It was a complete Black Monday on Dalal Street on January 24 as the benchmark indices plunged more than 2.6 percent with selling across sectors and sharp increase in volatility. Traders and investors seem to be cautious ahead of Federal Reserve meeting outcome & Union Budget, and after margin pressure seen in quarterly earnings season.

The BSE Sensex tanked 1,545.67 points to 57,491.51, while the Nifty50 fell 468.10 points to 17,149.10 and formed large bearish candle on the daily charts.

"Nifty faced a massive selloff in trade on Monday ahead of the FOMC meet and ended with a strong Bearish Candle on the daily timeframe. In intraday, the index made a low of 16,998 but found some support at the psychological 17,000 mark and bounced to end at 17,149," says Malay Thakkar, Technical Research Associate at GEPL Capital.

India VIX shot up by 20.84 percent to 22.83 level, indicating increasing anxiety among investors ahead of the budget and the FOMC meet.

"The index has breached below the key moving averages 20 SMA (17,780), 50 SMA (17,485), 100 SMA (17,640)," says Thakkar who advised traders to be cautious. "A break below 17,000 can drag the index towards 16,700-16,750 level," Thakkar added.

The broader markets also crashed with the Nifty Midcap 100 and Smallcap 100 indices falling 3.86 percent and 4.78 percent, respectively. Metal fell the most among sectors, declining 5.2 percent followed by IT (down 3.4 percent), while Auto, Financial Services, and FMCG were down more than 2 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,898.13, followed by 16,647.17. If the index moves up, the key resistance levels to watch out for are 17,499.73 and 17,850.37.

The Nifty Bank slipped 626.75 points to close at 36,947.55 on January 24. The important pivot level, which will act as crucial support for the index, is placed at 36,317.1, followed by 35,686.6. On the upside, key resistance levels are placed at 37,636.4 and 38,325.2 levels.

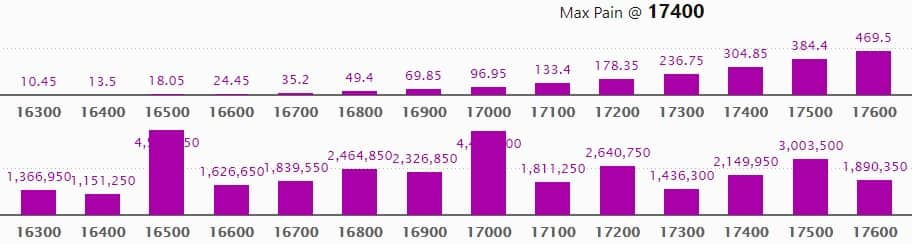

Maximum Call open interest of 96.96 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 17,500 strike, which holds 83.8 lakh contracts, and 17,600 strike, which has accumulated 58.47 lakh contracts.

Call writing was seen at 17,500 strike, which added 69.01 lakh contracts, followed by 17,400 strike which added 37.47 lakh contracts, and 17,600 strike which added 32.41 lakh contracts.

Call unwinding was seen at 17,900 strike, which shed 4.81 lakh contracts, followed by 16,500 strike which shed 11,600 contracts and 16,400 strike which shed 200 contracts.

Maximum Put open interest of 45.11 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the January series.

This is followed by 17,000 strike, which holds 44.75 lakh contracts, and 16,000 strike, which has accumulated 44.39 lakh contracts.

Put writing was seen at 16,600 strike, which added 7.77 lakh contracts, followed by 16,500 strike, which added 7.71 lakh contracts, and 16,000 strike which added 7.67 lakh contracts.

Put unwinding was seen at 17,600 strike, which shed 14.78 lakh contracts, followed by 17,000 strike which shed 11.83 lakh contracts, and 17,300 strike which shed 7.34 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here is the one stock in which a long build-up was seen.

![]()

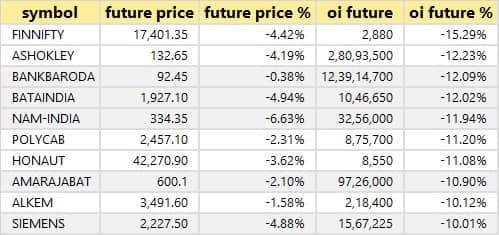

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

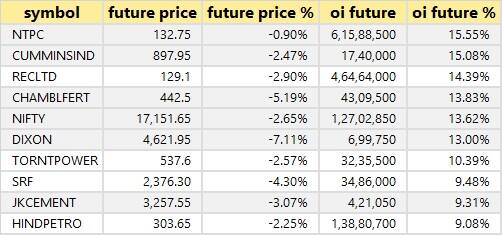

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

4 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the four stocks in which short-covering was seen.

