The market snapped its six-day winning streak and fell sharply amid reports of India-China border tensions on August 31. Selling was seen across sectors with bank, automobile, metal and pharmaceuticals falling 3-5 percent.

The Sensex corrected 839.02 points, or 2.13 percent, to 38,628.29, and the Nifty plunged 260.1 points, or 2.23 percent, to 11,387.5. It formed a large bearish candle, which resembles a Long Black Day kind of pattern on the daily charts and engulfed the high-low range of the last six sessions.

"This pattern could be considered as a Bearish Engulfing pattern. Hence, formation of such pattern at the new swing highs and near the hurdle could be considered as an important reversal pattern. We need follow through weakness in the subsequent session to confirm the reversal pattern," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"The short term trend of Nifty seems to have reversed. We expect sell on rise opportunity on any upside bounce back attempt around 11,450-11,500 levels. One may expect further weakness in the short term and the next lower levels to be watched at 11,100-11,000," he said.

The broader markets were also caught in bear trap with the Nifty Midcap and Smallcap indices falling 4 percent and 4.75 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty According to pivot charts, the key support levels for the Nifty is placed at 11,210.8, followed by 11,034.1. If the index moves up, the key resistance levels to watch out for are 11,679.2 and 11,970.9.

Nifty Bank The Bank Nifty underperformed the Nifty, falling 769.50 points, or 3.14 percent, to 23,754.30. The important pivot level, which will act as crucial support for the index, is placed at 23,015.54, followed by 22,276.77. On the upside, key resistance levels are placed at 24,862.84 and 25,971.37.

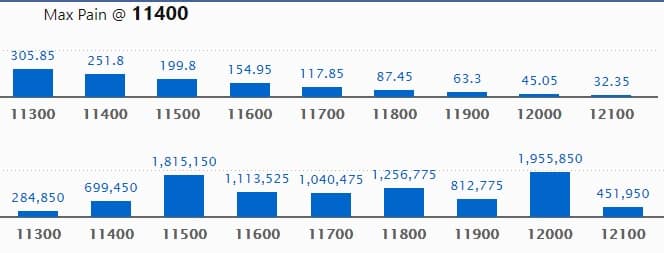

Call option data Maximum Call open interest of 19.55 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the September series.

This is followed by 11,500 strike, which holds 18.15 lakh contracts, and 11,800 strike, which has accumulated 12.56 lakh contracts.

Call writing was seen at 11,700, which added 2.03 lakh contracts, followed by 11,500, which added 1.91 lakh contracts, and 11,600 strikes, which added 1.08 lakh contracts.

Call unwinding was seen at 12,000, which shed 2.41 lakh contracts, followed by 11,900 strikes, which shed 53,250 contracts.

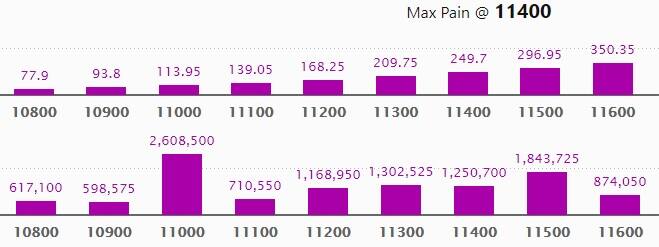

Put option data Maximum Put open interest of 26.08 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 11,300, which holds 13.02 lakh contracts, and 11,200 strikes, which has accumulated 11.68 lakh contracts.

Put writing was seen at 11,700, which added 1.03 lakh contracts, followed by 11,800 strikes, which added 19,425 contracts.

Put unwinding was witnessed at 11,300, which shed 3.18 lakh contracts, followed by 11,500, which shed 3.1 lakh contracts, and 11,600 strikes, which shed 2.91 lakh contracts.

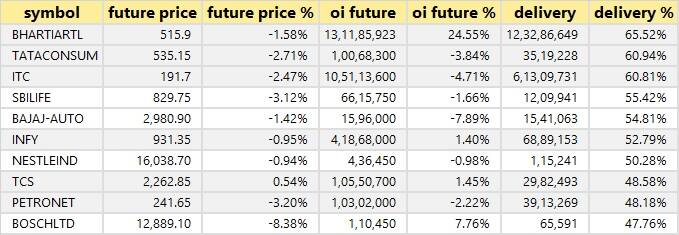

Stocks with a high delivery percentage A high delivery percentage suggests that investors are showing interest in these stocks.

