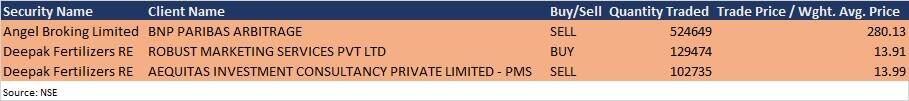

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Eicher Motors: The company's officials will interact with Comgest and BNP Paribas on October 6, and HDFC Life Insurance on October 7, via a conference call.

Shalby: The company to announce September quarter earnings on October 12.

L&T Finance Holdings: The company to announce September quarter earnings on October 22.

Sandhar Technologies: The company to announce September quarter earnings on November 6.

Kokuyo Camlin: The company to announce September quarter earnings on October 28.

Stocks in the news

Infibeam Avenues: The company entered into a definitive agreement with Jio Platforms and its affiliates.

Escorts: The company completed the acquisition of 2 crore equity shares of KAI from KBT, constituting 40 percent of the share capital of KAI at Rs 45 per share for an aggregate value of Rs 90 crore.

Tata Motors: JLR retail sales rose 50 percent to 1,13,569 vehicles in Q2FY21, against 74,067 vehicles in Q1FY21, but down 11.9 percent YoY.

Majesco: The company to consider a proposal for buyback of fully paid-up equity shares on October 8.

Sterlite Technologies: The company approved the appointment of Mihir Modi as Chief Financial Officer.

Sobha: In Q2FY21, the company achieved a total sales volume of 8,91,700 square feet valued at Rs 690 crore, with a total average realisation of Rs 7,737 per square feet.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 236.71 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 471.56 crore in the Indian equity market on October 5, as per provisional data available on the NSE.

Stock under F&O ban on NSE

One stock - Vedanta - is under the F&O ban for October 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!