The market started off the week on a positive note with the benchmark indices rising more than half a percent on July 4, backed by banking and financial services, and FMCG stocks.

The BSE Sensex climbed 327 points to 53,235, while the Nifty50 rose 83 points to 15,835 and formed a bullish candle on the daily charts.

"A long bull candle was formed on the daily chart, which signals a broader range movement of 15,900-15,700 levels and the market is placed at the upper range. After the formation of a hammer-type candle pattern on Friday, a sustainable upmove in the Nifty on Monday suggests a sharp upside bounce in the market ahead," Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Shetti believes that the short-term trend of the Nifty continues to be positive with range movement. The market is now showing signs of witnessing a decisive upside breakout of the important resistance of 15,900 levels in the next 1-2 sessions, he said, adding a sustainable upmove above 15,900-15,950 is expected to pull the Nifty towards the next resistance of 16,300 in the short term.

Immediate support is placed at 15,750.

The broader markets also gained momentum with the Nifty Midcap 100 index rising 0.7 percent and Smallcap 100 index climbing 0.6 percent.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,714, followed by 15,593. If the index moves up, the key resistance levels to watch out for are 15,904 and 15,974.

Nifty Bank jumped 401 points or 1.2 percent to 33,941 on Monday, outperforming broader space. The important pivot level, which will act as crucial support for the index, is placed at 33,645, followed by 33,349. On the upside, key resistance levels are placed at 34,108 and 34,275 levels.

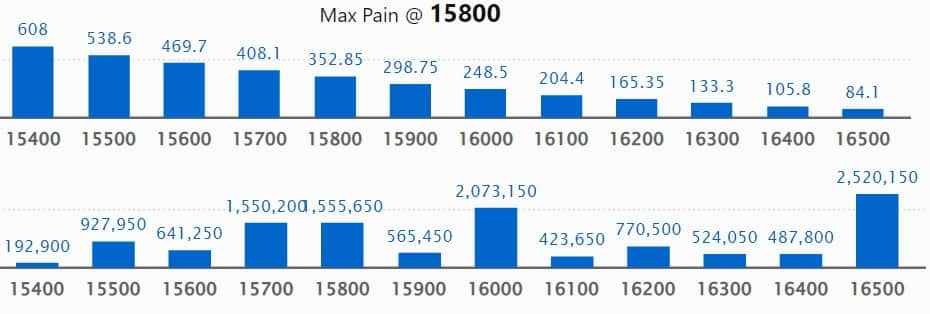

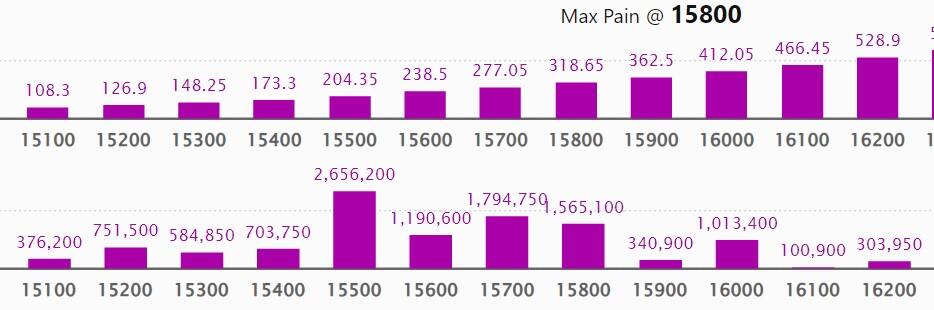

Maximum Call open interest of 25.2 lakh contracts was seen at 16,500 strike, which will act as a crucial resistance level in the July series.

This is followed by 17,000 strike, which holds 23.72 lakh contracts, and 16,000 strike, which has accumulated 20.73 lakh contracts.

Call writing was seen at 15,800 strike, which added 4.81 lakh contracts, followed by 16,500 strike which added 4.25 lakh contracts and 15,700 strike which added 4.01 lakh contracts.