4 stocks saw long build-up Based on the open interest future percentage, here are the top 4 stocks in which long build-up was seen.

69 stocks saw long unwinding Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

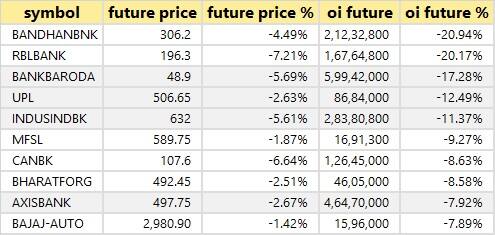

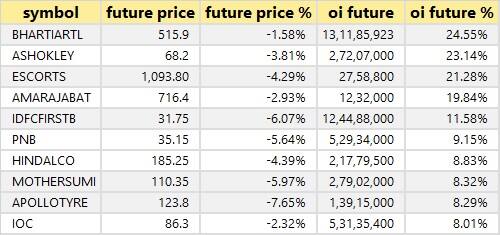

62 stocks saw short build-up An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

1 stock witnessed short-covering A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here is the stock in which short-covering was seen.

![]()

Bulk deals Aarey Drugs: Vikas Ecotech bought another 2.5 lakh shares in the company at Rs 38.04 per share on the BSE.

Sheela Foam: DSP Mutual Fund acquired 5.9 lakh shares in company at Rs 1,365 per share. However, Tushaar Gautam sold 10 lakh shares at the same price on the BSE.

Aavas Financiers: New World Fund and Nomura India Investment Fund Mother Fund bought 5.2 lakh shares each in the company at Rs 1,409.97 and Rs 1,410 per share, respectively. However, Partners Group ESCL and Partners Group Private Equity Masterfund sold 17,78,105 and 7,80,319 shares in the company at Rs 1,410.01 and Rs 1,414.96 per share, respectively, on the NSE.

Alankit: LTS Investment Fund acquired 10 lakh shares in the company at Rs 18.08 per share on the NSE.

Bharti Airtel: Integrated Core Strategies (Asia) Pte bought 3,80,10,584 shares in company at Rs 513.79 per share on the NSE.

CG Power & Industrial Solutions: Swapnil Mehta sold 32,51,471 shares in company at Rs 22.4 per share on the NSE.

Future Enterprises: Snehil Mehta bought 60,08,000 shares in company at Rs 21.09 per share on the NSE.

Future Retail: Norges Bank on Account of the Government Pension Fund Global sold 95 lakh shares in company at Rs 158.61 per share on the NSE.

Jash Engineering: Bellwether Capital Pvt acquired 62,126 shares in company at Rs 160 per share on the NSE.

(For more bulk deals, click here)

Earnings on September 1Oil and Natural Gas Corporation (ONGC), Anant Raj, Fiem Industries, Shalimar Paints, etc will announce their June quarter earnings on September 1.

Stocks in the news L&T completed divestment of its electrical and automation operations to Schneider Electric.

Biocon and Mylan launched insulin drug Semglee in the US market.

Century Textiles: Aditya Birla Sun Life AMC raised stake in the company to 5.23 percent from 4.94 percent earlier.

Bharat Dynamics: Q1 loss at Rs 78 crore versus a profit of Rs 65.54 crore, revenue at Rs 31.4 crore versus Rs 491.56 crore YoY.

JVL Agro Industries: Asia Investment Corporation (Mauritius) reduced stake in company to 3.01 percent from 5.03 percent earlier.

Zensar Technologies received US patent for its innovative tool enabling direct conversation with the organisation's leadership - ZenVerse.

JB Chemicals & Pharmaceuticals: Promoters sold 48,54,667 shares of company to Tau Investment Holdings, Singapore.

BEML bagged Rs 842 crore order from the Ministry of Defence.

Fund flow

FII and DII data Foreign institutional investors (FIIs) net sold shares worth Rs 3,395 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 681 crore in the Indian equity market on August 31, as per provisional data available on the NSE.

Stock under F&O ban on NSE One stock -- Vodafone Idea -- is under the F&O ban for September 1. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!