The market witnessed sharp selling pressure in the afternoon and closed with more than 2 percent loss on September 21 as traders worried about rising coronavirus cases again in several nations including Europe.

The BSE Sensex fell 811.68 points or 2.09 percent to 38,034.14, while the Nifty50 plunged 254.50 points or 2.21 percent to 11,250.50 and formed a large bearish candle which resembles a Long Black Day kind of pattern on the daily charts, after consolidation in previous 5-6 sessions.

"The index has broken below the crucial lower support of 20- day EMA at 11,415. The downward breakout attempt of a couple of occasions has resulted in a false downside breakout and the market regained that support in a short period of time. Now, the market has closed below that moving average support on Monday. If Nifty fails to regain that support in the next 1-2 sessions by showing upside bounce above 11,450, then one may expect a resumption of broad-based weakness in the market," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"The lower area of 11,100-11,150 is likely to offer minor support for the market in the next few sessions, but the market is expected to break below that support area in the near term. The next downside levels to be watched at 10,700 in the next 1-2 weeks," he said.

The correction was seen across sectors with Nifty Bank, Auto, FMCG, Metal and Pharma leading the charge which saw 3-5 percent fall. The Nifty Midcap and Smallcap indices also corrected nearly 4 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,134.27, followed by 11,018.03. If the index moves up, the key resistance levels to watch out for are 11,450.97 and 11,651.43.

Nifty Bank

The Bank Nifty slumped 664.25 points or 3.02 percent to close at 21,366.80 on September 21. The important pivot level, which will act as crucial support for the index, is placed at 21,061.13, followed by 20,755.47. On the upside, key resistance levels are placed at 21,885.63 and 22,404.47.

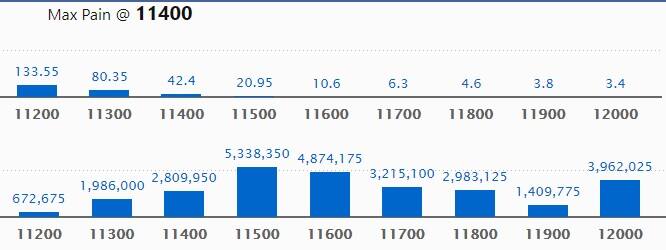

Call option data

Maximum Call open interest of 53.38 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the September series.

This is followed by 11,600 strike, which holds 48.74 lakh contracts, and 12,000 strike, which has accumulated 39.62 lakh contracts.

Call writing was seen at 11,500 strike, which added 20.91 lakh contracts, followed by 11,400, which added 17.29 lakh contracts, and 11,300 strike, which added 16.2 lakh contracts.

Call unwinding was seen at 11,900 strike, which shed 6.37 lakh contracts, followed by 12,000 strike, which shed 4.28 lakh contracts and 11,800 strike which shed 3.4 lakh contracts.

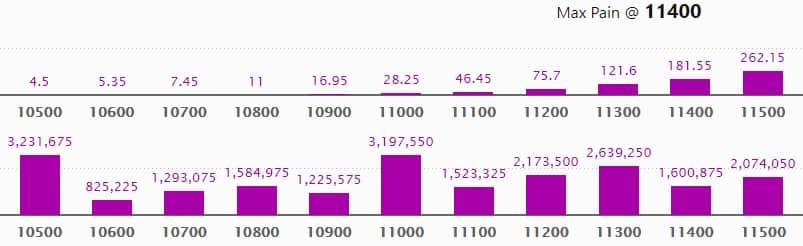

Put option data

Maximum Put open interest of 32.31 lakh contracts was seen at 10,500 strike, which will act as crucial support in the September series.

This is followed by 11,000 strike, which holds 31.97 lakh contracts, and 11,300 strike, which has accumulated 26.39 lakh contracts.

Put writing was seen at 11,300 strike, which added 3.49 lakh contracts, followed by 10,700 strike, which added 32,325 contracts.

Put unwinding was witnessed at 11,500 strike, which shed 13.09 lakh contracts, followed by 11,400 strike which shed 8.65 lakh contracts and 11,600 strike which shed 3.04 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

No stock saw long build-up

Not a single stock witnessed long build-up on September 21.