Call unwinding was seen at 17,500 strike, which shed 14,850 contracts, followed by 15,000 strike which shed 5,700 contracts and 15,300 strike which shed 2,700 contracts.

Maximum Put open interest of 33.73 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the July series.

This is followed by 15,500 strike, which holds 26.56 lakh contracts, and 14,500 strike, which has accumulated 26.16 lakh contracts.

Put writing was seen at 15,800 strike, which added 5.29 lakh contracts, followed by 15,700 strike, which added 4.48 lakh contracts and 15,000 strike which added 3.31 lakh contracts.

Put unwinding was seen at 18,000 strike, which shed 11,800 contracts, followed by 16,500 strike which shed 5,600 contracts, and 16,800 strike which shed 2,500 contracts.

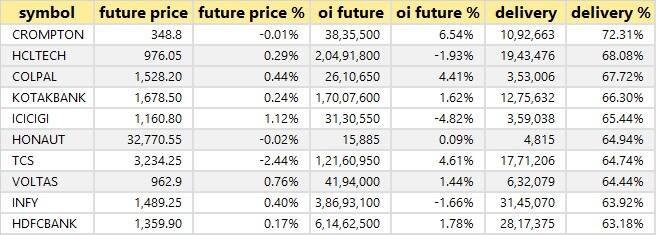

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Crompton Greaves Consumer Electricals, HCL Technologies, Colgate Palmolive, Kotak Mahindra Bank, and ICICI Lombard General Insurance, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Coromandel International, Nifty Financial, ABB India, United Breweries, and Whirlpool, in which a long build-up was seen.

Nine stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 9 stocks including ONGC, Syngene International, Hero MotoCorp, Dr Reddy's Laboratories, and Cipla, in which long unwinding was seen.

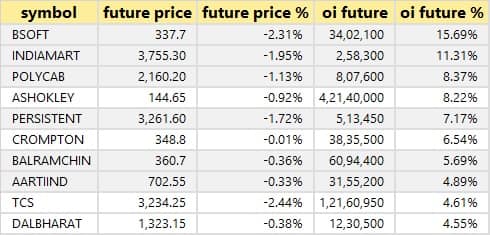

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks including Birlasoft, IndiaMART InterMESH, Polycab India, Ashok Leyland, and Persistent Systems, in which a short build-up was seen.

47 stocks witnessed short-covering

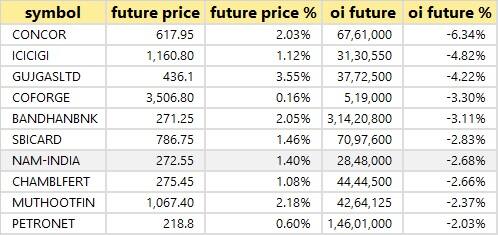

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Container Corporation of India, ICICI Lombard General Insurance, Gujarat Gas, Coforge, and Bandhan Bank, in which short-covering was seen.

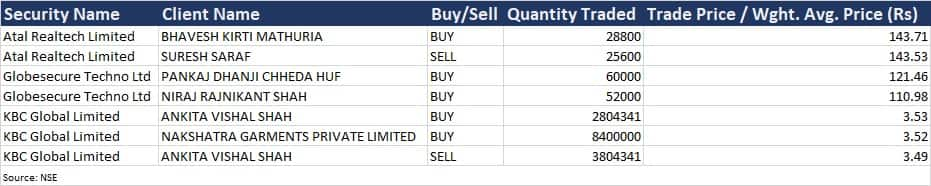

(For more bulk deals, click here)

Investors Meetings on July 5

Nazara Technologies: Officials of the company will meet B&K Securities, CLSA, Dolat Capital, Equirus, IIFL, Jefferies, JM Financial, Prabhudas Liladhar, Spark Capital, and Yes Securities.

Delhivery: Officials of the company will participate in India E-commerce logistics- Opportunity and Outlook hosted by HSBC Global Research.

Vascon Engineers: Officials of the company will meet analysts and investors.