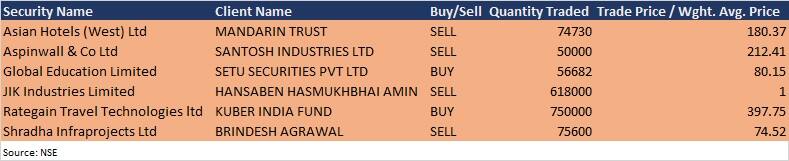

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on January 25

Results on January 25: Maruti Suzuki India, Cipla Allsec Technologies, APL Apollo Tubes, Astec Lifesciences, Best Agrolife, Burnpur Cement, Can Fin Homes, CarTrade Tech, Cosmo Films, Deccan Cements, Emkay Global Financial Services, Federal Bank, Finolex Industries, Indiabulls Real Estate, ICRA, Macrotech Developers, Max India, Pidilite Industries, Raymond, RPG Life Sciences, Skipper, Snowman Logistics, SRF, Star Cement, Sundaram Multi Pap, Swaraj Engines, Symphony, TeamLease Services, Torrent Pharmaceuticals, United Spirits, and Uttam Galva Steels will release their quarterly earnings on January 25.

Ajmera Realty & Infra India: The company's officials will meet Edelweiss Securities on January 25.

Fineotex Chemical: The company's officials will meet Old Bridge Capital on January 25.

Kirloskar Ferrous Industries: The company's officials will meet investors and analysts on January 25 to discuss financial results.

Tips Industries: The company's officials will meet analysts and institutional investors on January 25 to discuss financial results.

Macrotech Developers: The company's officials will meet analysts and investors on January 27 to discuss financial results.

Privi Speciality Chemicals: The company's officials will meet investors and analysts on January 28 to discuss financial performance.

HT Media: The company's officials will meet analysts and investors on January 28, to discuss financial results.

Chalet Hotels: The company's officials will meet analysts and investors on January 28, to discuss financial results.

Vaibhav Global: The company's officials will meet analysts and investors on January 28, to discuss financial results.

Crompton Greaves Consumer Electricals: The company's officials will meet analysts and investors on January 31, to discuss financial results.

Aditya Birla Capital: The company's officials will meet investors and analysts on February 4 to discuss financial results.

Stocks in News

Burger King India: The company narrowed loss to Rs 15.15 crore in Q3FY22 against loss of Rs 29 crore in Q3FY21; revenue jumped to Rs 279.89 crore from Rs 163.19 crore YoY.

Axis Bank: The bank reported a sharp rise in profit at Rs 3,614 crore in Q3FY22 against Rs 1,116.6 crore in Q3FY21. Revenue rose to Rs 8,653.4 crore from Rs 7,372.8 crore YoY.

Craftsman Automation: The company reported lower profit at Rs 37.6 crore in Q3FY22 against Rs 43.4 crore in Q3FY21, revenue increased to Rs 554.1 crore from Rs 489 crore YoY.

Sudarshan Chemical Industries: The company reported lower profit at Rs 36.38 crore in Q3FY22 against Rs 39.16 crore in Q3FY21, revenue jumped to Rs 601.75 crore from Rs 506.37 crore YoY.

Indian Energy Exchange: The company reported higher profit at Rs 80.73 crore in Q3FY22 against Rs 58.14 crore in Q3FY21, revenue rose to Rs 117.54 crore from Rs 85.23 crore YoY.

Ramco Cements: The company reported lower profit at Rs 82.6 crore in Q3FY22 against Rs 201.4 crore in Q3FY21, revenue rose to Rs 1,549 crore from Rs 1,339 crore YoY.

Deepak Nitrite: The company reported higher profit at Rs 242.46 crore in Q3FY22 against Rs 216.56 crore in Q3FY21, revenue jumped to Rs 1,722.27 crore from Rs 1,234.69 crore YoY.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 3,751.58 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 74.88 crore in the Indian equity market on January 24, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Escorts, and NALCO - are under the F&O ban for January 25. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!