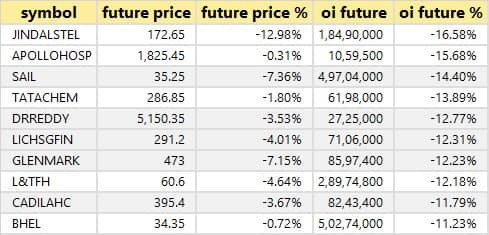

91 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

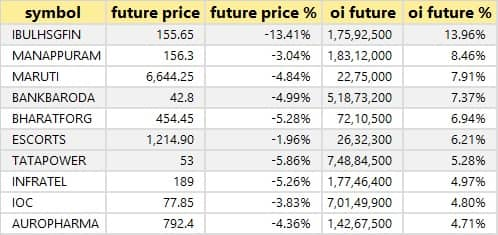

43 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

4 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are 4 stocks in which short-covering was seen.

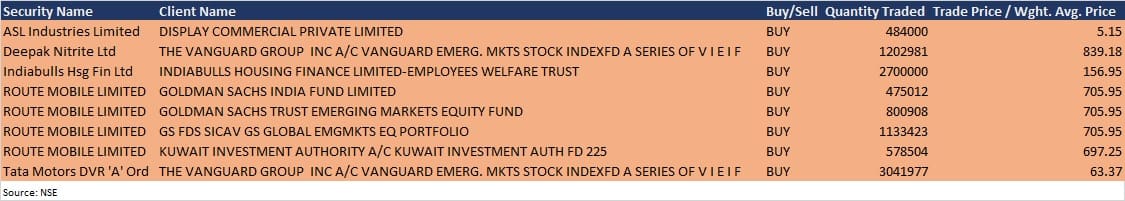

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Cipla: The company's representatives to attend JP Morgan's India Investor Summit Virtual on September 22 and to meet Jefferies India via call on September 23.

SRF: Ashish Bharat Ram, Managing Director and Rahul Jain, President and CFO, will be interacting with certain institutional investors through various audio-visual means from September 21 till September 30.

Rossari Biotech: Officials of the company will interact with analysts and investors, Edelweiss Securities and Neuberger Berman, on September 22.

Mahindra Logistics: Group Conference Call is scheduled to be held with Bajaj Allianz and Philip Capital on September 22.

IRCTC: Management of the company will be meeting various investors/analysts/institutions through a group conference call being organised by IDBI Capital Markets and Securities on September 22.

Fine Organic Industries: Officials of the company will be doing virtual meeting with investors/analysts (participants) on September 22.

UPL: The company will be participating in a conference call with analysts/investors on September 22 and 24.

IIFL Finance: The company's representatives will be meeting Triada Capital via video conference call on September 22.

Welspun Enterprises: Officials of the company will be attending an investor conference organised by Antique Stock Broking on September 22.

Crompton Greaves Consumer Electricals: The company's representatives will meet M&G Investment Management on September 24, Alliancebernstein LP on September 25 and Mirae Asset Management on September 28 via call.

Tech Mahindra: Officials of the company to interact with investors (virtual) on September 22 and 24, and attend JP Morgan – India Investor Summit 2020 (virtual) on September 24.

Stocks in the news

GMM Pfaudler: Promoter to sell 25.71 lakh shares via offer for sale, floor price set at Rs 3,500 per share on September 22-23.

Angel Broking: IPO will open for subscription on September 22 and close on September 24, with a price band at Rs 305-306 per share.

Phillips Carbon Black: CARE reaffirmed the company's long term credit rating at AA-/Stable.

Shree Renuka Sugars: The company approved the allotment of 21,16,70,481 equity shares, for cash at a price of Rs 8.74 per share aggregating to Rs 185 crore on preferential basis to Promoter, Wilmar Sugar Holdings Pte Ltd.

Ramco Cements: ICRA reaffirmed long term credit rating at AA+/Stable.

MEP Infrastructure Developers: Promoter entity Sudha D Mhaiskar released 4.5 lakh pledged shares.

HSIL: The company approved buyback of up to Rs 70 crore worth of shares at Rs 105 per share.

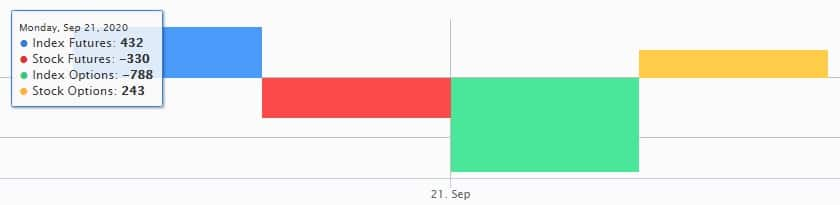

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 539.81 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 517.95 crore in the Indian equity market on September 21, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Four stocks -- Glenmark Pharma, Vodafone Idea, SAIL and Vedanta-- are under the F&O ban for September 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!