PPAP Automotive: Officials of the company will meet Dron Capital, Aditya Birla Money, Sharekhan, Indsec Securities, JMP Capital, JM Financial, Motilal Oswal, AM Investment, and Unique PMS.

Krishna Institute of Medical Sciences: Officials of the company will meet various investors in Singapore.

Jubilant Ingrevia: Officials of the company will meet Abakkus Asset Managers LLP, Lucky Investment Managers, Grantham Mayo Van Otterloo & Co, Ashmore Investments, HDFC Mutual Fund, and Dymon Asia.

Stocks in News

Kirloskar Ferrous Industries: The company has completed the upgradation of its mini blast furnace II (MBF-11) at the Koppal plant in Karnataka. The operations of MBF-11 have resumed from July 4. After the upgrade, the pig iron manufacturing capacity of MBF-11 has increased from 1,80,000 metric tonne per annum to 2, 17,600 metric tonne per annum and consequently, the company's total manufacturing capacity of pig iron has increased to 6.09 lakh metric tonne per annum.

Vedanta: The company in its BSE filing said its alumina production in Q1FY23 at Lanjigarh refinery increased marginally YoY to 4.85 lakh tonnes, up 1 percent YoY due to scheduled maintenance in April 2022. The cast metal aluminium production at smelters rose by 3 percent YoY to 5.65 lakh tonnes. Mined metal production grew 14 percent YoY to 2.52 lakh tonnes on account of higher ore production across all the mines and supported by better mill recovery. Total saleable production was at 2.68,523 tonnes, lower by 7 percent YoY due to debottlenecking activities in blast furnace-3 and gunning of blast furnace-2. Overall power sales increased by 32 percent YoY to 3,577 million units.

NMDC, MMTC, Tata Steel: Tata Steel has completed the acquisition of a 93.71 percent stake in Neelachal Ispat Nigam (NINL) through its step-down subsidiary, Tata Steel Long Products. The transaction cost is Rs 12,100 crore. NMDC successfully sold its 10.10 percent stake and MMTC transferred its 49.78 percent stake in NINL to Tata Steel Long Products.

Beema Cements: Promoters Prasanna Sai Raghuveer Kandula, and Fortuna Engi Tech and Structurals (India) proposed to sell 48.91 lakh shares or a 15 percent stake through offer for sale on July 5-6. The floor price for the sale will be Rs 75 per share.

Marksans Pharma: The company said the board of directors will hold a meeting on July 8 to consider the proposal for share buyback.

Kotak Mahindra Bank: The Reserve Bank of India has imposed a penalty of Rs 1.05 crore on Kotak Mahindra Bank for non-compliance of certain norms.

IndusInd Bank: The Reserve Bank of India has imposed a penalty of Rs 1 crore on IndusInd Bank for compliance deficiency.

Fund Flow

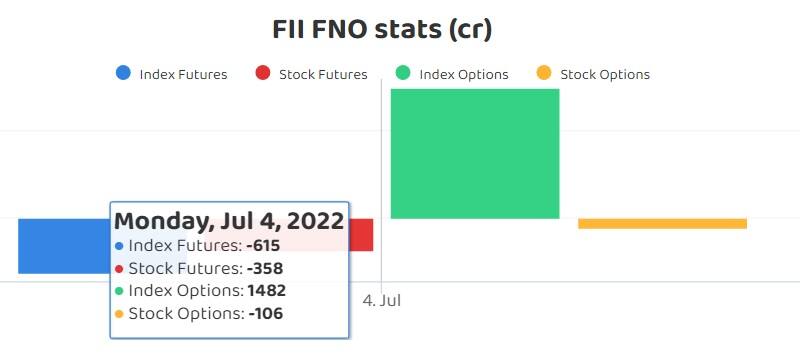

Foreign institutional investors (FIIs) have net sold Rs 2,149.56 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 1,688.39 crore worth of shares on July 4, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are in the beginning of July series, the National Stock Exchange has not added any stock under its F&O ban list for July 5. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!